If you're a freelance, every penny counts when it comes to maximizing your tax savings. And let's face it – commuting expenses can really add up. But can you deduct business travel expenses from your taxes?

The answer is a bit complicated, but we're here to break it down for you. In this article, we'll explore if travel expenses are deductible for an independent contractor so that you can keep more of your hard-earned money in your pocket. So buckle up and get ready to learn how to save big on your taxes with deductible expenses!

Outlining Deductible Commuting Costs

If you use your own vehicle for business travel, you may be able to deduct some of your commuting costs. The Internal Revenue Service (IRS) considers commuting expenses to be expenses incurred between your tax home and your main place of business. In order to deduct expenses, you must keep detailed records of your mileage, as well as any other related expenses such as parking fees and tolls.

If you are an independent contractor, you may also be able to deduct certain business-related travel expenses. These include costs associated with traveling to and from client meetings, job sites, or other business-related activities. As with commuting expenses, you will need to maintain detailed records in order to take advantage of this deduction.

When it comes to maximizing your tax savings, every little bit counts. If you think you may be eligible to deduct commuting or business travel expenses, be sure to talk to your tax advisor for more information.

Eligibility Requirements for Claiming Commuting Expenses as an Independent Contractor

In order to claim commuting expenses as an independent contractor, you must meet the following eligibility requirements:

- You must be a self-employed individual, meaning that you are not an employee of the company you are contracting with.

- You must be contracted to perform services for a company or individual at a location other than your tax home.

- Your commute to the contract site must be considered "ordinary and necessary" in order to complete your duties.

If you meet all of the above requirements, you can deduct travel expenses from your taxes. This includes costs such as gas, business-related tolls, public transportation, and parking. Keep in mind that you can only deduct real expenses – so if you drive your personal vehicle, you can only deduct the amount of gas used, not the full value of your car.

How to Determine the Amount Eligible for Mileage Deduction?

When it comes to figuring out how much you can deduct for mileage, the IRS has a few specific rules you'll need to follow. First, you can only deduct mileage driven for business travel. This means you need to deduct actual expenses, and not just your theoretical commute to and from work - sorry!

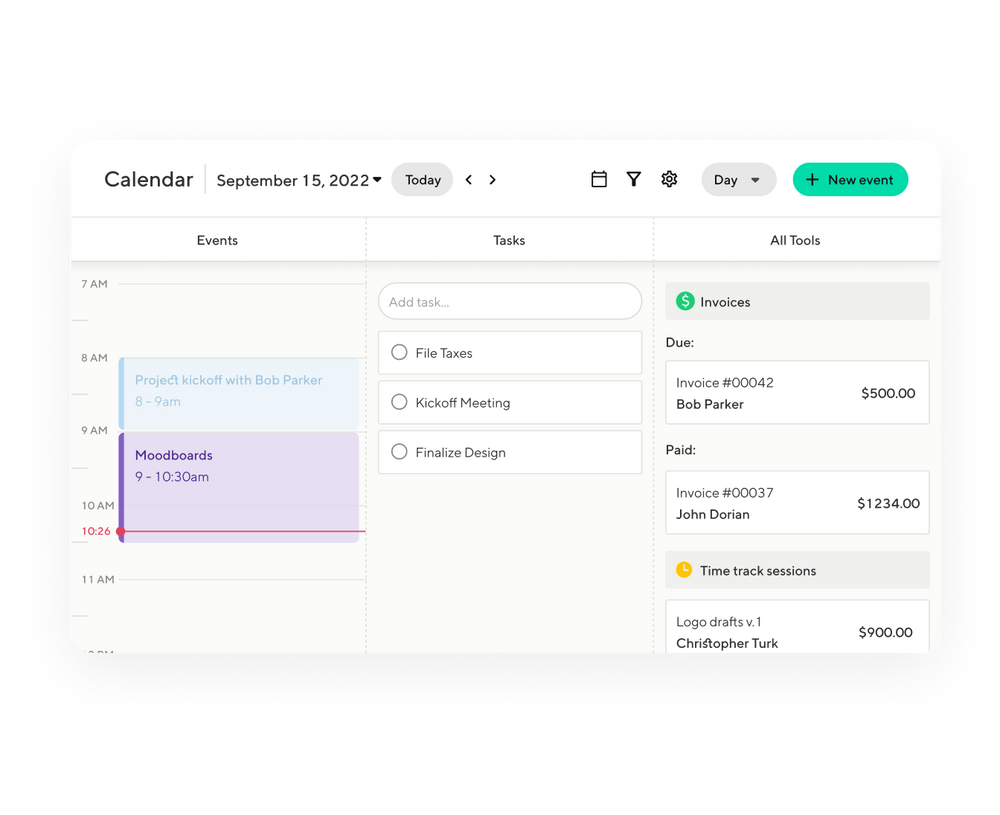

Next, you'll need to keep careful records of all the miles you drive for business. The IRS requires that you keep a log of your mileage, including the date, destination, and purpose of each trip. You can use a simple notebook to track this information. Or, if you want to elevate things a little, you can use Indy’s software for freelancers! Indy’s calendar lets you input everything you need, including the dates you traveled, mileage, the purpose of the trip and more! Plus, it is completely linkable with your Google calendar, so you can have all the info you need over multiple platforms, easily accessible!

Once you have your mileage logs ready, you can calculate your business travel deductions using either the actual cost of gas or the standard mileage rate method. The standard mileage rate is a set amount per mile that covers gas, wear and tear on your car, and other driving expenses.

If you choose to use the actual expenses method instead, you'll need to track all your car-related expenses (gas, oil changes, repairs, etc.) and only deduct a portion of those costs based on the percentage of miles driven for business purposes. For example, if you drove 10,000 miles in a year and 2,000 of those were for business, you could deduct 20% of your total car expenses.

Both methods have their pros and cons - it's up to you to decide which one will get you the biggest deduction! Whichever method you choose, make sure you save all your receipts in case the IRS asks to see them.

Keeping Track of Mileage Records

Keeping track of mileage records can be daunting, but it's important to keep accurate records in order to maximize your tax deductions. Here are a few tips to make sure you're keeping track of your mileage and travel expenses correctly:

1. Keep a separate mileage log for a business expense. This will help you ensure that you're only recording miles that are related to your business.

2. Make sure to record the date, start and end points, and purpose of each trip. Since we already mentioned how Indy’s calendar is interlinkable with your Google calendar, you can simply input everything you need on your smartphone and transfer it to Indy’s software for freelancers! This information will be important when it’s time to file your taxes.

3. If you use more than one vehicle for business travel, keep track of the miles driven for each vehicle separately. This will make it easier to calculate your deductions later on.

4. Keep all receipts and documentation related to your business mileage in a safe place. This includes things like gas receipts, parking receipts, and toll receipts. These can be helpful in case you need to prove your deductions later on.

Claiming the Standard Mileage Rate vs. Actual Expenses Method for Deduction

If you are self-employed, you have the option of claiming the standard mileage rate or actual expenses when deducting business travel expenses. So, let's get to the bottom of the two ways.

The standard mileage rate is a set amount per mile that you can deduct for your commute as a business expense. For 2023, the rate is $65.5 cents per mile. This means that if you commute 100 miles per week, you can deduct $655 per week from your taxes.

The actual expense method requires you to track all of your actual expenses related to your commute, such as gas, maintenance, and wear and tear on your vehicle. You can then deduct a percentage of those travel expenses based on how much of your vehicle's use was for business-related expenses. For example, if you use your car 50% for business and 50% for personal use, you can deduct 50% of your actual expenses.

So, which method is better? It depends on your individual situation. If you have a long commute or high commuting costs, the actual expense method may be more beneficial for you. However, if you have a shorter commute or lower costs, the standard mileage rate may be more advantageous. Ultimately, it's up to you to decide which method will save you more money on taxes.

Examples of Deductible Commuting Expenses

There are a few different scenarios where you may be able to deduct your commuting expenses as an independent contractor.

If you use your personal vehicle for business trips, you can deduct the business-use portion of your vehicle expenses from your taxes. This includes gas, oil changes, repairs, and depreciation. Keep careful records of your business mileage and make sure to keep receipts for all of your vehicle expenses.

If you use public transportation to commute to your job sites, you can deduct the cost of your fare from your taxes. This includes bus or train fares, as well as taxi or Uber/Lyft rides. Keep track of all of your public transportation expenses and save your receipts.

You can also deduct the costs of parking and tolls when commuting to work. Save all parking receipts and toll booth tickets to document these expenses.

Are Business Travel Expenses Tax Deductible?

Business expenses are tax deductible when you travel out of the office and your primary residence (called your tax home). Transportation charges, baggage fees, car rental, taxis, shuttles, hotels, gratuities, and fees are examples of travel expenses.

For tax purposes, it's crucial to keep receipts and records of the actual costs in order to deduct the true cost.

Which Kind of Travel Expenses Can Be Written Off On Your Taxes?

To be able to deduct business travel expenses, they must fulfill specific IRS requirements.

The major conditions that a travel expense must satisfy in order to be qualified for a tax deduction are as follows:

Travel expenses must be tied to business

The expenses must be strictly work-related and not personal in nature. For your trip to qualify as a tax deduction, it must largely be a business travel expense. Trips taken for pleasure are never considered travel expense deductions.

You cannot deduct as a business expenditure any travel costs that you pay in connection with buying or opening a new business. However, you can include such expenses in the start-up costs, choose to deduct some of them, and amortize the rest over 180 months.

You need to have reasonable, ordinary, and necessary expenses

The cost must be typical, acknowledged in the industry, beneficial to, and appropriate for your company.

If your trip costs are exorbitant or lavish, you cannot deduct them. However, just because you chose to travel first class or eat at four-star establishments won't result in your costs being denied.

For tax deduction purposes, the IRS permits additional ordinary and necessary expenses to be considered travel-related. Such travel expenses may include transportation expenses to and from business meetings, the cost of using a public stenographer, computer rental fees for the trip, and the shipping of baggage and display goods for business purposes.

In order to deduct travel costs, you must be "away from home"

Although it should go without saying, you must be on the road to claim your travel expenditures. This travel must be overnight and more than 100 miles from your home. If you fit either of the following two criteria, you are considered to be away from home for this purpose:

- The trip is outside of the general area or proximity of your tax home.

- Your journey is long enough or far enough away that you cannot fairly be expected to finish the round trip without stopping for sleep or rest. This does not require you to spend the night at the location; for instance, it's possible that you have a full-day meeting, and now you need to go to a hotel to lie down for a couple of hours before driving back home.

You must possess the necessary paperwork to deduct business travel expenses

The taxpayer is required to maintain accurate records of the costs incurred, including receipts and other paperwork. If you do not have saved receipts, you can’t prove the amount spent. So, make sure you always take a receipt, so that you can file it later for a tax deduction.

Travel Expenses You Can Deduct

Any travel expenses that are required, ordinary, and necessary for your business activities are tax deductible. Examples of possible travel charges are shown below. Let's start by discussing which tax write-offs are acceptable.

Transportation

You can get from your house to your business destination by plane, train, bus, or car. Taxi fares or other transportation costs between the airport or train station, and your hotel, as well as between the hotel and the workplace of your clients or customers, a business meeting venue, or a temporary workplace also count as travel expenses.

Shipping or baggage

Do you need to check your bags? Baggage fees are deductible. Getting the trade show's exhibit items shipped? Write it off as well, as long as it's between your usual and temporary job locations.

Lodging expenses

If your housing is reasonable and essential to your business, such as a hotel or resort stay during a business trip, you may deduct it as business expense.

You can only deduct accommodation costs that are fair for one person for the nights or days that you worked, even if you decide to bring a partner, friend, or child.

Laundry and dry cleaning

Keep the receipts for any laundry or dry cleaning costs you incur when traveling for work. You can deduct them as well.

Communication outside of your work cell phone costs

You can deduct any additional communications costs, made for the purpose of conducting business.

Tips

Gratuities, such as those for porter fees, room service/cleaning, cab fares, and other incidental expenses, are also considered deductible business expenses, as long as you have a receipt.

Meal expenses

Here are some important facts concerning business meals and deductible travel expenses. The IRS advises against engaging in the administrative gymnastics of keeping track of every receipt from every meal and instead suggests utilizing a standard meal allowance. There are two methods for tracking and deducting meal costs. Either utilize a per diem or keep track of your real out-of-pocket costs.

Instead of holding on to documents of your meal expenses and deducting the actual costs, you can use a standard meal allowance, which differs based on where you travel. You can write off 50% of your food expenses as a deductible expense.

However, if a meal occurred during a dinner theater performance with a client and the meal is not specifically included on the theater ticket, it is considered entertainment expenses and thus not deductible.

Other deductible expenses

Use of a hotel business center, hiring an interpreter, travel to and from the hotel to a business function, etc. are other comparable ordinary and necessary expenses associated with your work trip.

List of Travel Expenses That Aren't Tax Deductible

Here's the less amusing part: a few instances of travel expenditures you CANNOT claim as a deduction.

Entertainment

Entertainment costs are not permitted. While attending a business conference, are you playing golf at the resort with a prospective customer or a business development manager? It's considered a nondeductible personal expense.

People you are traveling with

You cannot deduct any of the costs associated with a friend, family member, or dependant who travels with you.

Talk to your CPA if you believe you qualify for an exemption to this rule, such as when you pay a dependant or friend to perform essential company tasks while you are away and you have the 1099 or W-2 to verify it.

Expensive costs

The IRS does not permit exorbitant or lavish spending. They simply say that "an expense isn't considered lavish or extravagant if it's reasonable based on facts or circumstances," which leaves a lot of room for interpretation.

Speak with your CPA if you think this could be an issue for you.

Reimbursed travel

Although it may seem simple, you cannot claim travel expenses if they are free. You cannot deduct housing, for instance, if you are giving a presentation at a conference and the event organizer compensates your whole hotel stay.

The same applies when redeeming reward program points for travel, housing, etc.

Personal purposes

You cannot claim personal travel expenses. When it comes to mixing work and pleasure, we enter a kind of gray area.

Conclusion

As an independent contractor, you can get a tax return by deducting certain commuting expenses. But it is important to be aware of the rules and regulations regarding these deductions and make sure that you are taking full advantage of them. And, Indy makes your life so much easier with all the tools we have available for freelancers who want to take control of their business!

By following the advice outlined in this article, you will be able to maximize your tax savings while also making sure that your business complies with all applicable laws. So take a few moments to review what we discussed here and start saving more on your taxes today!