Everyone hates forking over their money to the IRS. If you're a US freelancer, you know the pain of parting with your cash to fund the government. Thankfully, there are many tax deductions you could claim to reduce your tax burden. The QBI deduction is one of them. This allows you to potentially deduct 20% of your qualified business income from your taxes.

Indy wants to help freelancers. So, in this article, we'll explain what the qualified business income deduction is, which trade or business income qualifies, and we'll help you learn how to apply it to your taxes. Let's get started by talking about eligibility for this tax break.

Who is eligible for QBI?

The first big thing to work out with tax deductions is whether you even qualify. Not every job and source of income count as qualified business income for the purposes of this deduction.

Which income counts for eligibility?

To get the QBI deduction, you have to receive what is called pass-through income from a qualified trade or business. This isn't too difficult because most businesses qualify. In short, if your freelancing generates income you file as personal income on your tax return, such as Schedule C or E, then you probably qualify.

Common business entities that qualify include:

- Sole proprietorships

- Partnerships

- S corporations

- Limited liability companies (LLCs)

- Trusts and estates

Which businesses qualify?

A qualifying trade or business is pretty much any business that is working regularly and tries to make a profit. This is all spelled out in Section 162 of the IRS code. Generally, though, almost every freelance business will qualify. This means you could qualify if you are in these businesses:

- Retail stores, including online stores

- Web design, development, and software engineering

- Lawn care businesses

- Sports officials

- Writers and editors

What are the Specified Service, Trade, or Business exceptions?

Of course, the IRS cannot do anything simply - everything has to be complicated. Some jobs are considered specified service trades or businesses (SSTBs). These types of businesses have some limitations or exclusions based on their taxable income. A specified service, trade, or business involves the performance of services in the following fields:

- Health (such as doctors, dentists, nurses, etc.)

- Law (such as lawyers, paralegals, judges, etc.)

- Accounting (such as accountants, bookkeepers, auditors, etc.)

- Actuarial science (such as actuaries, statisticians, etc.)

- Performing arts (such as actors, singers, musicians, etc.)

- Consulting (such as consultants, advisors, coaches, etc.)

- Athletics (such as athletes, coaches, trainers, etc.)

- Financial services (such as financial planners, brokers, bankers, etc.)

- Investing and investment management (such as investment advisors, fund managers, etc.)

- Trading (such as traders, dealers, brokers, etc.)

- Dealing in certain assets (such as securities, commodities, partnerships interests, etc.)

- Any trade or business whose principal asset is the reputation or skill of one or more of its employees or owners (such as celebrities, influencers, authors, speakers, etc.)

There are some income limits that affect your QBI deduction. Here are some points about the taxpayer's taxable income and how it affects the tax deduction.

- The taxable income threshold that determines whether SSTBs are eligible for QBI or not is $170,050 for single filers and $340,100 for those who are married, filing jointly (amounts for 2022 tax year). If your taxable income is below this threshold, you can claim QBI for your SSTB without any limitations.

- If your taxable income is above this threshold, you cannot claim QBI for your SSTB at all.

- If your taxable income is within a phase-out range of $50,000 ($100,000 for joint filers) above this threshold, you can claim a reduced QBI for your SSTB based on a formula.

For example, if you are a single filer who earned $150,000 in taxable income from your consulting business in 2022, you can freely claim QBI. However, if you earned $200,000 in taxable income from your consulting business in 2022, you can only claim a partial QBI. And if you earned $250,000 in taxable income from your consulting business in 2022, you cannot claim QBI for your SSTB at all.

Therefore, it is important to know whether your trade or business is a QTB or an SSTB and what is your taxable income level when claiming QBI. In the next section, we will explain what are the limitations and exceptions for QBI that may affect your deduction amount.

What are the limitations and exceptions for QBI?

Unfortunately, QBI is not as simple as multiplying your net income by 20% and calling it a day. There are some limitations and exceptions that may reduce or eliminate your QBI deduction depending on your situation. These limitations and exceptions are like hurdles that you have to clear before you can claim your full QBI deduction.

Hurdle #1: The qualified business income (QBI) component

This is the part of your QBI deduction that comes from your QTB income. To calculate this component, you have to multiply 20% of your QTB income by a wage and property factor. This factor is the greater of:

- 50% of the W-2 wages paid by your QTB, or

- 25% of the W-2 wages paid by your QTB plus 2.5% of the unadjusted basis immediately after acquisition (UBIA) of qualified property used by your QTB.

The wage and property factor is designed to limit the QBI deduction for businesses that have little or no employees or capital investment. For example, if you are a freelance writer who works from home and has no employees or equipment, your wage and property factor will be zero and so will your QBI component. Sorry, no QBI deduction for you.

Hurdle #2: The REIT/PTP component

This is the part of your QBI deduction that comes from your qualified REIT dividends (Real Estate Investment Trust) and qualified PTP income (Publicly Traded Partnership). To calculate this component, you have to multiply 20% of your REIT/PTP income by a REIT/PTP factor. This factor is either 100% or 0%, depending on whether your PTP is engaged in an SSTB or not. If it is, then you have to apply the same taxable income threshold that we discussed in the previous section to determine if you can claim any QBI for your PTP income. If it is not, then you can claim 20% of your PTP income without any limitations.

The REIT/PTP component is designed to encourage investment in real estate and publicly traded partnerships that are not SSTBs. For example, if you own shares in a REIT that pays you $10,000 in dividends in 2022, you can claim $2,000 as QBI for your REIT/PTP component. Congratulations, you just got a free tax break.

Hurdle #3: Overall limitations

This is the final check that ensures that your total QBI deduction does not exceed 20% of your taxable income minus net capital gains. To calculate this limitation, you have to subtract your net capital gains from your taxable income and multiply it by 20%. Then you have to compare this amount with the sum of your QBI component and your REIT/PTP component. Whichever amount is lower is your total QBI deduction.

The overall limitation is designed to prevent taxpayers from claiming more than 20% of their taxable income as QBI. For example, if you have $100,000 in taxable income and $10,000 in net capital gain in 2022, your overall limitation will be $18,000 ($100,000 - $10,000 x 20%). If the sum of your QBI component and your REIT/PTP component is $20,000, then you can only claim $18,000 as QBI. Tough luck.

As you can see, claiming QBI is not a walk in the park. You have to jump through several hoops before you can enjoy this tax benefit. In the next section, we will explain how to calculate and claim QBI on your tax return using some forms and schedules that will make your life easier (or harder).

How to calculate and claim QBI?

Now that you know what QBI is and whether you are eligible for it, you may be wondering how to calculate and claim it on your tax return. Well, don’t worry, we have you totally covered. In this section, we will tell you what forms and schedules you need to use and give you some tips for getting awesome results with the QBI deduction process.

The main form that you need to use to calculate and claim QBI is Form 8995 or Form 8995-A. Form 8995 is a simplified version for taxpayers whose taxable income before the QBI deduction doesn’t reach the threshold amount ($170,050 for single filers and $340,100 for joint filers in 2022). Form 8995-A is a more complex version for taxpayers whose taxable income exceeds the threshold amount or who have other special situations. You can only use one of these forms, not both.

Form 8995 has four parts:

- Part I: Trade or Business Income (Loss)

- Part II: Qualified REIT Dividends and Qualified PTP Income (Loss)

- Part III: Calculation of QBI Component

- Part IV: Calculation of Total QBI Deduction

Form 8995-A has five parts:

- Part I: Trade or Business Income (Loss)

- Part II: Qualified REIT Dividends and Qualified PTP Income (Loss)

- Part III: Calculation of QBI Component

- Part IV: Calculation of Total QBI Deduction

- Part V: Tracking Losses or Deductions Suspended by Other Provisions

Form 8995-A also has four schedules:

- Schedule A: Specified Service Trades or Businesses

- Schedule B: Aggregation of Business Operations

- Schedule C: Loss Netting and Carryforward

- Schedule D: Special Rules for Patrons of Agricultural or Horticultural Cooperatives

Depending on your situation, you may need to use one or more of these schedules to help calculate your QBI component. You can find detailed instructions on how to fill out these forms and schedules on the IRS website.

To make your life easier (or harder), here are some tips for getting good results with the QBI deduction process:

- Keep accurate records of your business income and expenses throughout the year. This will help you determine your net income from each QTB or SSTB that you have.

- Separate your business and personal expenses. Only business expenses are deductible from your QBI. Personal expenses are not.

- Choose the right business entity for your trade or business. Different entities have different tax implications for QBI. For example, C corporations are not eligible for QBI, while S corporations and partnerships have to pass through QBI information to their shareholders or partners.

- Consider aggregating multiple trades or businesses into one if they meet certain criteria. This may allow you to increase your wage and property factor and claim a higher QBI component.

- Consult a tax professional if you have any questions or doubts about QBI deduction. This is a complex and new tax provision that may require expert guidance.

By following these tips, you can maximize your QBI deduction and save money on your taxes.

How Can Indy Help?

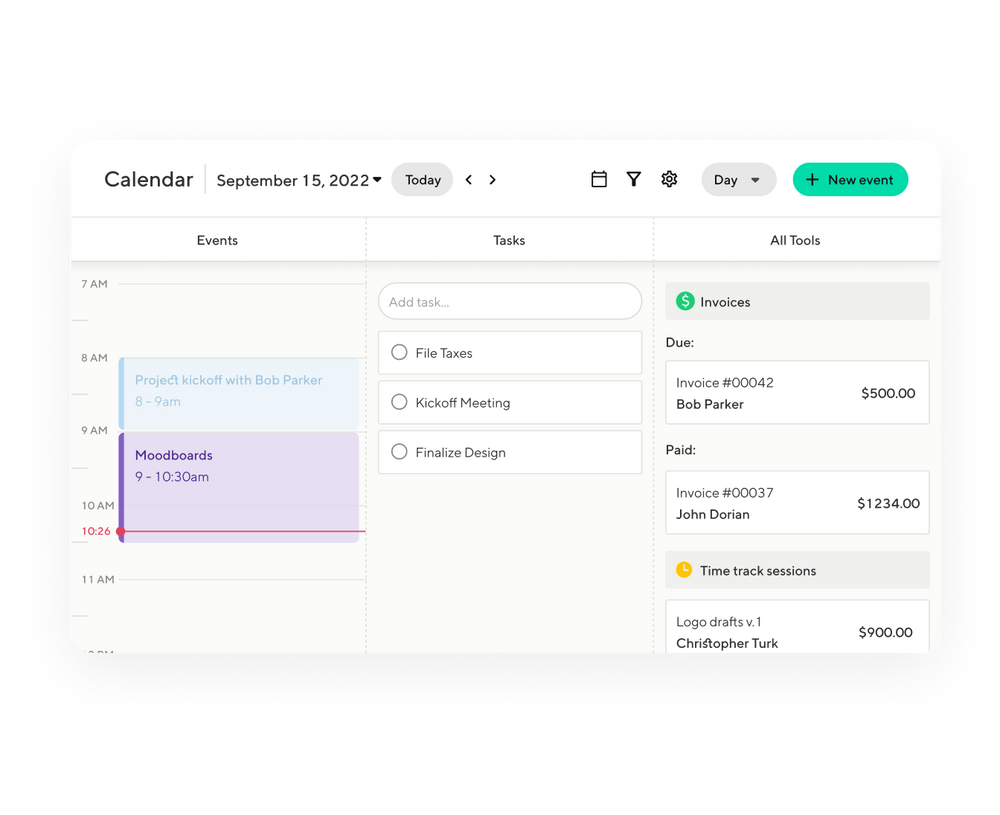

At Indy, we want to make freelancing simple. There are two ways Indy can help you with your taxes:

- Use Indy's Projects tool for your taxes. Set up your deadlines, to do lists, and track your progress during the year. You can give yourself monthly reminders to organize your receipts and stay on top of things.

- Track your business payments using Indy's Invoices tool. This will help you get paid faster and also keep an eye on how much money has come into your business during the year.

Most of all, Indy can help you save time and energy on admin by using a single platform for lots of jobs. All the time you save will come in handy when it's time to make time for filing your taxes. Sign-up now!

Conclusion

In conclusion, the Qualified Business Income (QBI) deduction presents a valuable tax-saving opportunity for freelancers and independent contractors. Understanding the eligibility criteria, limitations, and exceptions is crucial for maximizing your deductions. Indy aims to simplify the freelancing experience, offering tools to help you manage projects and track payments. However, given the complexity of the QBI deduction and its potential impact on your taxes, it is always wise to consult with a tax professional to ensure you're taking full advantage of this tax incentive.