Finding invoice software with accounting features can be challenging. Finding affordable invoicing software with accounting functionality is even more difficult. There are several accounting software platforms available to help with invoicing, managing expenses, and general ledger.

However, FreshBooks and QuickBooks are especially popular among freelancers, independent contractors, and small business owners. Here at Indy, we aim to make freelancing simple. In this article, we'll take a look at the advantages and disadvantages of both FreshBooks and QuickBooks to make your decision a little easier.

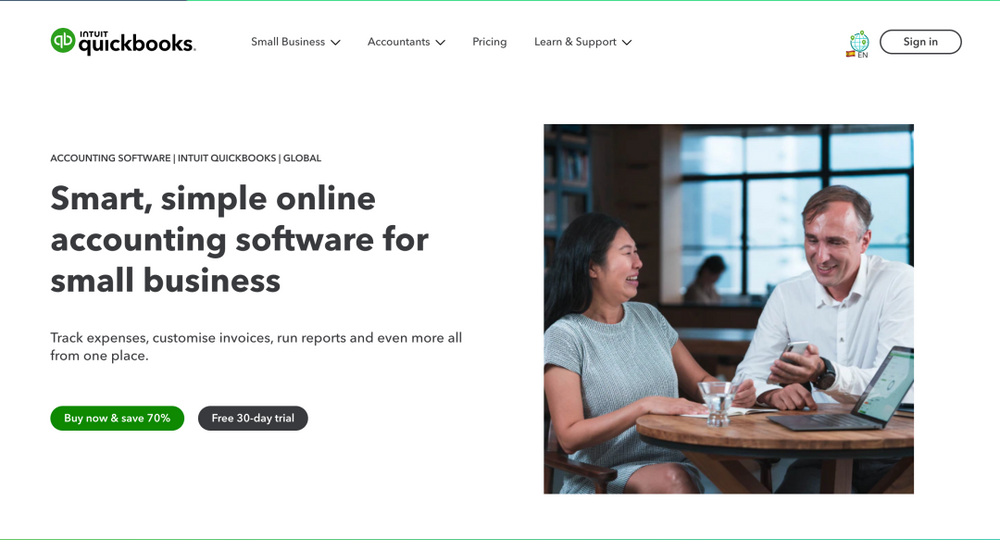

What is QuickBooks?

Although best known for its bookkeeping software, QuickBooks offers a range of finance and accounting solutions for small business owners, which we will go into more later.

QuickBooks offer several apps and online services depending on the software you require for your business. You do not need to sign up for all of QuickBooks' services at once. You may decide to start with a single app or platform service, such as payroll or accounting software, and expand as your business grows.

Any software that you outgrow can also be upgraded or removed as necessary.

Who is QuickBooks for?

For decades, QuickBooks applications and online services have been designed with small businesses in mind.

Suitable for small business professionals, freelancers, and independent contractors who need extra support with everything from running payroll to tracking income and invoices. Freelancers, particularly, can take full advantage of QuickBooks Self-Employed (online or separate application, depending on the device) to keep tabs on expenses, income, and tax obligations.

Full list of QuickBooks' features, benefits, and downsides for freelancers further in the article.

What is FreshBooks?

FreshBooks is small business accounting software, ideal for independent contractors and freelancers. It distinguishes itself with reliable phone support and adaptable invoicing software.

Starting out solely as an invoice management tool, FreshBooks has evolved into an accounting product and is now used in over 160 countries.

Who is FreshBooks for?

With four plans available, FreshBooks is a good fit for growing businesses, freelancers, and service professionals (such as architects or attorneys).

An excellent option for small businesses and freelancers who send a lot of invoices and receive a large number of payments, FreshBooks' online invoice and payment software can take the stress out of your administrative activities.

Full list of FreshBooks' features, benefits, and downsides for freelancers further in the article.

Features of QuickBooks vs FreshBooks

Now that we have covered the basics, it's time to dive a little deeper and compare the full features, benefits, and downsides of both platforms to help you decide which one is best suited for yourself and your business.

What FreshBooks offers

FreshBooks features depend on the subscription plan you purchase. FreshBooks offers four plans, each with added features, should you want to upgrade when your business grows.

However, there are several features offered in each plan - from basic to premium - suitable for small businesses, independent contractors, and freelancers.

Let's take a look at what FreshBooks offers:

Accounting software

FreshBooks is designed with freelancers in mind. Because of this, most of its accounting software focuses on client billing, instead of product billing.

FreshBooks accounting software offers several tools for accurate profit and loss reports, including:

- General ledger

- Journal entries

- Balance sheet

- Accounts payable

- Accountant access

- Trial balance

- Chart of accounts

- Costs of goods sold

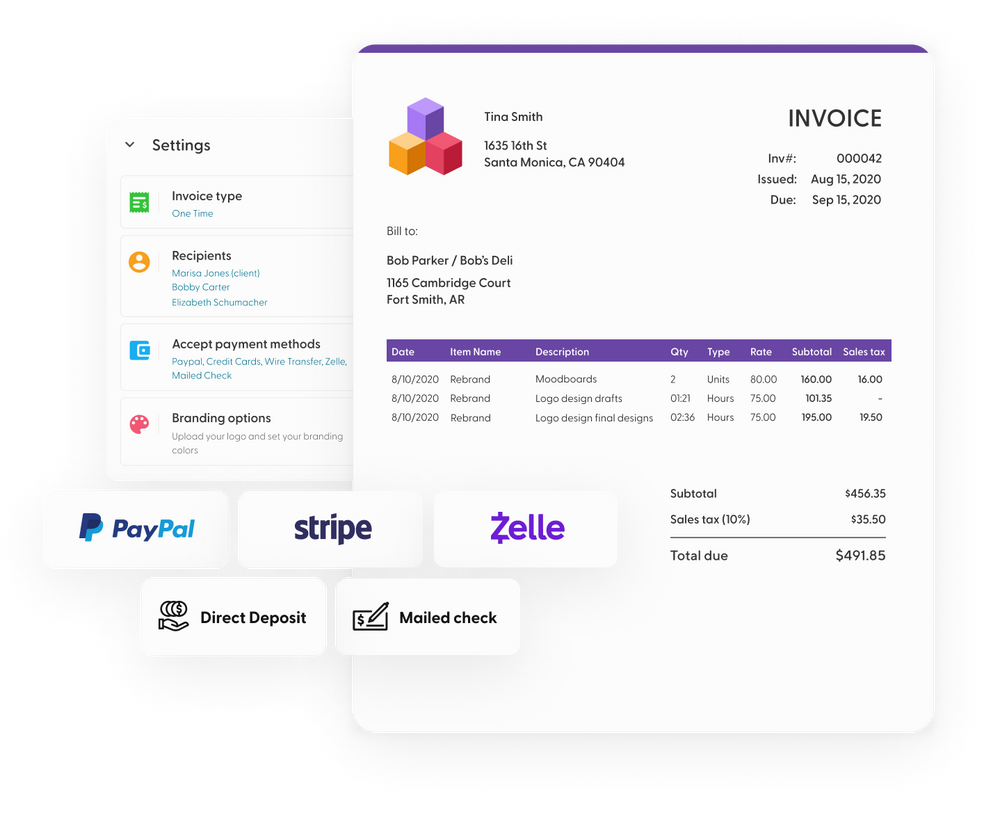

Invoicing features

FreshBooks invoicing features offer two tabs - "from me" or "to me". This means you can easily accept or make payments all on one platform.

"From me" lets you send out payment reminders, accept payments, and create custom invoices.

"To me" shows you your cleared payments, and any overdue accounts on organized flashcards.

FreshBooks also takes data directly from timekeeping (if you use its time tracking software, more information in the next section) and automatically creates invoices for the hours you marked billable.

Time tracking

FreshBooks offers a beginner-oriented and accurate built-in time tracking system.

You simply press the "start" button, and FreshBooks will record the time until you press "stop". You can then use the "generate invoice" option to automatically add the tracked hours to your invoice.

Expense tracking

Designed with freelancers in mind, FreshBooks' expense tracking software is an excellent option for client billing.

There are several things you do with FreshBooks' expense tracking, including:

- Connect your bank account to FreshBooks for up-to-date spending records

- Automatic receipt scanning - scan and save your receipts to securely log and categorize expenses in your account

- Categorize your expenses in preparation for the tax season - log all of your expenses in one place

- Quickly mark your expenses as billable, and automatically transfer them onto an invoice for your clients

- Track your project expenses

- Track and log your multi-currency expenses

- Get real-time expense tracking data

As your business grows, you may decide to purchase a different plan with additional features.

What QuickBooks offers

Let's take a look at the features QuickBooks offers, and how they compare to FreshBooks.

Much like FreshBooks, QuickBooks' features depend on the subscription plan you purchase. QuickBooks offers three plans, from basic to advanced, all for self-employed professionals.

There are several features offered in each plan suitable for all small business owners, including freelancers and independent contractors.

Let's take a look at what QuickBooks offers:

Accounting software

Unlike FreshBooks, which is mostly geared towards freelancers, QuickBooks offers more in-depth features for all self-employed professionals.

QuickBooks offers several accounting tools, including:

- A detailed cash flow report - making tax preparation easier

- Maximise deductions with the built-in accounting mobile app

- Inventory management

QuickBooks also offers additional accounting-specific integrations, including budgeting, order management, client billing, and 1099 reporting - most useful for freelancers and independent contractors who receive 1099 forms from each client.

Invoicing features

Unlike FreshBooks, QuickBooks relies on third-party apps to record billable hours and transfer them onto invoices.

However, QuickBooks' invoicing features are more detailed, allowing you to enter more information including payment method, terms, and client/customer location.

Time tracking

As noted above, unlike FreshBooks, QuickBooks doesn't offer a time-tracking feature.

However, you can use a QuickBooks app to add this feature – TSheets time tracking. It offers scheduling, project management tools, and timesheets.

Expense tracking

On top of general expense tracking features, QuickBooks offers additional supplier and client tabs for a more organized expense tracker.

There are several things you do with QuickBooks' expense tracking, including:

- Connect your bank account, credit cards, PayPal, and other platforms to QuickBooks for up-to-date spending records

- Categorize your expenses in preparation for tax time - log all of your expenses in one place

- Set custom rules to categorize your expenses

- Use their built-in cash flow feature for tracking your money

- The QuickBooks mobile app offers mileage tracking - you can then mark your miles as personal or business travel

- Accountant access

As your business grows, you may decide to purchase a different plan with additional features.

Pricing of QuickBooks vs FreshBooks

FreshBooks and QuickBooks features depend on the subscription plan you purchase. Both platforms offer several pricing plans, each with additional features and integrations.

Let's compare the plans to find which may be best suited for you:

FreshBooks pricing plans

In May 2023, when we are writing this article FreshBooks offers four plans, these are:

Lite plan - $17 per month or $204 annually

FreshBooks' Lite plan is best suited for freelancers and independent contractors.

Here's a full list of what the plan offers:

- Covers five billable clients - send unlimited and customized invoices to up to five clients

- Send unlimited estimates

- Track unlimited expenses

- Accept credit card payments and bank transfers

- Track your sales and reports

- Unlimited time tracking

- Connect your bank account

- FreshBooks mobile mileage tracking

Plus plan - $30 per month or $360 annually

FreshBooks' Plus plan is best suited for small businesses.

It offers all of the Lite plan features, and also:

- Covers 50 billable clients - send unlimited and customized invoices to up to 50 clients

- Automatic receipt scanning - scan and save your receipts to securely log and categorize expenses in your account

- Run business health reports

- Accountant access

- Double-entry accounting reports

- Set up recurring billing and client retainers

Premium plan - $55 per month or $660 annually

FreshBooks' Plus plan is best suited for growing businesses.

It covers all of the Plus features, and also:

- Unlimited billable clients

- Customize email templates and signatures with dynamic fields

- Track project profitability

- Track accounts payable

Select plan - custom pricing

FreshBooks' Select plan is best suited for businesses that require dedicated support.

It covers all of the Premium features, and also:

- Access for two business team members

- You'll get a dedicated account manager

- Customized training

- FreshBooks branding is removed from client emails

- Lower transaction rates (rates depending on the country)

QuickBooks pricing plans

In May 2023, when we are writing this article QuickBooks offers three plans, these are:

Self-employed plan - $15 per month

QuickBooks' self-employed plan offers the following features:

- Automatic mileage tracking

- Separate your personal and business expenses

- Automatic calculations for your quarterly estimated taxes

- Organize your expenses

- Send and log basic invoices

Self-Employed Tax Bundle - $25 per month

QuickBooks' tax bundle plan covers all of the core features, and also:

- Pay your quarterly taxes from QuickBooks online

- Import data into TurboTax, the third-party platform that offers additional features including timekeeping

Self-Employed Live Tax Bundle - $35 per month

QuickBooks' live tax bundle plan covers all of the tax bundle features, and also:

- Access to TurboTax Live experts for additional support

- Have a certified accountant review your tax return

Pros and Cons of QuickBooks vs FreshBooks

There are many factors to consider when choosing the right accounting software for your business. Both QuickBooks and FreshBooks offer several features, are easy to use, and offer additional user support when necessary.

However, both platforms also come with a few drawbacks, which are important to consider when choosing the right one for you.

Let's take a look at the benefits and drawbacks of QuickBooks vs FreshBooks:

FreshBooks benefits

Time and mileage tracking

All of FreshBooks plans include mileage and time tracking features, which are also available on the mobile app. This is beginner-oriented and accurate, and automatically adds the tracked hours to your clients' invoice.

Ideal for freelancers and independent contractors who handle multiple clients and invoices, this FreshBooks feature allows you to manage, write and send invoices all on one platform.

The mileage tracker is also ideal if you do a lot of traveling for your business. With this feature, all of your tracked mileage will be stored in one place ready for your tax return.

Phone support

FreshBooks offers phone support from 8am to 8pm ET on weekdays. This is ideal for self-employed individuals and freelancers who conduct their administrative activities in the evenings, and calls are typically answered within three rings.

Powerful invoicing services

Designed with freelancers in mind, FreshBooks' invoicing platform offers several features, including automatic transfer of time tracking data, making it easy to accept or make payments all on one platform.

Invoicing features are also available on the mobile app.

FreshBooks drawbacks

Limits on clients

FreshBooks' Lite plan only covers up to five clients. Freelancers, in particular, handle multiple projects and clients, so the basic plan's limit is not always suitable.

However, the more popular Plus plan does cover up to 50 clients. This does, of course, mean added expense, which may not be ideal for every business owner or freelancer.

Lack of double-entry accounting

FreshBooks' Lite plan doesn't support accounting basics like bank reconciliation tools. Bank reconciliation compares your bookkeeping records against your bank records to ensure they add up. A particularly helpful tool for new freelancers and self-employed professionals, FreshBooks' lack of this feature in its cheapest plan may not be suitable for you.

The Lite plan also doesn't cover accountant access, which is often included in most software companies' basic plans.

Let's take a look at how QuickBooks compares.

QuickBooks benefits

Swipe left for business

With the QuickBooks Self-Employed app, you can quickly and effectively mark your income and expenses as either business or personal with the swipe of a finger.

This feature also allows you to set rules to automatically assign expenses and income by category. For example, you can set a rule that any deposits from a specific client should be marked as business income.

With this, QuickBooks takes the pressure out of managing finances and expenses, and does the organizing for you!

Mileage deductions

Much like FreshBooks, QuickBooks can track your mileage if you travel for business.

However, one additional feature that QuickBooks offers is the ability to automatically calculate your mileage deductions based on your current IRS mileage rate. QuickBooks keeps a log of your business miles and the corresponding deduction.

You can also enter trips manually via the app or online.

Categorize expenses

Filing your IRS Schedule C has never been easier.

QuickBooks lets you categorize your income and expenses that align with Schedule C. For example, you can categorize all of your advertising expenses through QuickBooks, so that everything is in one place when filing your expenses.

QuickBooks drawbacks

Doesn’t accommodate multiple businesses

This isn't a particular concern for freelancers and independent contractors, however, if you are operating more than one business, you will need to create and pay for a separate QuickBooks account for each business.

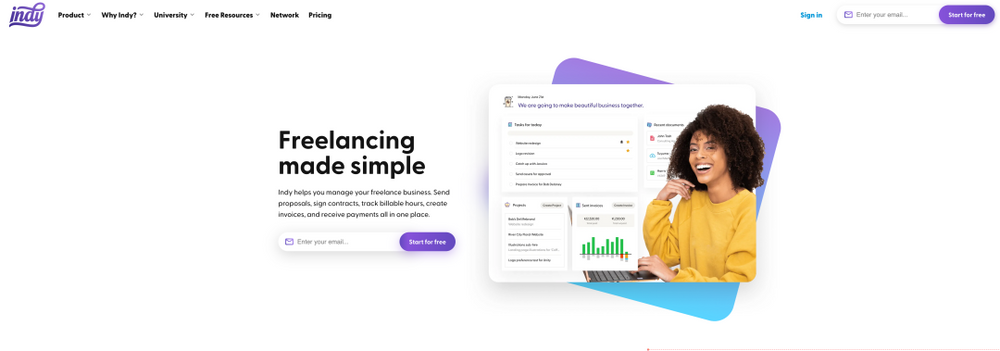

Why Indy is a good alternative to both FreshBooks and QuickBooks for freelancer invoicing

At Indy, we aim to make freelancing simple. Much like QuickBooks and FreshBooks, Indy offers several features to help with managing and creating invoices.

Our online invoice software can take the hassle out of invoicing with a generator that produces templates in seconds. Our invoice tools also make it easy to send invoices at set intervals - perfect for freelancers with recurring clients.

Indy's Invoices, lets you manage your current and future expenses. Our app also helps you keep track of your personal purchases, so you can easily separate your personal and business expenses ready for your tax return.

Preparation is key when it comes to filing your taxes. With Indy, you can set up monthly reminders to manage your receipts and invoices so everything will be manageable and ready for the tax season. Sign-up now and try it for yourself!

Conclusion

FreshBooks and QuickBooks are the two most popular accounting software among freelancers, independent contractors, and small business owners. From tracking expenses and incomes, to writing and sending invoices, accounting and invoice platforms can take the stress out of your administrative activities and create a more manageable tax season.

Still undecided? You can read our guide on FreshBooks alternatives for a breakdown of the nine best FreshBooks alternatives, including Indy, along with their key features and pricing.