For freelancers, sending a clear and professional invoice letter is not just a formality; it's a critical step in avoiding late payments, getting paid on time, and maintaining a smooth working relationship with clients. However, composing an effective invoice can be daunting, especially if you're new to freelancing or unsure about the essential elements to include.

Join us as we explore the key components, best practices, and professional communication techniques to help you streamline your invoicing process and enhance your freelance business. Let's get started and unlock the secrets to invoicing like a pro!

Understanding the Basics of Invoice Letters

An invoice letter isn't just a regular payment details letter or a cover letter. It is a formal and itemized document used by a business owner and a freelancer to request payment for goods sold or services rendered to clients. Such a letter serves as a vital tool for facilitating transparent and efficient financial transactions. How to create an invoice letter for payment?

The key components of an invoice letter typically include the sender's and recipient's contact information, the invoice date, payment details, a unique invoice number for identification purposes, a clear description of the products or services provided, the quantity or hours involved, the unit price or hourly rate, the subtotal for each item, any applicable taxes or discounts, and the total amount due. Properly constructed invoice letters not only ensure timely and accurate payments but also foster professionalism and trust in the business-client relationship.

Why Is Having a Proper Invoice Letter So Important?

Invoicing plays a pivotal role in the success and sustainability of a freelancer's business. It goes beyond being a simple transactional document; instead, it serves as a crucial communication tool that benefits both the freelancer and their clients. Understanding the importance of invoicing for freelancers is essential for maintaining a smooth and professional workflow. Here are some key reasons why invoicing is vital for freelancers.

Ensuring timely payments

An accurate and well-timed invoice acts as a clear reminder to clients of the services rendered or products delivered. It outlines the agreed-upon payment details, including due dates, which helps minimize late payments and ensures that freelancers receive payment in a timely manner.

Professionalism and trust

An organized and professional invoice enhances the freelancer's credibility and builds trust with clients. It demonstrates that the freelancer values their work and takes their business seriously, thereby encouraging clients to make prompt payments.

Clarity in transactions

Invoicing provides a transparent breakdown of the services or products provided, along with their associated costs. This clarity reduces the chances of disputes or misunderstandings between the freelancer and the client, leading to smoother business transactions.

Legal protection

An invoice acts as a legally binding record of the agreement between the freelancer and the client. In case of payment disputes or legal issues, having a detailed invoice can serve as essential evidence to protect the freelancer's rights and interests.

Financial management

Invoices are crucial for accurate financial tracking and record-keeping. They help freelancers keep an organized record of their income and expenses, making tax filing and financial planning more manageable.

Professional communication

Sending a well-crafted invoice demonstrates professionalism and attention to detail, which can positively influence clients' perceptions of the freelancer. It reflects a level of competency and reliability that can lead to repeat business and word-of-mouth referrals.

Cash flow management

Consistent and timely invoicing is vital to maintain cash flow in a freelancer's business. It enables freelancers to manage their finances effectively, pay their own expenses, and invest in growth opportunities.

Business growth

Efficient invoicing practices contribute to a smoother workflow, allowing freelancers or small businesses to focus on their core services and pursue new business opportunities. When clients experience a hassle-free invoicing process, they are more likely to engage in future projects with the freelancer.

Different Types of Invoice Letters

There are several types of invoice letters that small businesses and freelancers may use, depending on the nature of their work and billing arrangements. Some common types of invoice letters include:

Standard invoice

The most common type of invoice letter used for one-time transactions. It includes a detailed breakdown of the goods or services provided, along with the total amount due and payment details.

Recurring invoice

Used for ongoing services that require regular payments, such as monthly retainers or subscription-based services. Recurring invoices are sent at predetermined intervals, simplifying the payment process for both the client and the service provider.

Proforma invoice

Often used for international transactions or when a formal quote is required before completing the actual sale. The proforma invoice includes a description of the products or services, their prices, and other relevant details, but it is not considered a legally binding document. They are just advanced business letters.

Interim invoice

Used for long-term projects or contracts where payments are made in stages or milestones. Interim invoices request payment for completed project phases before the final delivery.

Final invoice

Sent at the completion of a project or contract to request the last payment owed. The final invoice summarizes all previous payments and outstanding balances.

Credit invoice

Issued when adjustments or refunds need to be made to a previously issued invoice. A credit invoice deducts the specified amount from the client's outstanding balance.

Debit invoice

Opposite to a credit invoice, a debit invoice is used to increase the client's outstanding balance due to additional charges or corrections.

Commercial invoice

Primarily used in international trade, this document provides details of the goods being shipped, their value, and other essential information required for customs and tax purposes.

Time-based invoice

Often used by freelancers or consultants who bill based on the hours worked. The invoice specifies the hours spent on each task, along with the hourly rate, resulting in the total amount due.

Progress invoice

Similar to interim invoices, progress invoices are used in projects that require partial payments as work progresses, but they may not necessarily be linked to specific project milestones.

Each type of invoice letter serves a specific purpose and caters to different billing scenarios. Choosing the right invoice type ensures accurate billing and fosters clear communication between businesses or freelancers and their clients.

Legal and Professional Implications of Invoice Letters

An invoice letter carries significant legal and professional implications for both businesses and freelancers. Understanding these implications is crucial for ensuring smooth financial transactions and maintaining a strong business reputation. Here are some key legal and professional implications of an invoice letter:

- Legal contract: An invoice letter serves as a formal request for payment, and once accepted by the client, it becomes a legally binding document. It outlines the terms and conditions of the transaction, including the goods or services provided, payment date, and any applicable fees or penalties. In case of payment disputes or legal issues, a well-constructed invoice can serve as essential evidence to protect the rights and interests of both parties.

- Tax compliance: Invoices play a vital role in tax compliance for businesses and freelancers. They serve as supporting documents for income reporting, expense deductions, and value-added tax (VAT) or sales tax calculations. Accurate and properly issued invoices help ensure compliance with tax laws and regulations.

- Payment verification: An invoice letter serves as a record of the transaction, enabling both the client and the business/freelancer to track and verify payments made. Having a systematic invoicing process helps prevent payment discrepancies and provides a clear history of submitting payments for future reference.

- Professional image: A well-crafted invoice letters reflect professionalism and attention to detail. They reinforce the reputation of the business or freelancer, instilling confidence in clients about the quality of services or products provided. A professional image enhances trust and fosters positive long-term relationships.

- Timely payments: Sending sales invoice letters promptly and consistently encourages clients to avoid late payments. Clear communication of payment details and due dates helps avoid delays, improving cash flow for businesses and freelancers.

- Dispute resolution: Invoices play a crucial role in resolving payment disputes or discrepancies. In case of payment delays or disagreements over the services rendered, the invoice provides a reference point to address the issue and find a friendly solution.

- Auditing and record-keeping: Invoices contribute to efficient record-keeping and financial auditing. They provide a comprehensive overview of business transactions, facilitating accurate financial analysis and reporting.

- Credit and financing: Invoices can be used as documentation for obtaining credit or financing from banks or financial institutions. They demonstrate a business's revenue and the creditworthiness of a freelancer, supporting loan applications or credit assessments.

An invoice letter carries both legal and professional significance, serving as a formal contract, a tax compliance document, and a record of financial transactions. A well-managed invoicing process enhances professionalism, fosters trust with clients, and ensures the smooth flow of payments, contributing to the overall success and growth of businesses and freelancers alike.

Preparing to Write an Invoice Letter Template

Preparing to write an invoice letter is a crucial step that sets the foundation for a clear, accurate, and professional document. Proper preparation ensures that the invoice effectively communicates the details of the transaction and protects from late payments. As we said before, it cannot be just a cover letter.

Got a blank document? Here are essential steps to consider when preparing to write the invoice letter:

Gather information

Collect all the necessary information before drafting the invoice letter. This includes the client's details (personal title, company name, city, and street address), the freelancer's contact information (personal title, business name, city and street address, invoice email, phone number), and any specific project details or purchase order numbers.

Set the invoice date and number

Decide on the date of the invoice issuance and assign a unique invoice number. Using a sequential numbering system helps with the organization and tracking of multiple invoices.

Determine payment details

Your payment details letter clearly defines the payment terms, including the payment deadline, accepted payment methods (e.g., bank transfer, PayPal), and any late payment penalties or early payment discounts if applicable.

Itemize services or products

List all the services provided or products delivered, along with the quantity or hours, unit price or rate, and subtotal for each item. Include a detailed description to avoid any confusion.

Calculate the total amount

Sum up all the subtotals to arrive at the total amount due. Double-check the calculations to ensure accuracy.

Include additional information (if necessary)

If there are any special instructions or terms related to the project or payment, include them in the invoice letter to avoid misunderstandings.

Choose the right format

Select an appropriate invoice template or format that aligns with your branding and reflects a professional image.

Review and proofread

Before finalizing the invoice letter, review the content for errors, typos, or discrepancies. A well-proofread document enhances your credibility as a freelancer.

Save a copy

Save a copy of the completed invoice letter for your records. Having an organized system for storing and managing invoices will facilitate financial tracking and reporting.

Determine delivery method

Decide how you will send the invoice to the client. Email is a common and convenient option, but you may also consider using invoicing software or online platforms.

By preparing diligently before writing the invoice letter, freelancers can ensure that all necessary details are included, payment terms are clear, and the overall document is polished and professional. A well-prepared invoice letter not only expedites the payment process but also reflects positively on the freelancer's business practices, fostering trust and reliability with clients.

How to Send Invoice Letters

Delivery and communication are vital aspects of the invoicing process for freelancers. Efficient methods of sending invoice letters and clear communication ensure that the invoice reaches the client promptly and facilitates smooth interactions throughout the payment cycle. Here are key considerations for delivery and communication in the invoicing process and some hints on how to send invoice letters:

- Choose the right delivery method: Select a delivery method that is convenient for both you and the client. An email with an attached invoice is a popular and efficient option for sending invoices quickly. Additionally, many invoicing platforms offer seamless delivery and tracking capabilities.

- Personalize the invoice emails: When sending the invoice via invoice email, personalize the message by addressing the client by name and expressing gratitude for their business. A personalized touch enhances the professional relationship and demonstrates your attention to detail.

- Attach a clear invoice document: Attach the invoice as a PDF or another widely accessible file format. This ensures that the client can open and view the invoice easily, regardless of their device or software.

- Follow up with a courtesy email: If the client hasn't acknowledged the receipt of the invoice within a reasonable time, send a cover letter follow-up email as a gentle reminder. This communication demonstrates your commitment to ensuring that everything is in order.

- Provide multiple contact options: Include multiple contact options in the invoice letter, such as your email address, phone number, and any relevant social media handles. This allows the client to reach out to you through their preferred communication channel.

- Clarify payment instructions: In the invoice letter, provide clear instructions for making the payment, including details on the accepted payment methods and any necessary payment reference numbers. This avoids confusion and minimizes potential delays.

- Respond promptly to inquiries: If the client reaches out with questions or concerns about the invoice, respond promptly and professionally. Address their queries with clarity and courtesy to maintain a positive client experience.

- Use professional language: Keep your communication professional and courteous at all times. Avoid using slang or informal language, even in email correspondence.

- Include important dates: If there are specific dates for payment milestones or progress updates related to the project, communicate them clearly to the client. This ensures that both parties are on the same page regarding project timelines and payment schedules.

- Acknowledge payments received: When the client makes a payment, promptly acknowledge receipt and express your appreciation. A brief thank-you note fosters a positive relationship and encourages timely future payments.

By prioritizing efficient delivery methods and clear communication, freelancers can streamline their invoicing process and ensure that clients receive and understand their invoices promptly. Effective communication enhances professionalism, trust, and overall satisfaction, ultimately contributing to the success and growth of the freelancer's business.

Invoice Letter Templates

Templates provide a convenient and efficient way for freelancers to create professional invoices. They can be customized with the freelancer's logo, color palette, and other branding elements to ensure a polished, unified look. Pre-formatted with all the essential information needed for an invoice—including payment terms, itemized services or products, the total amount due, and additional notes or instructions—templates enable freelancers to quickly generate accurate documents.

Examples of an invoice letter include basic invoices for services rendered; hourly rate invoices; recurring invoices for subscription-based services; pro forma invoices that provide an estimated cost of goods before shipment; and product/goods delivery invoices that list each item shipped along with its quantity and cost.

Each template is designed to meet specific requirements related to the scope of the project or goods being delivered. For instance, a service-based invoice typically includes columns for rate per hour and total hours worked on the project, while a product/goods delivery invoice will display an itemized list of products and quantities shipped. In addition to tailored features for each type of invoice letter template, they often include helpful tools such as automated tax calculations, currency conversion capabilities, customizable payment options (e.g., bank transfer or PayPal), customer database integration, email reminders before due dates arrive, and more.

Example of an invoice template (a letter body)

Heading and Contact Details

A. Your Name or Business Name

B. Your Address (use standard address format)

C. Your Phone Number

D. Your Email Address

E. Client's Name or Company Name

F. Recipient Address

G. Client's Contact Details

Invoice Details

A. Invoice Number

B. Invoice Date (be careful with American date format when delivering to Europe)

C. Payment Due Date

D. Reference or Purchase Order Number (if applicable)

E. Project Description or Title (if applicable)

Services or Products Provided

A. Itemized list of services rendered or products delivered

B. Quantity or hours for each item

C. Rate or price per unit

D. Subtotal for each item

E. Total amount owed

Payment Details and Terms

A. Payment methods accepted (e.g., PayPal, bank transfer, etc.)

B. Late payments penalties or fees (if applicable)

C. Early payment discounts (if applicable)

Additional Information (Optional)

A. Notes or special instructions related to the invoice or project

B. Any terms or conditions related to the payment

Closing

A. Express gratitude for the opportunity to work with the client

B. Encourage prompt payment and reiterate the payment due date

C. Provide your contact details for any queries or concerns

Attachments (if applicable)

A. Include any supporting documents, such as receipts or contracts

5 Invoicing Software and Useful Tools

In today's fast-paced business world, using invoicing software has become increasingly important for freelancers and small business owners. It offers a host of benefits, from streamlining the invoicing process to ensuring prompt and accurate payments from clients. Whether you're looking for customizable templates, automatic calculations, or the ability to accept multiple payment methods, invoicing software has got you covered.

Here are 5 popular invoicing solutions, from dedicated software to popular word processing and spreadsheet platforms.

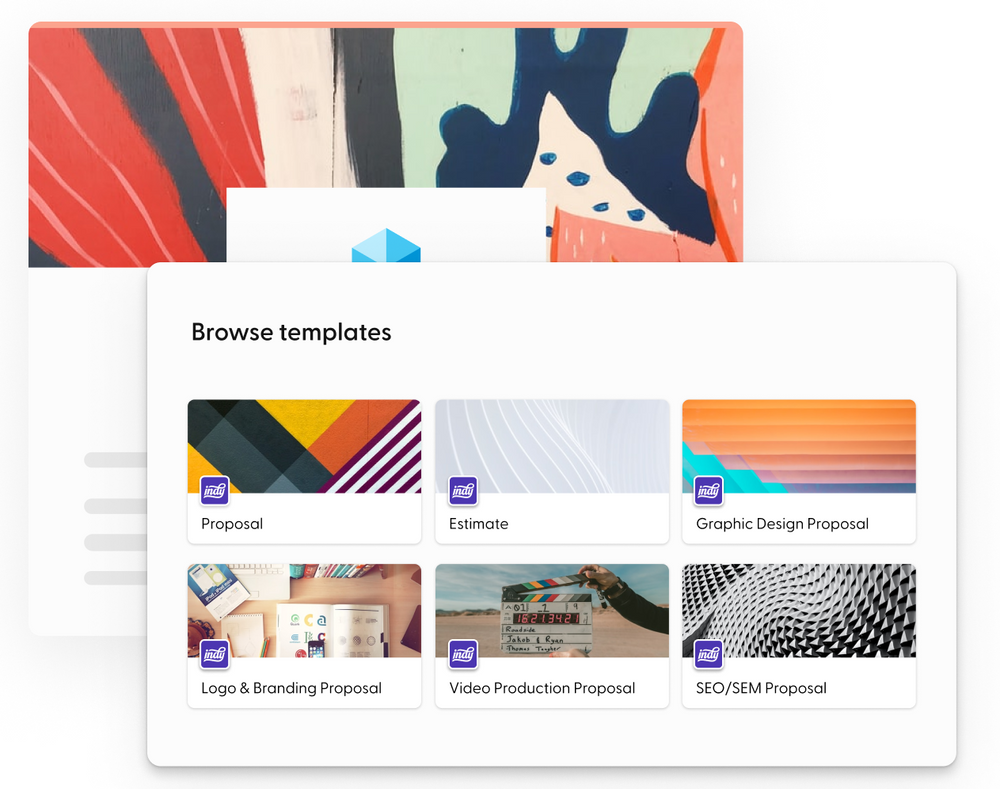

- Indy: Indy offers customizable invoice templates as part of its robust tool suite. It comes with additional features like automatic calculations, payment tracking, and the ability to send an invoice immediately and directly from the platform. Plus, you can accept multiple online and offline payments to get paid faster.

- Microsoft Word or Google Docs templates: These templates are readily available in word processing software and allow users to create invoices with ease. They typically include sections for the header, client information, invoice details, services or products provided, payment terms, and a footer for closing remarks.

- Excel or Google Sheets templates: Spreadsheets can be used to create simple yet effective invoice templates. Users can enter data into cells and formulas can be used to calculate totals automatically.

- Invoicing software: Dedicated invoicing software provides a wide range of invoice templates that users can customize according to their needs. These software solutions often offer advanced invoicing features like recurring invoices, expense tracking, and reporting.

- Freelance marketplace platforms: Some freelance marketplaces, where freelancers offer their services, provide built-in invoice templates. Freelancers can easily generate and send invoices to clients directly through the platform.

When using invoice letter templates, it is essential to ensure that the template aligns with your branding and contains all the necessary elements required for your specific invoicing needs. Customizing the template with your logo, contact information, and specific payment terms helps maintain a consistent and professional image across all invoices.

Additionally, remember to double-check the accuracy of the information entered in the template before sending it to the client. A well-designed and error-free invoice letter not only facilitates smooth transactions but also contributes to a positive impression of your business or freelance services.

Tips on Creating an Invoice Letter for Payment

Here are some quick tips to help you maximize the effectiveness of invoice letter templates, ensuring accuracy, incorporating payment terms, customizing branding elements, utilizing helpful tools, and implementing follow-up strategies for timely payments from clients.

1. Ensure accuracy: When using an invoice letter template, carefully review the information you enter to make sure it is accurate and up-to-date. Check the details such as dates, names, amounts, and other related information before sending the invoice to your client.

2. Include payment terms: Make sure to include payment terms in your invoice letter templates, such as payment due date, preferred payment methods (e.g., PayPal, bank transfer), late payment penalties, or discounts for early payments (if applicable).

3. Customize with branding elements: Utilize your invoice letter templates by customizing them with your logo, contact information, and specific payment terms that will help maintain a consistent and professional image across all invoices. This will show your clients that you take pride in delivering quality services and products.

4. Use helpful tools: Take advantage of automated tax calculations, currency conversion capabilities, customizable payment collection options (e.g., bank transfer or PayPal), customer database integration, and email reminders before due dates arrive - these are all features that can help you save time and easily generate accurate invoices for each project in no time.

5. Follow up on invoices sent: Keep track of the invoices you send out to clients by following up with them at least once prior to the due date indicated on the invoice letter template. You can do this by sending an email reminder or making a phone call to confirm that they received it and understand when they need to make their payments.

How Indy Can Help?

Are you a freelancer or a small business owner looking for a simple yet effective invoice letter? We've got you covered! Say hello to Indy, your new invoicing buddy. With Indy, you can create and send out invoices quickly, ensuring they reach your clients without any delays. No more waiting around for payments!

Indy lets you quickly customize invoice templates and even supports automated payment reminders. So, you can rest easy knowing that your cash flow is in good hands.

Excited to give it a try? Join Indy right now and explore all the other amazing features it has to offer. Get started now for free!

A Small Recap

A winning invoice letter is a professionally crafted document that ensures prompt payment and fosters strong client relationships. It aligns with the structure and formal tone of a standard business letter, providing essential invoice details, payment terms, and contact information.

Similar to a cover letter, a winning invoice letter demonstrates professionalism, attention to detail, and clear communication, enhancing the freelancer's reputation and credibility. By adopting best practices from both a standard business letter and a cover letter, freelancers can create effective invoice letters that facilitate smooth financial transactions and contribute to business success. Ready to create a quick invoice? Get started with Indy to create your next invoice in minutes and get paid fast.