No day is ever the same as a self-employed writer. Whether you’re a freelance author writing fictional stories or a journalist writing for multiple publications, there’s no doubt that writing is a creative profession that comes with numerous perks unoffered in traditional employment - travel opportunities, creative freedom, and the ability to work from home to name a few.

However, anyone who’s ever written professionally can tell you that the job comes with a lot of other responsibilities beyond authoring. And, if you are a freelancer, one of those responsibilities is taxes - a stressful and overwhelming process for anyone. Indy wants to help freelancers, so in this article we’ll walk you through how to file taxes as a freelance writer and some of the deductions you can claim.

What taxes do freelance writers pay?

The IRS considers writers as self-employed (unless you are employed on a regular salary). Whether you are a journalist, author, or content writer, there are three types of taxes you may have to pay as a professional writer.

Self-employment tax

Freelancers, small business owners, and independent contractors, no matter the industry, are required to pay self-employment tax.

All earners in the US, self-employed or in traditional employment, pay into FICA (Federal Insurance Contributions Act). If you're in a traditional 9 to 5 job, you pay 7.65% of your paycheck in FICA taxes. Your employer pays half and to match this, and also gives the IRS 7.65%.

If you are self-employed, you will need to pay both the employer's and employee's contributions, meaning you must pay 15.3% of your paycheck in FICA taxes. For example, let's say your net income from freelance writing is $1,500, then you will need to contribute $229 (15.3% of $1.500) to self-employment tax.

Income taxes

Everyone, whether self-employed or in traditional employment, is required to pay income tax. This means, on top of your doubled self-employment tax, you must still pay income tax.

However, there are a few deductions you can claim, which we will share further in the article.

Quarterly taxes

If you expect to owe the IRS more than $1000 in taxes (in a year), you need to pay your taxes in four installments. This means, you will need to pay estimated taxes four times a year, unlike most taxpayers who pay once at the end of the tax year.

Your income can vary, whether it's from freelance projects or book sales. If you're not sure how much you will owe, you can calculate your estimate using your previous year's tax return.

Additionally, you can use Form 1040-ES on the IRS website to figure out estimated tax.

Generally, the due date for quarterly tax payments is on the 15th of April, June, September, and January. However, if the 15th falls on a weekend or bank holiday, the deadline is pushed to the following business day.

What expenses can I deduct as a freelance writer?

The good news is, there are many tax deductions for freelance writers. Let's go through some of the deductions you can claim, and how to claim them.

How to use your self-employment taxes to lower your income taxes

Before we go into the basics, let's first take a look at how you can reduce your income tax bill! As a freelancer or independent contractor, the IRS allows you to deduct 50% of the self-employment tax you pay as income tax deduction.

For example, let's say your self-employment tax payment is $1,000, your taxable income can be reduced by $500 (50% of $1000). If you are in the 24% tax bracket, then you will save $120 (24% of your $500 deduction) in income taxes.

Before filing your tax return and claiming this deduction, it is important to understand your income tax bracket and which income tax rates apply to you.

Business expenses

Typical with any business, freelance writers have many business expenses that can be used to lower your tax bill. Some deductible expenses include:

- Equipment, such as computers or printers

- Computer software, such as Microsoft - an essential for most writers

- Website hosting fees and domain registration

- If you use services such as Substack, platform fees are deductible

- Paid advertising, including online ads (check our guide on deductible marketing and advertising costs)

- A portion of your home office (check our guide on the home office deduction for freelancers)

- Writing courses and education, this includes student loan interest (check our guide on bank fees and interest deductions)

- Business travel expenses for research trips or meetings, this can include accommodation and car rentals

- Literary agent fees

- Research expenses such as materials, books, and journal subscriptions

- Office supplies, such as pens and notebooks.

As long as the expense is ordinary and necessary - meaning they're typical for your industry and required to conduct your business activities - they can be deducted on your tax return as business expenses. For example, if you are a freelance blogger who writes movie reviews, the costs of a movie ticket can be claimed as a business expense.

Don't forget to keep track of all expenses throughout the year. This can be on programs such as Excel, traditional pen and paper bookkeeping, or online services such as QuickBooks.

Do I need to set up a separate company for my writing business?

This is a common question for freelance writers - is a separate company recommended for tax purposes? But, under IRS guidelines, freelance writers don't need to set up as a limited company in order to claim deductions on their tax returns.

How to save money for retirement

When you are employed and earning a regular wage, your employer often puts some of your wages aside for your retirement. As a freelance writer, you can too. This can't lower your self-employment tax, but it can reduce income taxes.

Let's go through some of the ways you can save for retirement with individual retirement arrangements (IRAs)

Traditional IRA

If you are a freelance writer just starting to save for retirement, a traditional IRA is probably the best option. With a contribution limit of up to $6500, or $7500 if you are 50 years or older, traditional IRAs allow tax-deductible contributions - since you are acting as an employee of your own business. This means, any withdrawals of your funds in retirement are tax-free. A 10% penalty applies for withdrawals before you reach the age 59½.

The Individual 401(k)

The Individual 401(k) is the ideal savings plan for a self-employed individual without staff. As most freelance writers do not employ staff, the Individual 401(k) may be the best option for you. Unlike other self-employed retirement savings plans, this plan allows you to contribute up to 100% of your income, maximizing your contributions.

Similar to the Traditional IRA, your contributions are tax-deferred until the age 59½. However, withdrawals of your funds after this age are taxed.

The contribution limit for the Individual 401(k) is up to $66,000 if you are under 50 years of age, and $73,500 if you are over 50.

The Roth IRA

If you are just starting out as a freelance writer, the Roth IRA is a great account. This is because, unlike the other IRAs mentioned above, the Roth IRA has an income limit for eligibility (less than $153,000).

With the Roth IRA, you can withdraw your funds at any time, for any reason, without a penalty. This can be helpful if you are just starting out as a freelance writer, and struggling with inconsistent income at any point.

The Roth IRA has a contribution limit of $6500 if you are under 50 years of age, and $7500 if you are over 50.

How to file and pay your tax bill as a freelance writer

Now that we have covered the required freelance writer taxes and eligible tax write-offs, let's go through the process of filing your return and paying your tax bill.

1099 Forms

As a freelance writer, you may already be familiar with 1099 forms. If not, here is a brief overview.

In simple terms, a 1099 form is an information return that shows income earned from work. The most common type of 1099 form - 1099-NEC - goes out to self-employed individuals like freelancers, independent contractors, and gig workers.

These are filed and submitted from a person or entity other than your employer that paid you money. For example, if you completed some freelancing work on Upwork, the 1099 form will inform the IRS about taxable income you received.

It is the responsibility of the payer (in the example above, it would be Upwork) to fill out and send the form to you and the IRS.

There are several types of 1099 forms, the ones most common for freelance writers include:

Form 1099-NEC

NEC stands for "Nonemployee Compensation". This means, if you did any independent contract work, such as a writing project for a local business and received more than $600 for the contracted work, you will receive one of these forms from the client or customer.

Form 1099-K

In this day and age, 1099-K forms are one of the most common for freelancers. This form is used for third party network transactions, including:

- Credit cards

- Debit cards

- Payment apps such as PayPal and Venmo

If you received card payments from clients, you most likely will receive one of these forms. However, this is only if you:

- Earned at least $20,000 in business-related payments (changing to $5,000 for the 2024 tax year)

- Logged at least 200 separate business transactions (This rule goes away for the 2024 tax year)

What do 1099 forms mean for my taxes?

As the IRS receives a copy of your 1099 forms, you will be expected to report the income.

However, you may not be required to owe taxes on all of the income reported on your 1099s, as the forms don't include your write offs, which will decrease your taxable income.

How do I fill out my Schedule C?

A Schedule C is used to break down all of your business expenses to determine how much of your business income is taxable.

Here's what you need to do:

- The first step is to define what type of business you are operating.

- Your earnings - this is where you list the total of all of your 1099s and any other income you've earned from freelance writing.

- Deduct any customer returns and costs of goods sold. This section doesn't apply to most writers, however, if you are a self published author who sells books directly, you can deduct the expenses occurred here.

- Now you list the rest of your business expenses. All expenses are separated by category.

The final step is to determine your taxable income. This is done by adding all of the numbers together.

How do I fill out my Schedule SE?

Now that you know your taxable income, you need to fill out Schedule SE which establishes how much self-employment tax you owe.

Here's what you need to do:

- Enter the total of your Schedule C

- Calculate your self-employment tax for the year following the forms instructions

- Submit the return!

How Indy can help

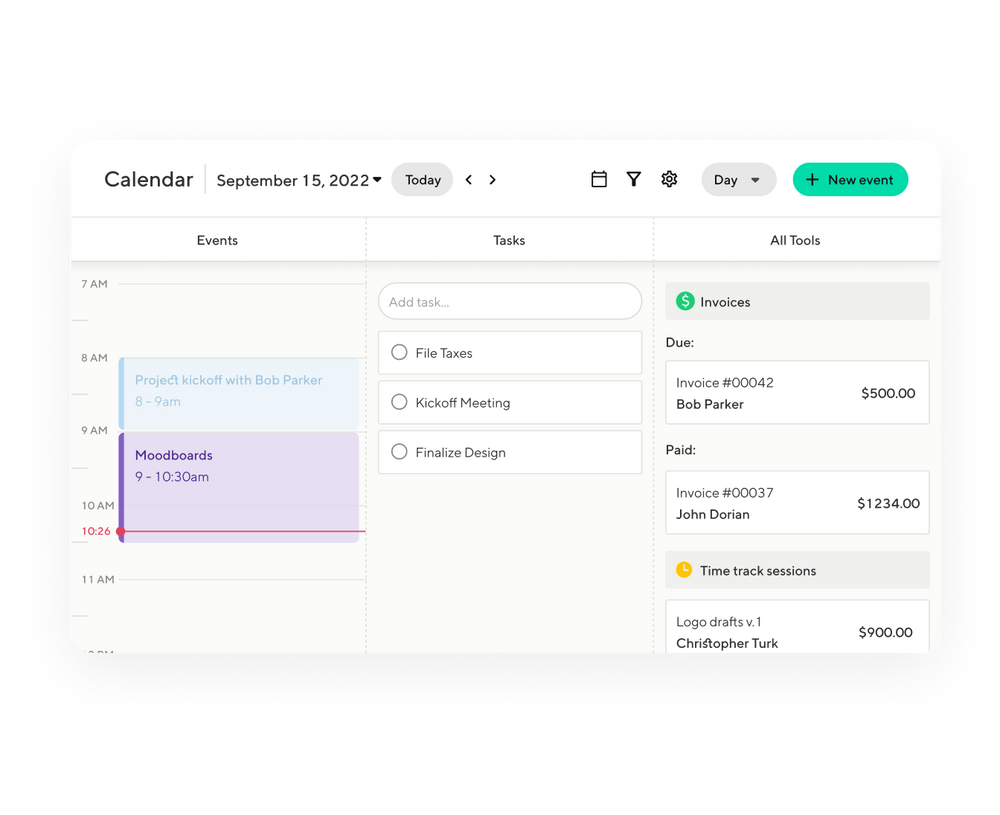

At Indy, we aim to make freelancing simple. There are several ways Indy can help freelance writers with their taxes:

- Our project tools can help manage your workload. Indy's forms can help gather information from clients for your projects. Our calendar tool can then help manage and schedule meetings.

- Our online invoice software can take the hassle out of invoicing with a generator that produces templates in seconds. Our invoice tools also make it easy to send invoices at set intervals - perfect for freelancers with recurring clients.

Preparation is key when it comes to filing your taxes. With Indy, you can set up monthly reminders to manage your receipts and invoices so everything will be manageable and ready for the tax season. Sign-up now and try it for yourself!

Conclusion

There's no doubt that writing professionally comes with numerous perks, but that doesn't mean it doesn't come with its own stressors. As freelance writers are considered self-employed by the IRS, you are responsible for 100% of your taxes. Understanding the different eligible tax write-offs, from writing courses to literary agent fees, can help you significantly reduce your tax bill.

And these aren't the only deductions for freelance writers! Working from home? Check out our guide to the home office deduction for a more in-depth look into home office expenses, how to claim, and more tax tips.