As a freelancer or independent contractor, there are several things that you will need when filing your taxes for the tax year. They include proper business transaction records and several tax forms, such as the Internal Revenue Service Form 1099.

The IRS Form 1099 is crucial in ensuring you fill out your tax return forms with accurate information, so you do not under or overpay taxes. As an independent contractor, you need to understand what exactly this form is and how to use it. Here is a 6-step guide that explains all you need to know.

1. Understanding the 1099 Tax Form

The IRS Form 1099 is best described as an information filing form for freelancers and independent contractors. There are over 20 different variations of the 1099 form.

Although the 1099-MISC form was used for reporting non-employee compensation in prior years, it has since been replaced by 1099-NEC.

The 1099 forms serve more purposes besides reporting non-employee compensation. Independent contractors can also earn income from other sources such as prize winnings, state tax refunds, and interest income. Income from these sources is reported using other types of Form 1099.

As an independent contractor, you will deal with form 1099-NEC more often than the other 1099 types, and so it will be the focus of this guide.

What is Form 1099-NEC?

Form 1099-NEC is the form your clients or customers will use to tell the IRS that they have paid you as an independent contractor or freelancer. You will often receive it when your payment is more than $600.

The IRS will rely on these forms to verify your income as an independent contractor and hence determine your taxable income and the amount you owe in taxes for the tax year.

A typical Form 1099-NEC will also show your personal information as a freelancer, address, and other things like taxpayer identification number. The form will have the taxpayer-identification numbers for both the contractor and client.

Independent contractors are not responsible for filing the 1099-NEC, but it is good to follow up if you don't get them from your clients as they are vital when filing income taxes. Also, you should remember that most 1099-NEC forms do not withhold income taxes, so you still need to make your estimated quarterly income tax payments as an independent contractor.

How do independent contractors use Form 1099-NEC for filing self employment taxes?

Independent contractors will use Schedule C (IRS FORM 1040) to report payments or income from their self-employment endeavors when tax filing for the year.

The first part of the Schedule C form will report the contractor's income. The totals from all the 1099 forms you get from clients, your gross receipts, or sales should be posted in line 1.

Any federal taxes withheld in the form 1099-NEC for the tax year have to be reported on form 1040 during tax return filing.

2. Where Does the 1099 form for Consultants Come From?

The 1099-NEC form originates from clients and business owners that pay an independent contractor or freelancer wages equal to or more than $600. The IRS makes it mandatory for businesses to fill and send the form to non-employees they establish an independent contractor relationship with.

The IRS makes the definition of an independent contractor clear, and so it should be easy to tell business engagements where you expect to get the 1099-NEC form. For example, according to the IRS, independent contractors will have non-core functions, non-permanent relationships, and written contracts with clients. Also, to be an independent contractor, you should have financial control over your business.

Additionally, independent contractors can receive the 1099-NEC forms from financial institutions like banks when they make more than $10 in royalty income.

Independent contractor work is the most common reason for getting the 1099 form, but there are also several other situations when you can get it. For example, you will get the form when you receive payment for your legal services or awards and also when you get fees and commissions as a non-employee.

The 1099-NEC will often come in your mail like most other financial statements, but some businesses will send them in electronic form via email with a link for downloading the 1099-NEC.

3. Should I Worry If I Don't Receive Form 1099 as an Independent Contractor?

You should expect to get the 1099-NEC when you get nonemployee compensation of more than $600, especially if you have a written contract with the business owner.

However, sometimes these forms can get lost in the mail, which can complicate things for you during the tax season as your tax preparer will require them when filing taxes.

Sometimes, you need to talk to your customers or client and ask them to send the form if they forgot or do not know they have to do it. Also, in some cases, they might have sent it to the wrong address or even just waiting for you to provide important details like your social security number to fill out the form before sending it.

If for some reason, you still do not get the form or the client insists they do not need to send it, there is still nothing to worry about. You should be okay, provided you report all the income you earned for the tax year.

Ensure that the income the customer reports to the IRS matches what you report in your tax form. Failing to report any income earned will land you in trouble with the IRS whether you received the 1099-NEC form or not. A professional tax advisor should provide better insight on tax return filing if you do not get the 1099-NEC form from clients.

4. What is the Purpose of Form 1099-NEC When Filing Income Taxes?

You will need Form 1099-NEC when filing taxes. Unlike employed individuals, independent contractors and freelancers are responsible for paying their payroll taxes as they do not have an employer to deduct them automatically from their paychecks.

Therefore, these forms and other things like invoices and bookkeeping records will be your source of information for tax purposes.

When filing your taxes using tax software, you will often be asked to key in the information from each 1099-NEC form individually. If you are using a professional tax preparer to file the taxes for you, these forms will form part of the tax documents you give them to fill out your tax form.

One more thing to remember is that you will still need to retain and keep the forms in a safe place even after filing the taxes. IRS recommends keeping these documents and other tax records for at least 3 years after filing your income tax, but keeping them for a few extra years is even better if you have to refile the taxes or correct something in the future.

5. 1099-NEC vs. Other Independent Contractor Tax Forms

Freelancers, independent contractors, and other small business owners need to know what other forms like 1099-K, W-9, and 1096 are all about, as they will also encounter them a lot. It is also important to know how they differ from the IRS Form 1099-NEC to avoid confusion.

1099-NEC vs. 1099-K Forms

The forms you get for products sold or services rendered will also depend on how your clients make the payments.

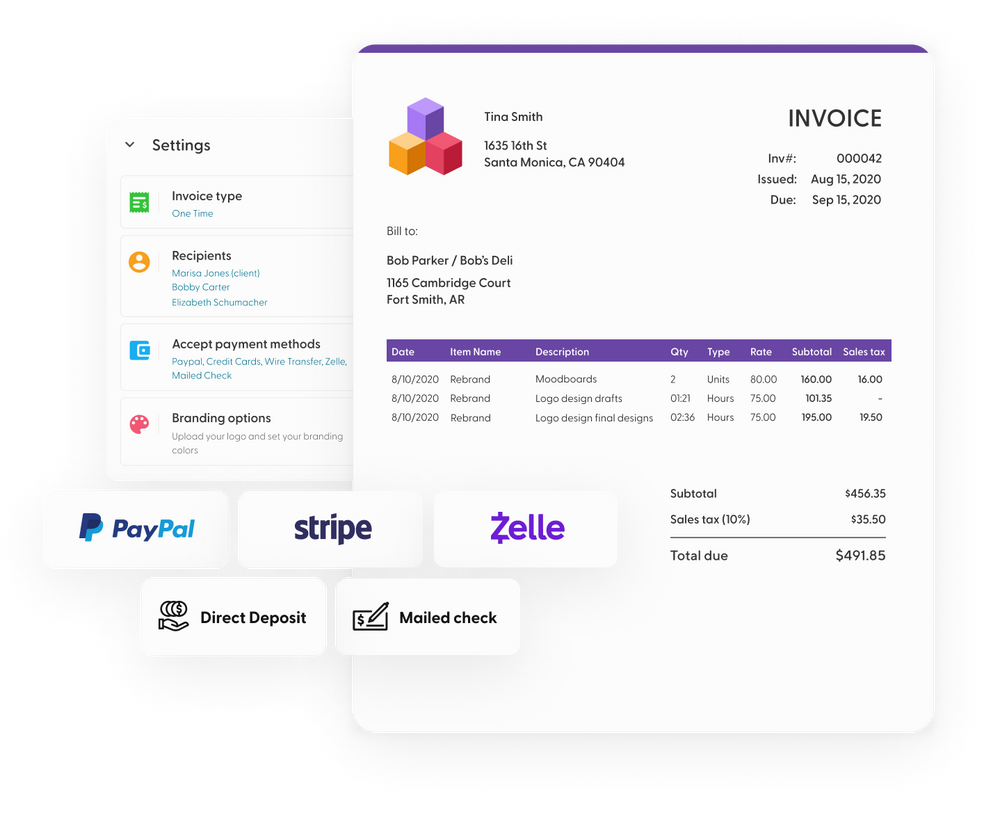

If your clients use third-party payment services like Stripe and Paypal or pay using credit cards, these payment platforms collect all the payment info and send it to you in a 1099-K form.

Unlike the 1099-NEC form that originates from the clients, 1099-K will come from third-party payment service providers.

However, to get form 1099-K, your total revenue must be over $20,000 and make more than 200 transactions. Before you report income from this form, make sure you reconcile it with the 1099-NEC to avoid double reporting. Beginning in the 2024 tax year, this threshold will lower from $20,000 to just $600.

1099-NEC vs. W-9 Forms

The main difference between the 1099-NEC and W-9 forms is the information they report and who files each form.

The W-9 form is what a client uses to request an independent contractor to provide their taxpayer identification number, which can be the social security number or employer identification number. This number helps ensure the client makes payments to the right person.

Therefore, unlike the 1099-NEC that the client fills and sends to the contractor, the W-9 form is filled by the contractor and returned to the client/business.

1099-NEC vs. 1096 Forms

Form 1096 is a summary report of informational returns that a business files. Like the 1099-NEC, it will also be prepared by the client. However, unlike the 1099 form sent to the independent contractor, the 1096 form is filed with the IRS only.

6. Can Independent Contractors Issue a 1099 Form?

Independent contractors are always receiving the 1099 forms after getting nonemployee compensation from their clients. However, they can also issue 1099-NEC forms in some particular situations.

For example, if you outsource or subcontract some of the work or hire a virtual assistant as a freelance employee, you have to send them these forms for any payments you pay them over $600.

Independent contractors often also engage other freelancers such as web designers and software developers. If what you pay for their services is over $600, you should send a 1099-NEC form.

The good news is that generating these forms is quite straightforward. You only need good tax software to generate these tax forms and have the contractor complete the W-9 form to get their tax identification number and other relevant information.

Bottom Line

As an independent contractor, getting more 1099-NEC forms indicates that your business is doing well since you are getting paid for your services.

However, the more forms you get, the harder it can be to keep track and organize everything, and so you need to have a proper system for handling them.

Also, it is important to check all your forms to ensure there are no errors or discrepancies and remember to reconcile them with others like form 1099-K to avoid double reporting.