Independent or small software-developing businesses are an important part of the IT infrastructure. You develop software that can help small businesses compete in a competitive market and be a small, vital part of the success of large global brands. However, because many software developers work from home or don’t have a permanent office, you can often miss potentially rewarding tax deductions for software developers.

In this article, we will discuss the importance of tax deductions for software developers, self-employment tax, taxable income, what tax breaks you can take, and some of the common tax write-off mistakes you make. We will also show you how Indy can support your freelance career.

Why Is It Important to Maximize Your Software Development Tax Deduction?

Running a small business requires you to consider many aspects of the business, but as a software developer, you might not have the knowledge or skills for every aspect of running the business. One might be within finance. You might understand the basics of cash flow and profit/loss, but tax is a demanding subject that even the best tax accountants can sometimes need to reference.

Therefore, you might need the help of a tax professional to help you report the right business expense for tax deductions.

And there are many tax deductions that you can sometimes think aren’t allowed but are a fundamental part of what you can have.

When you take that allowance, it isn’t included in your taxable income, and therefore, the amount of tax you’re paying against is reduced and you get more money. It can help with ensuring you’re maximizing your earnings from your business while also at the same time improving cash flow in your business.

And cash flow is a vital consideration. Numerous businesses fail within the first couple of years of their existence because they don’t have the cash flow necessary to run.

And one of the biggest cash flow problems is paying the right tax to the relevant government department. The tax debt can also lead to additional fines. Yet some of the tax debt could be written off if you knew what you could claim against.

And these tax deductions aren’t just for software developing businesses. If you’re a software developer that works from home, you can claim some of these against your earnings from employment, allowing you to retain more of your earnings for doing the same amount of work.

Software Development Expenses to Claim On?

There are numerous purchases that software developers can claim back from your tax. Here is a list of some of the most common tax-deductible business expenses you can claim back.

Computer Equipment

Without a computer, you can usually not complete any work. Therefore, when you purchase any equipment that has significant business use, then you can claim the capital expense. Computer equipment can include numerous items, such as your laptop, desktop, tablets, printers, mouse, laptop bags, accessories, etc.

The key component to ensure it is liable for tax deductions is you use the computing equipment for business use. That doesn’t mean that you can’t use the computer for other reasons, but the majority of the time, the device needs to be used for business purposes, such as servicing clients.

So if you buy a printer because you can print off the children’s homework or print family photos but then use it a couple of times for work purposes, this shouldn’t be included. However, if you use the printer 80% of the time for business purposes, then you can count that as a tax write-off.

Computer Software

Having the technology is one thing, but as a software developer, you need to have software to help you do your write code and do other work. All software, whether it is a single purchase or a recurring subscription could be considered a tax deduction for software developers.

Software might include applications to help you code projects. Or it could include programs that can help you run your business like accounting software, email software, word processing software, etc.

It is important, again, to consider use. You might buy a word processing software package like Microsoft Word, but that doesn’t mean that you use it for work the majority of the time. The software might be for personal use most of the time and you only use it occasionally for work. If this is the case, the total cost cannot be claimed for work tax write-offs and instead you're looking for partially deductible costs.

You can also claim the business expenses for any tax prep software that you might be using.

Office Furnishings

Some office furnishings can also be claimed as a home office deduction, which is often forgotten by the best software developer teams. For example, the desk and desk chair can be a home office deduction because they are essential to the business. Therefore, these are business expenses that you must record and report.

However, you can’t claim against items that aren’t essential for the business. So if you decorate your home office with potted plants or inspiring wall art, these are personal purchases and must be taken off after you've paid your self-employment tax.

Professional Expenses

There are times when you might need to include self-employed business expenses on your tax return. These might be professional memberships to organizations. Adding these to your tax return allows you to claim them against your income taxes and reduce the tax payment that you need to make to the IRS.

Insurance

When you’re a software developer you’re going to need to have some insurance. One of the most important policies that you should have is professional indemnity. This insurance will protect you from claims against work you’ve done that a client believes you’ve incorrectly completed and they think it's cost them business.

Another policy you should have is public liability. If you were to go to a client’s location and they fell over some of their equipment or you accidentally bumped into them, then you will be protected with public liability.

There are also insurance policies that protect your business property. Your computer equipment and any other equipment that you need is very valuable. Having insurance that can protect it from theft or accidental damage is going to be useful. And all of the costs for this insurance can be written off from your taxes. So they can contribute further to your income.

Those that travel in their own car, might want to claim their car insurance as well. Those working from home might also be able to claim a proportion of their homeowners' insurance.

Repairs

Computers and equipment can sometimes break down and you might want to get that computer back to working order very quickly. Luckily, these repairs can be claimed back from your tax burden, reducing it.

What you need to do is to ensure that you’re keeping a record of the repair log for the equipment including the costs. You might be able to claim back the entire sales tax in addition to a portion of the cost of the repairs. So this could be a relatively positive option for your business.

Leased Items

While you might not lease many items as a software developer there might be some items that you rent or lease during your work. For instance, if you visit a client in another city and you rent a car there for your time with the client, the lease of the car can be claimed against your software developer taxes.

While also visiting clients you might need to lease additional equipment, like projectors. These can also be claimed against your taxes.

Home Costs Related to Your Business

Working from home does not mean that all your costs are absorbed by the business and forgotten. The opposite can often be the truth. If you have a home office, you can calculate the percentage of the home office space that the software-developing business occupies. This business expense is based on square footage, and then include the mortgage interest as a proportion in your tax calculations.

Other costs inside the home might include the building of outside office spaces or a proportion of your utility costs.

You might also want to consider your internet bill and whether you can claim against this in the Schedule C.

Additional Services

Running a business can be a hard and tiring prospect. And there are going to be certain people who are going to struggle to do all the work themselves. While sometimes people consider outsourcing some of their work, other aspects of the business can be outsourced.

For example, you can hire a PA, marketing company, accountant, etc to do some of the mundane and other work that you don’t have experience/expertise in and that takes away from your main job, developing software.

If you do hire another developer to help you complete projects, then you will also be able to claim against this. However, be sure that you’re not taking on an employee, this can complicate some aspects of the tax write-off, as there are additional taxes to be paid by employers which aren’t paid when you’re hiring a freelancer.

If your clients can pay online, you can claim back the payment processing fees too from your bank or credit card processing company.

Travel Costs

If you’re visiting a client that is not at your usual place of work you have the right to claim the business travel costs and other costs for the trip. For instance, you can claim back the train ticket, airfare, mileage, fuel, hotel, and food for the trip.

There are some complications with this claimable tax relief you can have with this. For instance, if you visit a client’s city for five days, but the meeting was only two days and you had decided to visit some local attractions as you were in the city, those days that were spent on personal aspects cannot be claimed, so you might only be able to claim two or three days.

And if you rented a car in the city and used it for all five days, but only used it for business for two days, you can only claim for the usage of two days. Meals that were bought outside of business times will also need to be personal expenses rather than business expenses.

Therefore, be sure that you keep detailed tax records with detailed receipts for all purchases, the dates, and more. This information should be stored alongside the total income for your business.

Education

A good professional never stops learning and there are always changes when it comes to education on software development, there are always new learning opportunities. Coding is changing to make it more effective and easier to use. And keeping up with these changes is important.

You might also want to keep up-to-date with new coding languages and those used by other software developers.

The costs for the courses travel to courses, and any lodgings you need can be taken against your tax, and therefore reduce the business tax burden.

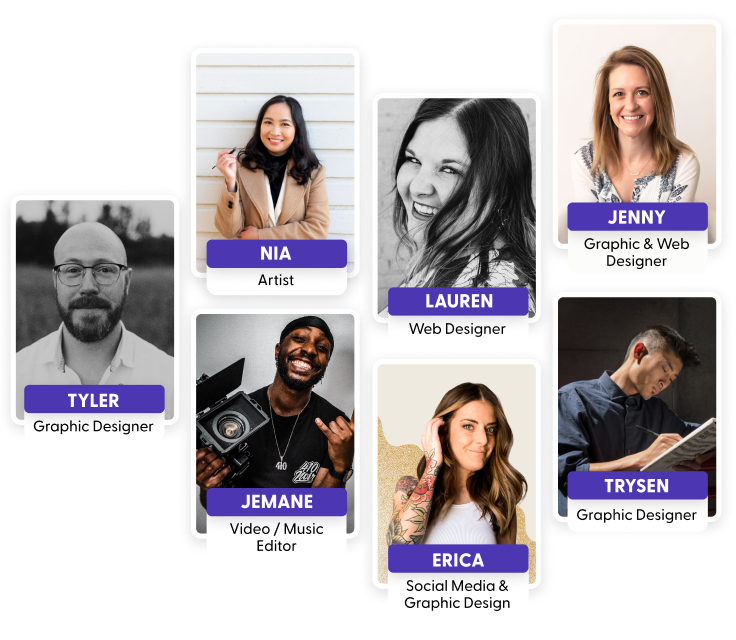

How Indy Can Help You with Your Taxes

Indy is the perfect platform for helping freelancers, like you to streamline the self-employment experience. Using Indy allows you to focus more on your passion, earn more money from less work and achieve your career and life goals, through effective tax management. Indy includes numerous features:

Tasks: Help organize your personal tax-related tasks. You can see deadlines, develop task lists and monitor your progress with helpful guides and reminders.

Invoices: Get paid for the work that you do. Quickly send invoices and get paid for the work without too much hassle.

Comprehensive Platform: This is an all-inclusive hub, catering to every aspect of your freelance journey - from proposal through contract to invoicing, helping you to save time.

Indy is also dedicated to help you, a freelance business owner, to confidently manage your business and tax at Indy University.

Final Word: Tax Deductions for Software Developers

Tax deductions for software developers can be numerous. They allow you to earn more money and get the additional financial rewards that you deserve for your work. Too many self-employed software developers don’t know actual expenses they can claim back and are therefore losing out on potential money that can help them out.

If you're struggling with your self-employed tax filing, then you might want to seek the support of a tax professional. They can help with tax preparation, net income calculations and what you need to do to have significant tax savings.