When you’re a photographer, keeping all the gross income and tax records can be tough. And knowing what you can include in taxable income figures can be very challenging when filing freelance photography taxes. Yet by getting tax liability returns right and claiming the correct capital expenses, photographers can improve the financial returns they get from their business to maximize financial stability.

In this article, we provide you with a list of the legitimate business expenses that you should be looking to include on your taxable income returns when you run a photography business. We’ll also show you how Indy can help you manage your taxes. And we will provide the best information on business expenses to help you reduce your tax liability. Let’s get started with this look at your tax deductions.

Why Photography Tax Deductions Matter

There are numerous reasons why you should make sure you take tax deductions seriously. For one, they can help you reduce your tax burden, build your financial worth and take more earnings from the same amount of work.

In addition, it can help you to fund legitimate business expenses, allowing you to expand your business or make life easier by investing in technology to help you automate certain aspects of your business.

So many photographers, and so many other business owners, forget to claim all the tax allowances that they can. The amount that is left unclaimed can make a real difference to lives.

The Internal Revenue Service (IRS) believes $1.5 billion in refunds for allowable tax deductions in 2019 went unclaimed. This could be a refund of $893 for each individual owed the refunds. And these are for self-employment taxes, not other business taxes.

Unless these refunds are claimed within three years, the money is automatically transferred to the US government for their use. And this is just related to federal taxes as well. There are probably some local taxes that can be reduced as well.

Another factor is that tax deductions can support your business's cash flow. When you have a higher tax burden than expected you incur a tax debt. To avoid these, look at possible options to save on business costs and put this back into your business. Most businesses close down because they are in debt without the cash flow to cover legitimate business expenses.

So what are the potential tax deductions you can make on your tax reports? Here is a list of the potential tax credits that you can make.

How to Prepare Tax Deductions for Photographers

One of the biggest mistakes that business owners make is that they don’t think about the photography tax deductions that they should make until the tax return. However, the best business owners will think about every expenditure and cost they have and determine whether or not that can be claimed against the tax.

Therefore, throughout the year you should keep on track of all the costs and keep a good record of the costs so that you can take off the tax burden at the end of the year or your quarterly taxes.

The Tax Write-Offs for the Photography Business Owner

There are several tax write-offs that you need to consider when you are running a photography business. Some of these are obvious, some aren’t obvious and others are those that you probably know, but never do. So if you own a photography business then use Schedule C to record these specific tax deductions.

If you’re struggling to keep track of everything, you might want to create a photography business expense list. You can do this on a Google Doc, Excel Spreadsheet, or another reporting software program. If you keep a record early on and throughout the year, then it will make completing the tax return easier.

Cameras and Photography Gear

One of the most vital upfront expenses you’ll have is the camera and photography gear. Without these items, you don’t have a business and can’t offer services to your customers. Not surprisingly, these are the first items you should consider when it comes to tax deductions. And cameras can be rather expensive, which can offer significant tax savings.

However, it isn’t just the cameras you can claim when it comes to photography equipment. As a photography business, there might be other equipment you use. You might, for instance, have some lighting gear, camera tripods, camera bags, and even memory sticks for storing the photographs.

It is important to always make sensible decisions when you are going to purchase photography gear. So you shouldn’t purchase new equipment just because it will help reduce your tax bill.

Computer Equipment Purchases

Most photography businesses are now using digital photography options, or work exclusively with digital images. For this to work, you'll need a computer and photo editing software. These business-related costs are tax deductible and significant upfront expenses.

You might need to carefully consider the computer equipment when it comes to what you can claim. You might, for instance, use a personal computer for editing with some professional image editing software. Your computer might not be deductible if you use the computer for personal reasons as well, but you should be able to write off the tax for the software.

However, there are times when a personal computer might be tax deductible. For instance, if you’re a sole proprietor and use the computer mostly for your work, then you can claim it. Also, if you buy the computer and use it mostly for work, then it should be a tax-deductible item.

Printers and telecommunication equipment (mobile phones, landline handsets, etc.) can also be tax deductible. Therefore, keep records of what you spend on these items.

Office Furnishing

Office furnishings are often the forgotten cost within many offices. Too many buy their desks and chairs without thinking of the costs and potential tax savings they can provide. Office chairs and desks can be expensive but are essential.

At the same time, you can take off some other equipment, like when you have examples of your work put onto canvas. These are often of a lower value, but they can improve the look of a room and market your work.

However, some tax furnishings can not be deductible from the tax burden. For example, when adding plants to the office, then these can sometimes not be claimed back, especially if they don’t have any business purpose.

Decor/Props

When you are taking family photographs or you’re a children's photography business, then you might have some props. Props can help turn a crying child into a smiling kid that will look cute in photographs. When you buy décor or props that create these backgrounds or have the purpose to help you run your business well, these can be deducted from your tax burden.

All these might make a small contribution to your tax deductions.

Service Providers

One of the best ways to improve the service you offer your clients is to outsource some of the activities for running your business. Whenever you use a service, like marketing, accounting, PA, or something else, you can take the service charges off your annual tax bill easily.

You must consider carefully what services you need, however. Costs can quickly rise, which can affect your cash flow, even when you can claim the costs back.

Subcontractors or Second Shooters

As you grow there might be times when you need to have another photographer or a photography assistant that you need to complete jobs. These assistants can become part of the tax claim that you can make. You can claim for the labor costs and also any equipment that you purchase for the assistant to use on your work.

Normally, a second shooter will work on a freelance basis, which makes it fairly easy to calculate what you can claim back. However, should you place additional staff on the payroll of the photography business, then you might not get the full benefits that you would expect.

Insurance

Insurance is one of the biggest costs that you can have for your business. However, they are also really important. When you are out and about accidents can happen and if you don’t have personal liability then you are liable for the costs to make right what went wrong and you might also need to pay for court costs.

These costs can be highly damaging to your cash flow. Therefore, it is very important that you speak to a broker and get the best coverage for your business.

You should also have insurance for your equipment. When working away from your office there’s always a chance that your equipment could be damaged or even stolen. Those that travel a lot in cars, can claim car insurance as a tax deduction.

Insurance can be a regular cost, but luckily these costs are tax deductible. And so you should keep a record of all the insurance costs you have.

Rental Equipment and Space

There are going to be times when you might not want to buy equipment or space. Renting can be much more affordable and help to keep profitability high. In addition to reducing the outgoings of your business, rental equipment and space can reduce the tax burden.

There are numerous items that you might want to rent or lease. For example, you might want to lease a vehicle to help you move from shooting location to location. Leasing a vehicle can be a great option for saving on costs because you can get a new car for a low monthly fee and the leasing company will take care of all testing, servicing, and repairs.

Some equipment for taking photos might need to be rented. For instance, you might not offer videos regularly, but for one client, you might have included this. And it would be more cost-effective for you to rent the video equipment rather than purchase the equipment outright.

There are also home office deduction options that allow you to deduct expenses relevant to your work. If you have a home office and are a registered LLC company or corporation, you can rent a room from your home. This rent can be an additional income for your personal finances, but also, you can take the cost of the rent off your tax bill.

If you’re a sole proprietor and you rent your property, you can take some costs of rental off your tax bill. To do this, you need to calculate the square footage in the home you’re using exclusively for the business and then divide that number by the total square footage of the home. This number can be multiplied against your rent to calculate how much you can claim for your tax deductions.

And if you are a homeowner with a mortgage, you can claim mortgage interest as a capital expense. Mortgage interest is also calculated in a similar way.

It is important to note that if you are renting equipment to test it in personal projects, these purchases cannot be deducted from the tax benefit.

Training, Courses, and Other Educational Costs

The best photography business owners will continuously look for ways to improve their skills and offer a better service to customers. Training and having a continuous development program is expensive. However, getting these new skills and qualifications can improve business’ offerings and also be a way to write off some tax burden.

If, for example, you were to attend a workshop on how to take client videos at weddings or how to repair equipment in the field, then these courses are a perfect option for your business expenses.

You must note what is acceptable business use. Under federal tax laws, any purchase you actually make against the tax burden must be for reasonable and essential business use. So you can’t claim money for a course that is for baking the perfect cakes when you’re a photographer.

However, remember that there are other ways that you can benefit from further education. There is the option to claim a huge tax break..

Another education-related activity that is important is the cost to attend the course. So you can claim back expenses such as fuel, car mileage, and car insurance plus lodging you might have needed to attend the course off your tax bill.

Therefore, there are lots of potential ways that education can help you improve your tax burden.

Tax, Legal, Filing, and License Costs

When doing business in the United States, there are so many fees that you might have to pay just to be able to do business. And many of these licensing costs can be deducted from the tax bill. Some of the taxes, fees, permits, and licensing costs that you might need to do include elements like:

- Property and sales tax fees

- Limited Liability Company/corporate filing fees.

- Any permits that are required by the local government to do business

- Fees paid to be a member of a business association memberships

- Any fee to have professional certifications

- Any copyright fees

- Any license related to your profession and trade.

Travel Expenses for Conducting Work

As a photographer, you might be required to attend client events, such as weddings, birthdays, corporate events, and even school photo days. You might also need to visit the location before the event day to plan the day for your business. Your travel expenses can be claimed against your business expenses.

These travel expenses can include your fuel, train, bus, or other expenses that might occur as a result of your work. Included costs might include lodgings should you need to stay away from your home for work. You might also be able to include costs for food for time away from the business.

If you want to claim these from your tax bill, then you will want to save all receipts your business claims.

However, you cannot claim any costs against traveling from home to the office if not in the same location. These are considered personal costs and not related to your work.

Interest on Loans or Credit

Many business owners start or expand their business with the help of a loan or credit from an investor. When you are incurring interest on these elements, you can claim the interest back from the tax burden you have. You can also claim the interest your business credit card is being charged.

You will need to provide proof of these for the IRS. Therefore, you might want to save financial statements from your creditors that show exactly how much interest you’re being charged.

Mistakes Made on Tax Deductions for Photographers

Some common mistakes are made when it comes to calculating and claiming tax deductions for photographers. Ignorance of the tax law, rules and regulations is not an excuse, the IRS or local government will claim against you if they think you’ve not followed the rules in the past.

Some mistakes don’t cause conflict with the government over the taxes that must be paid, however, it does increase the tax burden.

Reliable Storage and Accounting System

The first mistake is that photographers don’t have a reliable storage or accounting system that they can use. These should not just record gross income but also store information about deductible expenses. There are lots of options available and where possible, ensure there is a backup of the data, to protect it from accidental loss.

Using software to monitor your own taxes can also be a great way to see estimated taxes. Some software can help with filing taxes and pay taxes.

Do not rely on your bank account information. They are not accurate and going through more than a year of financial information is going to be a real challenge. Especially if you have a lot of business income and deductible expenses.

Take Information Throughout the Year

One big problem is that photographers tend to not keep all your business expenses stored and sort it out throughout the year. And that means that when it comes to the tax year, photographers can quickly complete taxable income documents and not spend hours sorting out the business and capital expenses information for the returns.

Another problem is that by not recording everything throughout the year, you can accidentally miss something, which means that you're not reducing your tax liability.

Don’t Leave the Tax Filing Until the Last Minute

Some photographers will run the deadline date for tax filing right until the last minute. This can cause significant problems during a busy tax season. One issue is that information about capital expenses and business expenses is less accurate and sometimes deadlines during the tax season are missed which could result in a fine.

Being rushed when you report income, can also cause you to miss off gross income.

How Indy Can Help You with Your Taxes

Indy is an online platform of freelancers seeking to streamline their self-employment experience and focus more on their passion. Indy helps achieve this goal by providing effective tax management solutions. There are numerous features that can help this, including:

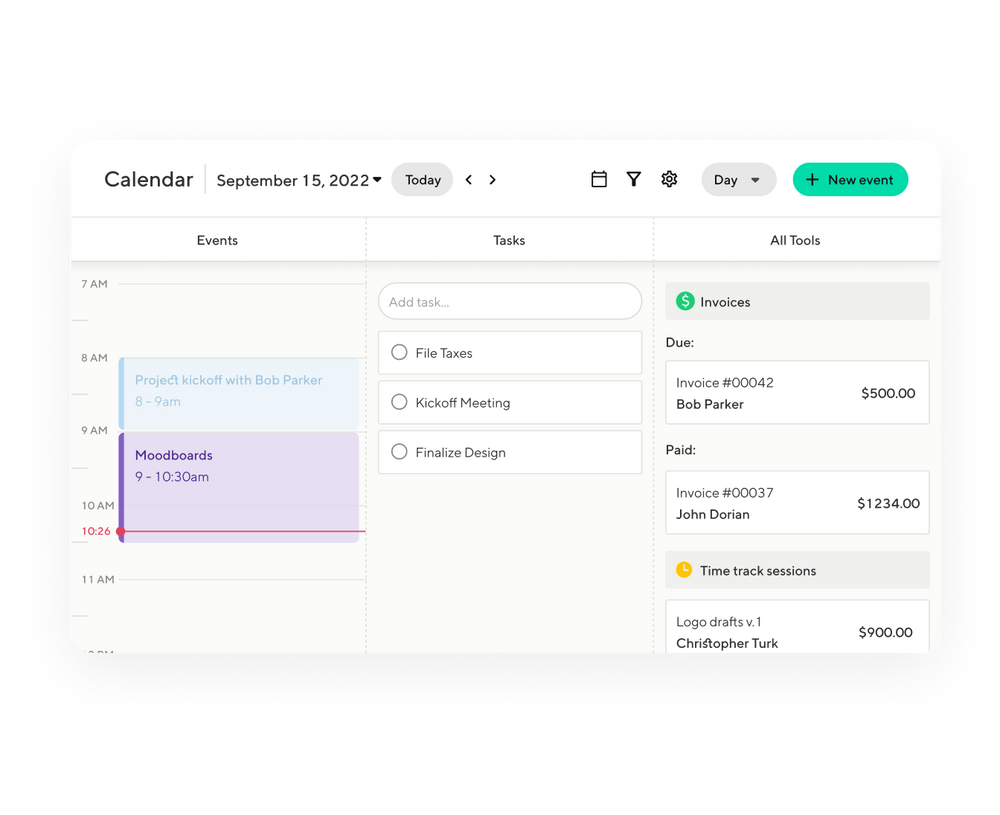

Indy’s Tasks: A personal tax-related task guide. It enables you to arrange deadlines, develop task lists and monitor progress. Users can also establish reminders to organize receipts and manage a tax filing system.

Indy’s Invoices: A clever tool to streamline business transactions. Quickly generate and transmit invoices, expedite payments and generate an annual income summary.

Indy’s Comprehensive Platform: An all-inclusive hub catering for every aspect of freelance work. Reduces time-consuming administrative tasks.

Indy is dedicated to supporting freelance business owners. By using Indy, you’re able to confidently manage all aspects of your tax, while also reaping the rewards of being self-employed. Experience the joy of freelancing by joining Indy today.

Final Word: Tax Deductions For Photographers

So when it comes to photographer tax deductions, there are lots of potential ways that you can reduce your self-employment tax and even claim money back. Costs from business expenses, capital expenses, extra labor, and even space can be claimed back with ease. And with less tax payments to make, you can have more money to spend on yourself.

And to ensure that you get the least income taxes to pay from your own business, you should start managing business expense information long before the tax season starts. Good business records can help with this. But if you need help, perhaps you need to speak to a tax professional, like a tax accountant.