Companies should report payouts and compensations done to non-employees and specific sellers with the help of 1099 forms. If you have sources of income other than wages or monthly salaries, you should receive a Form 1099-MISC or Form 1099-NEC. Basically, the revenue on these forms is a matter of federal income tax and state income tax for the receiver. Here, we shall discuss the things included in both forms and the penalties applied if you do not meet the due date of the form 1099-NEC and form 1099-MISC are.

When Does an Enterprise Require to Issue a 1099-Miscellaneous Income?

This form is specially crafted to record miscellaneous income. Consider a tax form to report additional payments made in the tax year. A single form 1099-misc should be filed for every person or non-corporate body to whom your company has made the payment, a minimum of $10 in royalties or a minimum of $600 for services, such as medical or health care or rent.

When calculating tax for 2019, non-employee compensation was also added in Form 1099-MISC. However, after that, the compensation was asked to be reported on Form 1099-NEC by the IRS.

When Does an Enterprise Require to Issue a 1099- Non-Employee Compensation?

From 2020, enterprises have to file a 1099-NEC to provide details of non-employee payments of at least $600 or more. These forms have replaced Form 1099-misc.

You need to complete the form and send it to all your vendors, independent contractors to whom you have made a payment of $600 or more for commission, award, any form of compensation, or prize for the business service they have rendered to you. However, you do have some exclusions as to who you should send the forms to. The list of the people or businesses given below will not need to be sent, a 1099-NEC:

- If you have made the payment for physical goods, the form will not be issued.

- If the payment you have made is an S Corporation or a C corporation, there is no need to issue a 1099-NEC unless the payment has been made for attorney services or health care payments.

An essential point to consider here is sending a 1099-NEC to every company that works as an LLC sole-proprietorship. Those who are unsure about a company is a C Corp, S Corp, or an LLC should use the W-9 form that the vendor provides while you hire them.

What is the Deadline for 1099-MISC Filing?

There are two filing deadlines for the 1099 MISC, and skipping both can lead to a separate penalty.

Deadline to provide 1099-misc to the receivers

The first filing deadline is when the 1099 form is given to the recipients. The form with information in 8 or 10 boxes should be submitted to the recipients by February 15th. The 1099-MISC with other forms or no information in 8 or 10 boxes can be submitted by January 31st. The day can only be extended, if it is a weekend and the next day is a business day. With such rigid deadlines, make sure you file timely.

Deadline to provide 1099-Misc with the Internal Service Provider

The next due date for 1099-MISC is when you must file it to the IRS. The deadline differs depending on whether it is being filed with the IRS, through mail or electronically. If you use the paper method to mail it to the IRS, the deadline is February 28th. For those filing electronically, the deadline for them is February 28th. Like the other tax forms, if the last date to file the form is a weekend or holiday, the next business day becomes the due date. Failure to file it on the last date may lead to late filing penalties.

What is the Late Filing Penalty for 1099?

There are two options of late filing penalties for 1099 depending on when the form is filed. The penalties are based on the assumption that the correct payee statement was submitted and no incorrect information was filed. If a correction is required, the timelines are different. Several new laws have been passed to enhance the penalties if the taxpayer has failed to file information returns. If the taxpayer hasn't filed the correct statement on purpose or needs to change a return for correct information, the least fine paid is $540 per information return.

Well, everyone can make mistakes. If you have filed the wrong form, you need to void 1099.

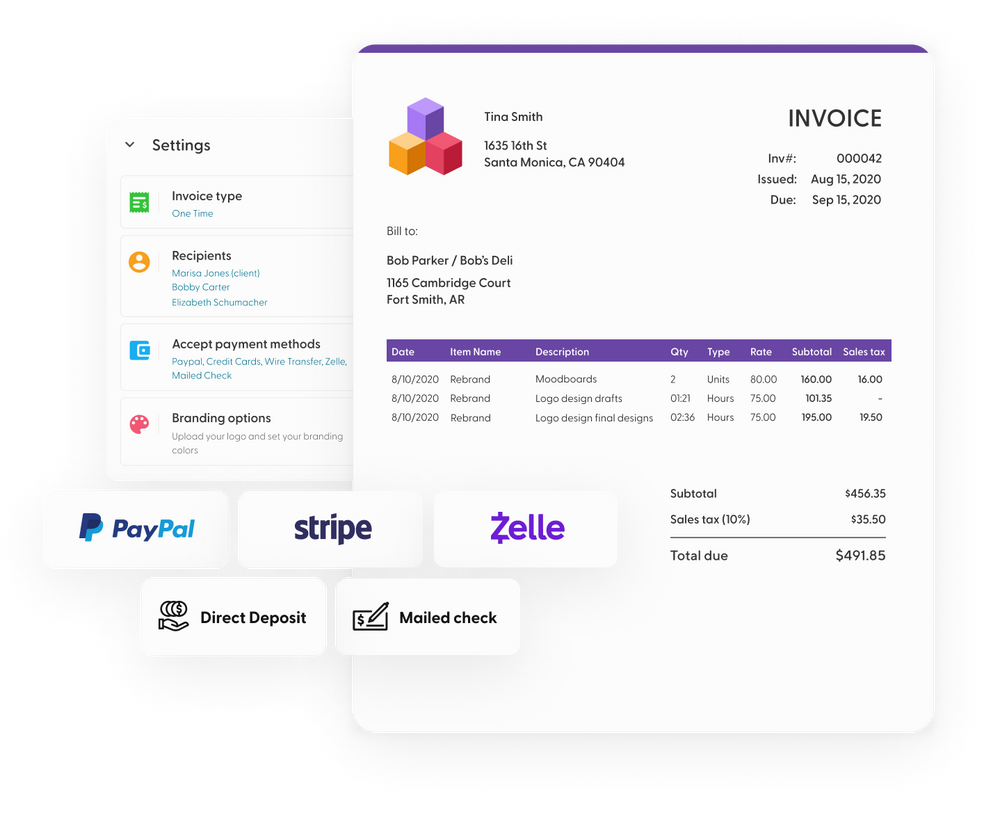

If you want to file your returns and avoid 1099 late filing fines correctly, you should hire tax professionals. You can also use accounting software to do all the tax calculations and remind yourself of the deadlines.

Late Filing Penalty for 1099-MISC and 1099-NEC

The penalties apply depending on how late the filing has been done, the number of 1099s filed after the deadline, and your business size. The IRS assesses penalties depending on whether you are a small business or a big business. Small businesses are companies with receipts of $5 million or lower. A big business has average annual gross receipts of over $5 million.

It is essential to remember that the penalties applied below are calculated on the calendar year 2020, so the amounts may vary after that year depending on regulations.

- Failed to file less than 30 days from the due date

- The penalty for filing 1099 after 30 days from the deadline but by August 1st is $120 for every form. And the maximum penalty for small businesses can be $630,500.

- When filed after 1st August

- If the taxpayer files after August 1st, they are subjected to a penalty of $310 for every form, with the small businesses paying a maximum penalty of $1,261,000.

- Penalty, if not filed at all

- If for intentional disregard or any other reason, the taxpayer fails to file 1099-MISC or 1099-NEC, the Internal Revenue Service may charge separate penalties. If no reasonable cause is mentioned, it is marked as an intentional disregard. Surely, the IRS catches a skipped 1099.

Without a doubt, the IRS keeps a complete note of the intentional late filing when you know about the filing requisitions but purposely ignore them. According to the IRS, three conditions should be met to pass the intentional disregard norm.

- You were liable to file 1099.

- You knew that you had to file 1099.

- You overlooked your responsibility to file 1099 and report income on time.

According to the IRS, you are subjected to penalties if you meet these conditions and miss filing tax returns. Dissimilar to the other tax penalties, you don't have a cap on the final payout you have been penalized with and the bill you foot can cost you dearly.

What Happens if You Need to Pay Taxes Back for 1099 You Haven't Received?

Often 1099 may be issued and received by the IRS, but the taxpayer doesn't get it, and the income fails to testify on their tax returns. If this is the situation with you, you will receive a notice from the IRS that you need to pay back taxes on the unreported income. The notice received by you will have interest on taxes charged on you from the due of the tax return to 30 days from the date the notice was issued.

If any penalties are levied, they will be mentioned in the notice. Interest will consistently be added till the complete owed amount is paid in full. It is essential to add all your income on the tax returns irrespective of whether or not you will get a form 1099.

Things to consider when filing 1099

To make the procedure simple and quick, you should follow these tips:

- Always add the right taxpayer identification number, correct payee statements, and other accurate information. You can do this by maintaining your bookkeeping through the tax years.

- Get an updated W-9 form from your independent contractor and vendor every year. Include it as an essential part of your onboarding procedure.

- Whether you file electronically or paper forms, always pay attention to the deadline.

You can hire a tax professional or choose accounting software to manage your accounting transactions, tax filing, and other essentials. It is always recommended that businesses should file the right form with the right information to get you every dollar you deserve and help you enjoy specific deductions.