If you're a US freelancer living abroad, you might be wondering how to pay your taxes on your foreign earned income. You might also be feeling overwhelmed by the complex rules and requirements of the US tax system. Don't worry, you're not alone. Many freelancers face the same challenges and questions when it comes to filing their US expat taxes.

That's why we created this comprehensive guide to help you navigate the ins and outs of US expat taxes for freelancers. In this guide, you'll learn everything you need to know about filing requirements, tax benefits, tax treaties, foreign bank accounts, and more. You'll also discover some tips and resources to make your tax filing easier and more efficient. By the end of this guide, you'll be able to confidently file your US expat taxes and save money in the process.

Filing requirements

One of the most important things you need to know as a freelancer living abroad is whether you have to file a US tax return or not. The answer is yes, you do, if you meet the income thresholds. The US tax system is based on citizenship, not residency. That means that as a US citizen or Green Card holder, you have to report your worldwide income to the IRS, regardless of where you live or where you earn it.

The income thresholds depend on your filing status and age. For the 2022 tax year, they are:

- Single (under age 65): $12,950

- Married filing jointly (under age 65): $25,900

- Married filing separately (any age): $5

- Head of household (under age 65): $19,400

- Single (65 or older): $14,700

- Married filing jointly (one spouse 65 or older): $27,300

- Married filing jointly (both spouses 65 or older): $28,700

- Qualifying surviving spouse (under age 65): $25,900

- Qualifying surviving spouse (65 or older): $27,300

If your gross income is above these amounts, you have to file a US tax return. Gross income includes all income from any source, such as wages, salaries, tips, interest, dividends, rents, royalties, etc. It also includes foreign earned income, which is income from services performed outside the US.

If you are self-employed and have at least $400 in self-employment income, you also have to file a US tax return. Self-employment income is income from a trade or business that you operate as a sole proprietor or an independent contractor. It also includes income from partnerships and other entities that are treated as pass-through entities for tax purposes.

You might be wondering why you have to file a US tax return if you don’t owe any tax or if you already pay tax to another country. The reason is that filing a US tax return is the only way to claim the tax benefits that apply to you as a freelancer living abroad. These benefits can reduce or eliminate your US tax liability and save you money in the long run.

Foreign Earned Income Exclusion (FEIE)

One of the most beneficial tax benefits for freelancers living abroad is the Foreign Earned Income Exclusion (FEIE). This allows you to exclude up to $109,800 of your foreign earned income from US taxation (valid for 2022 tax year). That means you can keep more of your hard-earned money and avoid double taxation on the same income.

To qualify for the FEIE, you have to meet two criteria: your tax home must be in a foreign country and you must pass either the physical presence test or the bona fide residence test.

Your tax home is the general area of your main place of business, employment, or post of duty, regardless of where you maintain your family home. Your tax home is in a foreign country if you are a US citizen who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year, or a US resident alien who is a citizen or national of a country with which the United States has an income tax treaty in effect and who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year.

The physical presence test requires you to be physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months. The 330 days do not have to be consecutive. You can count days spent in transit between two places outside the US as days of physical presence in a foreign country. However, you cannot count days spent in the US or its possessions.

The bona fide residence test requires you to establish a permanent residence in a foreign country for an entire tax year. You have to show that you intend to live in that country indefinitely and that you have no immediate plans to return to the US. Factors that may indicate your bona fide residence include your purpose of travel, the nature and length of your stay, your family and economic ties, your participation in social and cultural activities, and your compliance with local laws and customs.

To claim the FEIE, you have to file Form 2555, Foreign Earned Income, with your US tax return. You have to report your total foreign earned income and the amount you want to exclude. You also have to indicate which test you meet and provide information about your foreign address, employer, and travel dates.

The FEIE can save you thousands of dollars in taxes, but it may not be the best option for everyone. Depending on your situation, you may benefit more from the Foreign Tax Credit (FTC) or a combination of both. We’ll explain more about the FTC in the next section.

Foreign Housing Exclusion or Deduction

Another tax benefit for freelancers living abroad is the Foreign Housing Exclusion or Deduction. This allows you to exclude or deduct some of your housing expenses from your taxable income. Housing expenses include rent, utilities, insurance, repairs, and more. This can lower your taxable income further and increase your tax savings.

To qualify for the Foreign Housing Exclusion or Deduction, you have to meet the same criteria as for the FEIE: your tax home must be in a foreign country and you must pass either the physical presence test or the bona fide residence test. You also have to have reasonable housing expenses that exceed a base amount.

The base amount is 16% of the FEIE amount for the year, prorated for the number of days in your qualifying period that fall within the tax year. For 2022, the base amount is $17,568 ($48.25 per day). You can only exclude or deduct the excess of your housing expenses over this base amount, up to a certain limit.

The limit varies depending on your location and is based on the cost of living in different countries and regions. The IRS publishes a list of these limits every year. For 2022, the limit ranges from $32,610 to $172,600. You can find the list on the IRS website.

To claim the Foreign Housing Exclusion or Deduction, you have to file Form 2555 with your US tax return. You have to report your total housing expenses and the amount you want to exclude or deduct. You also have to indicate which test you meet and provide information about your foreign address, employer, and travel dates.

The Foreign Housing Exclusion or Deduction can help you reduce your living expenses abroad, but it may not be available to everyone. Depending on your situation, you may not have enough housing expenses to exceed the base amount or the limit. You may also have to choose between taking the Foreign Housing Exclusion or Deduction or the Foreign Tax Credit (FTC) for the same income. We’ll explain more about the FTC in the next section.

Foreign Tax Credit (FTC)

The Foreign Tax Credit (FTC) is another way to avoid double taxation on your foreign earned income. The FTC allows you to credit the taxes you paid to another country against your US tax liability. This can help you lower or eliminate your US tax bill, especially if you live in a high-tax country.

To qualify for the FTC, you have to meet certain criteria and limitations. For example, the foreign tax must be a legal and actual tax liability and the income must be from sources within the foreign country. You also have to choose between taking the FTC or the FEIE for the same income. You can’t take both.

The amount of FTC you can claim depends on several factors, such as your total foreign income, your total US income, and the tax rates of both countries. The FTC is limited to the lesser of the foreign tax paid or the US tax liability on the foreign income. You can use Form 1116, Foreign Tax Credit, to calculate and claim the FTC.

The FTC can be either direct or indirect. A direct FTC is a credit for taxes paid directly to a foreign country on your foreign income. An indirect FTC is a credit for taxes paid by a foreign corporation or partnership in which you own shares or interests. You may be able to claim an indirect FTC if you receive dividends or distributions from such entities.

The FTC can be either general or passive. A general FTC is a credit for taxes paid on general category income, which includes most types of foreign earned income. A passive FTC is a credit for taxes paid on passive category income, which includes certain types of investment income. You have to separate your foreign income and taxes into these categories and calculate the FTC separately for each category.

To claim the FTC, you have to file Form 1116 with your US tax return. You have to report your total foreign income and taxes and the amount of FTC you want to claim. You also have to indicate which category and type of income and taxes you have and provide information about the source country and exchange rate.

The FTC can be a great option for freelancers living abroad who pay high taxes to another country, but it may not be the best option for everyone. Depending on your situation, you may benefit more from the FEIE or a combination of both. You may also have to deal with complex rules and calculations to claim the FTC correctly.

Tax Treaties

Tax treaties are agreements between the US and other countries that provide additional benefits or exemptions for certain types of income or situations. Tax treaties can help you avoid double taxation or reduce withholding rates on certain payments. Tax treaties can also help you resolve tax disputes or avoid discrimination based on nationality or residence.

The US has tax treaties with more than 60 countries around the world. Several countries have a tax relief treaty with the US that provides similar benefits for residents of both countries. These benefits include reducing withholding rates on dividends, interest, royalties, pensions, and other payments, and providing special rules for cross-border business activities and social security benefits. These countries include Canada, United Kingdom, Australia, Germany, France, and more. You can find the full list of tax treaty countries on the IRS website.

To use tax treaty benefits, you have to meet the eligibility requirements and report them on your tax return using Form 8833, Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b), or other forms. You may also have to provide a certificate of residence or a Form W-8BEN to the payer of the income to claim a reduced withholding rate.

Tax treaties can be very beneficial for freelancers living abroad who receive certain types of income from another country, but they may not be available to everyone. Depending on your situation, you may not qualify for a tax treaty benefit or you may have to choose between taking a tax treaty benefit or another tax benefit. You may also have to deal with complex rules and interpretations to use a tax treaty benefit correctly.

Foreign Bank Accounts and Other Assets

If you’re a freelancer living abroad, you may have foreign bank accounts or other assets that you need to report to the US government. This is part of the US government’s efforts to combat tax evasion and money laundering by US citizens and residents who have offshore accounts or assets.

There are two main reporting requirements that you need to be aware of: the Foreign Bank Account Report (FBAR) and the Foreign Account Tax Compliance Act (FATCA).

The FBAR is a report that you have to file with the Financial Crimes Enforcement Network (FinCEN) if you have a financial interest in or signature authority over one or more foreign financial accounts that have an aggregate value of more than $10,000 at any time during the calendar year. Foreign financial accounts include bank accounts, brokerage accounts, mutual funds, trusts, and other types of accounts.

The FBAR is not a tax form and does not affect your tax liability. It is a separate reporting requirement that is due by April 15 of the following year, with an automatic extension to October 15. You have to file the FBAR electronically using FinCEN Form 114 on the FinCEN website.

The FATCA is a law that requires certain US taxpayers to report their foreign financial assets to the IRS if they exceed certain thresholds. Foreign financial assets include bank accounts, stocks, bonds, mutual funds, trusts, pensions, and other types of assets.

The FATCA reporting requirement is part of your tax return and affects your tax liability. You have to file Form 8938, Statement of Specified Foreign Financial Assets, with your tax return if you meet the following thresholds:

- Single or married filing separately: You have to file Form 8938 if you have more than $50,000 of foreign financial assets at the end of the year or more than $75,000 at any time during the year.

- Married filing jointly: You have to file Form 8938 if you have more than $100,000 of foreign financial assets at the end of the year or more than $150,000 at any time during the year.

The FATCA reporting requirement is in addition to the FBAR reporting requirement. You may have to file both forms if you meet both thresholds.

Reporting your foreign bank accounts and other assets can be a hassle, but it’s important to do it correctly and on time. If you fail to report them or report them inaccurately, you may face severe penalties and even criminal prosecution.

Tax Deadlines and Extensions

As a freelancer living abroad, you need to know the tax deadlines and extensions that apply to you. The tax deadlines and extensions for US expats are different from those for US residents. Here are some of the key dates and deadlines that you need to remember:

- April 15: This is the regular deadline to file your US tax return and pay any tax you owe. If you live in the US or Puerto Rico on this date, you have to file and pay by this date. If you live outside the US or Puerto Rico on this date, you get an automatic two-month extension to file and pay.

- June 15: This is the extended deadline to file and pay your US tax return if you live outside the US or Puerto Rico on April 15. You don’t have to request this extension; it’s automatic. However, if you owe any tax, you will have to pay interest on the unpaid amount from April 15 to June 15.

- October 15: This is the final deadline to file your US tax return if you request an additional extension using Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. You have to file this form by April 15 if you live in the US or Puerto Rico, or by June 15 if you live outside the US or Puerto Rico. This extension only gives you more time to file, not to pay. You still have to pay any tax you owe by April 15 or June 15, depending on your location.

- December 15: This is the special deadline to file your US tax return if you request an extra extension using Form 2350, Application for Extension of Time To File U.S. Income Tax Return. You can use this form if you expect to qualify for the FEIE or the foreign housing exclusion or deduction by meeting either the physical presence test or the bona fide residence test, but you need more time to meet those tests. You have to file this form before your regular or extended due date. This extension only gives you more time to file, not to pay. You still have to pay any tax you owe by April 15 or June 15, depending on your location.

Filing and paying your US tax return on time can help you avoid penalties and interest. However, if you can’t file or pay on time for a valid reason, such as a natural disaster or a serious illness, you may qualify for relief from penalties and interest. You can contact the IRS or visit their website for more information.

How Indy Can Make Your Tax Life Easier

Indy is more than just a website. It’s a community of freelancers who want to simplify their freelance life and focus on what they love. One of the ways Indy can help you do that is by managing your taxes more effectively. Here are some of the features that Indy offers to make your tax life easier:

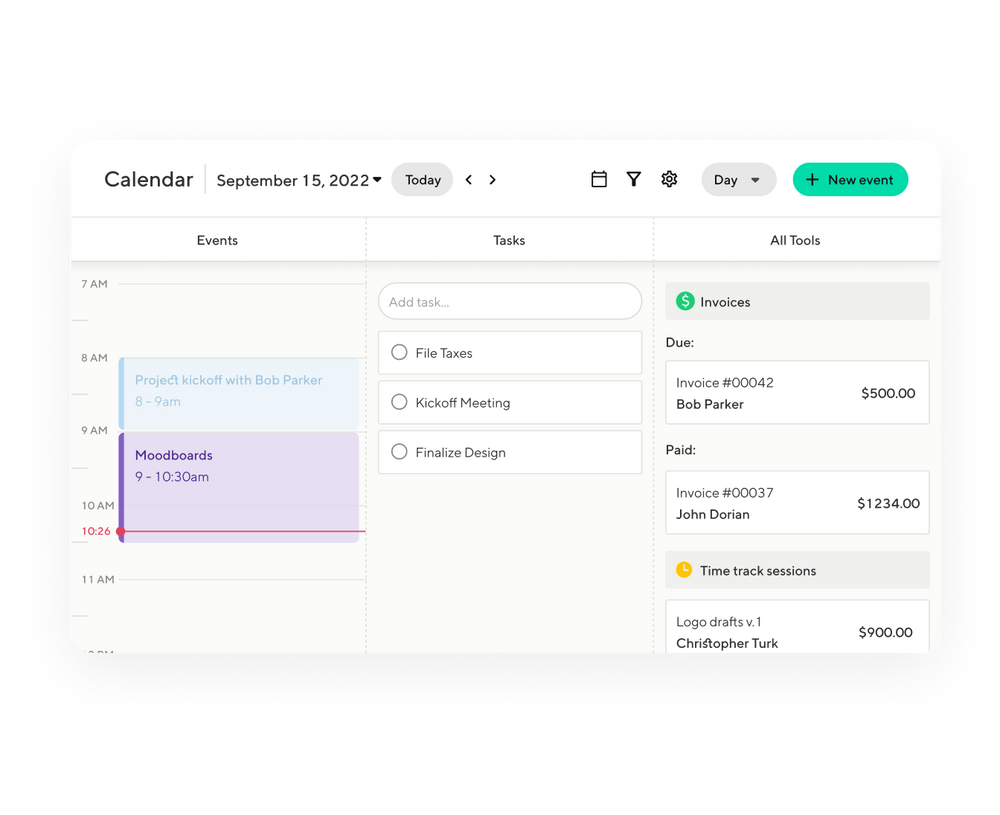

- Indy’s Task Manager: This is your personal assistant for all your tax-related tasks. You can organize your deadlines, create to-do lists, and track your progress throughout the year. You can also set up monthly reminders to sort out your receipts and keep your tax filing system in order.

- Indy’s Invoice feature: This is your smart tool for all your business transactions. You can create and send invoices in minutes, get paid faster, and see an overview of your annual income. This will help you monitor your financial performance and plan ahead for your taxes.

- Indy’s unified platform: This is your one-stop shop for all your freelance needs. You can access all the features and resources that Indy offers from one place, saving you time and hassle on administrative work. The time you save can be used for tax deductions or for filing your taxes with ease and confidence.

Indy is here to support you in your freelance journey. By using Indy, you can take control of your taxes and enjoy the benefits of being a freelancer. Join Indy today and see the difference for yourself.

Final Thoughts

We hope this guide has helped you understand the basics of US expat taxes for freelancers. As you can see, filing your US tax return as a freelancer living abroad can be complicated and challenging, but it can also be rewarding and beneficial. You can take advantage of the tax benefits that apply to you, such as the FEIE, the FTC, the foreign housing exclusion or deduction, and the tax treaties.

You can also use Indy to make your tax life easier and simpler. Indy is a website and a community that offers features and resources to help you manage your taxes and other freelance needs. By joining Indy, you can save time and money on your taxes and focus on what you love. Don’t wait any longer. Sign up for Indy today and start simplifying your freelance life.