The number of people opting for a freelance or self-employed career is growing. In a recent report, it was estimated that 59 million people in the US were freelancing in 2020: that’s around 36% of the total workforce. Not only that, but it is also predicted that this figure could rise to more than 90 million by 2028, whether it is full time or part time.

Some people decide to freelance because they prefer being their own boss. Others turn to this way of earning a living after losing other employment. There are those for whom freelancing is their full-time gig, while some freelance to earn extra money on the side. Let’s give you some numbers – 53 per cent of Gen X (42-57 years of age) and 46 per cent of Millennials (26-41 years of age) are choosing freelancing as a long-term career. However, 64 per cent of Gen Z (18-25 years of age) and 54 per cent of Boomers (58-86 years of age) are using freelancing or self-employment to top up their income temporarily.

No matter how you ended up in the world of freelancing, you need to save for retirement. For a freelancer, a self-employed person or an individual business owner, the best retirement savings option is the Simplified Employee Pension (SEP) Individual Retirement Account (IRA).

A SEP-IRA not only provides you with income when you have decided to finally retire from work, but during your career it allows you to take advantage of significant tax savings, too. The general rule of thumb when considering retiring is that you will need around 80% of your pre-retirement income to live comfortably. When you’re a freelancer, self-employed or a small business owner, it can be difficult to think about giving up some of your hard-earned cash and put it aside into a retirement fund. But the contributions flexibility of an SEP-IRA is the answer to making sure that your retirement is as good as your working career.

The SEP-IRA is similar to a traditional IRA. If you operate your freelance business as a sole proprietor, partnership, or even a corporation, you can set up such a retirement account.

How does an SEP-IRA work?

A SEP-IRA is an appealing option for freelancers and the self-employed as there are little start-up costs, it is easy to set up and manage, and enables you to start saving towards retirement. From a tax point of view, an SEP-IRA has the same transfer and rollover conditions a traditional IRA would have, and you make contributions annually. Another gain is that how you fund your SEP-IRA is flexible. For example, if you have had a tough year financially, you can choose not to add any funds. Alternatively, if you’ve had a really good year, you are allowed to contribute more than perhaps you would normally. Basically, you can change the amount you put into your fund depending on your circumstances at the time.

There are eligibility rules for an SEP-IRA – generally, you must be a freelancer, self-employed or a small business owner with preferably no employees, although you can still get an SEP-IRA if you have one or two employees, but you must be 21 years of age and over. The contributions you make are tax deductible.

SEP-IRAs vs. Traditional and Roth IRAs

Traditional or Roth IRAs are usually the first steps in retirement saving for freelancers. Both types of retirement plans allow you to contribute up to $6,000 of earned income annually. If you are over 50, you may put away an additional $1,000 as a catch-up contribution.

Contributions to traditional IRAs, as with SEP-IRAs, are made with pre-tax dollars. These investments are tax-deferred until withdrawal, at which point they are taxed as ordinary income. Roth IRA contributions are funded with post-tax money. You cannot deduct Roth IRA contributions, but you do not pay tax on the monies later withdrawn. Unlike traditional and SEP-IRAs, there are no mandatory withdrawal requirements for Roth IRAs. There are annually adjusted income limits for Roth IRA contributions.

The good news is that you can contribute to both a traditional or Roth IRA and a SEP-IRA, as long as you meet the income requirements. Whether or not you can deduct your traditional IRA contributions depends on various factors. If you are a part-time freelancer covered by an employer-sponsored retirement plan at work, you can make but not deduct traditional IRA contributions. That is not the case with an SEP-IRA.

The beauty of a SEP-IRA is that you can contribute more towards your retirement and receive greater tax savings.

SEP-IRA vs. Solo 401(k)

The Solo 401(k) is another option for freelancers. Contribution limits and tax advantages are the same as for the SEP-IRA. However, if your freelance business includes any eligible employees –with the exception of your spouse –you cannot open a Solo 401(k).

The key difference between the two retirement plans, though, involves paperwork. The administrative requirements for a Solo 401(k) are far more burdensome than that of the SEP-IRA. In addition, once you have saved $250,000 in a 401(k), you must submit annual reports to the IRS. That is not the case with the SEP-IRA.

Both plans offer flexibility in that annual contributions are not required. While you should try to fund your retirement plan fully each year, freelancers know some years are leaner than others.

Contribution Limits

The IRS permits you to put away as much as 20 per cent of your annual net income from self-employment into an SEP-IRA. The contribution limit changes each year based on cost-of-living adjustments. For 2020, self-employed individuals may put away as much as $57,000, based on a net income limit of $285,000. For 2021, the self-employed may save up to $58,000, based on a net income limit of $290,000.

An SEP-IRA functions in the same way as a traditional IRA, with the exception of contribution limits. The money contributed to the SEP-IRA grows tax-free until withdrawal.

Withdrawing funds before you reach the age of 59½ results in penalties, and you must start withdrawing funds by the time you reach 72 years of age. That is true whether or not you have retired.

The IRS changed the maximum age for withdrawing SEP-IRA funds in recent years, so anyone who turned 70½ years of age before January 1, 2020, is required to start making withdrawals. Keep in mind that failing to take the Required Minimum Distributions (RMDs), the minimum amounts you must withdraw each year after reaching this mandatory age results in significant penalties.

Unlike traditional IRAs, SEP-IRAs do not include catch-up contributions.

Part-time Freelancers

Even if you are a part-time freelancer, you can still open an SEP-IRA. That is true even if you are employed and contribute to an employer-sponsored 401(k) at work. You can still put away up to 20 per cent of your freelance net income in an SEP-IRA, and your traditional IRA contributions from your employer can also be put into your personal SEP-IRA, if you wish.

If you don’t have a retirement plan through your employed workplace and your spouse isn’t either, there is no limit on the income you can deduct from your contributions on your taxes. But there are limits for other situations. If you aren’t covered but your spouse is, the limit is $204,000. If you are covered by a retirement plan (including an SEP-IRA), and single, the limit is $68,000 or £109,000 if you are married and both of you are filing at the same time.

Tax Advantages

For a self-employed person or a small business owner that is contributing to employee SEP-IRAs, your income tax and self-employment tax is reduced

Because SEP-IRA contributions are tax deductible, your taxable adjusted gross income for the year is lowered. If you are a sole proprietor, just claim the SEP contribution on your IRS Form 1040.

Pros and Cons of an SEP-IRA

As with any investment-type fund, there are advantages and disadvantages.

The advantages of an SEP-IRA for a freelancer or self-employed person are:

- The fund is easy to set up and maintain.

- It can be combined with either a traditional IRA or a Roth IRA.

- The amount you contribute to your fund each year is flexible, depending on your financial circumstances. You don’t have to commit to a set amount each year.

- Your contributions are tax deductible, including any contributions made to an employee IRA account if you employee more than a few people. For freelancers and the self-employed, the tax deduction is 25 per cent of your net self-employment income.

The disadvantages are:

- You can’t make any catch-up contributions if you are over 50 years of age.

- There isn’t a Roth version of an SEP-IRA; therefore, you aren’t able to pay tax on your contributions at the point they are put into the fund and take a tax free deduction in retirement.

- When you reach the age of 72, you will have to make minimum distributions, as you would with a traditional IRA or 401(k).

- Any distributions you take after the age of 59½ are taxed as though it is income, and is also taxed as a 10% penalty, unless you are able to meet one of the early withdrawal exceptions on distributions.

Setting Up a SEP-IRA

SEP-IRAs are indeed simple to set up. The IRS permits you to place your IRA funds in a wide variety of investments, with the exception of collectibles and insurance. The contributions you make to your SEP-IRA fund are not taxed at the point of contribution, but at the point you withdraw funds.

Contact your bank, broker, mutual fund advisor or other qualified financial institution to get started. Many of them have an IRS-approved SEP document or are able to design an SEP plan document tailored to your requirements that will be approved by the IRS. Alternatively, if you are a freelancer, self-employed or a business owner, you are able to use Form 5305-SEP, Simplified Employee Pension-Individual Retirement Accounts Contribution Agreement. If you own a business with your spouse, you will both need to submit an SEP plan individually.

In all cases, you will need to also submit your bank or other qualifying financial institution details and insurance company to the IRS. The deadline for making contributions is April 15 of the following tax year, although it can be later if you have filed for an extension of your tax return.

The financial institution reports SEP-IRA contributions to the IRS on Form 5498 in the year in which they were made. You do not have to submit any paperwork on your own. You own and control your SEP-IRA at all times.

Why You Can't Afford Not to Save for Retirement

There are all sorts of advantages to freelancing. You have more control over your time and the projects you take on. Of course, there are disadvantages, too. Your work life may fluctuate between feast and famine. There are periods in which you are so busy that the rest of your life falls by the wayside, and other times in which you are scrambling for a gig. Depending on your field, your work is in demand at certain times of the year and may prove nonexistent in others.

Too many freelancers fall into the trap of not saving for retirement. It is probably the last thing on your mind when you are starting out and struggling to pay bills, as well as keeping track of your quarterly tax payments. But time marches on, and you don't want to find yourself nearing retirement age with no retirement savings on which to fall back.

Successful freelancing requires discipline, as you are your own boss responsible for finding your own work. Use that discipline to put some money aside each month for retirement. Even if it is just a small amount, it's a start. Increase the amount as your career grows. From tiny acorns grow huge oaks.

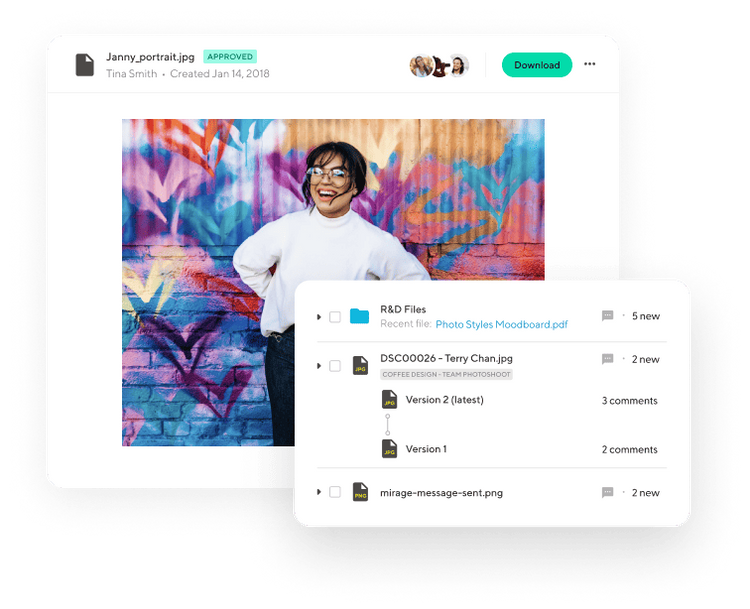

No one got into freelancing so they could get bogged down doing paperwork, but it is a vital part of running your own business. Indy is here to help with many of those frustrating elements of freelancing, like invoicing, contracts, and other forms.