In 2020 70% of American Freelancers reported that income and savings were one of their biggest concerns.

While more Americans than ever are listed as working in a freelance or self-employed role, 59 million to be exact, issues with cash flow are still a concern.

Bit of a Debbie Downer, right?

Yes, but also no.

There are various reasons for these negative-leaning statistics, and, fortunately, all of the problems with cash flow have tangible solutions.

Income as a freelance worker, self-employed worker, or proprietor of a small business is tricky. There’s no doubt about it.

But there are things you can do to protect yourself and your money.

This blog will outline first why these problems with cash flow occur in freelance life before showing how you can overcome them.

What are the common cash flow problems for freelancers and small businesses?

First things first, let’s discuss how perplexing cash flow issues occur.

1. Forgetting to factor in start-up costs

Whenever people start working as freelancers, they fail to prepare for all of the initial costs involved.

Many jump the gun and leave their salaried job before they have the savings needed to start freelancing or start a small business.

You need to consider what it will cost to buy the equipment you need, any software, office equipment, products, and inventory stock.

On top of this, you need to think about whether you will work from home and pay more in bills per month if you want to work in a coworking space and if so, how much that will cost, or if you will need to rent an office space.

Failing to figure this all out beforehand can lead to a rough start in freelancing.

2. Heavy overhead costs

Another cash flow problem that tears its head at the start of your freelance or small business venture is overhead costs.

Overhead costs can be anything from big issues like insurance, employees, and bills, right down to smaller problems, such as postage costs and the energy efficiency of the appliances in your workspace.

Failing to factor these in to deduct your first payouts will give you some strong cash flow problems.

It’s important to know what exactly you’re spending, why, and whether you can reduce it.

3. Poor invoicing

Invoicing is pivotal to the success of your business or freelancing career.

In fact, how you make and send invoices can make or break your cash flow as a freelance worker.

With no salary and no payroll, invoices are how you get paid.

And yet, the process doesn’t always seem to go smoothly, with 54% of freelancers stating it takes too long to get paid and 45% saying clients don’t pay them on time. Therefore, it’s vital for freelancers to be able to know how to write invoices well.

4. Slow Clients

Even if your invoices are sparkly and fabulous, there is still the common problem of slow-acting clients.

More than half of freelancers wait up to one month for finalized payments to come through.

A big part of freelance life is knowing what to do when a client is slow to pay or doesn’t pay at all because, unfortunately, it happens more than you might imagine.

5. Single cash flow line

One of the reasons freelancers struggle with their cash flow levels is that they only have one single line of cash flow.

Think of it like this:

If you had an empty swimming pool and you wanted it to fill up with water, you would prefer to use multiple pipes, pumps, and filling devices to do so as quickly as possible.

If one breaks, then no worries; water is still flowing in from elsewhere.

You wouldn’t rely on one small hosepipe to fill a whole swimming pool.

It’s the same with cash flow.

If you rely too heavily on one client and they become a victim to the economy, they change a business, or they straight up ghost you, then what do you do?

Sure, you’ll find a new client, but the gap in between won’t be funded, and your cash flow will run as dry as a broken hosepipe.

The most successful freelancers have more than 9 clients on average, and none are dominant.

6. Forgetting about taxes

Listen, no judgment here. Taxes are burdensome and it’s hard to know precisely what you have to pay as a freelance or self-employed worker.

When we have a salary job, our taxes, health insurance, and other government shenanigans are done for us by payroll clerks.

But when we work for ourselves, we have to do it ourselves.

Forgetting to set aside enough money to be deducted later is one of the biggest cash-blow blunders a freelancer can make. Having a big chunk taken at once from what you thought was pure profit is disheartening.

How can you solve these freelance cash flow problems?

Ok, now the negative Nancy show is over, let’s get to the good part.

How do you fix it?

Well, luckily, it’s easier than you might think.

Here’s how to do it with Indy:

Indy is an all-in-one project management service that helps freelancers in need. It has the right tools to manage your work and cash flow in one place, including the time tracker, invoice builder, and proposal designer. And you can create contracts, chat, and share files, too.

What would you need to organize your freelance business?

1. Effective budgeting and planning

Most of these cash flow issues mentioned above could have been solved with solid budgeting and planning in the first place. You need to know how much you are paying out and how much you are getting into the budget effectively as a freelancer.

Having a cumulative spreadsheet is a great start. It doesn’t need to be fancy; it just needs to keep track of your money to not rely on your memory.

Tracking your time spent on projects is also essential so that you can quote a good price for your clients and can see how much you are spending on each project. If it isn’t worth it, it isn’t worth it. If it should be on the invoice, it should be on the invoice.

Indy’s Time Tracker is an accessible and efficient way to do this all in one place.

2. High quality invoices

Invoices are the pièce de résistance of freelance working.

To ensure a steady cash flow, you need to confirm your invoices are clear, direct, and professional.

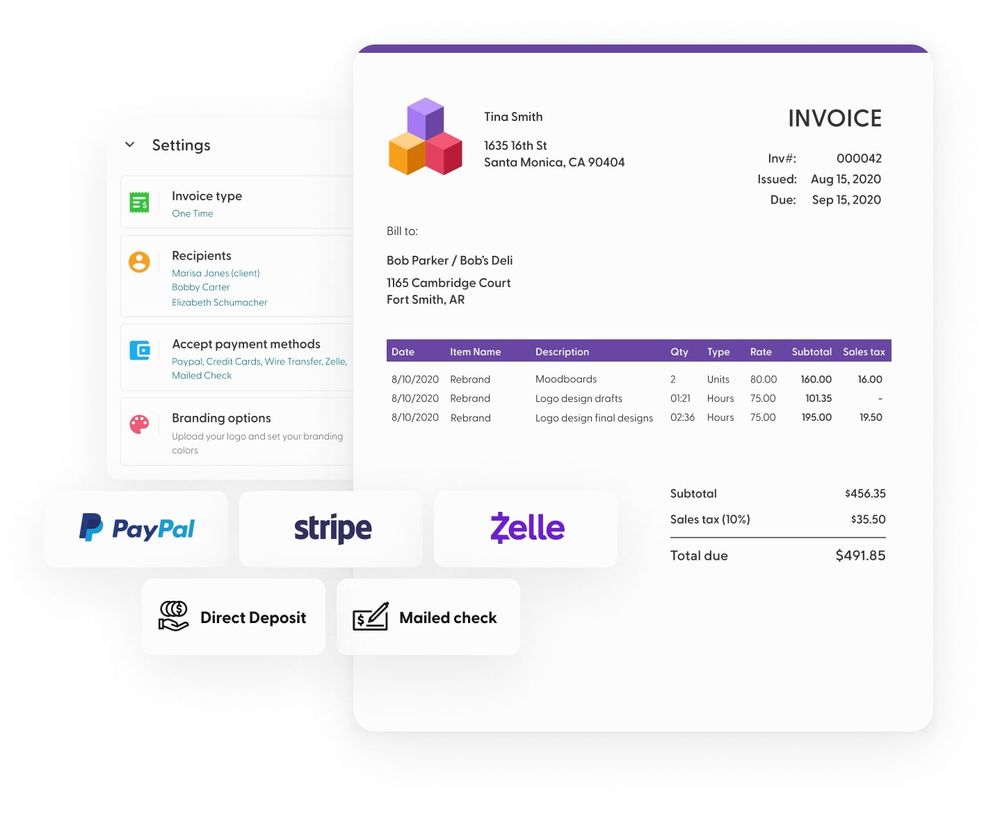

Indy’s Invoice Builder and set of Invoice Templates leave no room for error. You can make personalized invoices for your specific work, with your own branding front and center.

The range of high-quality invoice templates allows you to choose an invoice that really works for you and your business goals, no matter in what field your freelance business operates.

3. Diversifying client base

To solve the one leaky hose pipe problem we discussed earlier, and secure a steady cash flow in freelancing is to diversify your client base.

Having multiple clients keeps your work consistent and steady, even if one or more pulls out or takes a break.

And don’t worry about getting overwhelmed with juggling too many balls at once; using a multipurpose platform such as Indy keeps you right, with centralized communication and an all-purpose dashboard.

Remember: When it comes to freelance work, it’s essential to have multiple different safety nets to keep you from falling.

4. Make getting paid even easier

Indy makes getting paid convenient, with both automated and manual options for client payment.

With legitimate and accessible forms of payment attached to your invoices, there are no excuses for late or failed payments from clients.

You have to protect yourself, and you have to get what you’re owed.

Indy simplifies the payment process for you and helps to take away one of the most stressful parts of freelance working.

Conclusion

Being a freelance worker is both enjoyable and challenging.

On the one hand, you get to be your own boss. On the other, you get to worry about your own cash flow every single day.

But the plus side is that no matter how many problems arise in your freelance cash flow, there are an equal number of practical solutions to help you avoid them.

The main pitfalls to avoid are forgetting about outgoing expenses like overhead costs, startup costs, and taxes, having poor invoice practice, and relying on only one or two clients for all of your income.

Being practical and setting aside savings, alongside using Indy’s all-in-one platform to help you build invoices, contracts, and proposals, will guarantee your freelance success. High-quality invoices that can be paid easily are also a great way to ensure clients pay their dues on time.

It’s easy to get overwhelmed and stressed. However, it’s easier to just sign up to Indy and get all your work organized in one place, conveniently.

Start your free trial today!