When I took my freelance business full-time in January 2019, I wasn’t sure how to manage my money. The business had been profitable since I founded it in 2017, but it was only a side hustle. When I went full-time, I couldn’t rely on a 9-5 job to make ends meet.

I read a bunch of personal finance books, but found the systems were made for full-time employees looking to escape the “rat race” (bonus points if you know which book I’m referring to). I augmented the concepts I liked into one larger money management system that worked for me as a freelancer. Fast forward a year and a half, and I’m able to pay my expenses, save money, and invest for the future. Yes, a portion of this is due to my income growing, but it’s much more than that - it’s also how I manage my money once I have it.

My money foundation

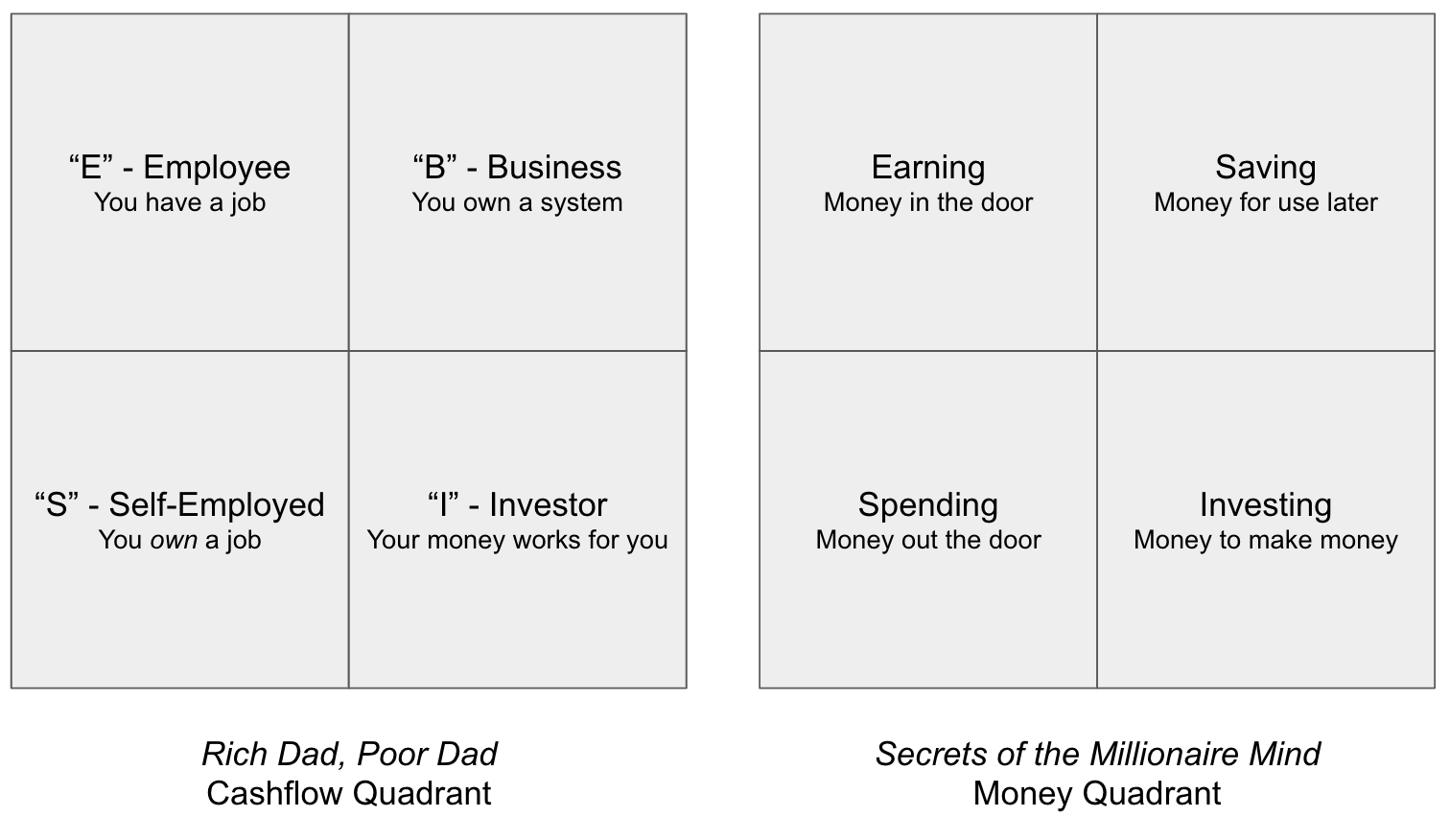

The first thing you should know about me is that I hate following rules. I much prefer automation and guidelines that give me room to be human. With that in mind, my money foundation came from two guiding systems: The Rich Dad, Poor Dad cashflow quadrant and the Secrets of the Millionaire Mind money quadrant.

The two quadrants that inspired my money foundation

Most freelancers are like me and fall into the “S” category, since we own our jobs (no boss, but at the same time if we stop client work, we stop earning). However, my career goal is to detach my earning potential from my physical location and literal hours worked. In order to achieve that, I’ll need to move to the “B” and “I” categories of the cashflow quadrant. Looking at the money quadrant, that means I’ll need to use my earnings for building or buying business systems (“B”) and investments (“I”).

Managing my money as a freelancer

I’m a business

First things first, I am a business (or, as venture capitalist Arlan Hamilton says, I am money). This is part truth, part about owning your identity in order to become your identity, an unspoken law of success for all freelancers.

When I started freelancing in 2017, I did the following:

- Registered my business with the government.

- Opened a business bank account.

- Got a business credit card.

- Created professional invoices and accepted multiple forms of payment, including credit cards, from clients.

By breaking myself out of the idea that I am only self-employed, I have been able to scale into other products like books and newsletters, or focus on my investments (more on that in the next section).

I made my fun free or tied to business growth

I make sure that my fun is tied into either my business growth or made free by my business, a lesson I learned from Dragon’s Den entrepreneur Michele Romanow. To accomplish this, I do a couple things. First, my personal and business cards both collect the same kind of travel rewards. That way my regular expenses plus all corporate expenses result in free air travel, lodging, or car rentals.

Second, whenever I close a new client, I’ll buy myself a book, a bottle of wine, or some other small treat. That way I get gratification not just for revenue coming in the door, but the actual sales process. I do something similar when a client renews a contract too, so I’m not only incentivized to chase new clients.

I spend money to save time

When I spend, I try to make sure I’m getting a time ROI. That’s either really enjoying something and getting happiness from it or that it literally saves me time.

I call this “pay as you grow,” and it’s all about the idea that spending money should be tied to value. I extend this mentality throughout my whole life, not just my business, and I can honestly say I am so much happier for it. The extension also protects me from being frugal in business but wasting all my profits.

I think like a farmer, not a hunter

To make sure I always have extra cash for saving and investing, I think like a farmer. I need something that will be healthy for 50+ years into the future, and I have to act today. This mentality is in opposition to a hunter, who eats what they kill in that moment. I have some hunting instinct in me, as all entrepreneurs do, but I’m constantly thinking about how to turn my “hunted” gains into long-term, sustainable revenue.

Here are a couple things I’m doing:

Seeking ongoing, longer-term client relationships: By shifting some of my focus to long-term clients, I have an income base and don’t need to “hunt” all the time. This frees up energy to take on cool short-term projects that I’m interested in and build more for the future.

Building multiple streams of income: I make a small royalty every time someone buys a copy of my book, The 50 Laws of Freelancing. I also run a small blog called PulseBlueprint where I make a few dollars in ad revenue each month from articles on career growth and freelancing. Right now, these channels are small, but I use them as practice so I understand how to grow when bigger opportunities come along.

I compartmentalize my cash

I made sure to put cash aside for all three of the “output” categories of the money quadrant:

- Spending: I minimized short-term spending to keep as much as possible.

- Saving: I saved both an emergency fund and set aside money for taxes - there’s nothing like a huge bill to crush your money dreams.

- Investing: I funneled business profits into both my retirement accounts and general “investing” accounts.

A big part of saving money for me is about my mental health as a freelancer. Having the additional cash on hand for emergencies really helps for when / if things get tough.

Money is a tool, vehicle, and fuel

I think of money as a way for me to get the things I value. In my case, that’s location and time freedom. I also want enough money to buy and restore a French chateau (I’m not kidding. It’s a real dream of mine. And they can get expensive). So my money management is all about taking what I have now and making it work for me into the future. Each dollar is like a little employee, helping me produce just a bit more money than before.

Stefan Palios is a freelance writer for startups and venture capitalists with clients in multiple countries, and is the author of the bestselling book The 50 Laws of Freelancing. Reach him on Twitter @stefanpalios.