"I am quitting my job without a plan" is quite familiar to many people preparing for a job search. It refers to the situation where someone decides to leave their current full-time job or employment with absolutely zero clue for what they will do next in terms of their career or livelihood.

Driven by dissatisfaction, burnout, a toxic work environment, or a yearning for change, many individuals find themselves making the bold move to quit their day job without a backup plan in place. Are you a part of the Great Resignation? How about doing freelancing as a step in your career? In this article, we’ll explore the psychological effects of quitting your job without a backup plan, how freelancing can be a rewarding new career path, and some tips to make the transition a smooth process!

Why Do People Decide to Leave Their Current Position?

While there's no precise statistics detailing how frequently individuals quit jobs without a plan b, anecdotal evidence and societal trends suggest it's happening with increasing regularity. This phenomenon is predominantly driven by several factors.

First, the desire for personal growth often catalyzes such decisions. Employees may feel they've reached a standstill in their current role, hindering their professional development.

Second, workplace dissatisfaction plays a significant role. This can stem from a poor work-life balance, lack of appreciation, or an uninspiring corporate culture.

Last, the yearning for a career change or to pursue passions outside the confines of conventional work often leads individuals to seek the next opportunity. It's a testament to the human aspiration for self-fulfillment, personal happiness, physical health, and the determination to live life on one's own terms.

Experiences of Individuals Who Quit Without a Plan

The experiences of individuals who quit without a plan can vary significantly, depending on the individual's financial and emotional resources at their disposal. For some, they may already have an idea of what to do next. With these individuals, they simply lack the confidence or certainty to fully commit to the endeavor before resigning or may consider it to be a terrifying leap. Others may find themselves in a position where they have no clue about what lies ahead. These individuals tend to be the most at risk, as their lack of contingency planning often puts them in a precarious situation.

Although the path ahead may seem intimidating and daunting, there are steps that can be taken to set oneself up for success after quitting without a plan. It's important to create an actionable roadmap with achievable short-term goals and milestones in order to navigate the transition process. A financial cushion can also be beneficial, allowing individuals to feel more comfortable taking risks with their career path. Finally, networking can prove vital in developing a professional network, exploring opportunities, and seeking out mentors who may be able to provide guidance.

Ultimately, leaving your old job a plan isn't an easy decision to make. It requires a tremendous amount of courage, resilience, and planning. Yet, if done right, it can be a rewarding experience that leads to professional and personal growth.

Psychological Impact and Influence on Mental Health

The emotional journey after quitting a job without a plan can be a roller coaster of tumultuous feelings. Initially, there's often an adrenaline-fueled sense of liberation; the chains of an unfulfilling job have been broken, and the world is a wide canvas for exploration and self-discovery.

This feeling, however, is frequently eclipsed by fear and uncertainty. A sense of trepidation as individuals confront the nebulous future can become overwhelming, leading to feelings of anxiety and self-doubt.

The emotional journey after quitting a full-time job

During this period, it's not uncommon for individuals to experience stress and struggle with their self-esteem, especially if the next steps in their professional journey are unclear. They may question whether they've made the right decision, and these doubts can manifest into feelings of regret or guilt. It's essential during these times to practice self-compassion, acknowledging the courage it took to make such a significant life change.

As time progresses, individuals may start to feel encouraged as they explore new opportunities and experiences. The promise of personal growth and the potential to pursue one's passion can mitigate the initial panic and uncertainty. Gradually, the fear and anxiety may start to recede, replaced by excitement and anticipation for what's to come.

This transition period is a time of introspection, resilience, and growth. Through this emotional journey, individuals often gain a deeper understanding of themselves, their aspirations, and their capabilities. It's a transformative experience that, despite the initial emotional turmoil, can lead to immense personal satisfaction and fulfillment.

The role of uncertainty and risk in decision-making processes

Uncertainty and risk play integral roles in decision-making processes, particularly when it comes to career transitions such as quitting a job without a plan. In this context:

- Uncertainty refers to the unknown variables and outcomes associated with a decision.

- Risk represents the potential negative consequences of that uncertainty.

When individuals decide to quit their jobs without a plan, they're undertaking a significant risk due to the uncertainty of what lies ahead. However, this uncertainty can also spur change and personal growth.

Financial insecurity and the challenge of re-entering the job market are primary risks when quitting without a plan. Yet, risk can motivate individuals to explore new paths, develop skills, and find a more fulfilling career.

To navigate this decision-making process, tools like SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis and decision matrices can help assess risks and uncertainties. Seeking advice from mentors or connecting with others who have experienced similar transitions can offer valuable insights and strategies for managing these elements.

Do You Want to Quit Your Job? Exploring the Economic Implications

When contemplating the decision to quit a job without a plan, one must not overlook the potential financial implications. The absence of a regular paycheck can lead to a rapid depletion of savings, particularly in the face of ongoing expenses such as rent, utilities, and groceries. Depending on the length of the ensuing unemployment period, this financial strain could escalate to missed mortgage payments, increased credit card debt, or even bankruptcy in the worst-case scenario.

Moreover, without employer contributions to retirement plans or healthcare insurance, individuals may find themselves grappling with long-term financial disadvantages. They may have to dig into their retirement savings for survival or pay out-of-pocket for healthcare costs, which could be prohibitively expensive.

Furthermore, the job market unpredictability is another financial risk that cannot be underestimated. The time it takes to secure a new job could be longer than anticipated, and the next job may not necessarily come with the same or higher pay. In some cases, individuals might have to accept a lower-paying job or change careers entirely, which might also require upskilling or reskilling in the company.

On the flip side, this decision might also lead to exploring new career paths that might prove to be more lucrative in the long term. Starting your own company, becoming a freelancer, or pursuing higher education are some potential routes that could potentially yield higher economic rewards in the future.

In sum, quitting one's job without a plan is a high-stakes financial decision that calls for careful consideration and prudent planning. It is essential to have a comprehensive understanding of one's financial position, including savings, debt, expenses, and potential sources of income. This understanding, combined with a well-thought-out contingency plan, can help mitigate the financial risks associated with such a major career move.

How to Manage Your Finances After Quitting a Job

Managing finances after quitting a job without a plan can be challenging, but with careful planning and smart decisions, you can navigate through this period of uncertainty. Here are some steps to help you manage your finances during this time:

- Assess Your Financial Situation: Take a close look at your savings, monthly expenses, and any outstanding debts. Understand how long your savings can sustain you without a regular income. This assessment will give you an idea of how much time you have to find a next position or alternative sources of income.

- Create a Budget: Develop a detailed budget to track your expenses and prioritize essential items. Cut back on non-essential spending to stretch your savings further during this transitional period. Remember you have got bills to pay!

- Emergency Fund: If you don't have one already, consider setting one up. This fund and enough savings can act as a safety net during unexpected situations and provide you with some financial security.

- Explore Government Assistance: Depending on your location and circumstances, there may be government assistance programs that can offer temporary financial aid or unemployment benefits. Research what options are available to you.

- Part-Time or Temporary Work: While searching for a new job in your field, consider taking up temporary or part-time work to generate some income and simply earn money. This can help cover essential expenses and reduce financial strain.

- Freelancing or Gig Work: If you have skills that can be utilized in the gig economy or as a freelancer, explore opportunities to provide services on a freelance basis. Online platforms offer various freelance opportunities in fields like writing, graphic design, web development, and more. You can be your own boss and work remotely, even from a small town!

- Networking and Job Hunting: Make job hunting your priority. Network with professionals in your industry, attend job fairs, look for career sections on the websites of companies, and use online job portals to actively seek new employment opportunities.

- Skill Development: Utilize this time to upskill or reskill yourself in areas that are in demand in your industry. Enroll in online courses or workshops to enhance your employability.

- Health Insurance: If your previous job provided healthcare, look into alternative coverage options, such as private health insurance or government healthcare programs.

- Avoid Unnecessary Debt: Try to avoid accumulating new debt during this period. Limit the use of credit cards to essential expenses only.

- Seek Professional Advice: If you find it challenging to manage your finances on your own, consider consulting a financial advisor. They can offer personalized guidance based on your specific situation.

Remember, managing finances after quitting a job without a plan requires discipline, resourcefulness, and patience. Stay focused on your job search and be willing to adapt your strategy as needed. With determination and proper financial management, you can navigate this period and find a new path forward.

How Freelancing Can Be the Perfect Backup Plan After Quitting a Job

Freelancing can be an excellent backup plan after quitting a job due to its many advantages and opportunities. It provides immediate income, bridging the gap while seeking a new job or venture. Freelancers enjoy flexibility, choosing their working hours, and maintaining a work-life balance.

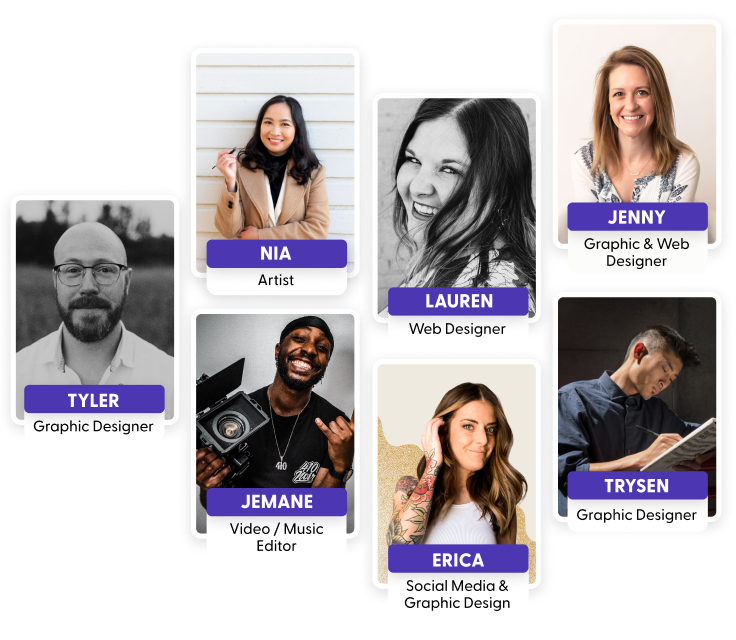

Freelancing lets individuals monetize their skills like design, writing, programming, and marketing, reducing reliance on a single income source. It also allows exploration of new industries and clients, broadening skillsets and uncovering new passions.

Freelancers build networks and portfolios, benefiting future job opportunities or client pitches. It also serves as a testing ground for entrepreneurship, developing essential business skills. Location independence offers the freedom to work remotely from anywhere, facilitating travel or relocation.

Despite the benefits, freelancing poses challenges like inconsistent income and self-discipline. Careful evaluation of the financial situation and market demand is essential. Diversifying income sources or considering part-time work can be a smart approach during the transition period after leaving a job.

Pros and Cons of Quitting to Become a Freelancer

Quitting a traditional job to become a freelancer can be a life-changing decision, and it comes with its own set of pros and cons. Here are some of the main advantages and disadvantages to consider:

Pros of becoming a freelancer

- Flexibility: One of the most appealing aspects of freelancing is the ability to set your own schedule. You can choose when and where to work, which allows for a better work-life balance and the potential to pursue personal interests.

- Autonomy: As a freelancer, you are your own boss. You have the freedom to select the projects you want to work on and the clients you want to collaborate with. This independence can be empowering and rewarding.

- Diverse Opportunities: Freelancing often opens doors to a wider range of projects and industries. This variety can help you develop diverse skills and experience, making your professional profile more attractive in the long run.

- Unlimited Earning Potential: Unlike a fixed salary in a regular job, freelancers have the opportunity to set their rates and can earn more by taking on additional projects or higher-paying clients.

- Remote Work: Many freelancers work remotely, which eliminates the need for commuting and allows them to work from anywhere with an internet connection.

Cons of becoming a freelancer:

- Financial Uncertainty: Freelancers typically face irregular income streams. It may take time to establish a steady client base, and there might be periods when work is scarce, which can lead to financial stress.

- Lack of Benefits: Unlike traditional employment, freelancers do not usually receive benefits such as health insurance, retirement plans, paid vacations, or sick leave. These costs and considerations must be managed independently.

- Self-Employment Responsibilities: As a freelancer, you become responsible for managing your own taxes, invoicing, contracts, and other administrative tasks, which can be time-consuming and sometimes daunting.

- Competitive Market: Freelancing can be highly competitive, especially in popular industries. Building a reputation and securing regular clients may require significant effort and networking.

- Isolation: Freelancers often work alone, which can lead to feelings of isolation and a lack of social interaction compared to working in a traditional office setting.

- Inconsistent Workload: Freelancers may face periods of overwhelming workloads and tight deadlines followed by quieter periods with less work. Balancing these fluctuations can be challenging.

Before making the decision to become a freelancer, it's essential to evaluate your personal circumstances, financial stability, risk tolerance, and long-term career goals. Some individuals thrive in the freelance world, while others may find it more suitable to stick with traditional employment.

Consider your strengths, weaknesses, and preferences to make an informed choice that aligns with your aspirations.

Tips and Recommendations to Accelerate a Freelance Career

Becoming a freelancer requires careful planning, dedication, and a proactive approach to building your career. Here's some advice to help you get started on your journey as a freelancer:

Identify Your Skills and Niche: Assess your skills, expertise, and passions to determine what services you can offer as a freelancer. Choose a niche that aligns with your strengths and interests, as specializing in a particular area can help you stand out in a competitive market.

Build a Portfolio: Create a portfolio showcasing your best work and projects. If you're just starting, you can include personal projects or volunteer work to demonstrate your capabilities. A strong portfolio can make a significant impact on potential clients and increase your chances of getting hired.

Research the Market and Rates: Conduct market research to understand the demand for your services and the rates typically charged by other freelancers in your niche. Pricing yourself competitively while considering your skill level and experience is crucial to attracting clients.

Network and Build Relationships: Networking is vital in the freelance world. Attend industry events, join online communities, and engage with potential clients and fellow freelancers. Building strong relationships can lead to referrals and new opportunities.

Create a Professional Online Presence: Establish a professional website and social media profiles that showcase your services, portfolio, and contact information. Having a strong online presence can help potential clients find you and learn more about your work.

Start Small and Gain Experience: In the beginning, you might need to take on smaller projects or offer your services at a discounted rate to gain experience and build a client base. As you gain more experience and positive reviews, you can gradually increase your rates and take on larger projects.

Set Clear Terms and Contracts: Clearly define your terms, including payment terms, project scope, deadlines, and deliverables, in written contracts. Contracts protect both you and your clients and help manage expectations.

Manage Finances Wisely: As a freelancer, you'll need to handle your finances independently. Keep track of your income and expenses, set aside money for taxes, and consider using accounting software or hiring an accountant to help with financial management.

Be Responsive and Professional: Respond to inquiries and communication from potential clients promptly and professionally. Good communication skills and reliability are essential for building trust with clients.

Continuous Learning and Improvement: Stay updated with industry trends and continually improve your skills. Invest in courses, workshops, and training to enhance your expertise and offer more value to your clients.

Remember that freelancing can be challenging initially, but with persistence and dedication, you can build a successful and fulfilling freelance career. Be patient with yourself, stay motivated, and be open to adapting your approach as you learn and grow as a freelancer.

How to Approach the Decision and Navigate the Subsequent Period of Uncertainty?

Approaching the decision to quit a job without a plan and navigating the subsequent period of uncertainty requires careful thought, preparation, and resilience. Here's a step-by-step guide to help you through this process:

1. Reflect on Your Reasons:

Take the time to reflect on why you want to quit your job without a plan. Identify the factors contributing to your decision and consider if there are any potential solutions to address your concerns within your current job or workplace.

2. Weigh the Pros and Cons:

Make a list of the potential advantages and disadvantages of quitting without a plan. Evaluate the risks and benefits associated with this decision. Consider the potential impact on your career, finances, and personal life.

3. Assess Your Finances:

Conduct a thorough assessment of your financial situation. Calculate your expenses, savings, and how long you can sustain yourself without a regular income. This will help you understand the financial implications of your decision.

4. Build an Emergency Fund:

If possible, try to save up some additional funds before quitting. Having an emergency fund can provide a safety net during the period of uncertainty and unemployment.

5. Plan for Career Transition:

Even if you don't have a concrete plan, start brainstorming and researching potential career paths or industries that interest you. Identify skills that you can develop to enhance your employability in those areas.

6. Network and Seek Support:

Talk to friends, family, or mentors about your decision. Seek advice from those who can offer valuable insights and support. Networking can also help you discover potential job opportunities or alternative career paths.

7. Stay Positive and Patient:

Navigating uncertainty can be challenging, and it may take time to find a new direction. Stay positive, patient, and persistent in your efforts to explore new possibilities.

8. Upskill Yourself:

Invest in your personal and professional development during this period. Take online courses, attend workshops, or acquire certifications that can make you more marketable in your desired field.

9. Consider Part-Time Job or Freelancing:

If possible, consider taking up a side gig, part-time work, or freelancing to generate some income while you explore your options. This can help bridge the financial gap and offer valuable experience.

10. Stay Flexible and Open-Minded:

Be open to exploring different opportunities and career paths. The job market may present unexpected options, and staying flexible can lead you to new and exciting ventures.

11. Set Realistic Goals:

Set achievable short-term and long-term goals for yourself. Break down your larger career aspirations into smaller, actionable steps to maintain focus and motivation.

12. Take Care of Yourself:

Managing uncertainty can be emotionally taxing. Take care of your physical and mental well-being during this time. Engage in activities that help you de-stress and stay balanced.

13. Evaluate and Adjust:

Periodically assess your progress and the direction you're heading. If needed, be willing to adjust your approach based on the experiences and feedback you receive along the way.

Remember, navigating uncertainty requires resilience and a positive mindset. Embrace this time as an opportunity for personal and professional growth, and be open to the possibilities that lie ahead. With determination and a proactive approach, you can find a new path that aligns with your goals and values.

How Can Indy Help?

Hoping for new opportunities? Have you decided "I am quitting my job"? Freelancing can provide a source of income and bridge the financial gap while you navigate your career transition.

Indy has all the tools you need to go from "zero to hero" as a freelancer, including proposals, contracts, invoicing, to-do lists, time tracking, real-time chat messaging, and more! Plus, with the Indy Community, Indy acts as a networking hub where you can connect and collaborate with other freelancers and even gain client referrals.

And with Indy University, you have all the knowledge you need to fast-track your freelancing success. Get started today for free!

A Small Recap

The decision to quit a job without a plan can be incredibly daunting, but freelancing might just be your ticket to a newfound sense of freedom! It is important to take the time to reflect on your reasons and consider all the potential implications for your career, finances, and personal life. With proper planning and support from friends, family, or mentors, you can navigate this period of uncertainty with greater confidence. Ultimately, it is important that you find a career path that aligns with your goals and values, as this is essential for personal fulfillment and satisfaction.

With the right attitude and commitment to self-development, you can turn this challenge into an opportunity for growth. Thinking of becoming a freelancer? Indy has all the tools you need to fast-track your freelancing success. Get started today for free!