Doing Business As, or more colloquially known as DBA, allows you to step away from your birth name and adopt a corporate pseudo-identity.

No, it is not a way to escape the system. On the contrary, adopting a DBA helps you in the first stages of setting up a business.

As a first-time business owner, there are weighty legal decisions to make. From choosing between an LLC or sole proprietorship, the lingo already throws you kilter.

And we have not even touched on the subject of DBAs yet.

But don't worry. This article will unpack everything you need to know about DBAs, and why it is a good idea for any business, yours included.

What Is a DBA? Let's Talk About It

DBA is the acronym for Doing Business As. People also refer to it as a trading name, fictitious business name, or assumed business name. However, it is not quite the same thing.

So what does Doing Business As mean? Well, it is the fictitious business name you register to trade under.

Not every small business owner or entrepreneur wants to put the face at the forefront of a company. That is why a DBA makes a lot of sense. Filing for a DBA allows you to do business under the name of your choosing. It gives you the option to register your business with a name that does it justice, one to support the services or products you have on offer while protecting your privacy and the partners involved at the same time.

Image source: https://www.incfile.com/blog/post/understanding-dba-doing-business-as

Whether it is different from your name as the business owner or your already legal business' registered name, depending on where you live, you will need to abide by your state's DBA requirements. Look into this before you file a DBA for your business entity, as it is highly important.

The Advantages of Creating a DBA

It is vital to understand that DBAs aren't business entities. However, they can provide flexibility and help streamline your business' operations. They may also protect your rights as a business owner, look after general partnerships, give you the go-ahead for your business bank account.

Now let's examine why you should adopt a DBA to do business:

As a Small Business Owner, You Want to Keep Budget Tight

Filing a DBA is relatively inexpensive. In fact, the filing fees are considerably low. Once your company's name is filed and approved, the DBA becomes the business's legal name.

DBAs Offer Options

Choose a DBA name that has legs. If you already have an LLC or corporation registered as the holding or umbrella company, it is easy to branch out with a DBA name.

For the best results, choose a business name that can live on many platforms since after you register your DBA, you need to find a domain name.

Remember to check which domains are available, as this will influence your business name choice. There is no use in choosing a name that you can't legally use online. The Internet is how we operate nowadays, so incorporate it into your business name thinking.

Add Value to Your Services and Products

Using a DBA name that suits your company's mantra will reflect your brand's vision and instill trust in the market and your prospective consumer base. A well-suited fictitious name creates opportunities for marketing campaigns to develop overall brand awareness.

It speaks your business truths and gives your market insight into what it is you are selling. So, don't think twice. Make your day-to-day simpler with the correct fictitious name.

Credibility Can Take You a Long Way

Stepping away from your name, unless you are a celebrity, gives you credibility. In some instances, a name, like the Hollywood elite's case, can help you sell a product. But on other occasions, it can feel empty and cheap without igniting consumer interest.

Take your company seriously by employing a business structure that gives you credible ratings.

Stay Out of the Public Eye

Registering a DBA adds value to sole proprietors, partnerships, and entrepreneurs who want to keep their identities private. Not everyone wants to be famous, and a DBA helps keep your low profile intact.

Retain Business Banking Ease

A DBA is an essential part of getting your finances in place. Many banks will list this as a requirement. So, make business banking a breeze by filing for a DBA.

Spot the Negatives Around Registering a DBA?

Like everything in life, a DBA also has negatives. Before registering your DBA, strive to understand both sides of the coin to make an informed and accurate decision. Besides, it's your business that is going to be affected. Always remember that.

Here are the cons to mull over when it comes to DBAs:

Your Business' Name Is up for Grabs

Filing for a DBA does not keep your business name off the market for others to potentially use. You need to also trademark your business to keep it off competitor's signs and pamphlets. Just do that.

Lack of Legal Protection

Too many DBAs can harm you as you will be a suspect of fraud. While a DBA protects the business owner's birth name, it does not look after your assets like a trademark would. If you need more legal protection than what a DBA can provide, look into what trademarking entails. But generally, for a smaller business, a DBA should do just fine.

Adding to the Administrative Burden

Yes, although DBAs are relatively cheap, they can present some hassles. Depending on the legislation, you have to upkeep your filing every other year. And it is possible that if you did not register your DBA with your state, you would have to do it separately wherever you want to trade, which is a bummer.

Branching Out Means Across Border Difficulties

Is the plan to grow your business into other states? If so, then you also need to Foreign Qualifying for each respective state you plan to operate. If you skip these steps, you will be prohibited from doing business across state borders.

In short, a DBA is your business passport.

Image source: https://www.incfile.com/blog/post/understanding-dba-doing-business-as

Lose Out on Tax Benefits

To get something back from the tax collector, you need to register your DBA as part of an LLC or within the umbrella operations. Regrettably, a stand-alone DBA won't be on the receiving end of tax benefits.

I Want A DBA Today

For successful filing of a DBA, you will need the following:

- DBA filing often requires proof that the corporation or LCC has a good standing certificate you can request from the secretary of state.

- You cannot use a name that implies you are a corporation or LLC. In this case, Serena Inc. will not get you into the registered books.

- Check if your state requires you to provide public notice of the DBA filing. You will have to post your filing in the local paper.

- Whether online or direct debit, make sure your state allows your preferred payment method.

- You will be required to identify your business with a Social Security Number or an EIN.

- Processing time for DBAs differ. It is best to plan to allow for some breathing space. It can take up to 4 weeks to receive DBA approval.

- In most states, the common term for a valid DBA is 5 years. After that, you will have to renew it. Be sure to know when your DBA expires.

If you have all your documentation in place, registering your DBA should be a piece of cake.

Why Small Businesses and DBAs are a Match

As a small business owner, DBAs are a great alternative to traditional LLCs. Your main objective at this early stage of your business is to grow, and a DBA can help you expand.

Your name is the first point of business when you are dealing with your target market. It is what your audience gets to know and trust.

Apart from DBAs giving you credibility in the market, it provides the opportunity to be taken seriously. At the same time, it allows you to grow your services as you see fit. One of the DBA's key benefits to a small business is you can file multiple DBAs while housed under one legal entity, which is great.

If the ongoing pandemic taught us something is that: Never have all your eggs in one basket.

Filing for a DBA means you can operate your kombucha company while keeping your eye on a little vacant shop to start a homemade Prego take-out or something similar. You get the meaning.

In our modern era, where we achieve more than one thing, a DBA might be what you need to achieve your goals.

DBAs, Sign Me Up

Doing business in 2021 requires you to step up and get a DBA. Getting the process of receiving one started is easier than it seems, and you will reap the rewards as a growing business entity. The hardest part is nailing a fictitious name that will age well.

You've got this. As a small business, you need to understand what it takes to start a company from the ground up, and DBAs are a part of this journey. Look, for some, LLCs might be the better option. For others, the easier solution that speaks to their current needs, a DBA works.

Creating a solid foundation for your business' future is what matters most. Filing a DBA is merely the beginning of the marathon.

Once you have completed your filing, you will typically wait for 1 to 4 weeks to hear if the county's clerk office approved your name.

Afterwards, you are open for business! You can now pour the champagne and cut the red ribbon.

But like everything new, there will be heaps of admin. Some days you may love organizing your files on your desktop and scheduling your time. On others, you might detest the invoicing software and capturing new leads.

That is completely normal.

Don't let this bring you down, though. Instead, look for options to assist you in the mundane tasks that leave you feeling drained and uninspired.

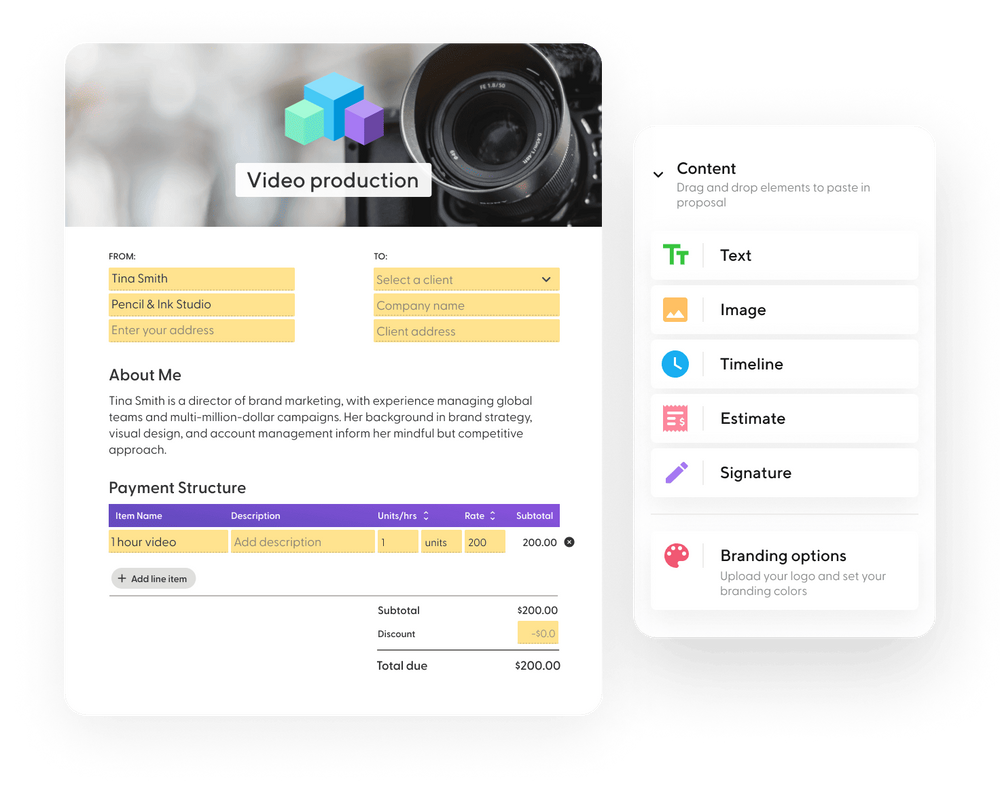

For example, with Indy, you can manage your entire workflow in one platform for one price. Indy is an all-in-one project management, contract, invoice, proposal, task, chat, and file-sharing platform that will level up your freelancing career or expand your small business.

Let Indy help you get a DBA. Sign up. It's free.