Every self-employed person in the US should pay a 15.3% self employment tax. While it might not sound like much, it can increase your annual tax bill by a significant percentage, given self-employed individuals still have to file other taxes.

The good news is that the IRS allows self-employed individuals access to several tax incentives that can help reduce their taxable income. They include everything from home office deductions to business travel expenses and start-up costs deductions.

Knowing and claiming these tax deductions can help you save more money to grow your self-employment venture or save for retirement. These deductions will help save you money, but you should not expect them to wipe out the entire tax bill for the tax year.

What is the Self-Employment Tax?

Self-employment tax deductions are for individuals that work for themselves. It includes sole proprietors, freelancers, partnerships, and small business owners.

The self-employment taxes comprise Medicare and Social Security taxes. It aims to ensure self-employed individuals pay the two taxes like all employed wage earners in the USA. The current self-employment tax rate is 15.3%, consisting of 12.4% that goes to Social Security for old age and disability and 2.9% for the Medicare hospital insurance.

Who is Required to Pay the Self-Employment Tax?

Self-employment tax deductions are mandatory for any US resident with net earnings of over $400 engaging in any self-employed activity. However, it is mandatory for those who get church employee income to pay the tax if the net self-employment income is over $108.28.

It is also important to note that the self-employed tax will apply to you regardless of your age, provided you are engaged in self-employment activities. Also, US citizens already benefiting from Medicare and Social Security payments are still obligated to pay taxes for their self-employed net earnings.

8 Self Employment Tax Deductions to Use in 2023

Here are some common tax deductions that self-employed individuals can use to reduce their taxable income and increase profit for their business.

1. Home office deduction

As a freelance or a fully self-employed individual that works a lot from home, you can make a home office deduction from your income hence lowering the taxable amount.

However, to qualify for this deduction, you have to regularly use a part of your home for your money-making endeavor. If you do this, you are entitled to deduct costs such as utility bills, rent, insurance, and depreciation from the business income as home office deductions. Many self-employed people often avoid making this qualified business income deduction as they do not want the hassle of keeping all the records.

Luckily, the IRS now makes things easier for you as they allow you to deduct $5 for every square foot of home space you use for your business. Therefore, if your home office is 200 square feet, you can deduct up to $1,000 from the business income.

2. Health insurance premiums deduction

Health insurance premiums and other medical expenses are deductible, but many self-employed individuals will not deduct them as they do not keep track of these costs.

Self-employed people need to itemize to get a tax break from health insurance premiums and medical expenses. Also, you only get a break for medical expenses if your total expenditure is more than 7.5% of your adjusted gross income.

The health premiums tax deductions are also applicable to spouses and contributions for dependants under your health plan, such as kids below 27 years.

3. Office supplies and other expenses

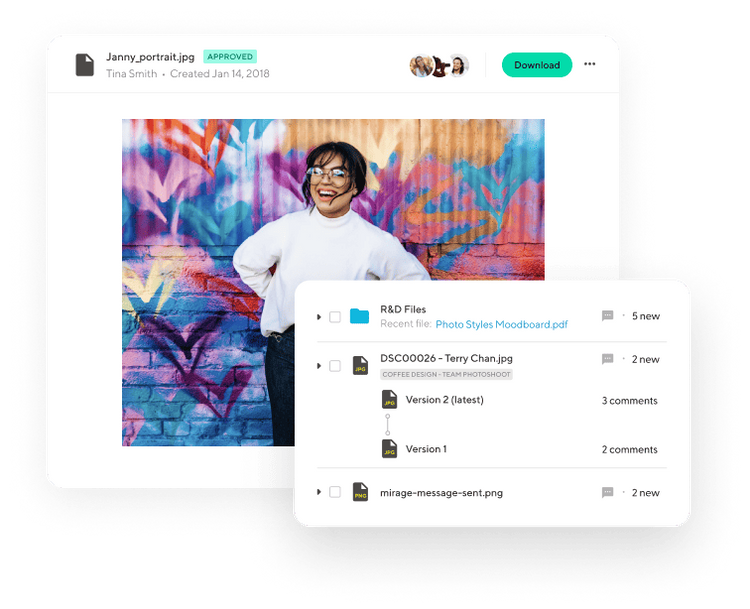

Office supplies you require to operate your business, like stationary, are a qualified business income deduction.

Other office supplies like computers that you use in your office can also be a deduction as office equipment depreciation. However, self-employed people have to keep receipts of these expenses to make the tax deduction.

Additionally, you will also have an option to deduct other office expenses such as internet and phone bills, as they are all incurred as you generate income for the business. You have to be careful when making these deductions, as you should only deduct the percentage associated with the business. A tax professional can help you understand how to do these calculations.

4. Vehicle use deduction

If you use a vehicle for business, you can also deduct this usage from your tax return. There are two ways of calculating your vehicle use deduction: actual expense method and standard mileage rate.

Actual expense method: You can deduct direct costs associated with using your vehicle for business when using the actual expenses method. The expenses include buying motor oil, fueling the car, and paying for insurance. However, it is essential to note that if the vehicle is also for personal use, you must calculate the actual car expenses directly related to the business.

Standard mileage rate: With the standard mileage rate, you have to multiple the number 0f business miles you make with the per-mile rate that IRS issues for the year. For example, the per-mile rate for the 2022 tax year was 58.5 cents/mile.

5. Retirement savings

Retirement savings are deductible from your tax return as a self-employed individual. Business owners have specific retirement plans tailored for them, like the Solo 401(k) and SIMPLE IRA. If you contribute to either of these plans, you can include them as part of your business expenses to lower your taxable income.

The more money you save towards your retirement, the smaller your taxable income will be and hence the lower the income taxes you pay. As of 2022, the IRS allows self-employed taxpayers to contribute up to $20,500 plus $6,500 in catchup for those over 50 years to the Solo 401(k) retirement savings.

6. Business travel expenses

e are other business travel expenses that you are likely to incur besides those associated with using your car, and they are also deductible business expenses.

These travel expenses include train and air tickets you pay for as you travel to do business, such as going to conventions and meeting clients. As usual, you only need to deduct the portion of the business travel expenses directly related to the business. For example, if you are going to New York for a convention, you can deduct the plane ticket and other direct costs related to attending the meeting. However, additional expenses that come with detours, such as visiting friends in the state or touring the city, are not deductible.

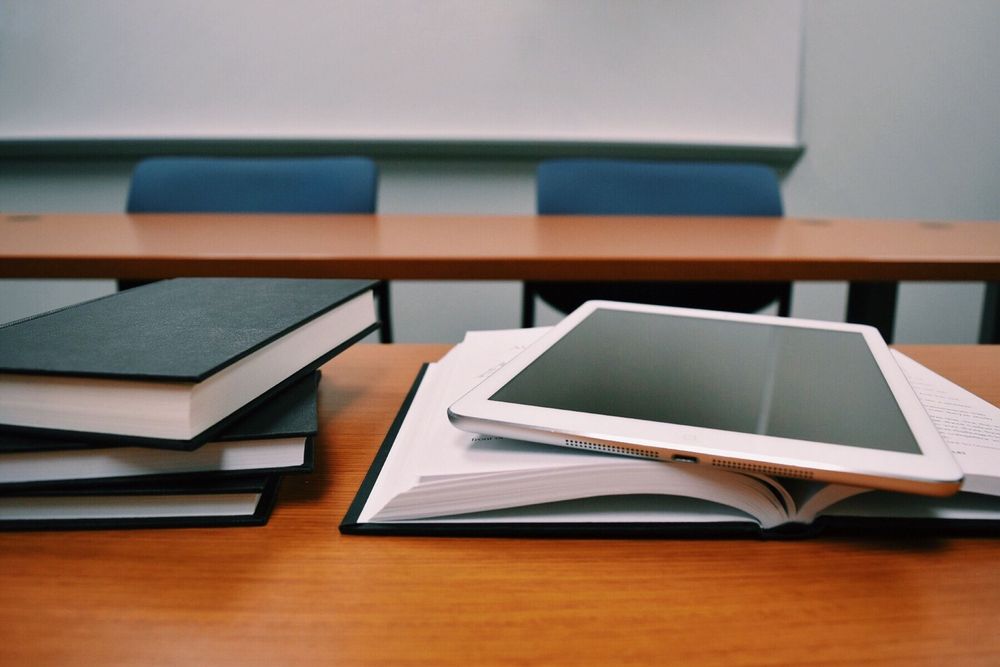

7. Education expenses

Some professions like lawyers, physicians, and accountants will require you to continue education to maintain your licenses and for your business to grow as you improve your expertise.

If you are self-employed in one of these sectors requiring you to advance your education, you can treat the education costs as deductible business expenses. For your education expenses to qualify as tax-deductible, it must be clear that education will help improve or at least maintain the skills you need to do the job.

The education expenses you can deduct here include tuition fees, school supplies, and book costs. In some cases, you can even deduct transportation costs associated with your education, provided they are related to education.

8. Start-up cost deductions

Self-employed taxpayers can also get tax deductions for the costs they incur to set up the business. The costs associated with a start-up include advertising, consultation fees, employee wages, and travel costs you incur looking for business supplies and customers.

The IRS allows you to deduct up to $5,000 as start-up costs from your business income when filing tax returns. However, this amount reduces if your business start-up costs exceed $50,000.

FAQs

How do self-employment taxes work as a self-employment tax deduction?

The IRS allows you to deduct up to half of your self-employment tax from your income tax.

For example, if your self-employment tax obligation is $5,000 for the tax year, you must pay that before the due date. However, you can then deduct half of this ($2,500) from your Form 1040 as you file your individual income tax return.

What should you deduct from self-employment income before paying tax?

It would be best if you always deduct anything tax deductible that is likely to reduce your net income so that you end up paying a smaller tax.

This includes health insurance premiums, business travel expenses, retirement savings, and qualified business income.

Will the self-employment tax be on top of income tax?

Yes, paying self-employment tax does not in any way exempt you from your other tax obligations, such as paying income tax.

The 15.3% self-employment tax caters to Medicare and Social Security taxes, which even employed people have to pay on top of their income tax. The only difference for employed people is that the employer retains 7.65% from their pay and tops the remaining 7.65% to pay the 15.3% required for these taxes.

Conclusion

Running a business is never easy and can also be quite expensive in the early days before you start making good profits. If you add a considerable tax liability, things become even more challenging for you. You can make the business a little less hectic for you by lowering your overall tax obligation by making the allowed deductions. These deductions range from home office deductions to business start-up costs.

While some might not look very significant, you can make massive cash savings for your venture every year if you include several of these deductions in your tax calculation.