Attention business owners and freelancers! Did you know that investing in a business coach can not only improve your skills and increase profits but also provide tax benefits? That's right - by taking advantage of tax deductions for business coaching expenses, you can maximize the value of this investment.

In this article, we'll explore the ins and outs of business coaching as a deductible expense, along with tips for how to make the most out of these tax savings. Plus, you'll have the opportunity to learn all about Indy and how we can help you with your tax write-off!

Are Coaching Fees Considered a Business Expense?

Business coaching and professional development courses are investments in your future. By working with a business coach, you can go from a small business owner to the next level and achieve your goals.

As a business owner, you may be wondering if business coaching is tax deductible. The answer is yes! The business portion of coaching is considered a professional development expense, which means it can be deducted from your taxes, the same way you can deduct work-related education. But it is important to note that only the business portion of the coaching is deductible. You cannot deduct a personal expense (such as a life coach).

There are a few things to keep in mind if you want to deduct expenses for career coaching:

1. Make sure you have a written agreement with a coaching business outlining the scope of work. This will help you document the coaching expense for tax purposes.

2. Keep track of all receipts and invoices related to your coaching sessions. This includes any travel expenses (like business meals and other professional fees) incurred to meet with your coach.

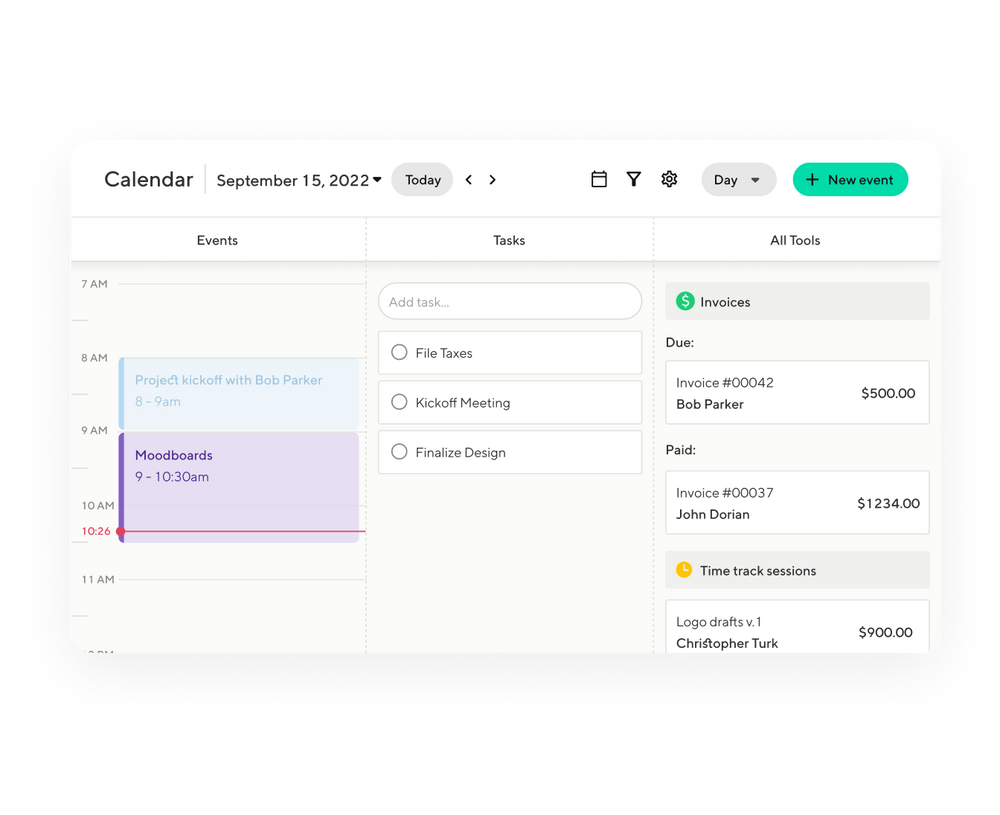

Indy's Invoices can aid you in keeping a perfectly neat record of how you spend money. You can track all the invoices and payments with dates and explanations on them, and keep your business expense clear for claiming a business deduction later on.

3. Be sure to keep records of how a career coach and business coaching have helped you improve your business. This could include documentation of increased sales, improved efficiency, or other positive outcomes.

Are Business Coaching Expenses Tax Deductible?

Business coaching is a great way to help your business grow and achieve its goals. But can you deduct the cost of business coaching from your taxes?

The answer depends on how you use the coaching services and what type of coaching you receive. For it to be deductible, the coaching must lead to professional development.

If the coaching is used to improve your business skills, then the costs may be tax deductible. This includes course fees, seminars, and one-on-one coaching that helps you learn new business skills.

However, if the coaching is used for personal matters (like a life coach), then the costs are not tax deductible. This includes life coaching, relationship coaching, or any other type of coaching that does not directly help you improve your business skills.

Business Coaching and Self-Employment Tax Deduction

As a small business owner or self-employed freelancer, you may be wondering if business coaching is tax deductible. So, for coaching to be considered a business expense, you need to follow a few guidelines.

First, make sure that the coach you're working with is qualified. The person providing coaching should be directly related to the industry in which you're looking for coaching and should be able to provide evidence of their successful track record, as well as working licenses.

Also, the coaching business you are working with needs to solely advise you on business-related matters. In an instance where they advise you on both personal matters and business matters, you can write off only the business portion of coaching (also called executive coaching).

Second, you will need to keep track of your expenses. This will include dates, amounts paid, and what services were provided. Be sure to get a receipt from the coach whenever possible so that you have documentation of the expenses. You will also need to keep track of how much time you spend with your coach, as this will affect the amount you can deduct.

Luckily, Indy has the perfect tools to help you with this! Both Invoices and Projects are great options for keeping track of the time and money you spent with a coaching business. You can choose a recurring payment option that lets you set a date and time for the payments so that that would be one thing less to worry about!

Third, make sure that the coaching services you're receiving are actually helping your business. The IRS will only allow deductions for expenses that are "ordinary and necessary" for running your business. This means that if the coaching isn't actually helping you run your business better, it's not something you can deduct from your taxes.

Finally, it's important to consult with a tax professional before claiming any deductions on your taxes. They can give you the perfect tax advice to help you determine if business coaching is an eligible expense and help you with your tax bill!

IRS Guidelines for Business Coaching Tax Deductions

The United States tax code provides numerous deductions for businesses, including those that engage in business coaching. However, it is important to understand the IRS guidelines.

First, business coaching must be considered a professional service. This means that the services must be rendered by someone with the appropriate credentials and experience. The business owner must also demonstrate that coaching is necessary for the operation of the business.

Second, the deduction is only available for expenses incurred while conducting business coaching sessions. This includes any travel expenses associated with meeting with clients or attending conferences related to business coaching. It does not include personal development activities such as reading books or taking courses unrelated to business coaching.

Third, the deduction is limited to the actual costs incurred. This means that you as a freelancer cannot deduct the value of your time spent on business coaching activities.

Conclusion

Business coaching can be a very valuable asset to any business, and it is important to understand the tax implications of engaging in such services. While business coaching may not always be considered tax-deductible, there are certain criteria that must be met in order for it to qualify as a legitimate deduction.

Knowing what these criteria are before engaging in business coaching can significantly reduce your overall taxes owed and maximize your potential deductions. With proper preparation and due diligence (and immaculate record-keeping, with the help of our trusted Indy), you’ll find yourself with more money saved throughout the year.