The gig economy continues to grow year by year. More people are shifting towards freelance careers and greatly enjoying the many fruits and benefits that come with it. As more people start becoming their own boss and taking more independent roles, there comes a certain unique set of challenges with the career. Some of them involve money, and the interesting dynamic that comes with it.

A lot can be said about what it takes to be a freelancer, but there’s one thing that stands out. Freelancers are self-motivated. They run with little to no instructions and take a more proactive stance towards growing their skill sets, productivity, and even cash flow. In this article, we’ll talk about finance for freelancers and how you can start maximizing your money as a freelancer professional.

The financial upside of freelancing

There are all kinds of freelancing jobs available nowadays. You can be a graphic designer, interior designer, software engineer, virtual assistant, consultant, speaker, life coach, or any of the hundreds of other self-employed practices you can now take over.

One thing that you probably know is that there’s definitely money in freelancing. That’s why 96% of self-employed individuals have no plans of returning to a “regular job.” Why is freelancing such a good financial opportunity? Here are some major reasons.

The sky is the limit

Unlike in a regular job where your monthly salary is pretty much the ceiling (plus some wiggle room for some bonuses), freelancers can earn as much as they can by getting more clients. Up to 31% of freelancers earn up to $75,000 or more a year. With more chances of financial growth, there’s little that can hold one back from increasing revenues year by year with the right strategies in place.

More flexibility and freedom

Learning how to manage a freelance career alongside your whole life might feel foreign at first. You work from home, have little to no boundaries between work and family, and juggle both work and house responsibilities at once. But when you understand the momentum, you actually get to experience flexibility and freedom. And not only financially. You also start to experience time flexibility too as you progress through your career.

More financial security

There’s a misconception that because freelancers don’t get a steady paycheck that the job is more financially unstable. But that’s not the case for many freelancers who have hacked the system. Most freelancers have more than one client. Meaning, if they lost one source of income, they would have others to fall back on. When an employee loses a job to retrenchment or resignation, they lose most if not all of their recurring income. That should tell one about the growing tide that is financial security and freelancing.

Finance tips and practices for freelancers

Of course, that’s not to say that money just keeps flowing and life remains good when you’re a freelancer. We need to realize that while there might be a more comfortable income stream in freelancing, it still remains finite. And so proper practices should be in place in order to manage finances as a freelancer better. Let’s go through some of the more common best practices.

Keep track

Tracking money in and out feels like a practice as old as time itself. But it’s surprising how many people skip this step. They say that you can’t improve what you can’t track. Keeping a regular tab of all your income and expenses isn’t just another task to add to your regular to-do list. It’s a helpful practice that helps you keep informed on how healthy your cash flow is.

Keeping track of finances starts with having a budget. What expenses are necessary for you and the business? How much money comes in regularly? The more balanced your books are, the more sustainable your freelancing career will be.

Register your business legally

The notion of registering as a legal entity might sound like an unpopular opinion, but it does come with its own perks. Being an official entity can help legitimize your business, thus opening your firm up to more clients and giving them a solid reason to believe that you’re legitimate and trustworthy. Moreover, paying dues keeps your business in the right with the government, ensuring that you’ll have no problems with the law in the foreseeable future.

If you want to learn how to register your business, it might be good to get a local expert to help you through the process. Business registration and compliances change according to countries and regions. Consider hiring a lawyer or accountant to help you through the setup process and keep your books balanced for tax filing.

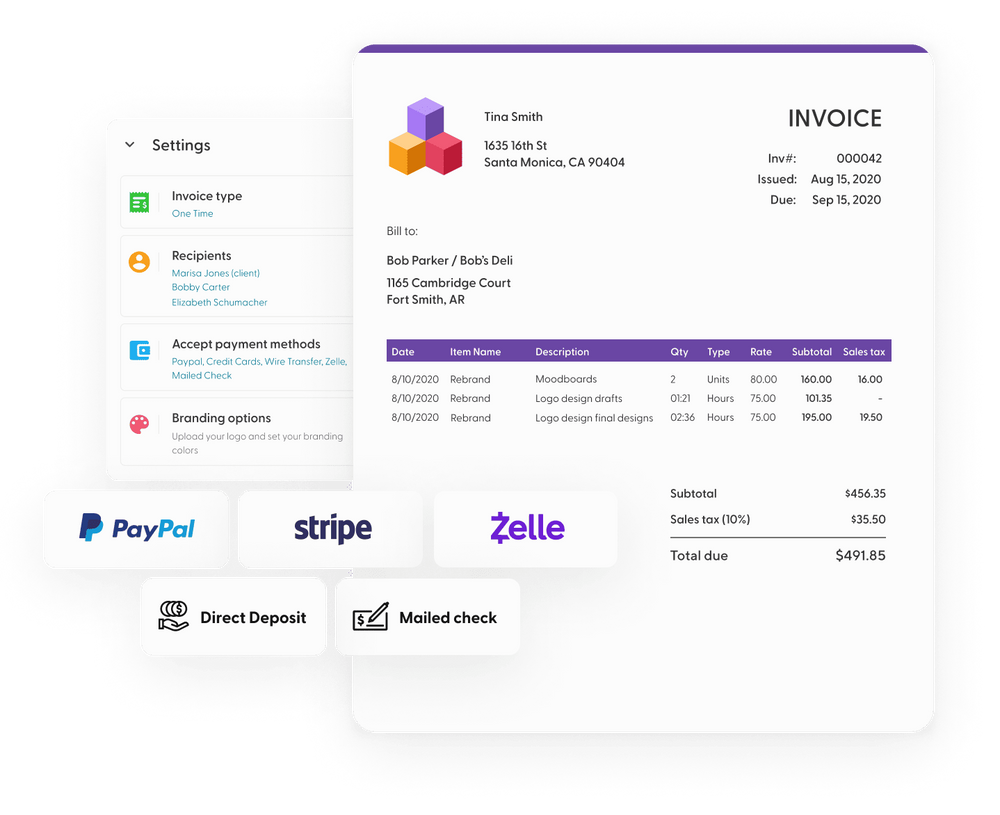

Use invoicing software

Accounts receivables can be a big headache for a business. Clients that you have that don’t pay on time (or don’t pay at all) can become the bane of a freelancer. Thankfully, you can use an invoicing software to automate the accounts receivable process and ensure that you get paid for services rendered.

Using invoicing tools doesn’t just improve collection rates. It also saves time by automating processes like reminders, payment processing, and so on. It takes up to one hour to manually process five invoices. With an invoicing solution, you can cut that time down significantly and reinvest it into client work and strategies to improve your freelancing career.

Create recurring income

Here’s an important tip on personal finance for freelancers—bills never stop. That’s the hard truth. We all have dues to pay regularly. What that means is that you shouldn’t just look at earning more. You need to learn how to earn more regularly. There are tons of ways to do that. First, you can charge clients a retainer, ensuring that you get something at a predictable cycle every month or so. You can also ask your existing clients for referrals or if you can do any more work for them. Doing so will help keep those projects flowing in.

Create passive income

On top of creating recurring income, you might also want to look into ways of creating passive or low-input income. Thankfully, there are now many ways you can do this. Here are some great ideas that have worked for many freelancers:

- Duplicate yourself by building a team

- Create an online course or do a master class

- Write and sell a book

- Try affiliate marketing

- Sell templates of your work like graphic files, mood boards, stock photos, stock videos, or music

Prepare for the long haul

We all need to realize that while times might be good today, they won’t always be smooth sailing. Everyone goes through financial challenges every so often— whether it’s a sickness, a business slump, or just a battle with father time. That’s why preparing for rainy days and retirement should be on every freelancer’s mind.

Financial planning for freelancers isn’t any different from business owners. Given that you don’t have a pension from an employer, you’ll need to start building a retirement fund. Hire a financial advisor to help you pinpoint wealth growth and protection instruments that suit your income level and risk level best.

Better management, better freelancing

Managing a freelance career is, in many ways, like running a business. So learning how to manage finances as a freelancer will provide you with a lot of upsides. Think about some of the tips that we’ve talked about that you want to start implementing and take those first steps to better money management. It will create more opportunities for growth, freedom, and security for you and your loved ones.