Cash flow is the operational income and expenses of your business as a result of its day-to-day activities. Keeping your cash flow in order is the prime ingredient to success in business. As many as one in five start-ups fail after the first year. This is as true for freelancers as any business and to avoid being among those who fail means staying on top of cash flow from day one.

Negative cash flow is what you want to avoid as a business owner, and it's easier than you think!

What is operating cash flow?

Operating cash flow refers to the amount of income generated by your business operations. Your operating cash flow will give a good indication of your company's financial performance and will help you to put together a cash flow forecast to determine future cash inflows. Essentially, keeping an eye on your operating cash flow will enable you to ensure that your company generates enough income to cover all expenses and operate at a profit.

Are profit and net income the same?

Net income and profit both deal with positive cash flow, but there are differences between the two concepts. Net income is a fixed calculation, which is the money you are left with when all taxes and other deductions have been taken from your profit. Profit is all of the cash generated for a certain time period minus the expenses.

What is net cash flow?

The net cash flow of a business refers to the total change in cash balance over a fixed period of time. This may be a month, a quarter, a half-year, or a full year but is the total sum of the income minus the expenditure during that period. Net cash flow is a simple way of seeing whether your operational cash flow is positive or negative.

Which is more important: operating cash flow or profit?

Although profit is more indicative of the success of your business, cash flow is more important in the day-to-day running of your business. Cash balances are important as a long-term concern, so in order to keep running at a profit, you need to ensure cash inflow exceeds cash outflow month by month. Of course, making a profit is the primary aim but managing how your money flows effectively is how you will ensure long-term profit is possible.

How are cash flows different from revenues?

Revenue is the total income generated from the work you carry out before any deductions. Cash flow, meanwhile, refers to the incomes and outgoings over an indefinite time period. Net profit is what you are left with when all expenses are taken off. Of course, the ideal scenario is when your net profit is still quite a high percentage of your total revenue. With this in mind, you need to always keep track of your outgoings vs. your income and be prepared to make changes when something is not working.

How does managing your cash flow affect your future?

Taking control of cash flow is essential in order to avoid financial worries in the future. It is important to analyze your operating activities as a freelancer and, if anything is proving unsuccessful, you may have to look at changing the way you work. Are your normal business operations ensuring a positive cash flow?

Cash flow forecast

A cash flow forecast is essentially a prediction of your future cash flow based on known outgoings and how you will generate enough income to surpass them. There are several important points to consider:

- Nobody can predict the future, so a cash flow forecast is your best estimate and should be adapted when unexpected events occur.

- With this in mind, try not to plan too far ahead. A year is the maximum time span a cash flow forecast should cover.

- Make sure you include every outgoing you know you will have to cover and consider making both best and worst-case scenario forecasts for your income. This will help you to decide if anything needs to change work-wise.

Cash flow statement

A cash flow statement is an actual record of your financial performance over a year. It enables you as the freelancer to compare with your cash flow forecast to analyze your financing activities. A balance sheet showing profit and loss at the end of each financial year will reflect the impact of your actual cash flow. If it shows a strong degree of positive cash flow, you could think about some investing activities that could lead to further income going forward.

11 ways to manage cash flow

You should be monitoring the changes in your cash flow regularly, as cash flow is the pulse of your business. Here are 11 tips for how you can analyze your cash flow.

Assemble a cash flow forecast

Put together a cash flow forecast (a quick google search will bring up several free tools to help with this). This is a prediction of your future cash flow based on known outgoings and how you will generate enough income to cover and surpass them.

Analyze your cash flow

Analyze both your positive and negative cash flows - was your cash flow consistently positive, and if not, why was this? Remember, a negative cash flow isn’t necessarily a bad thing, so long as it's for the right reasons. For example, if you’re making investments in property, equipment, or tools to grow your business.

Improve financial performance through investments

The financial performance of your business could be improved through business investment - new equipment, software, or the hire of office space, for example. Still, if you increase your operating expenses, you must consider risk vs. reward.

Assess ways to reverse a negative cash flow

Your cash flow statement will enable you to analyze your company's financial performance. If the balance sheet shows a negative cash flow, you must consider what you can do to turn this around. Do you have any unnecessary capital expenditures that you could remove?

Focus on the things you can control

Work on what you can control. There will always be unforeseen events that impact actual cash flows, either positively or negatively, but how can you plan for seasonal variations or any other factors that may make cash flow inconsistent?

Don’t wait to send invoices

Life gets busy, so if you do not send your invoice promptly, your client may simply forget to pay! Get into the habit of sending your invoices before they are due to be paid, or you may find that it affects your company's cash flow.

Lease your equipment instead of buying it

When considering business acquisitions, you must also consider the impact on cash outflows as opposed to cash received. Leasing enables you to avoid hefty upfront costs and does not have any of the potential risks associated with a bank loan. It is also a great option if you only need the equipment on a short-term basis.

Reevaluate your business operations

Cash flow statements show you an actual record of your financial performance over a year and, along with your cash flow forecast, allow you to analyze your positive cash flow in the future. Points to consider may include:

- What would you say were the major factors that enabled you to maintain a positive cash flow? How could you build on this?

- Are there any investments that you could make in order to increase your profits in the future, or do you have the free reserves to consider a bank loan?

- What could you do to increase your income without relying on further spending? Can you take on more work, or if you are selling a product, does the price reflect the cost of production and add to your net profit?

- If you could do with some support, there are a number of organizations that offer business insights and practical tips. There are also hundreds more articles on Indy on a diverse range of topics that could help you to come up with good ideas to help expand your business.

Restructure your payments and collections

Payments and collections have become more complex in the technological age, with many platforms now available for money transactions. When looking at restructuring your own payments and collections, you have to consider the financial implications of the choices you make. A particular platform may make the process much smoother and take a lot of the worry from you, but many of these providers charge a fee for their services - make sure that every deal you consider is going to be worth it in the long run.

Monitor where your money is going

You must keep track of all of your financing activities. Effective bookkeeping not only allows you to stay on track with your accounting but will also enable you to make a cash flow forecast based on previous financial performance. If your cash balance is negative, this needs to be addressed straight away - do you have any expenses that you could remove? Sometimes it may be necessary to spend money in order to make money, but if you are spending money without seeing further cash acquired, then it is time to make a change.

You will need enough cash to fund your operational expenses, and in order to do this, you must keep robust financial records every step of the way.

Take advantage of technology

Due to the speed of technological advancements in the past twenty years, there are way more opportunities available to freelancers than there were at the end of the previous millennium. Firstly, accounting is almost exclusively online along with marketing. Being online can open your business up to a world of opportunities.

Having your own website is a must as it instantly gives your business credibility, makes it look more professional, and therefore gains the trust of your customers.

Social media websites such as Facebook, Instagram, Twitter, and LinkedIn are great for increasing awareness of your brand and advertising your products. Here are some statistics to show just how huge your potential reach is via social media:

- Twitter has over 321 million users per month

- Facebook has over 1.5 billion users per month

- Instagram has over 1 billion users per month

- Linkedin has 250 million users per month

With these numbers constantly on the rise, it is definitely worth making the most of these platforms to reach a wide range of people. Social media platforms are also designed to be user-friendly, and so you do not need to be tech-savvy in order to use them to their full potential. There are companies nowadays who offer their services to help manage your social media channels in order to maximize exposure; this could be worth considering down the line, but as with all considerations, you must weigh up potential reward against expenditure.

How can Indy help?

So we have established that the key to managing cash flow is to keep everything about your work as a freelancer in order, and Indy can help you every step of the way. With tools ranging from our Time Tracker to Invoice Builder and the ability to create contracts, Indy has everything you need to ensure that you can manage your workflow and increase your cash flow. Let's take a look at some of these services and see how they can help you.

Use our Time Tracker to track billable hours

Perhaps the most important commodity of all as a freelancer is your time. Time is money, and if you are not charging the right amount for the number of hours that you are giving to a client, this can have a hugely negative impact on cash flow. With Indy's Time Tracker, you can stay completely on track with all of the hours you are spending on each task and work out what time you might be able to free up to take on other paid opportunities.

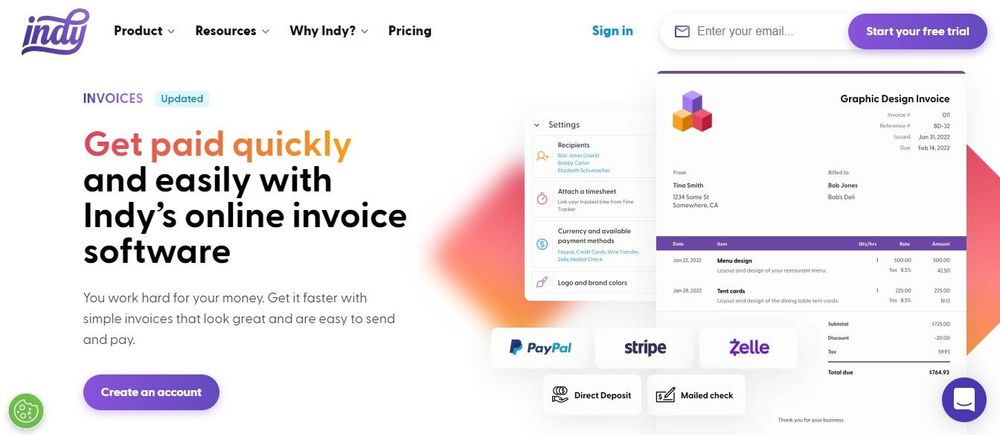

Create and send invoices with Indy

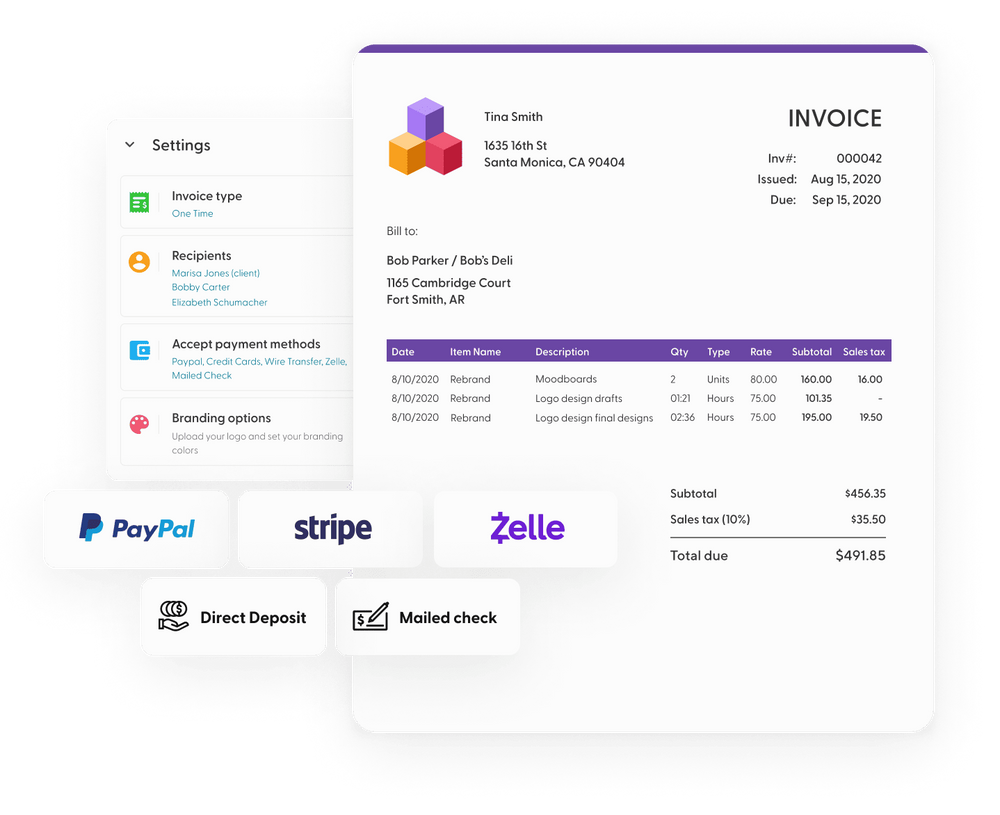

Invoicing is a vital part of the process as a freelancer - your clients need to know how much and when they are going to pay you, and the invoice acts as a record between you of these important details. Your invoices should look professional, contain all of the relevant information and be easy to understand. When you create an invoice with Indy, you can be assured that all of these crucial points will be taken care of, and you can use a template that is easily adaptable for different clients, making the process smooth and stress-free.

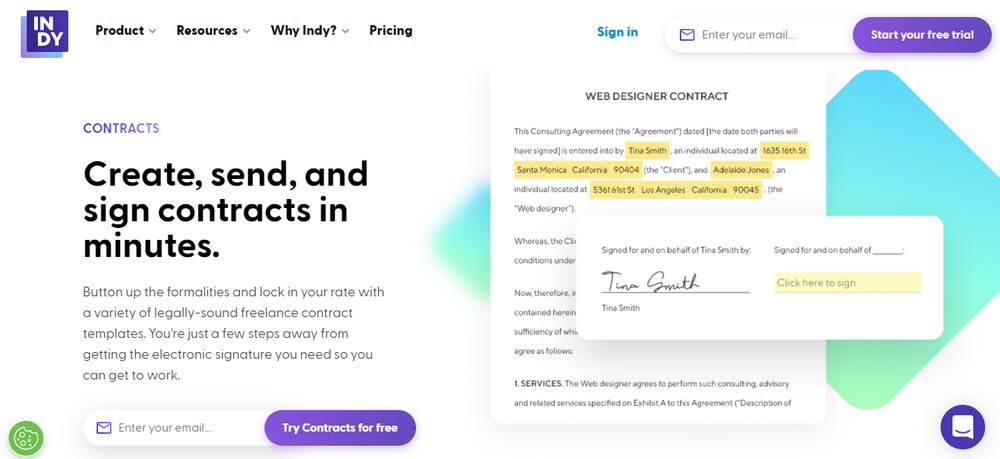

Write contracts with solid payment terms

Another key component of your work as a freelancer is to have reliable contracts in place. The contract allows both you and the client to have it all in writing what you expect from each other and is an opportunity to formalize the agreement between you. Indy has a variety of professional contract templates to choose from, which will enable you to have peace of mind about any working relationship you enter into.

Conclusion

To summarise what we have learned, managing cash flow effectively is the best way of ensuring you maintain a healthy financial balance as a freelancer. Here are some of the key takeaways to keep in mind: -

- Keep a record of everything - Log every hour you work, make a note of every expense and every bit of income, and make frequent analyses of what is working and what is not. Make sure you change anything that is losing you money.

- Plan for what you can control - Make your cash flow forecast initially based on what you know will take place, including any expenses and income you know are coming in. After this, you can look at possible variations but remember that there are always events, both positive and negative, that you just can not foresee. Prepare to be flexible when required.

- Avoid high-risk investments - When investing cash flow on equipment, software, or the location for your business, make sure your cash flow forecast reflects a low level of risk. Make sure you have enough free reserves to cover any financial shortfall that may result from your investing activities or a bank loan.

- Utilize any support available - Indy has a range of tools and articles that can help you with every step of the process as a freelancer. Make sure you are taking advantage of these as well as any other support that may be offered from a reputable source.

There is really not much more to it than that. If you are efficient with your work, then cash flow will take care of itself! You will get out what you put in, but always make sure you are only taking on work you know you will have time for, and never be afraid to say no if there is something that you know will not work for you. Positive cash flow depends on effective planning, regular analysis, and maintaining a process you know is effective.