Contracts are an important aspect of any business since they protect all parties involved in a transaction by outlining the terms and conditions of the agreement. Furthermore, while you may engage a lawyer to write a contract for you, using your own templates is typically less expensive. This is especially true if you frequently enter into similar contracts on a regular basis.

QuickBooks is one of the most popular accounting platforms today. QuickBooks contract management system includes a number of tools to assist in managing contracts and records. Here at Indy, we strive to assist freelancers with the day-to-day operations of their businesses. So, in this article, we will explore what templates QuickBooks contract management platform provides, the benefits, and contract creation.

Understanding the Role of Business Contracts

A business contract is a legally binding agreement that describes the terms and conditions of a business partnership between two or more parties. A business contract's significance cannot be overstated, since it performs numerous key purposes:

- Contracts provide a clear foundation for both parties, detailing their individual rights, duties, and expectations. Contracts serve to prevent misunderstandings and conflicts that may emerge throughout the course of a business relationship by precisely stating the terms of the agreement.

- Contracts provide legal protection to all parties involved. They define each party's rights and remedies if the other party fails to meet their duties. In the case of a breach of contract, a well-drafted agreement can assist with safeguarding the aggrieved party's rights and offer a foundation for pursuing legal remedies.

- Contracts serve as vital documentation of the business relationship and should be kept on file. They provide proof of the agreed-upon terms and conditions and other pertinent information. Contracts also make it easy to track the history of the business relationship and go back to specific agreements or commitments.

Typically during contract negotiations, legal teams for either the buyer or the seller will draft these business contracts, which will describe the specific terms of an agreement, such as what each party assures, when these promises must be fulfilled, what will be delivered, and the payment due date for the products or services. These are also known as contract components.

What information is included in your contract depends on your business and project. However, here are a few key elements typical of any contract.

Header

Include a title like "Freelance Contract" or "Service Agreement" at the beginning of the document, as well as important details of contract drafting such as the agreement's date and start date, as well as the names and contact information of the parties involved in contract negotiation (client and freelancer).

Introduction

Provide a brief summary of the contract's objective and the services to be provided. Include information such as the scope of the project, deliverables, and any particular dates or milestones.

The scope of the work

Define the precise services that you will offer. This section should outline both parties' roles, obligations, and expectations. To avoid future misunderstandings, be as precise as possible.

Payment terms

Define the payment structure, including the rate, currency, and manner of payment. Indicate how and when you will be paid (hourly, per project, in installments), as well as any invoicing methods that may be required. Include any late payment penalties and any other costs that may be refunded.

Intellectual property rights

Discuss intellectual property (IP) ownership and usage in relation to the work at hand. Determine who owns the intellectual property and whether you are providing the customer with any rights to utilize the work.

Confidentiality and non-disclosure

Create policies for protecting sensitive information disclosed during the project. Specify what information is secret, who is responsible for maintaining confidentiality, and any confidentiality exceptions (if any).

Termination clause

Outline the circumstances under which any party may cancel the contract. Include provisions for both termination with reason, such as a violation of contract, and termination without cause, as well as suitable notice periods.

Indemnification

Define each party's legal responsibility for any legal claims, damages, or obligations that may emerge over the course of the project. Determine who is liable for any third-party claims resulting from your work.

The rule of law

Specify which jurisdiction's laws will apply to the transaction. In most cases, this is the jurisdiction in which the customer resides.

Overview of QuickBooks

QuickBooks accounting software is intended to assist small and medium-sized businesses in efficiently managing their financial and accounting activities. QuickBooks has a number of features and tools that make bookkeeping, invoicing, payroll processing, inventory management, detailed reporting, and financial reporting easier. Here's an overview of QuickBooks accounting software:

- QuickBooks offers features for quickly tracking revenue and spending, managing bank transactions, balancing accounts, and generating financial statements. Users may categorize transactions, generate invoices, and record payments.

- QuickBooks allows businesses to produce professional-looking invoices, customize them to fit their brand, and send them electronically to clients. Additionally, the program enables businesses to accept online payments from clients via multiple payment channels.

- QuickBooks has payroll functionality that enables businesses to manage employee wages, generate payroll taxes, print pay slips, and file payroll tax forms.

- Inventory management capabilities in QuickBooks assist businesses with keeping track of their products, quantities, and expenses. Users may use it to establish points of reorder, track sales, and produce reports.

- QuickBooks offers a variety of financial reports, including profit and loss statements, balance sheets, cash flow statements, and personalized documents. These reports provide insights into the business' financial health, support in decision-making, and assist with tax preparation.

QuickBooks is commonly regarded as one of the most popular accounting software options for businesses. Its popularity may be attributed to a variety of factors, including its broad features, user-friendly interface, scalability, and global market presence. QuickBooks has a vast and diversified user base that includes freelancers, startups, and established SMEs from a variety of industries. With a user-friendly interface, QuickBooks doesn't require extensive accounting knowledge or expertise, making it accessible to individuals and businesses with varying levels of financial understanding.

Exploring QuickBooks' Template Library

The QuickBooks Template Library is a collection of pre-designed templates that customers may use within the QuickBooks accounting software to produce multiple types of business documents. These templates are intended to make it easier to create professional-looking documents and to expedite business processes.

The Template Library provides a diverse range of templates designed for a variety of business needs. These templates include:

- Invoices

- Sales receipts

- Purchase orders

- Estimates

- Sales

- Credit memos

Each template is created to adhere to industry standards with a polished and professional appearance.

It's worth noting that QuickBooks templates can be customized in addition to the pre-designed options. Users can develop their own templates from scratch or edit existing templates to meet their individual needs and preferences. These templates provide businesses a quick and easy method to create professional documents, while maintaining brand and communication consistency.

Alternative Options for Contract Templates

It's important to note that, to date, QuickBooks doesn't offer a contract template. Instead, you can build a template from scratch and customize. However, you will need to send your contract manually to clients (e.g., via email), as QuickBooks doesn't incorporate a sending feature. Additionally, you can obtain contract templates from alternative sources. Some places include:

- Online marketplace and template websites.

- Third-party contract management solutions such as Juro, which integrate with QuickBooks. Stored data in your QuickBooks account will be generated in your Juro contract.

QuickBooks lacks the necessary native contract storage capabilities to manage contracts. However, QuickBooks may be connected with a contract management system such as Juro, allowing customers to manage contracts within the platform.

Although QuickBooks is designed mostly for invoicing and offers no direct contract management tools or templates, there are several benefits of using QuickBooks with other contract management automation tools and integrations, including:

- Greater data accuracy: Rather than depending on manual data extraction and entry procedures, managing contracts in Quickbooks through third-party software ensures that contract data flows easily across systems, without the need for human intervention.

- Faster invoicing: If you integrate third-party software, such as Juro, with Quickbooks, all critical terms and contract data are extracted immediately into invoices for completed contracts. This avoids delays, resulting in speedier invoicing because parties do not have to wait for invoices to be manually populated.

How Indy Can Help

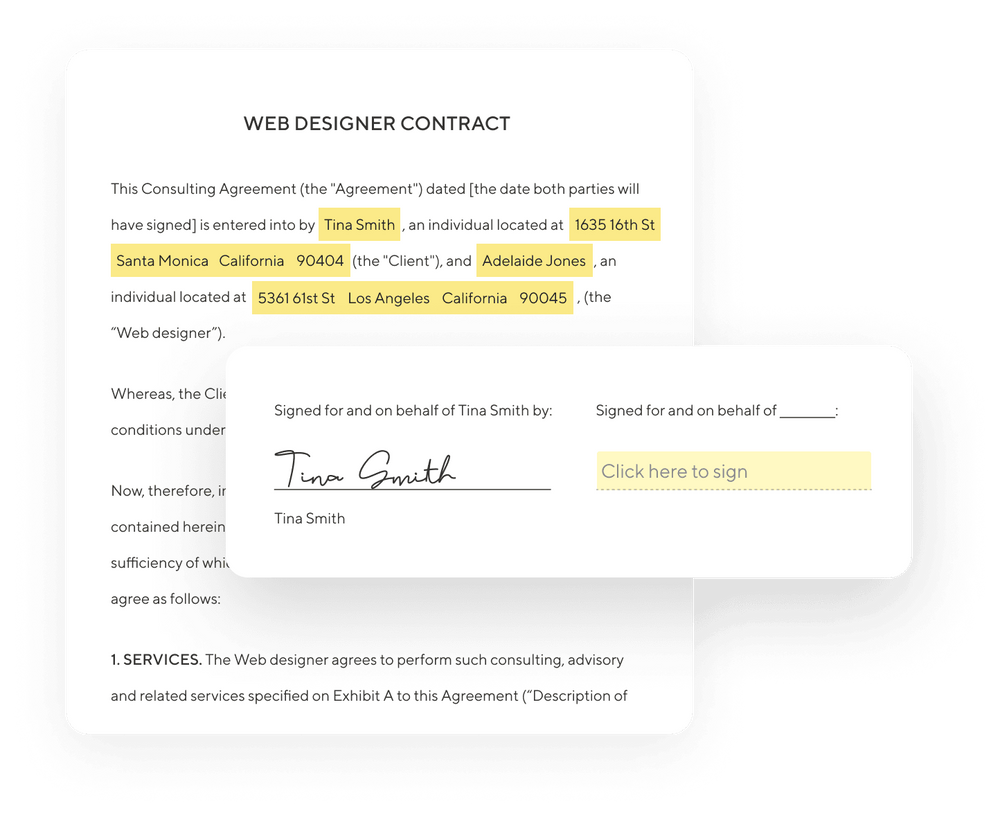

We at Indy strive to make freelancing as easy as possible. You can write, sign, and deliver contracts in minutes with our own contract management solution and creation software. You may view your existing contracts and create new ones from your dashboard by creating a free account. Simply follow the on-screen instructions, add the necessary information, and send straight to your customer through Indy. In addition, Indy provides a variety of free contract templates organized by industry to save you time.

Additionally, Indy easily interacts with hundreds of your favorite apps to automate your workflow, allowing you to get more done in less time via Zapier, a no-code automation tool that lets you connect multiple tools. Zapier links Indy to the applications you currently use, including QuickBooks, allowing you to streamline and automate your workflow. This means, as noted in the above section, you can integrate Indy with QuickBooks and manage your contracts through the platform.

Customizing Your Contracts

Customizing contract templates in QuickBooks allows you to tailor them to suit your business needs and branding. Although QuickBooks does not provide a contract template editor, you may make changes using other software tools and then import the amended form into QuickBooks. Here's how to customize contract templates in QuickBooks:

- Identify what changes you wish to make to the contract template. Adding or deleting fields, changing the layout, switching the font or color palette, or including your business logo and branding elements are all examples of this.

- Locate the existing contract template in QuickBooks that you want to edit and export it. Print the template as a PDF file or save it as a Word document to export.

- Modify the template. To make any necessary changes to the exported template, use a PDF editor or design tool. You can add content, delete parts, rearrange sections, change the formatting, and include your business logo or other branding elements. Check that the amended template complies with all legal standards and contains the relevant contractual information.

- Once you've made the necessary changes, save the modified template in a QuickBooks-compatible format. For this purpose, PDF and Word document formats are often utilized.

- Navigate to the relevant template section in QuickBooks (e.g., invoices or sales orders) and look for the option to import or upload a custom template. Select the amended template file from your computer and import it into QuickBooks following the on-screen instructions.

- After importing the customized template, create a sample contract or open an existing one to verify that the changes are accurately reflected. Ensure that the layout, formatting, and content are all correct. If required, make any necessary revisions or enhancements.

- Apply the customized template. Once you're happy with the customized contract template, make it the default template for future contracts. Go to the template settings in QuickBooks and make the new template the default option.

Customized templates that reflect your business' branding elements, such as logo, color scheme, and font, offer consistency in your business communications. A professionally designed template improves your brand image, promotes familiarity with it, and presents a consistent and polished appearance to clients, vendors, and partners.

Managing the Entire Contract Lifecycle

Contract lifecycle management (CLM) automates and simplifies contract operations at critical phases. Initiation, authorship, procedure and workflow, negotiation and the approval process, execution, management and compliance, and contract renewal are among these steps.

By developing a common language, fundamental templates, unified terms, and consistent conditions, contract management vendors and buyers and suppliers save time and reduce mistakes. Most contract management software is intended to provide insight into company spending, improve contract process efficiency, and reduce administrative expenses. This is achieved by:

- Managing contracts for procurement and sales, intellectual property licenses, and internal agreements.

- From start to finish, streamlining and automating contract lifecycle management.

- Standardizing and managing contract development.

- Using pre-approved templates and legal terms to create contracts swiftly and easily.

Contract management process software can assist legal, financial, procurement, contract management needs, and even sales teams and employees in expediting contract management procedures, by more effectively using sourcing and supplier information.

Companies sign contracts quicker, build confidence faster, and keep insight into how agreements affect the bottom line by storing bids, supplier data, negotiated prices, and contract clauses in a centralized digital repository.

Conclusion

QuickBooks accounting software is intended to assist small and medium-sized businesses in efficiently managing their financial and accounting activities. Although QuickBooks doesn't offer built-in templates for contracts, there are several options, including third-party integrations, for contract management through QuickBooks.

Not sure if QuickBooks is for you or your business? Check out our guide Quickbooks Alternatives: Best Invoicing Software for Freelancers.