Marketing and advertising is a necessary expense for all business, and every second counts when it comes to building clientele or showcasing your products and services. Fortunately, these costs are also tax deductible.

Here at Indy we want to help freelancers, so in this article we’ll take a look at what does and doesn’t count as advertising, and how to deduct the cost of your income tax.

What is Considered Advertising?

Advertising is a broad category. But simply put, advertising is any action that raises awareness about your brand, service, or product.

Years ago, print ads and billboards were your primary source of advertising. However, in a society driven by technology, there are a whole host of expenses that fall under the advertising umbrella. These include:

- Promotional items (such as stationary) featuring your logo

- The classics, including permanent signs and banner ads

- Business cards and brochures

- Logo design costs

- Networking activities, such as network events

- Online advertising, such as social media or Google AdWords

- Print advertisements

- Television and radio adverts

- Search engine optimization (SEO) services

- Social media influencers

- A business website

Anything that places your business on the map and raises awareness of your brand, services, or product is considered advertising and is tax deductible.

The list above is a broad overview of eligible advertising expenses, however, there a few more business activities that are considered as advertising expenses and are tax deductible, as listed below:

Promotional events

Promotional events are a great way of generating buzz about your brand, services, or products. This can include launch parties.

Costs incurred during promotional events qualify as deductible advertising expenses. For example, let's say you hired a DJ for your launch party, or a caterer providing meals, you can write these off completely, as they qualify as valid advertising costs.

Goodwill advertising expenses

Sponsoring a charity or event is also considered as valid advertising expense, if they feature your business in exchange for your support.

Some examples include:

- Sponsoring sports teams, and they display your logo on their team banner or jerseys

- You donate to a local charity, and they print your logo on their brochures

- Your small business is displayed on a charity organizations website that you donate to

- You donate to a charity event and they print your logo on their promotional materials

- You commit to donate a percentage of your sales to a charity

A broad list, these are examples of what you can write off as advertising expenses, as long as your contributions receive advertising in return. Any donations that don't offer anything in return regarding your business, do not count as a business transaction and cannot be claimed as an advertising expense.

Client gifts

As a freelancer, building clientele and finding new customers is an important aspect of the job. However, keeping your current clients and customers is just as important. Business gifts and giveaway items are an excellent way to maintain a strong relationship with new and existing clients and customers, and does count as promotional activities and a deductible business expense.

Under IRS guidelines, you are allowed to write off $25 per client when gifting free products or services. This does include shipping fees and taxes. For example, let's say if you're a freelance fitness instructor and decide to gift your clients with small digital fitness watches. After shipping costs and taxes, the gift costs $50 per client, and you do this for 10 clients, your total write off is $250 ($25 x 10).

However, the $25 limit doesn't apply if:

- You are freely handing out freebies (such as pens at a promotional event) and each item costs less than $4.

- The gifted item has your company logo permanently displayed. For example, a notebook with your logo printed isn't subject to the $25 limit, but a notebook with a branded sticker is (since the label can be removed).

Branded merchandise

Any items that feature your business' logo or brand is considered an advertising expense. This can include clothes, mugs, stationery, and more.

What is Not Considered as Advertising?

Now that we have covered what costs you can claim as advertising expenses, let's take a look at what you can't deduct.

Political platform advertisements

Any advertising on any political platform is non-deductible.

For example, let's say you decide to purchase advertisement space on a political party or candidate's website because you support them. This is a non-deductible advertising expense, as, under IRS guidelines, it is considered an indirect political contribution.

Personal events

There is often confusion regarding a promotional event and a personal event in which clients attend. In order to claim advertisement deductions, the event must be explicitly business related. Any expenses derived from personal events, such as wedding costs, are considered primarily personal and nondeductible.

Personal hobbies

Although entertainment expenses are eligible deductions in promotional events, they are generally nondeductible. This includes personal hobbies such as golfing, even if work was discussed, as it is deemed primarily personal and not a promotional activity.

Auto expenses for cars with printed ads on them

If you use only use your car for personal use, you can't claim auto expenses. This means, even if you print your brand' logo on your car, it is not considered an advertising expense as it is a personal vehicle and not used for business activities. Unless it is driven for work, any auto expenses are non-deductible.

However, if you do use your car for work (for example, a freelancer mobile hairdresser), and you advertise your business (for which the car is being used for), that is considered a valid advertising expense.

How to Deduct Advertising Expenses

You report your advertising expenses on line 8 of your Schedule C. You can add your advertising costs to your total business expenses to reduce your taxable income.

What Other Marketing Expenses are Tax Deductible?

Along with advertising, there are some other marketing expenses that are tax deductible. This includes:

Website expenses

In this day and age, having a dedicated business website can help with brand awareness. As a freelancer, a website is also a great place to showcase your portfolio and skills to new clients and customers.

Many website costs are also considered marketing expenses and tax deductible.

This includes:

- Costs associated with developing, designing and creating your website. Perhaps you use an online service such as WordPress and pay a monthly or annual subscription. This is tax deductible.

- Website fees for hosting and maintenance. This can include domain fees.

- Ongoing website content creation.

Marketing software expenses

If you use any marketing software (including Mailchimp or Hubspot), annual or monthly subscription costs are considered marketing expenses and are tax deductible.

Same as advertising expenses, you report your marketing expenses on line 8 of your Schedule C.

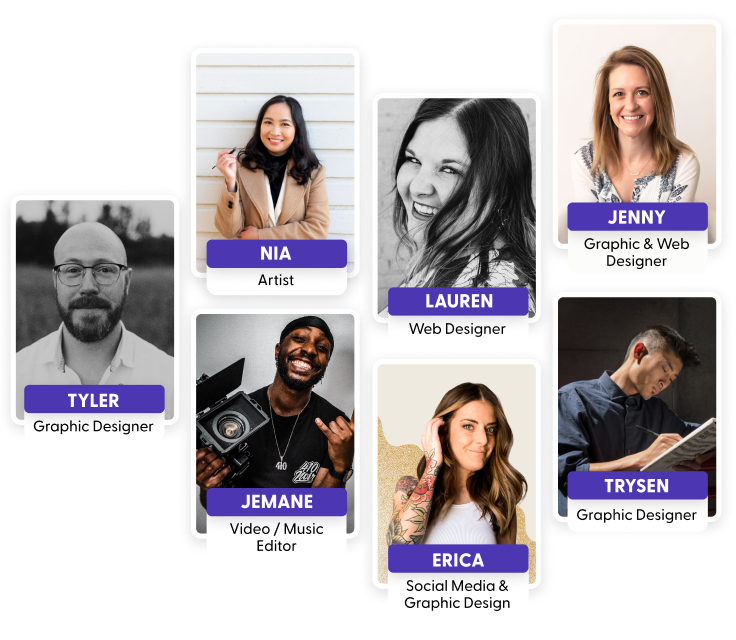

How Indy Can help

At Indy, we aim to make freelancing simple. Indy's Invoice app, lets you manage your current and future expenses. Our app also helps you keep track of your personal purchases, so you can easily separate your personal and business expenses ready for your tax return.

Our online invoice tools also offer the same services. Sign-up now and try it for yourself!

Conclusion

Advertising and marketing expenses are essential costs for any business. Whether you use online advertising tools such as Google Adwords, or more traditional means such as billboards or signs, claiming these expenses can significantly reduce your taxable income. Remember, advertising must be directly related to your business, and is considered as any action that raises awareness about your brand, service, or product - any personal hobbies, events, auto use, and political platform advertisements are not eligible tax deductions per IRS guidelines.

Marketing and advertisement expenses aren't the only deductible expenses for freelancers. You can check out our guide on the home office deduction for freelancers for some more tax saving tips and eligible tax deductions.