As we gear up for tax season, many of us are strapping in and wondering about one particular piece of the puzzle: the 1099-K form. So, what's the deal with Venmo? Will they be sending you one, and why does it matter?

In this article, we'll discuss the significance of 1099-K tax forms in the tax season, whether you'll get one, and what steps to take if you do.

Understanding Venmo's 1099-K and Tax Reporting

So what is a 1099-K? And why do you need one? Here's how Venmo's 1099-K and tax reporting processes impact freelancers and small business owners.

Introduction to 1099-K Forms

The 1099-K is a tax form used by the IRS to track income received through electronic payment methods. For freelancers, this can include payments made through platforms like Venmo. The big question is whether your Venmo transactions meet the criteria that trigger the issuance of a 1099-K. Let's break it down.

Venmo's role in your finances

Venmo, born out of the need to simplify splitting bills among friends, has evolved into a financial Swiss Army knife for many freelancers. However, it's crucial to distinguish between personal and business transactions on Venmo to avoid potential tax headaches.

When using Venmo for business, consider creating a separate account or clearly labeling business transactions. This practice not only helps you keep track of your professional income and expenses but also ensures a smoother tax reporting process.

Venmo's Thresholds for Sending a 1099-K

Will Venmo send you a 1099? This depends on whether you meet Venmo's thresholds for both taxable income and personal transactions.

Thresholds for 1099-K issuance

Alright, let's talk numbers. Venmo issues a 1099-K if your gross payments exceed both 200 transactions and $20,000 in a calendar year. If you fall below both thresholds, you won't receive the form from Venmo. However, don't let this lull you into a false sense of security. The IRS still expects you to report all your income, whether or not you receive a 1099-K.

This means keeping meticulous records of all your transactions, not just those that trigger a 1099-K. Remember, the IRS has a keen interest in your income, so transparency and accuracy are key.

Venmo's responsibility in tax reporting

Venmo is not just a convenient tool for exchanging money; it also plays a role in helping you meet your tax obligations. If your account meets the criteria for a 1099-K, Venmo will issue the form and submit a copy to the IRS. This ensures that both you and the tax authorities are on the same page when it comes to your income.

However, it's essential to double-check the accuracy of the information on your 1099-K. Mistakes happen, and you don't want to be on the receiving end of an IRS inquiry due to a simple error.

New Reporting Requirements: What Freelancers Need to Know

The IRS has introduced new reporting requirements for third-party payment apps, and freelancers using Venmo are in for some changes. Initially, the plan was to implement a lower reporting threshold of $600 for goods or services sold through these platforms. However, there's been a delay in the plans.

Delay in implementation

As of the end of 2022, the IRS has decided to delay the implementation of the new lower reporting threshold until tax year 2024. So, what does this mean for freelancers and small business owners who rely on Venmo for their financial transactions?

What to expect

If you receive $600 or more in payments for services or goods through Venmo, you won't be receiving a Venmo 1099-K just yet. The IRS is giving a one-year grace period, sticking to the old regulations for one more year. Instead, the Venmo 1099-K will be issued to individuals meeting the following criteria:

- Earning at least $20,000 during the year

- Having at least 200 business transactions in a year

Did you make the cut?

Freelancers and small business owners might breathe a sigh of relief if they haven't met these requirements. If you find yourself below the $20,000 income threshold or have conducted fewer than 200 business transactions in a year, you won't be receiving a 1099-K from Venmo.

The reason behind the delay

Now, you might be curious about the reason behind this delay. The IRS has opted for an extension not only to provide more time for third-party payment platforms to comply with the new threshold but also to allow individual taxpayers like you to familiarize themselves with the new terms.

Understanding these changes is crucial for freelancers, ensuring they navigate the evolving landscape of tax regulations with confidence. Stay informed, stay compliant, and keep those financial records in check as the IRS gives both platforms and taxpayers a bit more time to adjust to the new reporting requirements.

Navigating Venmo's 1099-K Threshold: What to Expect

Now that we've explored the changes in reporting requirements, it's crucial to understand how Venmo handles the issuance of the 1099-K form for those who meet the threshold. If you reach the reporting threshold, here's when you can expect to receive your Form 1099-K.

When to expect your 1099-K

Venmo typically starts preparing and distributing 1099-K forms in January each year. This means that if you've met the threshold for the previous tax year, you can anticipate receiving your 1099-K early in the new year. Keep an eye on your email inbox and Venmo account notifications during this period, as Venmo will notify you when your form is available.

How to access your 1099-K

Venmo makes it convenient for users to access their 1099-K forms digitally. Once your form is ready, you can log in to your Venmo account and navigate to the tax information section. Here, you'll find the option to download your 1099-K form as a PDF.

Ensuring accuracy: Reviewing your 1099-K

Before filing your taxes, it's crucial to review the information on your 1099-K for accuracy. Check that the income and transaction details align with your records. If you spot any discrepancies or have questions about the information provided, don't hesitate to reach out to Venmo's support for clarification.

Tips for a Smooth Tax Season with Venmo

If you've reached the threshold and will be receiving Venmo's 1099-K Form, here are tips to make your tax season easier.

Communication with Venmo support

Venmo support isn't just there for lost payments or technical glitches; they can also assist with tax-related inquiries. If you're uncertain about any aspect of your tax reporting on Venmo, reaching out to their support team is a proactive step.

- In-App Support Chat: Venmo provides an in-app support chat feature. Use this to ask questions about your account, transaction details, or any concerns you have regarding tax reporting.

- Email Support: If your query is more complex or requires documentation, you can also reach out to Venmo via email. Be clear and concise in your communication, providing relevant details to receive accurate assistance.

- Phone Support: In some cases, a phone call might be the most effective way to get immediate answers. Venmo's customer support hotline can guide you through specific issues and provide clarity on any tax-related uncertainties.

Remember, timely communication is key. Don't wait until the last minute, especially as tax deadlines approach. Venmo's support team is there to assist you, so take advantage of their resources.

When to Consult a Tax Professional

While Venmo support can address platform-specific inquiries, when it comes to the broader realm of tax advice, consulting a tax professional is invaluable.

Benefits of hiring a tax professional

- Expertise in Tax Laws: Tax professionals stay up-to-date with constantly changing tax laws, making sure you follow the rules and find additional opportunities for deductions.

- Personalized Advice: Every freelancer's situation is unique. A tax professional can provide personalized advice based on your specific circumstances, guiding you on the most tax-efficient practices.

- Risk Mitigation: Tax audits are stressful. Having a tax professional on your side reduces the risk of errors that could trigger an audit, providing peace of mind during tax season.

When to consult a tax professional

- Major Life Changes: If you've experienced significant life changes such as marriage, homeownership, or the birth of a child, consulting a tax professional can help optimize your tax strategy.

- Complex Income Sources: Freelancers often have diverse income sources. If your income streams extend beyond freelancing, a tax professional can help you navigate the complexities.

- IRS Notices or Audits: If you've received an IRS notice or are facing an audit, seeking professional assistance is crucial. A tax professional can guide you through the process and help address any issues.

- Year-Round Support: Don't limit your tax discussions to the weeks leading up to the tax deadline. Establish a relationship with a tax professional who can provide year-round advice, helping you make informed financial decisions.

How Can Indy Help?

Navigating your freelance business during tax season can be challenging, but Indy goes beyond simplifying business operations – it plays a big role in minimizing your tax costs.

Here's how Indy can fast-track your success:

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your designs and grow your business.

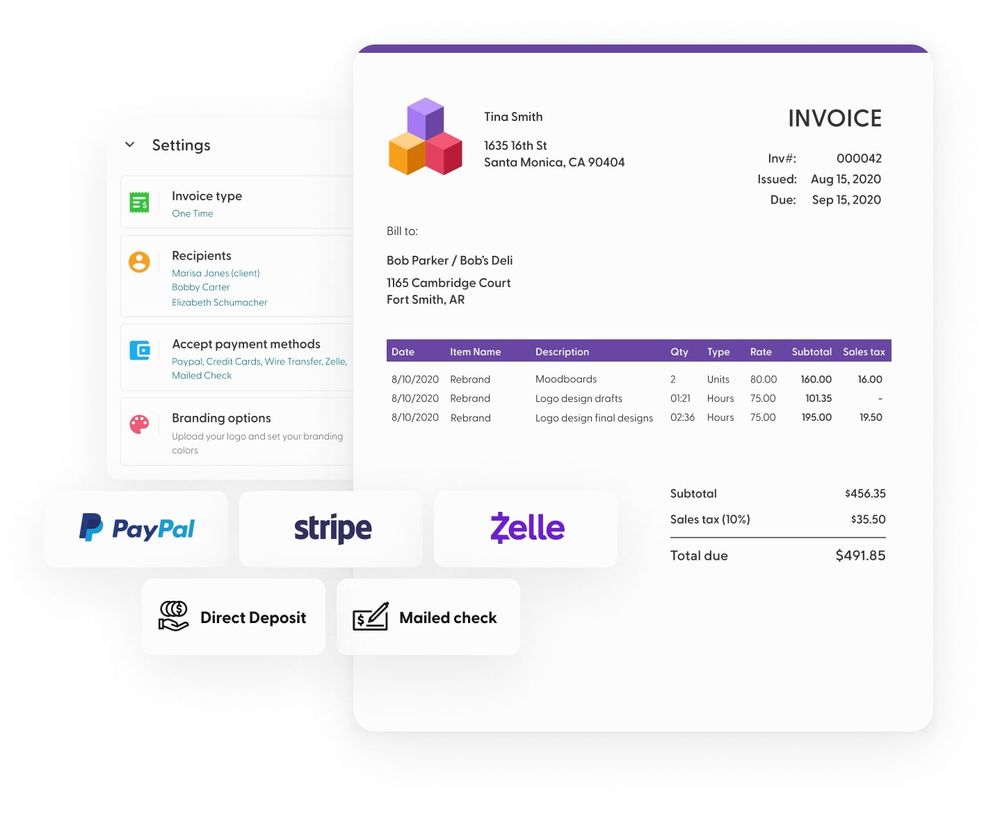

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share designs and any other documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself! Let Indy handle the administrative side, so you can focus on what you do best, creating outstanding projects for clients. Get started today for free!

A Quick Recap

Navigating the intricacies of tax administration is crucial for freelancers. You'll get a Venmo 1099-K Form if your payments exceed 200 transactions and $20,000 in a year. But beginning in tax year 2024, these limits will drop to $600. The IRS's decision to postpone the enforcement of the lower reporting threshold provides a grace period, giving both platforms and taxpayers the opportunity to adapt to the evolving tax landscape.

When completing your tax return, it's essential to accurately report payments received throughout the year. Take the time to review the information for accuracy, and if needed, reach out to Venmo's support for clarification. Timely communication with their support team can address any concerns and ensure a smoother tax season.

Indy can help fast-track your freelance business. What's more? It's tax deductible! Get started with Indy for free and manage your entire business under one roof, from contracts to invoicing and everything in between.