Here's why learning how to ask for money politely is so important:

29% of freelancer invoices are paid late.

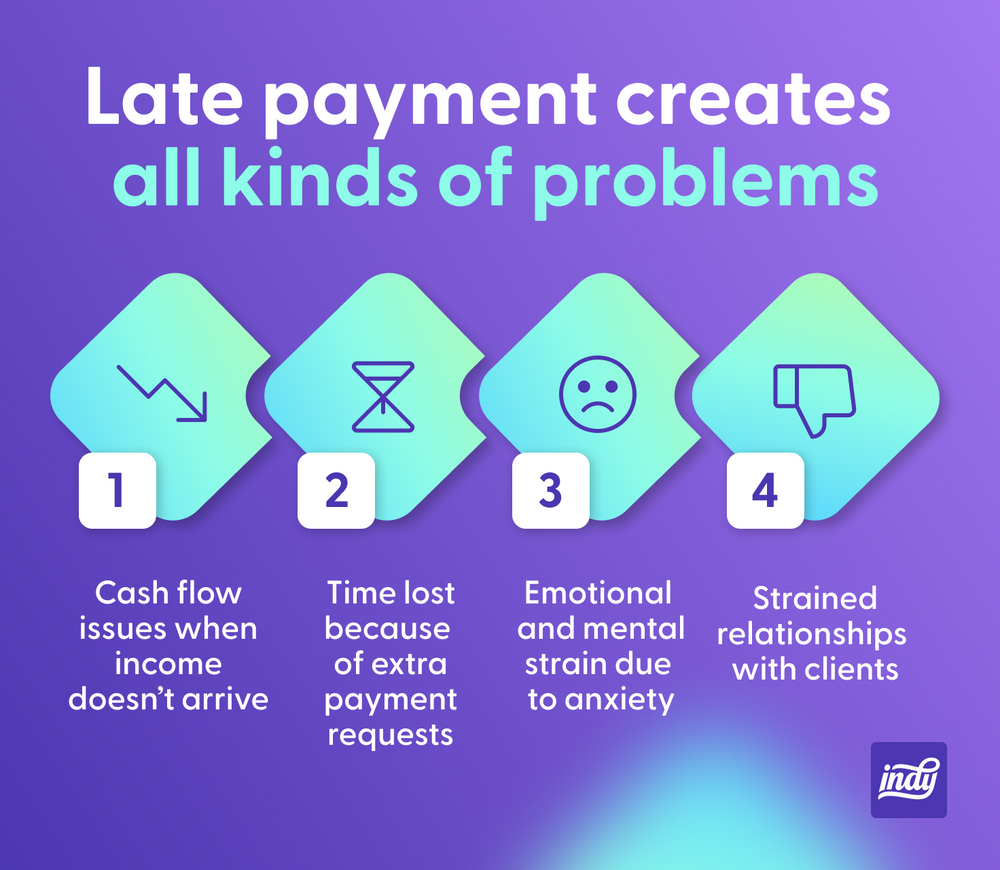

This means one of the most common challenges freelancers experience is getting paid on time. A late, or overdue invoice, creates all kinds of problems. Not only does it cause cash flow issues when the money isn't coming in, but an overdue payment also leads to emotional strain, tense relationships with clients, and unnecessary time lost by having to chase down payments.

In this lesson, we'll teach you what to include when you ask for payment professionally, how to write an email, how to ask for money politely from a customer for payment in a friendly way, and your options for dealing with overdue invoices.

So, how to ask for payment politely

The art of knowing how to ask for payment lies in maintaining a balance between politeness and professionalism. When crafting a payment request email, it's crucial to make sure that the tone is both friendly and firm, outlining the details of what is owed and when the payment is due. The payment process should be clearly explained, eliminating any possible confusion. A well-structured payment request can significantly speed up the payment process, reducing the likelihood of late or missed payments. Below, we’ll share with you how to create the perfect request payment email, whether you want to negotiate payment terms or remind a client who’s far behind the payment deadline.

But first: Why is money such a taboo topic?

It's no secret that people don't like to talk about money. Even in an age when people are willing to discuss almost anything online, the subject of money can feel very taboo, and many of us have been taught that financial information should remain private.

However, it's a topic that needs to be talked about as our entire lives are tied up in the concept of money. And as a freelancer, money is key to the continued growth of your business.

Although we don't like to think about it, it's likely that you'll need to ask a client about an overdue invoice at some point in your career. So what can we do to make this process easier?

We can move past these fears by breaking down the reasons behind our worries:

- Sounding rude/pushy: As freelancers, we have a fear that our clients might think we're being rude for asking about a late payment. And the last thing we want is for our clients to think we're rude. It took a lot of hard work to land this client, so we hesitate to ask for payment for fear of losing them.

- A fear of confrontation: We often try to play out the worst-case scenarios in our heads. What if this turns into an argument? What if they say no? What if I don't know how to handle the situation? However, it's more likely that your client simply got busy and forgot about the deadline. Often, our worst fears never happen.

- Not knowing the best approach: This is another big reason freelancers don't confront clients about overdue payments. It can be challenging to bring up this touchy subject. But don't worry! We'll show you how to ask for payment in just a bit.

By addressing the source of our worries, we can now think about the solutions that can help us break past this mental barrier.

Forget about outstanding invoices! Tips for getting over your fear of asking for payment:

- Know that you're not alone: Unfortunately, it's one of the grim realities of freelancing, and many other freelancers have been in your position (we were also nervous to ask). However, most freelancers would tell you that they were happy they did.

- Value your work: Know that you provided your client with valuable work, and you deserve to be paid for your efforts. You held up your end of the contract, so don't feel ashamed to ask your client to hold up their end.

- Send the email: Sometimes we just have to take the leap by sending the email. We'll always be nervous about handling a problem until we try it. But after you handle it, you'll know exactly what to do if it ever happens again.

- Ask for advance deposit: An advance deposit is a viable solution to mitigate the risk of unpaid invoices and foster a trustful business relationship. It allows a clear payment schedule to be established upfront, setting expectations for both parties and ensuring a smooth financial transaction. Moreover, offering multiple payment options can expedite the process, accommodating clients' preferences, and further reducing the likelihood of payment delays.

- Introduce late fees: Introducing late fees is an effective strategy to deter outstanding payments and ensure invoices are settled efficiently. By incorporating a late fee clause in your agreements, clients are often more motivated to avoid unpaid invoices or delayed payments. Additionally, sending a text message to remind clients about impending late fees can exponentially increase the efficiency and timeliness of payments.

So often we discover that the things we were initially worried about weren't so bad after we tried them. The more you ask for a payment, the easier you'll find the process to be, and you'll quickly develop a simple system for collecting overdue payments.

Struggling over how to ask for payment?

Let's make it easier! Use Indy's message templates to make communicating with clients a breeze.

Don't panic when the due date passes

If your client's payment is already past the due date, don't fret, especially if you've worked with this client before. Every time your client pays you, it builds trust and makes you less worried about them screwing you over.

If this is the first time you've worked with them, don't jump to the worst-case scenario and wonder how you're going to make rent with an outstanding payment. Focus first on collecting payment before stressing yourself out and wondering what you'll do if you don't get paid.

What should you include when asking for payment?

So, now you know you have to ask for payment. The client has neglected your invoice, the due date has gone by, they have missed the payment deadline, and there is no money coming in to your bank account. What do you say to your client?

Try to write a friendly, non-threatening payment request email subject line

The first thing to remember when asking for payment information from a client by email is the subject line. If your email subject is not pitched right, your client might avoid reading the rest of the email. So, here are a few tips:

- Don't threaten clients (in the subject). Instead, call your emails “friendly payment reminder emails.”

- Consider talking about your reminder emails as “contract updates.”

- If it is appropriate, use your client's name.

We'll show you some examples of subject lines in just a moment. For now, let's take a look at other things to include in your payment request email payment email.

Always attach a copy of the overdue invoice

Every payment request email should go with a copy of the invoice. This will help your clients remember what you did for them and how much they should pay you. However, sometimes people get a bit confused about invoices and the payment details. Here are a few things to remember:

- An invoice is not a legally binding document. Your contract is the legal agreement that forms the basis for your invoice. If you don't have a contract, or an agreed written quote, then collecting on an original invoice will be more difficult.

- Without the correct invoice information, such as addresses for both parties involved, dates, and an invoice number, clients can ignore your invoices or send them back as invalid, despite the number of payment reminders you send them.

An invoice email without an invoice attached is a little useless. Always attach invoices to your email messages when you make a payment request or send payment requests or reminders.

Politely remind clients of the payment terms

Payment terms directly influence how soon you will get paid. Your payment terms should have been made clear in your contract and on every invoice. The contract should explain the payment process, payment due date, and any late payment fee you will charge. Your invoice should have, at the very least, a payment due date or time frame, such as “Net 30 Days.”

Add your bank account or payment provider information to your payment request

If you're asking someone to pay you, make it as easy as possible for your client. Put the payment information in the invoice email and on the invoice itself, along with all the business contact details. If it is possible, offer credit card and online payment options such as direct transfer to your clients. Once you start turning up the heat on your client, try to make a convenient way for them to organize payment to avoid future late payment.

Payment reminder email templates

As promised, we're going to show you how to make payment request email templates to ask for payment professionally. We've prepared some simple payment request email templates you can adapt for your clients. Just be sure to change the info for you and your client.

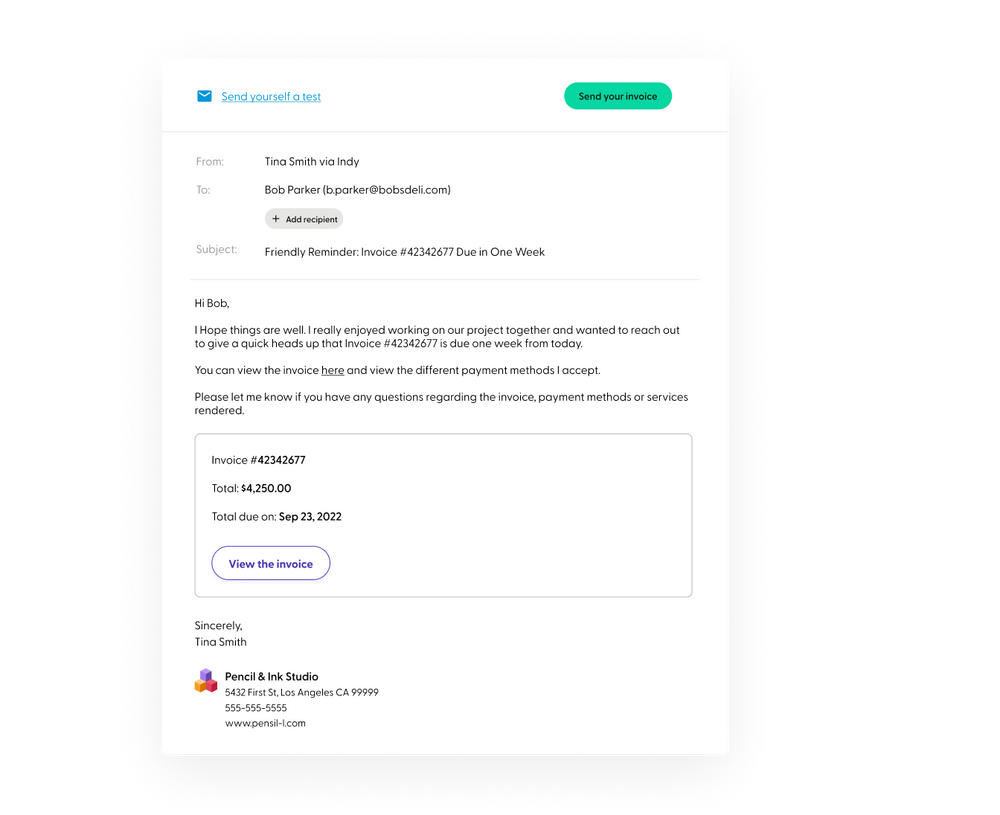

One Week Reminder Payment Request Email Template

Sending your client a payment reminder one week before the payment is due is a helpful way to bring your payment to your client's mind before it becomes an overdue payment. This is typically a light-hearted friendly polite email reminder that should be a normal part of your payment collection process. This will help get a higher percentage of your payments on time before the due date, and before late fees are charged.

Email Subject: Friendly Reminder: Invoice [#] Due in One Week or Just a Reminder: Invoice [#] Due in One Week

Hi [client name],

I hope things are well. I really enjoyed working on our project together and wanted to reach out to give a quick heads up that Invoice [#] is due one week from today.

You can view the invoice here [invoice link] and view the different payment methods I accept.

Please let me know if you have any questions regarding the invoice, payment methods or services rendered.

Thanks!

[First Name]

Friendly payment reminder template for one/two days late

Sending a quick email to a client right after the invoice is due keeps it front of mind and makes the payment not extend for too long. You're able to give clients a grace period of a few days before sending this out, especially if the due date fell over a weekend.

Email Subject: Friendly Reminder: Invoice [#] Past Due

Hi [Client Name],

I hope you're having a great day. Based on my records Invoice [#] is overdue as of [date]. There's currently a balance of [balance owed].

For your convenience and ease, I've attached the invoice and payment methods here [insert invoice link].

Please let me know if any issues arise with the payment or you have any additional questions.

Thanks so much,

[first name]

Email requesting payment of outstanding balance

In order to get paid, one of the strongest tactics to use is consistency with your follow up email. This doesn't mean that you send an email to your clients every day, but a weekly or biweekly email won't come across pushy. Use this invoice template below to send an additional payment reminder email to your client or change it to your discretion.

Email Subject: Friendly Reminder: Invoice [#] One Week Past Due

Hi [Client Name],

I hope your week is going well. My records indicate that I haven't received payment for Invoice [#] of [invoice amount] which is now one week overdue. Would you mind looking into this for me?

Please let me know if there's someone else I can contact regarding payment, or if there is a system or process that I can make payment easier on your end.

I have attached the invoice for your convenience [insert invoice link].

If you have any update on when this payment should be received, it would be greatly appreciated.

All the best,

[insert first name]

Friendly payment reminder email template for two weeks late

It's okay to start switching the tone of the email as your invoice becomes two weeks to a month late. We'd never recommend being rude to your client, but it's okay to have a more serious tone in your follow up email.

Email Subject: Invoice [#] is Two Weeks Past Due

Hi [Client Name],

I wanted to reach out because my records indicate that payment for invoice number [#] is two weeks late. Do you have any updates on when this should be received?

I've attached the invoice here [invoice link] for your convenience. Please let me know if there's any way I can be of further assistance. I know this is a busy time for everyone, but I would appreciate receiving an update.

Please note, that any payments that are over 30 days are subject to late fees as described in our contract terms.

If you have any questions, please don't hesitate to reach out.

Best,

[insert first name]

Final payment reminder email template

Now that it's been a month, we'll show you how to ask for payment a bit more urgently, without sounding rude. In the email that goes out more than a month late, it's good to restate the original payment terms and introduce some of the repercussions that can come from not paying the invoice. This can be a late payment or fee, or if you're still working with them on a project, you can temporarily pause services until payment is made.

Email Subject: Invoice [#] is now 30 days overdue - please send payment

Hi [Client Name],

This is my fourth reminder that your payment on invoice [#] is past due. My initial email was sent to you on [date]. Please let me know if there's anything you need from my end to initiate payment.

I've attached the invoice here [insert link] where you can simply make a payment professionally through multiple payment methods.

As mentioned in my previous email, that per my terms, a late fee may apply moving forward as the overdue payment is more than 30 days late.

Please organize the payment for this invoice.

Thanks,

[first name]

Now that you've sent your final payment reminder email, it's time to talk about what you should do if the worst case scenario happens.

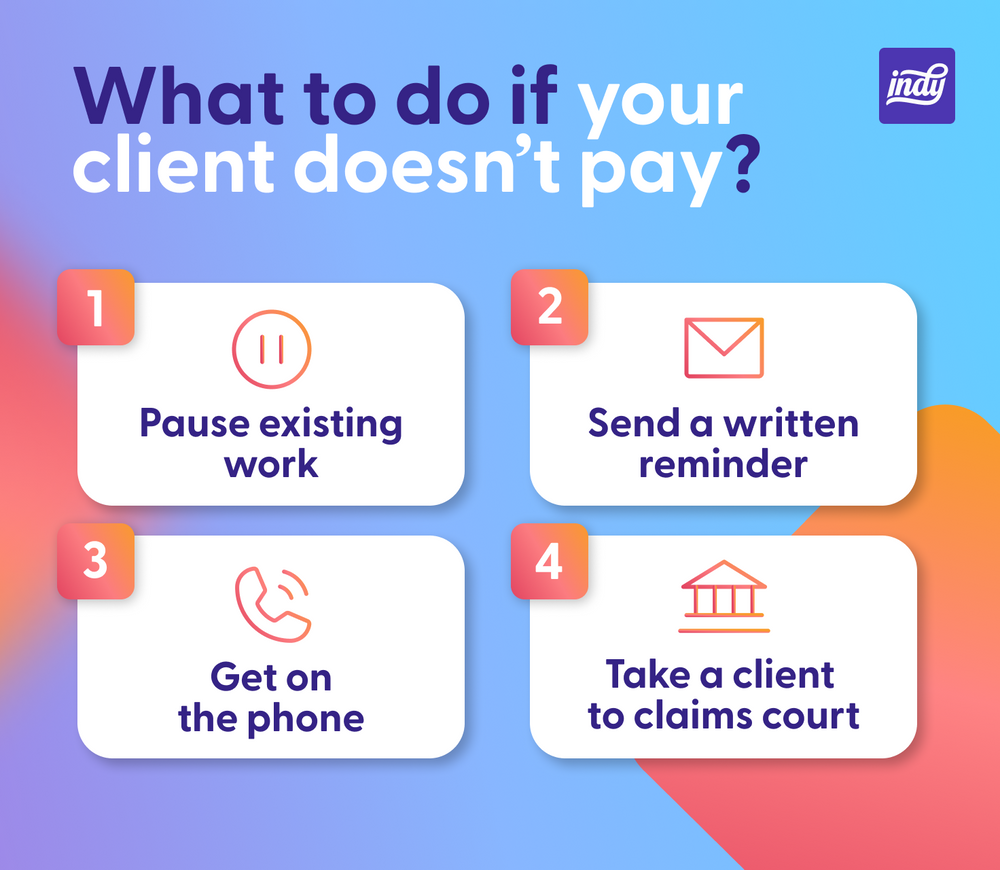

What to do if your client doesn't pay?

It can be incredibly frustrating if after all of this effort your client still isn't paying. Even though it can be really easy to get mad at your client, try and keep a cool head. If you maintain a good relationship, you're in a stronger power position moving forward than if you let your anger get the better of you. Late payments aren't personal attacks, even though they can feel like it. Let's go through the steps you should take if a client still doesn't pay you after you ask for payment.

Pause existing work

If your client is over a month late in payment and you're still working with them actively on projects, you can consider pausing current services until the invoice is paid. This mitigates the risk that you'll go several months without payment and opens up a more serious conversation with your client. This isn't a strategy that you can do for a one time project, but if they don't pay on time, it's a legitimate reason to not work with them again, or require 50% upfront.

Get on the phone

If your last payment request email has gone completely unanswered, hopping on a phone call with your client can eliminate possibilities that your business contact details are incorrect, your payment request emails have not gone to a spam folder, or your point of contact might have left. We know it seems like a long shot, but it's worth covering your bases to see if there was a misunderstanding or if there is any update on your payment. Pay close attention to the tone in which you deliver this message. Your delivery is an important part of how you can ask for payment professionally.

Sometimes communication can be misunderstood through writing. By getting on the phone, clients can hear the polite tone in your voice, which eliminates the potential of them feeling threatened over email. Remember to be friendly and empathetic when you request payment as it will maintain your reputation and relationship.

What if there are no results? Should you hire a collection agency?

What if the client just refuses to pay? Let's be serious: this is your business. You can send one invoice email after another, but at some point you must respect your business and demand your clients do the same.

Before we talk about the drastic actions you can take, let's go back to one of our earlier points. Your invoices are not legally binding documents. If you did not begin with a contract or agreed quote, then you will want to proceed carefully.

A collection agency should be your last resort. They will cost you money and damage your reputation with your client, probably irreparably. But you have another option: take your client to court.

Here is why a small claims court case is better: the law is on your side. Even if you don't have a contract, any paperwork, even if it's just an email or text message, that demonstrates your agreement with your client will be enough to establish a contract situation between you. In a court, you should be on solid ground. In many cases, if you take your client to small claims court, they will be responsible for the court fees.

A few more tips to avoid missed payments

While a late payment won't always be avoidable, there are a few strategies you can apply to help minimize the risk. Here are a few things you should incorporate into your business if you haven't already:

- Use a contract: A great way to avoid having to chase down payments is to have clear-cut terms from the start. This is where having a legally sound contract in place is key, and Indy can help. Check out how easy it is to create a client contract. In a contract, you can establish a late fee penalty that discourages clients from missing payment deadlines.

- Ask for client approval: In addition to your contract, you can use the Files tool from Indy to get approval for your work. This is helpful for being clear that your work has been accepted and, thus, payment is due.

- Advanced deposits: Another way to ease the sting of a missed payment is to ask for an advanced deposit. There isn't a hard rule for how much you should ask for upfront, but freelancers typically ask between 10%-50% of the total estimate.

- Make payments easy: Clients can be busy, so accepting as many payment methods as possible will make things easier on the client.

- Maintain the relationship: Check in on your clients from time to time throughout the project. Keep them updated on where you're at, ask them about how things are going on their end, and maintain a healthy relationship while working with them. A strong relationship helps build mutual trust and makes things easier on both of you if you ever have to ask about outstanding invoices.

Conclusion

Nobody likes a late payment, but it's an unfortunate reality for freelancers worldwide. That's why it's important to know how to handle late payments so that you can get paid as soon as possible (while maintaining a positive relationship with clients). The next time a payment is late; don't panic, write a friendly follow-up email for the overdue payment, remind the client of the payment terms, include your payment details, and always attach a copy of the invoice.

Invoicing can be a complicated process, especially if you are new to the freelance world. Fortunately for you, Indy has an invoicing tool that can help you. You can even try it for free with just a click, or two!

FAQ

How do you politely ask for payment via email?

The most polite way to ask for payment is an invoice email as a gentle reminder. Businesses get these regularly, and accept them as part of life. Send a simple payment request email and follow it up with another one if payment is not made for the late invoice. Remaining polite in your communication with small businesses is a key part of how you can ask for payment professionally.

How to ask for payment professionally in email?

Don't make it personal for you or the client. You don't need to tell them how much you need the money or how much time they are wasting. Equally, your customers are probably the party in the relationship with the most resources. They should not bully you by non-payment. So, avoid being rude but make your demands clear with a polite reminder and always remain polite and professional at all times when discussing overdue invoices.

How do you politely ask for payment via SMS?

If you've already sent an email reminder, you could try a text message instead of the next email reminder. However, we think you're better off with phone calls. If you have their number, just call them.

What happens when someone refuses to pay?

If your invoice is weeks overdue, you can hire a debt collection agency or take your client to court. Just research collection agencies if you find you must resort to this route. Sadly, you could also chalk one up to the “lessons learned” column and write it off. However, this is your business. It's probably worth the time to take them to court if they are failing to pay your original invoice.

How can a small business owner manage late payments?

Small business owners face cash flow challenges on a regular basis. The best time to manage late payments is before they happen. Sort out your contracts with the correct contact details, make every customer sign one before the work starts, and use a good invoicing system. Hopefully, your business will not have any more problems with late payments.