There is nothing worse than chasing a client for money. Days turn into weeks, weeks turn into months, and all-in-all you are biting the bullet for your client's lack of professionalism.

Cheers to your patience! Hang on. That's not something to celebrate. You have delivered on the job. Why is the client not upholding their end of the bargain?

In the hustle of staying on top, freelancers and small business owners count themselves lucky to be earning good money. However, this does not mean you should avoid enforcing the legal rules and regulations into your payment plans.

Yes, on the one end, payment terms are negotiable, and clients can legally take up to 2 months to pay you, and only if they mention it in your contract. If not, and your invoice covers all the basics, did you know that you can demand an additional fee on clients disrespecting your invoice terms?

Include payment terms into your contract, and you are automatically liable to ask for a late payment fee when the client falls behind in settling your invoice.

Here is all you need to know about late payments:

Late-Payment Fee Explained

A late-payment fee, also known as a service charge, is a percentage of the total amount on your invoice charged to the client according to your payment terms. Your invoice will outline the specifics, detailing the agreed waiting period to settle the amount due to you.

Essentially, as the freelancer or small business owner, you are now extending credit to your client that he needs to repay at an interest.

Is There a Late-Payment Fee Standard?

To calculate the interest rate on a late payment, you need to consider the annual interest rate. The percentage you add as a late payment fee on top of your monthly amount needs to adhere to industry standards.

So, let's say you and your client have agreed that payments are due 30 after submitting your invoice. And your late fees are charged for every additional month the client is neglecting to settle the outstanding amount.

Suppose the bill was $10000 at the end of March, the yearly interest rate sits at 12%. Divide that by 12 to get to what applies to a single month. Now you have $10000 + 1% interest. Therefore, the next invoice at the end of April will be $10100.

Alternatively, you can also opt for a flat fee. But applying an interest should be handled with caution. Sure, we all want to reach the top, but exuberant extras will have you lose the client. What's more, clients can build a case in court if you surpass the legal interest limit. And not in your favor.

To estimate your potential losses, keep the following points in mind:

- The interest you would lose on an unpaid bill;

- Your time. It adds a significant chunk to your day to follow-up with your clients and to resend invoices where needed;

- Business opportunities you lose out on due to time wasted on tracking your payment or cash flow shortages.

Is It Legal to Charge Late Payment Fees?

In short, yes, it is. But before you get ahead of yourself here, know that you need to communicate your payment plan to your client at the beginning of your work relationship. If needed, you will have to present proof you have followed all the steps before expecting a client to pay a late payment fee.

Although you will have the judge on your side with detailed evidence, unspecified extra charges are the fastest way to break bridges. Do you really want to go through this process? Probably not.

Charging obscene amounts can bite you back in the court of law. In fact, there are some guidelines to follow when it comes to charging a late payment. For example, as mentioned above, your interest rate needs to follow the annual interest rate. So, it needs to adhere to your local laws. On top of this, it is also essential to let your client know that late fees will apply if payment terms aren't adhered to. Finally, remember that a signed invoice indicating the percentage applicable indicates a client's understanding of the matter.

Be reasonable and evaluate the client's situation. Invoice etiquette applies to both parties. You need to follow up at least once before charging your clients with a hefty late payment fee.

How to Enforce Late Payments and Unpaid Invoices?

IPSE research shows freelancers spend an average of 20 days a year chasing invoices for late payments. And 43% of those have completed work that they have not seen a cent for.

That's not great news.

Freelancers or small business owners should try to avoid becoming a statistic. Steer clear from late payments and unpaid invoices by enforcing a plan of action. A well-thought-out plan of action will indicate to clients that your business is serious and professional.

How can you do this?

Here are some effective tips to keep late payments and unpaid invoices at bay:

- Use a Payment Plan: Get paid over a set period. If you work on bigger jobs, your client might find it easier to break your fee into equal chunks. It is not unusual to get a deposit upfront to ensure the project is moving forward. And then to receive the rest in installments. It is a tactic that also gives the client insurance that you will not disappear with a lump sum without delivering the final product.

- Charge Late Payment Fees: That will encourage the client to stick to the terms specified in your contract.

- Offer an Extension the First Time: Communication is key, by far. Give the client the benefit of the doubt and let a late payment slide the first time around. But be wary it does not become a recurring pattern. You do not want to create the impression that late payments do not bother you.

3 Tips to Get an Invoice Paid Faster

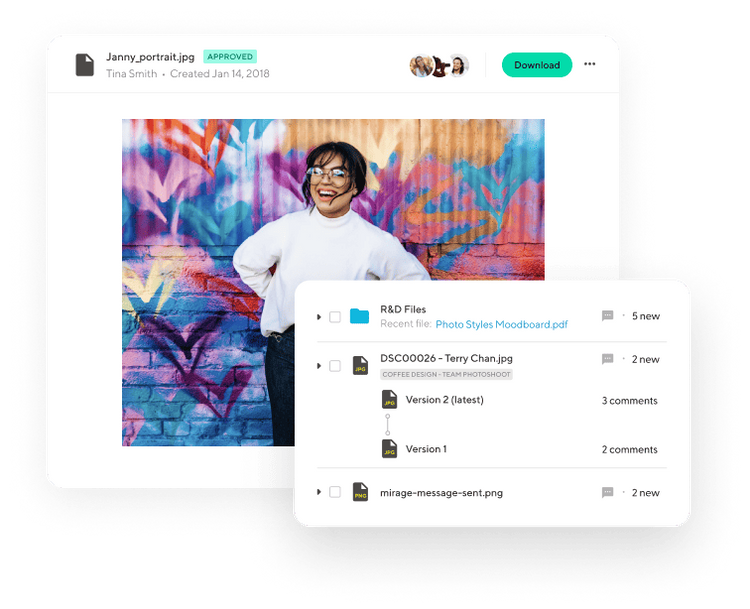

Unpaid invoices can cause unnecessary financial stress to freelancers or small business owners. Fortunately, there are predefined systems to keep track of your finances for you in today's day and age. Focus on what is substantial and gun for new leads. Freeing up space is a doable priority with the help of project management and invoice tools.

Automated Invoicing

Automated invoicing not only helps with time management. In fact, with this system in place, your clients get billed regularly, keeping recurring payments on time and schedule.

Clients are human, too, and forget. Remind them with automated messages that won't feel abrasive. In this way, you ensure you're paid for your work, plus clients won't feel that annoyed about constant paying remainders, as well.

Keep Track of Unpaid Invoices

Forget about Excel sheets and look to the systems that will help your business grow. Keeping track of money coming in and out can get confusing. There are many software options to choose from, so find the one that suits you best.

Leave the old-school ways in the past and get onto a software system that incorporates your entire financial outlook.

Sending Payment Reminders

Incorporate payment reminders into your financial strategy. Follow-ups have a high success rate and are less aggressive than getting collection agencies involved. Just make sure your billing and contact details are accurate and visible. Make it as easy as possible for your client to pay.

Should I Create a Late Payment Policy?

The answer is positive. As a freelancer or small business owner, it is important to get the foundation right. And a late payment policy is a crucial part of setting up your business and paving your way to success.

What Should Your Late Payment Policy Include

A late payment policy should include the following:

1. Payment Reminders

As much as you would like to get paid, there are undeniable steps you need to follow legally.

What's that?

Simply: Even though you have agreed to the terms at the beginning of the project, sending payment reminders falls on you.

Create an email string highlighting the issue. Reminding a client of an upcoming payment is expected, and you don't need to feel strange about it. On the contrary, a payment reminder is completely normal.

2. Invoices Need to Stipulate the Late Payment Policy

Your invoice needs to support your payment expectations. Ensure you outline the payment policy indicating the % late fee you will charge on the outstanding amount. Include all details like the date the invoice was created, payment terms, total due with tax, service provided, business details, contact information, and invoice due date.

3. Charge the Late Fee and Warn for Legal Action

Now, take this step with caution. Legal intervention can get ugly and extremely expensive. It has the potential to sink your working ship.

Before heading in the legal direction, ask yourself:

- Was the client aware of the late fee?

- Was the client unhappy with the service?

- Have you openly spoken to the client?

Evaluate each situation differently. So, keep in mind that it is a good business practice to communicate with your clients before charging a late fee or taking legal action.

What Are the Alternatives?

Kick unnecessary tension and stress to the curb. Yes, late payment policies should be a part of your invoices and way of doing business. But that does not mean you should enforce it every chance you get.

Punishing a client for paying late will pose bigger losses in the future, for sure. Consider early payment rewards by offering a discount on upfront payments. It is an incentive that will help you get around chasing after unpaid invoices. Receiving a deposit is also a principled strategy to follow.

Again, keep your discounts and late fees within range.

Simplify the Payment Process With the Perfect Invoice

If only late payments were the least of your worries. As freelancers and small business owners, there is a lot more to focus your attention on. That is why setting up your invoice solutions, and late payment policy at the start of your business endeavor is a must.

Apart from understanding the nitty-gritty of dealing with clients, when the situation arises, incorporate systems that will free up the time you waste on burdensome administrative tasks.

Indy offers free, simplified payment options to help you with your financial responsibilities. With us, your invoices will look greater than ever and get you paid every time.

Try our invoice demo today to see if it is for you.