If you're reading this, chances are you're knee-deep in the world of content creation, juggling cameras, keyboards, and creativity. While creating content is undoubtedly thrilling, there's one aspect that many of us tend to overlook until it's time to face the music – taxes.

Don't worry; you're not alone in this. Whether you're a TikTok creator, YouTuber, social influencer, blogger, or any other type of content creator, understanding the ins and outs of self-employment taxes is crucial. In this article, we'll unravel the complexities of paying your taxes as a content creator, making sure you not only survive tax season but thrive in it.

Understanding the Basics of Content Creator Taxes

Let's kick things off by addressing the cornerstone of your tax obligations – your self-employment income. Whether you're receiving payments from sponsored content, affiliate marketing, or selling digital products, it all contributes to your income.

The IRS (Internal Revenue Service) is keen on knowing every penny you make, so it's vital to keep detailed records.

Tracking your income

Start by setting up a system to track your income consistently. Spreadsheets, accounting software, or even a dedicated notebook can be your best friends here. Make it a habit to log every payment, and don't forget those smaller transactions – they add up!

Understanding taxable income

Not all income is created equal in the eyes of the IRS. Some sources may be subject to different tax rates or may even qualify for deductions. Knowing what constitutes taxable income is the first step in ensuring you're meeting your tax obligations accurately.

As a content creator, your income may come from various streams – ad revenue, sponsorships, merchandise sales, and more. Each income source may have its unique tax implications, so it's crucial to be aware of the specifics.

Differentiating between business and hobby income

One common pitfall for many content creators is the blurred line between running a business and pursuing a hobby. The IRS has clear criteria to distinguish between the two, and understanding these criteria is essential to avoid potential tax issues.

The hobby loss rule

If your creative endeavors are more of a passionate hobby than a profit-driven business, you might find yourself under the scrutiny of the hobby loss rule. This rule limits the deductions you can claim to the amount of income your hobby generates, potentially reducing the tax benefits.

Establishing a profit motive

To be considered a legitimate business, you need to demonstrate a profit motive – the intent to make money. Keeping detailed records, having a business plan, and consistently working towards profitability are key elements that show the IRS you mean business, literally!

Tax Obligations for Content Creators

Now that you've got a grip on what needs to be declared and how to differentiate between hobby and business income, let's dive into the heart of the matter – your tax obligations as a content creator.

Tax filing status: Are you a sole proprietor, LLC, or corporation?

As a content creator, you likely fall into the category of a sole proprietor or perhaps have considered forming an LLC (Limited Liability Company) for added protection. Understanding the implications of your chosen business structure is vital for accurate tax filing.

Sole proprietorship: The simple route

Many content creators start as sole proprietors – it's straightforward and requires minimal paperwork. However, keep in mind that as a sole proprietor, you and your business are considered one entity for tax purposes. This means your business income is reported on your personal tax return.

LLC: Balancing liability and flexibility

If you've opted for an LLC, you enjoy a bit more separation between your personal and business assets. While the tax implications can be similar to a sole proprietorship, an LLC provides liability protection, shielding your personal assets from business debts or lawsuits.

Corporation: When to consider going big

For those on an ambitious trajectory, forming a corporation might be on the horizon. Corporations offer a higher level of liability protection and may provide more advanced tax planning opportunities. However, they also come with increased complexity and administrative requirements.

Estimated taxes: Staying ahead of the game

One of the challenges for freelancers is the absence of an employer withholding taxes from their income. Instead, you're responsible for making estimated tax payments throughout the year.

Understanding quarterly payments

The IRS operates on a pay-as-you-go system, and missing quarterly tax payments can result in penalties. Quarterly tax payments are due on specific dates throughout the year: April 15, June 15, September 15, and January 15 of the following year.

Setting aside a portion of each payment you receive for taxes and making quarterly estimated tax payments helps you stay on top of your tax obligations.

Calculating quarterly payments

Estimating your income for the year and calculating your taxes can be a daunting task, but it's a necessary one. Numerous online calculators and accounting software can assist you in determining the appropriate amount to set aside for each quarter.

Recordkeeping: The key to stress-free tax seasons

Now that you know what needs to be declared and understand your tax obligations, maintaining meticulous records is your secret weapon against the chaos of tax season.

Documenting income and expenses

Create a filing system that works for you, whether it's digital or physical. Keep all your income documentation, including invoices, receipts, and payment confirmations. On the expense side, track every business-related purchase, from equipment and software to office supplies and mileage.

Organizing for deductions

Proper recordkeeping not only keeps you organized but also maximizes your deductions. When tax time rolls around, having well-documented expenses makes it easier to claim the deductions you're entitled to, ultimately reducing your taxable income.

Navigating Deductions and Expenses

Now that we've covered the fundamentals of freelance taxes, let's delve into a crucial area that can significantly lighten your income tax bill – the ability to deduct expenses incurred during your content creation journey.

What qualifies as a business expense?

Business expenses are the costs associated with running your content creation venture. These can range from the obvious, like equipment and software, to the less apparent, such as promotional expenses and professional development costs.

Common business expenses for content creators

Here are some of the most common tax deductions that you can use as write-offs:

- Equipment and Software: Deduct the cost of your camera, microphone, editing software, and any other tools essential to your craft.

- Home Office Deduction: If you use a portion of your home exclusively for work, you may qualify for a home office deduction, covering expenses like rent, utilities, and maintenance.

- Marketing and Advertising Costs: Expenses related to promoting your content, such as advertising, social media management tools, and website hosting, can be deducted.

- Professional Development: Invested in a course to enhance your skills? That could be deductible. Stay ahead of industry trends, and your expenses might just work in your favor come tax season.

- Certain Web-Related Expenses: Don't forget to deduct expenses paid for maintaining your online presence. This includes costs for domain registration, website hosting, and any other web-related services crucial for your content creation business.

But remember, these items must be used for business purposes only in order to qualify as tax-deductible expenses.

Maximizing deductions: Tips and tricks for content creators

Some expenses might straddle the line between personal and business. Pay attention to when you incur these costs. If it aligns with your business activities, it can likely be used for tax write-offs.

Keep a mileage log (claiming travel-related expenses)

If you find yourself traveling for content creation purposes, keep a detailed log of your mileage. Whether it's driving to a photoshoot location or attending a conference, these miles can add up and be deducted from your taxable income.

Documenting meal and entertainment expenses

If your work involves meetings or collaborations over meals, those expenses might be deductible. However, strict documentation rules apply, so keep receipts and note the business purpose of each meal.

Tax Forms and Filing Strategies

It's time to tackle the paperwork. Choosing the right tax form can make the process smoother and more efficient.

Common tax forms for content creators

- Form 1040 Schedule C: This form is the go-to for reporting business income and expenses. It helps determine your net profit or loss, which flows into your overall tax return.

- Form 1099: If you work with clients who pay you more than $600 during the tax year, they are required to send you a Form 1099. This form reports your non-employee income.

Working with an accountant vs. DIY filing

The decision to file your taxes independently or enlist the help of a professional depends on the complexity of your financial situation. While many content creators successfully navigate the process themselves, an accountant can provide valuable insights and ensure you're maximizing your deductions.

Common mistakes to avoid when filing as a content creator

Navigating the world of freelance taxes comes with its fair share of potential pitfalls. Avoiding these common mistakes can save you headaches and ensure a smooth tax-filing experience.

Neglecting quarterly payments

Missing quarterly tax payments can lead to penalties and interest charges. Stay on top of your estimated taxes, and consider setting reminders or utilizing automatic payment options to avoid oversights.

Misclassifying expenses

Properly classifying expenses ensures accurate deductions. Be meticulous in categorizing your expenses, and if in doubt, seek professional advice to avoid errors.

Overlooking deductions

Don't leave money on the table. Keep a keen eye on potential deductions, including those for business-related travel, equipment, and professional development.

Navigating Special Considerations

As a content creator in our interconnected world, your audience may span the globe. While this expands your reach, it also introduces additional considerations when it comes to taxes.

Understanding tax treaties

Many countries have tax treaties in place to avoid double taxation for individuals earning income in multiple jurisdictions. Familiarize yourself with these treaties to ensure you're not paying more taxes than necessary.

Reporting foreign income

If you earn income from international sources, you must report it to the IRS. Certain thresholds trigger additional reporting requirements, so stay informed to comply with tax regulations.

Documentation for sponsored transactions

Sponsored content and brand partnerships are exciting opportunities for content creators, but they also introduce specific tax considerations. Maintain thorough documentation for sponsored transactions.

Contracts, invoices, and communication with sponsors should be well-documented, ensuring you have a clear record of the terms and value of the sponsorship.

Staying Compliant and Planning for the Future

Tax laws can often be dynamic and unpredictable. Staying informed about tax law changes ensures you remain compliant and take advantage of new opportunities.

Regularly check for updates

Set aside time periodically to review tax law updates. Follow reliable sources, subscribe to newsletters, or consider consulting a tax professional to stay on top of any changes that may impact your content creation business.

Adapting to regulatory shifts

Some tax changes may necessitate adjustments to your business practices. Be proactive in adapting to regulatory shifts, and consider seeking professional advice to navigate any complexities introduced by new tax laws.

Planning for tax season: Strategies to avoid last-minute stress

As the saying goes, "failing to plan is planning to fail." This holds true when it comes to tax season. Implementing strategic planning throughout the year can significantly reduce stress as the quarterly tax dates approach.

Maintaining ongoing recordkeeping

Don't wait until tax season to organize your financial records. Regularly update your income and expense tracking system to ensure you have accurate, up-to-date information when it's time to file.

Setting aside tax reserves

Create a buffer for tax payments throughout the year. Setting aside a portion of each payment you receive into a dedicated tax savings account ensures you have the funds available when quarterly tax payments are due.

Consulting a tax professional: When and why it matters

While the DIY approach works for some, there's no shame in seeking professional assistance. A tax professional can provide invaluable insights, ensuring you navigate the complexities of freelance taxes with confidence.

When to consult a professional

Consider enlisting the help of a tax professional if you experience significant changes in your income or business structure or if you're uncertain about deductions. Their expertise can save you time, reduce stress, and potentially uncover additional tax-saving opportunities.

The benefits of professional advice

A tax professional can help you optimize your tax strategy, identify deductions you might have overlooked, and ensure your filings are accurate and compliant. Think of it as an investment in the financial health of your content creation business.

How Can Indy Help?

Juggling content creation while making sure that you consistently pay taxes is a tricky balancing act. It gets even trickier when you've got to keep tabs on stuff like sending out invoices, dealing with clients, handling different projects, and keeping an eye on your net income.

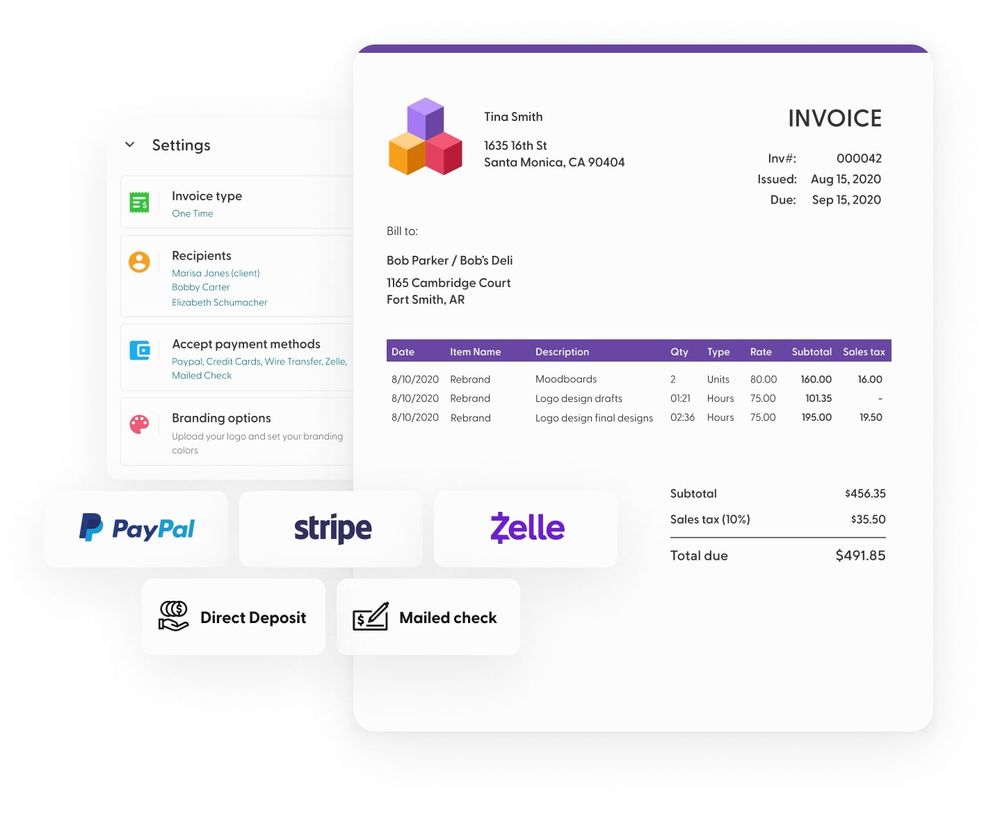

That's where Indy comes in! Here's how Indy fast-tracks your success:

- Invoices: Generate polished invoices with ease and get paid right through Indy. Keep a clear record of your invoices, including those that have been paid and those still pending.

- Tasks: Use to-do lists and Kanban boards to track projects and set up reminders for each tax season to stay organized and on top of your financial obligations.

- Files: Upload, store, and share projects, including videos, music, images, and any other types of documents with clients and get feedback and approval.

Plus, get all the tools you need to grow your content creator business faster, including legally vetted contracts, client portals, business proposals, and form templates (questionnaires, intake forms, project briefs, and feedback forms). Get stared today for free!

A Quick Recap

Freelance taxes are not a one-size-fits-all scenario. Tailor your approach to your unique situation, stay informed about industry and tax law changes, and don't hesitate to seek professional advice when needed. With these tools in your arsenal, you're not just creating content; you're crafting a successful and sustainable freelance career.

Want to make tax season a breeze? Get started with Indy for free and manage your entire business in one place, from contracts to invoicing and everything in between.