Everyone likes saving money and most people hate paying taxes. If you're a freelance graphic designer, there is a way to do both at the same time. Sure, it might take a little extra work to understand and claim all the tax deductions. But if you put in a little time and effort, you could save a good chunk of change on your tax bill.

At Indy we focus on making freelancing simple. So, we've put together a list of 17 common tax deductions you can claim every year. After we show you how to save money, we'll also show you how Indy can help you save time. Now, let's get started with the first tax deduction.

Business insurance

When you buy business insurance as a freelance graphic designer, you are investing in protection. As long as your business insurance benefits your business or serves a business purpose then you can claim the premiums as a business expense.

Business insurance cover is formed from several components, including general liability, professional liability, commercial property, business interruption, and additional add-on policies as required. Claiming health insurance premiums can be problematic for freelancers, so it’s best to take advice from a tax professional, otherwise, all premiums are tax deductible.

Bank fees

Bank fees are tax-deductible expenses as long as the fees are associated with a business bank account. The IRS allows monthly service fees, ATM withdrawal fees, and even credit card fees, but they all must be associated with work purposes. The IRS further dictates that expenses must not be excessive

Employees and subcontractors

The wages or salaries of staff primarily involved in the work of the business can be deducted as business expenses. Some employment schemes aimed at freelance designers and smaller companies are also tax-deductible expenses. These include health insurance premiums and health reimbursement arrangements (HRA), as well as paid employee leave and some retirement account contributions.

Materials and supplies

For the graphic designer, many items of equipment and materials are bought specifically for the work of the business and are consequently classed as business expenses. They are varied and include design software, website hosting, online advertising, digital design products (ie, images), data storage, and personal marketing materials (business cards, etc.).

Loan servicing

While you can't claim the capital cost of any business loan, you can claim the interest on the loan as tax deductions. There are a few conditions the Internal Revenue Service requires for the interest to be eligible:

1. You must be legally liable for the loan

2. You and the lender must agree to pay off the loan

3. You and the lender have a true lender-creditor relationship

Vehicle expenses

Freelance designers often want to visit clients personally to create a good first impression and to view the client's ideas, which are usually visual. Your vehicle expenses are common tax deductions, which must be apportioned to business and private expenses. Currently, the IRS offers the choice between calculating a per-mile rate (65.5 cents per mile) or apportioning the actual costs of running the vehicle.

Office rental and lease

Rent paid solely for business purposes is a business expense and can be considered a tax write-off. Usually, business rent paid is calculated and deducted for the year it is paid. So, if you pay rent for the year upfront, it's only possible to claim it as a tax deduction throughout the remainder of the tax year in your self-employment taxes.

Licenses

Any business licenses or certificates associated with a graphic designer's business purposes are eligible for tax deductions. Such licenses include national business registration fees and more local municipal permits.

Marketing and promotion

By the nature of their business, freelance graphic design companies employ extensive marketing and promotion tools. Marketing is wide-ranging, including website hosting, domain names, paid social media, and digital and physical advertising materials. So long as these costs are reasonable and solely attributable to the work of the business, they are eligible for a tax deduction from your taxable income.

Office equipment

Graphic designers operate in a world of presentation, so they must create a modern and stylish office so their clients feel confident in their capabilities. Decorating and furnishing a business office to a high standard is a requirement. Thankfully, these expenses can be claimed against income in most cases. In addition to furnishing, any office will require at least basic equipment for drawing, writing, sketching, and other essential design tools.

Home office deductions

To keep costs low, especially initially, it's common for freelance graphic designers to work out of a home office. This is normally a dedicated room in a domestic house used only for business purposes. As the definition between domestic and business can get blurred, the calculation for apportioning business use to a room can become complicated for a home office deduction.

Computer software

Many straightforward software programs are free to use; however, designers must routinely use paid, professional versions for the quality of work they undertake. Adobe Photoshop, Canva, Doodle, and Simplecast are just a few of the popular apps.

Trade events

Any business person needs to maintain a good professional network of contacts which can often supply new work and provide vital information about trends and industry progress. Trade events still offer useful personal contact, although the time taken to attend them means that webinars are becoming the more popular choice. The costs associated with attending either a trade event or a webinar are solely business-related; consequently, they are eligible for tax deductions.

Travel and subsistence

Although it's preferable to visit clients or trade events locally, on occasion, it may be necessary to travel long distances. So long as your travel is in connection with your work, then the cost of the travel, reasonable costs for staying overnight, and meals can be submitted as expenses to reduce your tax bill.

The IRS offers flexibility, so attending seminars, conventions, or trips to research a project or build a work portfolio is included. Meals and entertainment need to be undertaken before or after the business event being attended. If you have an office, travel to and from your workplace is not classed as an allowable expense.

Training and courses

Graphic design training can cost from $500 to many thousands of dollars. For example, a graphic design 112-hour certificate program costs $3,600. As the training is solely concerned with creating a business, the associated costs can be recouped as an expense to reduce your tax liability.

Shipping and postage

Any freelance graphic designer will frequently send out proposals, visuals, models, and many other samples that clients need to see and which can't be sent online. Consequently, designers regularly use postal services and couriers, which can deliver items quickly and securely. These costs are wholly business expenses and as such are eligible for tax deductions.

A proportion of cell phone usage

A cell phone is an essential tool for any small business owner. As they become more versatile the number of tasks you can complete while on the move makes them invaluable. When setting up in business some prefer to have a dedicated business cell phone to keep the costs and calls separate from private ones. When claiming expenses on a business phone both the rental and the calls can be claimed against business income.

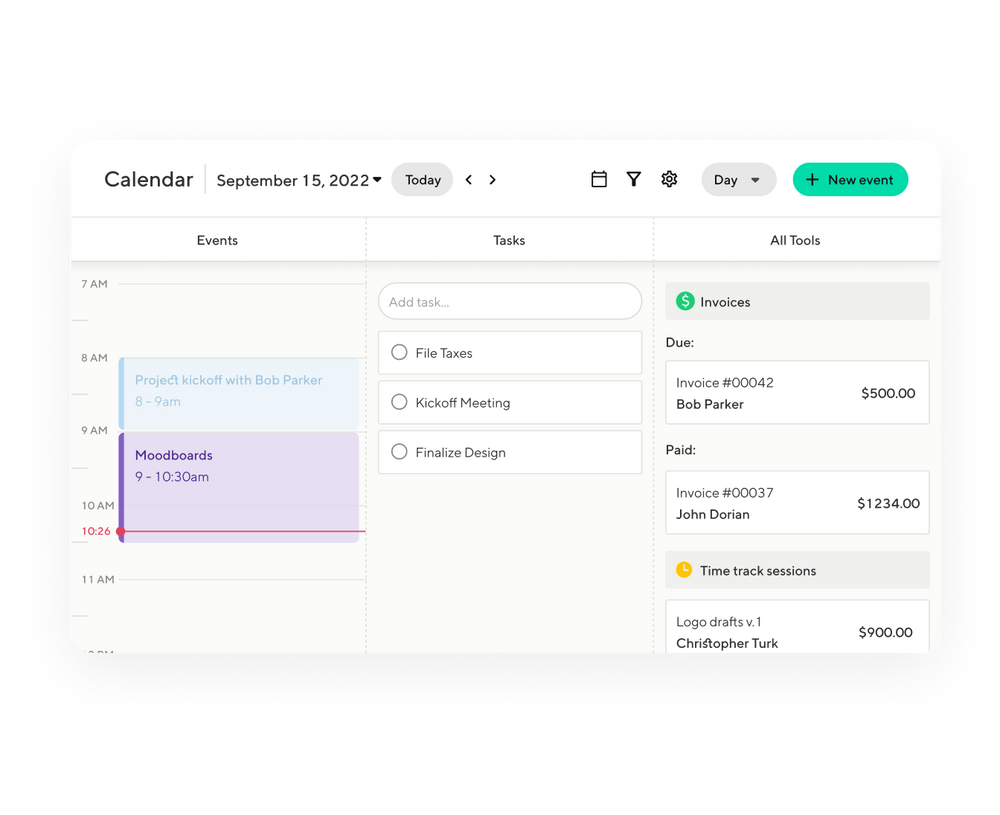

How Indy Helps Manage Taxes

Indy, the all-in-one business app for freelancers, acts almost as a virtual assistant, enabling you to keep tabs on your transactions as you go. So, no lost receipts or missing invoices. Indy's Tasks Tool brings tax-related tasks together, so you can monitor your progress throughout the year in real-time, organize task lists, and set those important deadlines. You save precious time and effort, your client relationships will be more professional, and best of all, you can maximize your deductible expenses at the end of the year.

Conclusion

Graphic designers that take full advantage of appropriate business expenses will make considerable tax savings. There are so many different possibilities for deductible expenses it's often worth the cost of paying a bookkeeper or accountant, who will be able to keep on top of your finances, as money comes in and out of the business.

An expert in tax will also be aware of what and where you can claim, keep you abreast of any changes in IRS legislation and most importantly ensure your quarterly tax payments are timely. This leaves you to concentrate on what you're good at, designing, while your accountant can be left to do his part and justify his fee. In a similar way, you can leave all the admin to Indy.