Suppose you've just launched a freelance career (or have been working independently for a while but still haven't got your financial situation under control). In that case, one of your main worries likely has to do with financial instability.

We've all been there; freelancing doesn't always involve a reliable and smooth income source. Having said that, there's one vital thing you need to consider if you're struggling financially: This could turn into a mental health problem.

In this lesson, we will explore how financial security concerns can lead to poor health and show you a few tips to keep in mind as you develop your freelancing career. So, let's get started!

What is financial insecurity?

Financial insecurity (or economic insecurity) is the anxiety you feel when you are exposed to adverse economic events. In particular, that gut-wrenching feeling when you know it might be challenging to recover from them.

A significant component of being financially insecure is having a 'money block' or avoiding even looking at your finances—which can lead to your bills getting paid late and your business racking up debt. In the long term, this can put your entire business at risk.

Reasons for freelance financial stress and financial instability

There are many events that can cause financial stress. For example, losing a job, having trouble finding one, or not knowing how to deal with increased costs of living. If you're a freelancer, you can feel insecure because your income levels vary from month to month (many independent workers don't even know how much money they make a month!), you have unpaid invoices, or you're unsure how much you're supposed to be charging per hour and whether you should update this number.

The reasons are varied, but one thing is sure: As a freelancer, your money is proportionally related to your time—something most corporate workers don't think about. Unfortunately, your income might also feel quite closely related to your self-worth, so if you're getting less money, you might start thinking you are the problem. Just remember, though: Your income can be all over the place; you don't have to be.

The link between financial worries and mental health

The link between mental well-being and financial stress is well established. Many studies have shown that high levels of debt are a frequent source of stress (almost one in five people with mental health problems are in it), and this stress can easily cause sleep disorders and anxiety. There's also a link between income equality and the risk of depression, and those diagnosed with it and problem debt are more likely to still experience the condition 18 months later than those who are not going through financial insecurity.

Unfortunately, this is a cycle in which mental health issues lead to more financial instability, which in turn fuels more money-related stress and worsens these conditions. Additionally, those going through hard times often fear stigma and have trouble asking for help.

How to reduce financial anxiety (and its influence on mental health)

One of the best ways to restore balance and deal with work-related stress is to seek professional help. It'll be hard to manage everything on your own, and it's helpful also to first get a diagnosis that is based on psychological evaluation and lab tests.

The more information you have, the more prepared you will be to understand what you need to do to deal with the issue (from learning careful planning to getting financial support or improving your cash flow, etc.) So, always try to first address your symptoms with a professional and get an accurate diagnosis so you can determine the best treatment.

Tips to improve financial confidence to stay mentally healthy

No matter what kind of financial struggle you are facing, below you'll find some helpful tips to achieve financial wellness.

Reframe your relationship with money and regain control

The first thing you should consider doing is regaining a sense of control over your money by reframing your relationship with it. You should, first and foremost, look at the numbers and explore your predominant emotion when you do so. What's causing you the most stress?

You can start small, for example, by opening your computer and looking at your finances. Identify any stressors and write down how you feel about them as well as any ways in which you could manage the expense more efficiently. Just the act of putting things down on paper can reduce stress, and the more you do it, the better you'll get at it. Then, you can commit to a plan and try to take it to fruition.

Here's a suggested first-step activity:

- Start by tracking your income.

- Note down the sources, whether they are recurring, and when you can expect the money to show up in your bank account.

- Look at your invoices and track your future income.

Consider alternative revenue streams

Nothing says instability like having a couple of clients scale down their projects in the same week. It's normal to panic when faced with this scenario. However, as scary as it might feel, it's also an opportunity to explore other revenue streams.

We mentioned your income and your time are tied together when you're a freelancer. This also means you can figure out ways to expand the first by spending a little more time doing things like looking for clients, updating your portfolio, or exploring social media platforms where you can share your skills.

Find out what your pay per hour is (for each client)

Many of us work on a per-hour basis. You'd be surprised to find that even though you're charging the same amount for two jobs, you might not make the same amount of effort.

For example, suppose you are a content writer, and you're asked to create two pieces: One about pet toys and the other about a WordPress plugin. Both clients might pay you the same (let's suppose they pay you by word, in this case), but you know you can write about pets much faster than you can about plugins. Eventually, you might decide to only write about pets because the payment is much better.

You don't need to scale down on things just because they make sense monetarily, though. If there's a revenue stream you really enjoy, you can still apply yourself to it.

Work with reliable income sources (or make them look so)

Unless you're getting paid regularly, it's hard to do any thorough financial planning. That's the nature of freelance work! But there are things you can do to smooth your income so you can track it more easily.

Suppose, for example, that you want to pay a deposit for a house. As a freelancer, you probably have what banks will see as financial instability. But accounting can get a little creative, too, so something you could do is, each month, move a minimum monthly income to a savings account so you can prove your income using bank statements.

Use spreadsheets and budget

An often-ignored tip for freelancers is budgeting. You shouldn't so easily dismiss it, though, because once you've managed to track your income, creating a future budget is much easier.

You can write down both how much you intend to spend on an expenditure (for example, your groceries as a household expense or training as a business activity) and track that list. Or you can list your budget goals to use them as motivation to improve your revenue streams. It's also a good idea to set yourself a 'big goal' (for instance, buying a house or opening a store) and look at its progress frequently to remember why you do what you do.

Conclusion

Financial stress can lead to mental health problems, and while it's common for freelancers and solopreneurs to deal with financial anxiety, it's also essential to understand how you can cope with it. We explored some tips to reduce financial stress, such as reframing your relationship with money, adding new revenue streams, and budgeting. Asking mental health professionals for help is also an excellent idea if you are already experiencing difficulties such as sleep problems or depression.

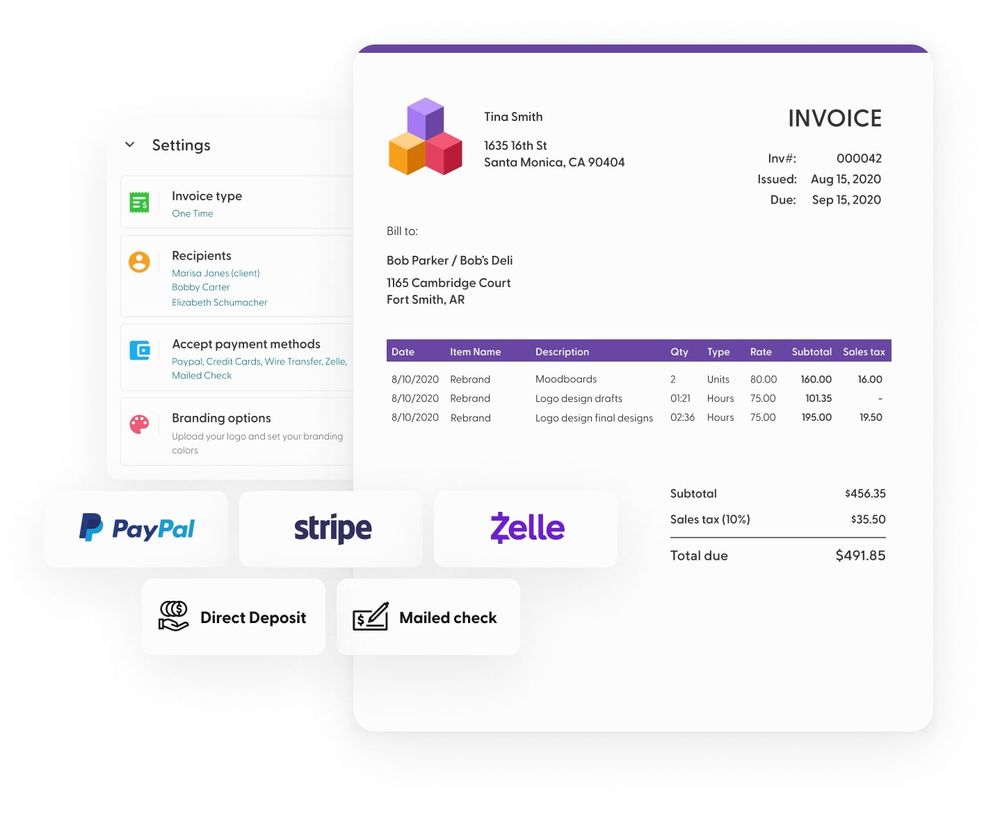

To make sure you have all your projects under control, you should also consider using a freelancer platform designed specifically to manage all your clients, contracts, invoices, and calendars from a single location. Indy is an all-in-one platform from which you can track billable hours, receive payments, share files, and use time trackers, among others. Start for free today and smooth your way to financial stability.