Accounting and bookkeeping are actually the most hated things about running a business for a lot of people who go it alone. Many are still preparing their financial statements for the authorities right up until the deadline, which is inevitably stressful. Therefore accounting services and bookkeeping services are in high demand.

If you are a freelance accountant you may well be in demand as an independent contractor. Something you must not forget when entering into a contract is to prepare a comprehensive scope of work document. This tells the client exactly what services you will provide including deliverables, timescale and cost. Basically, everything they can expect from taking you on as a freelancer rather than going to an accounting firm. Indy can help you manage your scope of work with our Proposals, Contracts, and Tasks tools.

Understanding the Scope of Work Document

A scope of work is a legally binding document that protects both you and the client by outlining all of the expectations for a project. As an accountant or bookkeeper, this will not involve streams of accounting data or detailed financial documents but more a list of different aspects of the project and what will be included with each.

If you use a template you can ensure that no important information will be left out and all services rendered will be plain to see. When you use a template you can make sure such services as management, tasks, resources and others can be set out and any detailed information necessary can be broken down into different sections.

Main Divisions of a Scope of Work Document

Scope of work documents can differ depending on the nature of the work involved but they will typically include the following divisions:

Introduction

This section is basically used to outline the project and what will be involved. How much information is included will depend on the scale and complexity of the work. It will identify all of the different parties who will be involved in the project such as the client, any independent contractor and the remainder of the team involved with the project.

Deliverables

This section is about the specific products and/or services that will be received by the client through the project. It will also provide assurance of the quality of the services delivered and how this will be proven.

Timelines

In this section will be a start and end date for the project along with milestones along the way. If this is a simple project then these should be easy to identify and set out. If it is more complex or larger in scale there might be more variables involved.

Tasks

This section is designed to establish the different subtasks involved that will lead to completion of the overall project. This will include which team members will bear the responsibilities for each subtask and clearly defined deadlines.

Resources

This section lays out all of the different personnel, materials and resources that will be required for the project. It will include cost estimates so that the client will have a good idea of how much they will have to budget. You should also include information on anything that may lead to additional expenses incurred.

Roles

This section is about clearly defining the roles of each project team member along with the particular responsibilities that are assigned to them. It may also include information on how and when communication will happen between you and the client.

Management

The final section details how the project will be monitored and evaluated as well as the general management of it. This should include what the potential risks are and how they will be managed should they arise.

A Sample Template for a Scope of Work Document for an Accountant's Services

Here is a sample scope of work document for an accounting job.

Introduction

The client is seeking an independent accountant to provide professional bookkeeping and accounting services for the upcoming financial year commencing 1st October 2023 and ending 30th September 2024. This is to include full financial information for the governing bodies including accounts payable, accounts receivable and financial reports. Financial transactions will be recorded, monitored and evaluated throughout the year.

There will be the possibility of this becoming an ongoing role should the client consider the contractor to be providing services that are of the required quality. Timely payment of any taxes incurred is essential.

Deliverables

The deliverables during the financial year will include the following services:

- Tracking income from various sources including cash, credit cards and other online payments.

- Oversee the payroll process, prepare monthly payroll and reconcile monthly bank statements.

- Prepare all necessary documents for government agencies on a monthly and annual basis.

- Prepare financial reports as and when necessary for funders, government agencies and auditors.

- Maintain an accurate chart of accounts and prepare the company for possible external audits.

There are many deliverables but these are some of the key ones. All of these will be delivered to a high industry standard in line with the quality expected from National Association of State Boards of Accountancy (NASBA.)

Timelines

The dates when work will be delivered will largely be determined by the specific date when each task would generally be expected. For example:

- Within one month of 1st October 2023 the payroll will be fully implemented and will be actioned on a monthly basis from this date onward.

- Within three months of 1st October 2023 there will be a quarterly financial report prepared including cash flow forecast going forward. This will help with planning for the next quarter.

- Within one year of 1st October 2023 all annual documents required by governing law of the state will have been produced and sent to the relevant bodies. Any tax owed will have been accurately calculated and paid before the deadline.

Tasks

All tasks will be carried out by the accountant. The main tasks that will be required have been outlined above but to focus more closely on the subtasks involved some of these have been broken down into different sections:

Daily Tasks to Include:

- Reconciling cash payments, card payments and receipts - All income will be accurately recorded and any discrepancies identified will be reported to the manager.

- Recording and categorizing expenses - Any business expenses incurred will be recorded with due diligence for tax and bookkeeping purposes.

- Updating financial data - All financial data will be updated on a daily basis; it is essential for this to be in order due to the possibility of an audit by a governing body.

Weekly Tasks to Include:

- Reconciling bank accounts - Making sure the weekly accounts represent an accurate record of all transactions.

- Invoicing clients - Ensuring all clients are provided with accurate and easily understood information on amounts owed as well as when payments are due.

- Reviewing employee timesheets - Making sure the hours worked by each employee tally with those expected in their contract and making sense of any discrepancies.

Monthly Tasks to Include:

- Paying utility bills - Ensuring all bills relating to electricity, water or other costs that go along with the work premises are paid promptly and recorded with due diligence.

- Tracking budgets - Comparing the actual spend of work activities with the planned budget and highlighting any variances.

- Creating data backups - Ensuring the company's financial data is safe by regularly backing up files.

Resources

In order to carry out this work effectively the accountant will require a monthly subscription to one of the recognized accounting software providers such as Sage, Xero or Quickbooks. The accountant's preferred software is Intuit Quickbooks, for which the advanced subscription is around $85 dollars per month and will allow all of the features that will be essential for this role.

In line with the industry standard, the accountant will be expecting monthly reimbursement of around $4,854 for the work carried out. This is negotiable between the client and the accountant.

Roles

The following roles have been identified to ensure the smooth completion of this work:

Client - The client will be responsible for providing the accountant with all of the necessary information so that his work can be completed accurately and on time. Also for reimbursing the accountant for his billable hours.

Accountant - The accountant will complete all required tasks to the standard expected by the client and will only charge additional fees for any work that goes beyond that which has been agreed in the original contract.

The accountant will provide regular updates to the client so both parties know that the work is on track and the client agrees that the accountant is delivering what has been promised.

Management

There will be a project management plan set out at the beginning so that everyone knows what is required, when the deadlines will be and who is responsible for each subtask along the way. There will be regular meetings to discuss any discrepancies between the expected and the actual outcomes.

Any changes that take place during the project will be clearly documented and a plan will be in place to mitigate the risks associated with anything that differs from the plan. By following these processes we will ensure that all project milestones are reached and that both parties can be satisfied that the work has been completed to the best possible standard.

How Can Indy Help With Effective Work Management

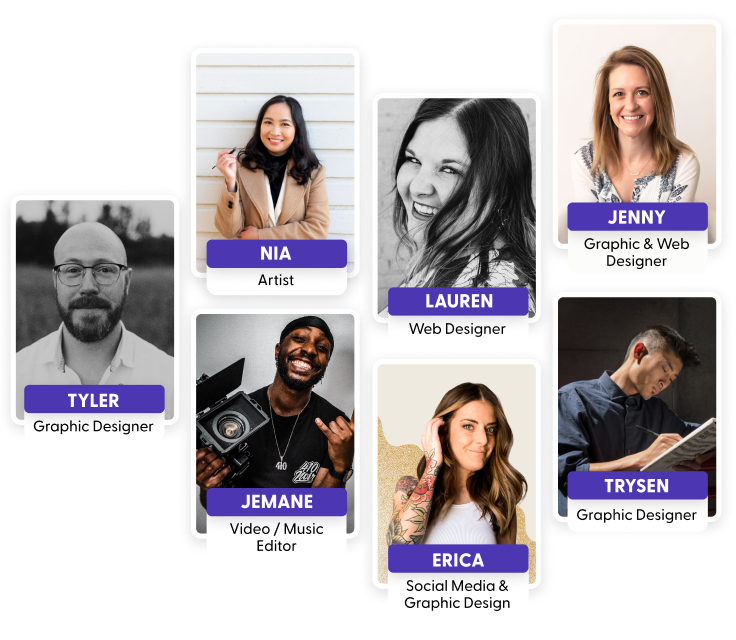

Indy is a highly effective tool for scope of work documents due to the range of templates on offer that are designed by freelancers with freelancers in mind. With a single subscription, you can access various tools that are all a great help in putting together a comprehensive scope of work document.There is also a free version for those who are just getting started.

Indy is known for being very user-friendly so you do not need to be very tech-savvy in order to make use of its best features. There are also tools to help with contracts, invoicing, time tracking and essentially everything you will need to make a success of your freelancing business.

Conclusion

No matter what your line of work as a freelancer, a scope of work document is an essential consideration. It shows your client that you will produce work that is of high quality, that you will be professional and understand what they are looking for. It will give them a firm idea of the time it will take to complete the project, what the various steps along the way will be and what costs will be involved. Ultimately it will give the client peace of mind that working with you will be a positive experience.

Indy is here to help freelancers manage their projects better. You can plan out your work, agree on a project scope, and then get to work. Indy’s free trial offers you a great way to get started with little risk. Why not give Indy a try today?