70.4 million Americans participate in the gig economy and earn over $1 trillion in freelance income. Freelancing is brilliant, and we're big fans, but it comes with a few pieces of extra work. Independent contractors have to manage their retirement fund, own health insurance, other medical benefits, and their retirement account.

Indy exists to make freelancing simple. Without a simplified employee pension plan or someone else to work out how to pay income tax, you might find lots of new work and details to solve. In this article, we're going to go through these benefits and help you understand why they are important and how you can make a plan for yourself.

Health Insurance for Freelancers

When you leave your job, you have a certain amount of time before your old insurance expires. You'll want to sign up for your own health insurance before then, because even if monthly premiums are higher than you'd like, having insurance will save you a ton of money in the case of a medical event down the line.

Thanks to the Affordable Care Act, many health insurance options may be discounted, based on your income. You can shop for health insurance through your state's online marketplace—get more information at HealthCare.gov.

You may also be eligible for discounted insurance through a professional association, union, or through a chamber of commerce. Check out all your options before you commit to a plan. Some of the typical plans types include:

An HMO, which usually will limit your choice of doctors and specialists to those within their specific network. With this sort of plan, you'll generally be assigned one primary care physician, who will then refer you to any other specialists you need.

A PPO plan offers your healthcare options a bit more flexibility—you can go to any healthcare professional you want to, without a referral—but if you choose to go outside your network, you'll have higher out-of-pocket costs, and some services might not be covered by your insurance.

A high-deductible plan with an HSA savings account. The premiums with these plans are generally lower, but you'll pay all of your medical expenses out of pocket until you meet your deductible. The other tax benefit of this plan is that you can save money for your health costs in a tax-advantaged HSA account.

If you find insurance plans confusing, consider using a “health care concierge” service like Joany. This service is free and will help find the best plan for your situation and walk you through the application process, if you just answer a few questions about your needs.

Other Medical Benefits

Vision Insurance

Many of the same providers that offer medical insurance will give you the choice to add vision onto your plan. If that's not an option for you, try looking up plans from national providers like Humana or VSP. If you have a high-deductible plan with an HSA savings account, you could also opt to forgo vision insurance and pay for any vision related costs out-of-pocket from your tax-advantaged HSA account.

Dental Insurance

This seems like it would fit into medical insurance, right? Wrong! Make sure to also sign up for dental insurance. On average, this will cost significantly less than medical insurance, but each are important in their own right. Because the last thing you want as a small business owner, or a freelancer is a tiny toothache costing you thousands of dollars.

There are three main options when you're looking to buy dental insurance.

- If you buy your health insurance off the state or federal marketplace, you can also buy dental insurance there as well. This is only an option if you're already purchasing a health insurance plan through the exchange.

- Your second option would be to get dental through a union like Freelancers Union.

- Another option is to purchase a plan directly through a private insurance company. Unlike health insurance, you can sign up for dental plans whenever you want—there is no enrollment period.

Life Insurance & Disability

Some freelancers may consider supplementary insurance policies that would cover your expenses should something happen that would take monthly income or make you physically unable to work. And as with any situation, life insurance coverage is always an option, especially if you have a family and dependents. While these types of insurance are not mandated, some freelancers may opt to purchase a plan.

These are all good places to start when you're creating your benefits package, health savings account and retirement plan for yourself. It may seem like a lot of information, but if you take the time to figure out your insurance and retirement accounts when you first start freelancing, it will help you be successful down the road as you continue to build your freelance career.

Sick Days & Vacation Days

Having the potential of unlimited vacation days sounds pretty amazing, but if those days are unpaid, it can make taking any days off a double-edged sword. This is why some freelancers save up in advance to have money to “pay themselves” their day rate if they need to take sick days or want to take a vacation in the future. Even if you don't have any vacations coming up, saving for a few unexpected sick days is a good policy to plan in advance for a rainy day.

Retirement Savings

One of the biggest challenges for freelancers is saving for retirement. Unlike traditional employees, freelancers do not have access to employer-sponsored retirement plans or matching contributions. This means they have to take full responsibility for their own retirement savings and invest wisely.

Fortunately, there are some options for individual retirement accounts, depending on income level, tax situation, and business structure. Here are some of the most common ones:

- Individual retirement account (IRA): An IRA is a type of account that allows you to save and invest money for retirement with tax advantages. There are two main types: a traditional IRA or Roth IRA. With a traditional IRA, you can deduct your contributions from your taxable income, but you have to pay taxes when you withdraw money in retirement. With a Roth IRA, you pay taxes on your contributions upfront, but you can withdraw money tax-free in retirement. The contribution limit for both types of IRAs is $6,000 per year in 2023, or $7,000 if you are 50 or older. You should definitely set up a traditional or Roth IRA as soon as possible.

- Simplified employee pension (SEP) IRA: A SEP IRA is a type of IRA that allows self-employed individuals and small business owners to save more money for retirement than a regular IRA. You can contribute up to 25% of your net self-employment income or $66,000 in 2023, whichever is less. The contributions are tax-deductible and grow tax-deferred until withdrawal. A SEP IRA is easy to set up and maintain, and it does not have any annual filing requirements.

- Self-employed 401(k): A self-employed 401(k) is a type of 401(k) plan that allows self-employed individuals and small business owners with no employees other than themselves or their spouses to save more money for retirement than a regular 401(k). You can contribute as both an employee and an employer, up to $22,500 as an employee in 2023, or $30,000 if you are 50 or older, plus up to 25% of your net self-employment income as an employer, up to a total of $66,000 in 2023. The contributions are tax-deductible and grow tax-deferred until withdrawal. A self-employed 401(k) requires more paperwork and administration than a SEP IRA, but it may allow you to save more money if your income is high.

Besides these retirement planning options, you can also invest in other vehicles, such as stocks, bonds, mutual funds, etc., depending on your risk tolerance retirement age, and time horizon. However, these investments may not have the same tax benefits or protections as the retirement accounts mentioned above.

Here are some tips to help you save for retirement as a freelancer:

- Start saving early: The sooner you start saving for retirement, the more time your money has to grow and compound. Even if you can only save a small amount each month, it can make a big difference over the long term. For example, if you start saving $100 per month at age 25 and earn an average annual return of 7%, you will have about $378,000 by age 65. But if you start saving the same amount at age 45, you will have only about $76,000 by age 65.

- Understand taxes: Taxes can have a significant impact on your retirement savings. Depending on the type of account and investment you choose, you may have to pay taxes on your contributions, earnings, or withdrawals. You should consult a tax professional or use online tools to estimate your tax liability and plan accordingly.

- Diversify and allocate your portfolio: Diversification means spreading your money across different types of investments to reduce risk and increase returns. Allocation means choosing the right mix of investments based on your goals and risk tolerance. Generally speaking, the younger you are, the more aggressive you can be with your portfolio, meaning more stocks and less bonds. As you get older, you may want to shift to a more conservative portfolio, meaning more bonds and less stocks.

- Reduce fees and expenses: Fees and expenses can eat away at your retirement savings over time. You should look for low-cost options when choosing your account provider and investment manager. You should also avoid frequent trading, which can incur transaction costs and taxes.

Start Saving for an Emergency Fund

Freelancing can be very lucrative, but it's also very uncertain—you can make a ton in one month, but struggle to make enough to pay the bills the next month. We suggest trying to set up a separate savings account to help you through the lean times before you start fully funding your retirement accounts. This way, if you fall on hard times, you'll have money available to help you get through it (without having to pay a fee for early withdrawals from your retirement account).

Tax Deductible Benefits

One of the advantages of being a freelancer is that you can claim some of earned income, your health insurance, other benefits, and retirement savings as a tax deduction. This means you can take business expenses to reduce your taxable income and pay less tax. Here are some examples of how you can do that:

- Health insurance: If you are self-employed and pay all your health insurance premiums, you can deduct the cost from your taxable income on Form 1040. This deduction applies to medical, dental, and qualifying long-term care insurance coverage for yourself, your spouse, and your dependents. You can also deduct the insurance premiums for liability coverage to protect yourself against a lawsuit, or for workers’ compensation insurance or state unemployment taxes.

- Other benefits: If you are self-employed and pay for other benefits, such as life insurance, disability insurance, dental insurance, or vision insurance, you may be able to deduct some or all of the cost from your taxable income. However, the rules for these deductions are more complex and depend on factors such as the type of policy, the amount of coverage, and the purpose of the benefit. You should consult a tax professional or use online tools to determine if you qualify for these deductions.

- Retirement savings: If you are self-employed and contribute to a retirement account, such as an IRA, a SEP IRA, or a self-employed 401(k), you can deduct your contributions from your taxable income on Form 1040. The deduction limits vary depending on the type of account and your income level. For example, in 2023, you can deduct up to $6,000 for an IRA contribution, up to $66,000 for a SEP IRA contribution, or up to $66,000 for a self-employed 401(k) contribution. These deductions reduce your taxable income and also lower your self-employment tax.

How Indy Helps Freelancers

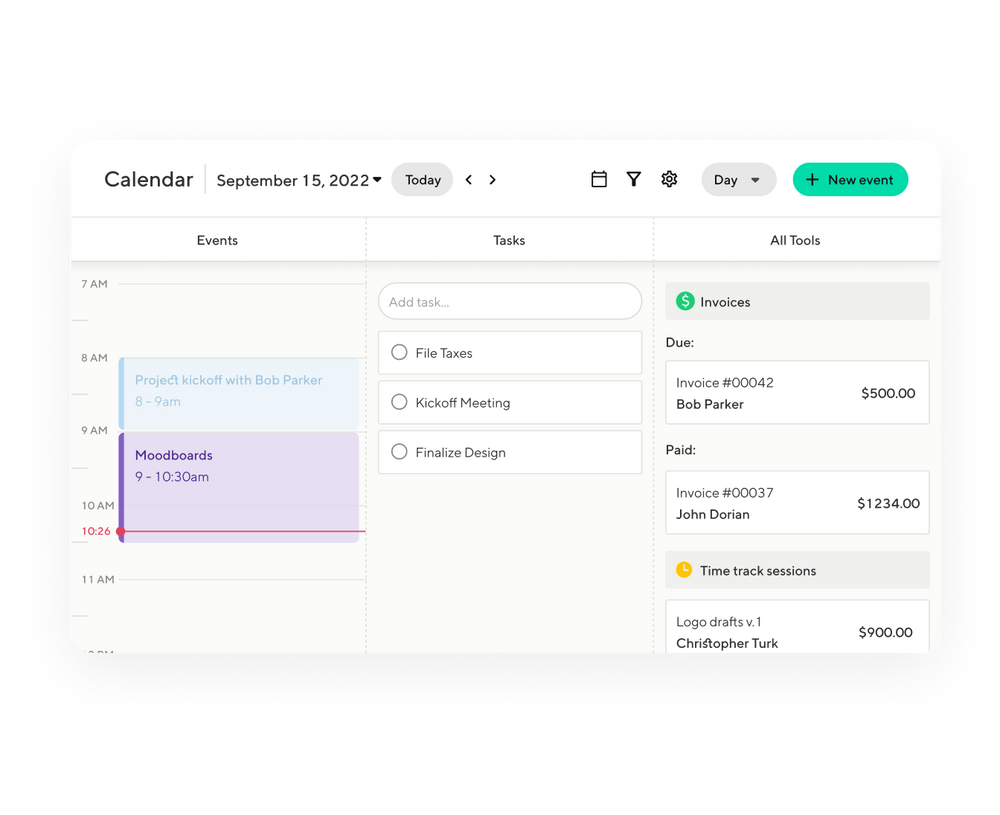

There are two ways Indy can help you with your employee benefits. First, you can set up your benefits as projects in Indy. This way you can manage your tasks, deadlines, and contacts efficiently. Treating your benefits like a project can help you stay on top of filing dates, insurance renewal times, and insurance company details.

The second way Indy can help you is by making the rest of life just a little easier. By simplifying your proposals, contracts, projects, and invoices, you can save a little time. Less stress and more time means it will be easier to take care of all your benefit admin when the time comes. Sign-up now and try it for yourself.

Wrapping Up

In conclusion, the gig economy presents freelancers with immense opportunities for growth and success. However, it's crucial to be proactive in managing your own health insurance, other medical benefits, tax savings, and retirement savings. With Indy's help, you can simplify your freelance life, allowing you to focus on building a secure future. Start by researching your health insurance options, considering additional medical benefits, saving for sick days and vacation days, maximizing retirement savings, and planning for retirement. Don't forget to take advantage of tax-deductible benefits available to you as a freelancer. By doing so, you'll be well-prepared to tackle the challenges of the freelance world and enjoy the freedom and flexibility it offers.

Ready to take control of your freelance benefits and ensure a brighter future? Sign up for Indy today and make managing your freelance career a breeze. Together, let's make freelancing simple and successful.