The Internal Revenue Service is continually improving and changing their tax forms and other tax documents as they try to make filing taxes as easy and smooth as possible. One of the most significant changes in recent years is the reintroduction of the 1099-NEC.

Reintroducing the 1099-NEC has necessitated changes to the 1099-MISC, which was used to record nonemployee compensation before the 2020 tax year.

One such change is on form 1099-MISC box 7. This article explains this change and other relevant ones on the 1099-MISC that 1099 employees need to know.

What is Box 7 on Form 1099-MISC?

Box 7 on Form 1099-MISC was previously used to report non employee compensation paid. The box was for reporting earnings for 1099 employees like prizes, awards, fees, and commissions.

However, starting for the 2020 tax year, the IRS will require clients and businesses to report these payments on the 1099-NEC.

Form 1099-MISC will still be used, but it will only be for miscellaneous income that does not qualify for inclusion in the 1099-NEC. The IRS provides instructions for filling out each box, and this guide will explain this in more detail in the sections to follow.

That said, box 7 on Form 1099-MISC is now used to record direct sales of at least $5,000 that are meant for resale. For example, multilevel marketing firms that sell their merchandise at wholesale price to individuals aiming to resell them will use box 7 to indicate they made direct sales.

Do You Need to Correct Box 7 Information on Old Form 1099-MISC?

You will not need to correct any information on your old form 1099-MISC to conform to the recent changes. Provided you entered the data according to the previous requirements, you will not have to make any corrections.

Correction is unnecessary for any form from the 2019 tax year and previous ones. However, you will have to do revisions if you used the old regulations when filling out your 1099-MISC for the tax year 2020 or 2021. Filing corrections will ensure accurate nonemployee compensation reporting according to the new IRS requirements.

However, before you decide to change any information on your filed tax forms, it is always good to seek tax advice from an expert tax advisor to be sure of the legal implications, if any.

Why the IRS Reintroduced Form 1099-NEC

Form 1099-NEC had not been in use since 1982 when the IRS retired it in favor of other 1099s like the 1099-MISC. However, the Protecting Americans from Tax Hikes Act (PATH Act) of 2015 necessitated the reintroduction of the form to take over some of the functions of form 1099-MISC.

The Path Act brought confusion for small businesses and other players such as tax professionals that have to deal with Form 1099-MISC. The Act created different filing deadlines for various incomes reported on this form.

The different filing deadlines meant that many taxpayers ended up getting penalized by the IRS for not filing the forms on time as there was a lot of confusion on which 1099 forms to file in the different deadlines.

Before passing the Path Act, small businesses had until February 28 to file their Form 1099-MISC with all the reporter nonemployee compensation. However, the Act changed the date to January 31, and so many taxpayers ended up submitting the forms late as they were still following the old deadlines.

Besides addressing confusion, the IRS introduced Form 1099-NEC to combat tax fraud. Some taxpayers avoided paying federal income tax by reporting small amounts in nonemployee compensation and high amounts of federal income tax withheld under the backup withholding rules.

Who Needs to Use Form 1099-MISC and Form 1099-NEC?

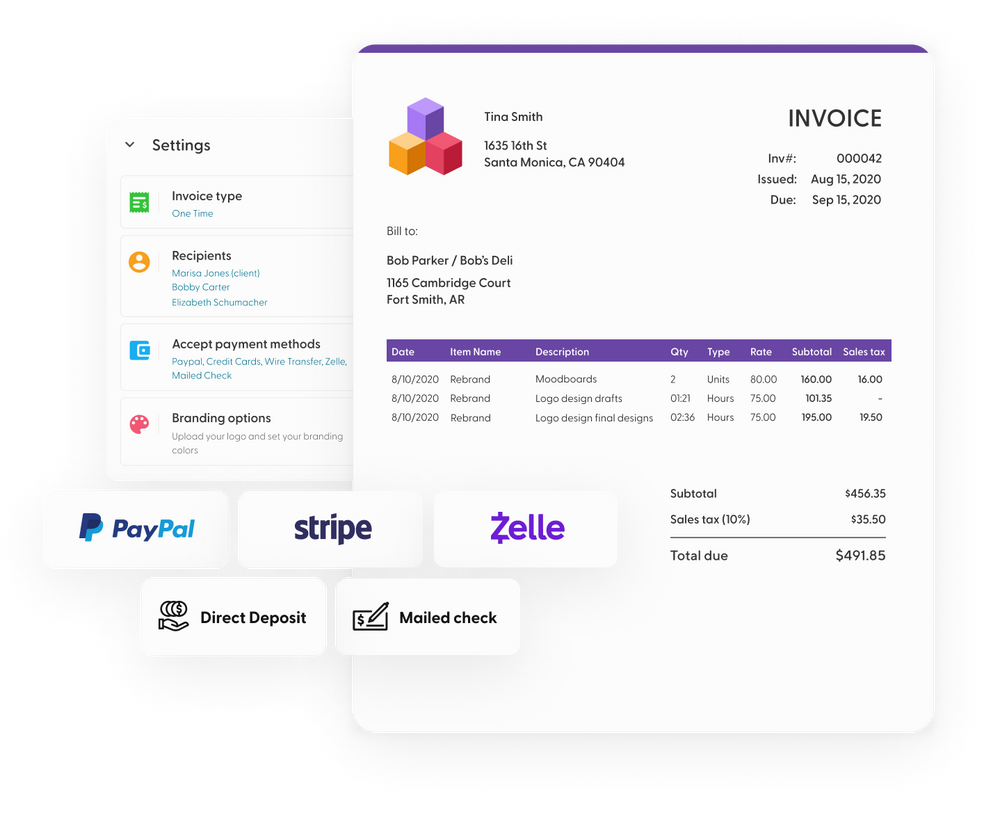

Like many other 1099s, these two forms report payments to nonemployees. The 1099-Misc reports miscellaneous income while form 1099-NEC reports all nonemployee compensation, and they will typically be used by small businesses and sole proprietorships that deal with 1099 employees.

Form 1099-NEC reports any nonemployee compensation over $600. Businesses will issue the form to 1099 employees like independent contractors and freelancers. Also, they are given to other professionals such as accountants and lawyers when they offer services to a business.

The IRS does not provide a complete list of everyone who should receive a 1099-NEC or 1099-MISC form, but it is basically anyone that provides service to a business and is not on the company's payroll. Also, almost any business can issue these forms when dealing with 1099 employees.

When to File the 1099-NEC

Businesses require the 1099-NEC when reporting nonemployee compensation for the tax year, and they have to file it by January 31. Additionally, the company should also send a copy of the tax form to the 1099 employees by January 31.

The filing date is the same whether you send the forms by mail or are filing electronically. It is also important to note that the IRS does not allow mail filing when you have more than 250 form 1099-NECs. Therefore, electronic filing will be the only option.

Independent contractors do not have to file these forms, as they only need the information to calculate their taxable income and income tax. With the information on these forms and by adding other receipts like cash payments, reporting independent contractor income is easy and accurate.

Unless it falls on a weekend or public holiday, there is no automatic extension to this deadline. Still, taxpayers can request a deadline extension from the IRS to avoid late filing penalties.

Filing 1099s with States

Whether or not you have to file Form 1099-NEC and other 1099s with the state depends on where you are filing, as states have varying regulations for this.

Many US states use the Combined Federal State Filing Program that allows the federal government to share tax forms with states. If you are in a state under this program, you only need to file the documents with the IRS and not do it again at the state or local level.

It is essential to check your state regulations concerning the filing of 1099s to be sure of what to do and avoid unnecessary fines for non-compliance.

Are there Any Other Changes to Form 1099-MISC

The reintroduction of Form 1099-NEC has forced several other changes to the 1099-MISC besides just replacing box 7.

Some of these other changes are that crop insurance proceeds will now be recorded on box 9, gross proceeds paid to attorneys will go to box 10, and nonqualified deferred compensation income will go to box 14.

The changes will also affect how your report state taxes on 1099-MISC. For example, state withheld tax will go to 15, state tax identification number is recorded in box 16, and the total amount earned at the state level goes to box 17.

What 1099-MISC Will Now Look Like

The IRS provides clear guidelines on the information you have to enter on the different sections of a 1099-MISC. Also, if you are filing using tax software or have a tax expert helping you out, they should guide you through the entire process. However, here is a brief overview on how to fill out some of the main sections after the recent changes:

1. Box 1: Rent

The first box reports all types of rents over $600. They include real estate rents for office space if you did not pay them to a property manager or real estate agent. Machine rentals and pasture rentals also go to this section where applicable.

2. Box 2: Royalties

Box 2 reports the gross royalty payments if they are over $10. You can report royalties from oil or gas payments. However, do not include working interest gas payments as they go on box 1. You can report royalties from intangible property such as patents, trademarks, trade names, and copyrights.

3. Box 3: Other income

Any other qualified income over $600 that does not have a place in box 1 or 2 above should be reported in box 3 as other income. You also report other incomes such as prices and awards on box 3 using the fair market value as they are typically in the form of merchandise.

4. Box 4. Federal income tax withheld

Federal income tax withheld will go to box 4. You often have to withhold federal income tax if the 1099 employee you are dealing with does not provide their taxpayer identification number. The business has to enter backup withholding under the backup withholding rules in this section.

5. Box 6: Health care payments

Medical and health care expenses over $600 to physicians and other professionals that offer the service should go to box 6. It is also important to note that the exception to issue a 1099-MISC form to corporations does not apply to health care payments. Therefore, if the health care or medical payment is to a corporation, you should still issue Form 1099-MISC.

6. Box 7: Direct sales over $5,000

You should enter an "X" in the check box if you make direct sales of over $5,000 to someone that intends to resell the goods or sell them on a deposit-commission basis. You can report this item on either box 7 on the 1099-MISC or box 2 on form 1099-NEC.

7. Box 8: Substitute payments for Interest and Dividends

You should report any substitute payments you get instead of tax-exempt interest or dividends on box 8 if the gross proceeds paid are $10 or more.

8. Box 14: Excess golden parachute payments

Excess golden parachute payments go on box 14, and the IRS also explains how to compute the excess amount to ensure you have an easy time when reporting.

Note: The IRS explains all these boxes and the items to include in more detail, and it is essential to check out their instructions when filling out your 1099-NEC to avoid confusion and ensure you do not leave out anything important.

Final Remarks

Before the 2020 tax year, nonemployee compensation was reported on box 7 of the 1099-MISC. New IRS regulations now require businesses to use form 1099-NEC to report this item from 2020 and all the tax years to follow.

These changes have also caused other changes on how you report other things on the 1099-MISC, and so if you will still be using this tax form, you have to know these changes.

The good news is that the IRS provides some helpful instructions on how to fill out the 1099-MISC and so taxpayers should not have any difficulties provided they follow them.