One concern when self-employed is managing your taxes and ensuring you're doing everything correctly. This is where people often bring in a tax professional to help them file their tax returns. Filing taxes is a stressful experience for anyone. With so many confusing tax forms to fill in, it can be a time-consuming task that takes you away from the things that matter: your business. So hiring a tax expert could be a good move.

The Internal Revenue Service (IRS) is the governmental department responsible for your taxes, and the forms you complete will all be sent to them. This article will help you decide when the best time is to hire a tax professional to help prepare for that annual task. They can even help you with tax planning, so you'll be more ready the next time it's time to file your tax return.

What are my taxes when I'm self employed?

In the US, the self-employment tax rate is 15.3%. Income tax applies to your net earnings, so whatever profit you've made as a freelancer or small business will be taxed. 12.4% goes towards Social Security, and the other 2.9% is for Medicare.

These apply if you've earned more than $400 in self-employment across the tax year, from January to December. However, it would help if you didn't wait until the end of the tax year before paying your taxes. This can mean you get charged late payment fees. The best way to pay your taxes is to pay quarterly during the tax year to make sure you're keeping on top of it.

When should I consider getting a tax advisor?

If you're running a small business or self-employed as a freelancer, and it's manageable, you don't have to get a tax expert unless you want to. It's okay to do your own taxes if you have a simple tax return. But, US tax codes can total up to 70,000 pages, so it's a lot of studying for one individual to learn all the loopholes and tax breaks in that overwhelming amount of statutory legislation.

Getting a tax advisor who has studied it extensively can help save you money, as they'll be aware of tax breaks that the average person won't know about. They're also experienced in complicated tax situations, so they'll be able to unravel your finances and help you prepare for making tax payments.

There are also tax software providers who can support you with the laborious process of federal tax returns.

Do I need a tax advisor and an accountant?

Depending on your self-employment situation, you might need both a tax advisor and an accountant to help you manage your books and taxes. They do slightly different things. A certified public accountant will have a substantial accounting education background and experience managing accounts and finances. Whereas a tax advisor is less likely to have a college degree in tax, the best ones will still have undergone stringent testing and training to be best placed to help you with your taxes.

Accountant responsibilities

A certified public accountant is there to help you manage your accounts like a small business or as an independent contractor. We have plenty of tips on how you can manage your accounts as a small business, but at a certain point, it will become helpful to bring in some help.

Accountants have an educational background in accounting and financial matters. They may help with tax planning and preparation, but it isn't their primary job. They are there to support you with your business's financial transactions and financial planning. Some certified public accountants specialize in other parts of accounting, so they may be unable to assist with tax matters. If you're looking to use an accountant to provide tax help, you'll need to ensure they have a background in tax preparation.

Tax advisor responsibilities

A tax advisor specializes in tax preparation and filing taxes. They will be there to help you prepare to pay your taxes. However, not all tax advisors have qualifications. Generally, qualified tax preparers are enrolled agents who must pass examinations and tests to prove their credibility in representing clients to the IRS.

Tax advisors know everything there is to know about taxes in the United States, so they'll keep you right, prevent you from doing your taxes incorrectly, and may help you get a tax refund where applicable.

Qualities a good tax advisor should have

Once you've decided to bring a tax expert on board to your small business, the next step is researching to make sure you get someone who knows what they're doing. When you hire a tax advisor, you entrust them with some of the most important and personal details in your life. They'll know about your marital situation, finances, and social security numbers.

Unfortunately, there are some fraudsters out there, so you need to choose your tax advisor carefully. The IRS has offered some tips to ensure you select a credible tax preparer.

Relevant qualifications

People don't need to be qualified to provide tax advice as a job. Many tax advisors aren't licensed. All tax advisors or preparers will have a Preparer Tax Identification Number (PTIN), but having a PTIN doesn't mean the tax preparer has any qualifications. They only need to complete a suitability check with the IRS to get one. The PTIN is federal, but only seven states require additional licenses for tax preparers: California, Connecticut, Illinois, Maryland, Nevada, New York, and Oregon.

The next level up from having a PTIN is for a tax preparer to complete the Annual Filing Season Program, which is a way for the IRS to recognize unqualified tax advisors. It takes roughly 18 hours and allows unqualified tax preparer's to represent clients in a limited way to the IRS and be included in the directory.

The highest level of qualification for a tax expert is the enrolled agent. You can look on the IRS website to check if a tax return preparer has any credentials or qualifications. If you're looking for an enrolled agent, the National Association of Enrolled Agents also has a directory for you to search. That way, you can ensure the tax advisor you choose will have the appropriate qualifications.

Going for a tax advisor who is an enrolled agent means you'll get someone who understands tax law, can handle in-depth IRS audits, make appeals on your behalf, and liaise with the IRS collections department. They will understand your specific tax situation and be able to provide the necessary support.

Reputation

In the tax world, word of mouth spreads fast. You want to ensure the tax advisor you hire has an excellent reputation. If you're a business owner, you should have a network of contacts with other businesses. Reach out to your network and find out who they work with to file their taxes. Companies will likely recommend them to you if they do a good job.

An excellent tax advisor will be happy to share their success stories and have testimonials to show you how capable they are at the job.

Experience

You want your tax advisor to understand all the necessary tax forms, be aware of all the loopholes and have a background in the comprehensive tax legislation in the US. If you're entrusting someone with all your financial details, they should be someone who is experienced in the form of tax you require. That could be a small business that involves corporation taxes, an independent contractor, or a self-employed freelancer who needs help with the relevant tax forms.

Therefore you should ensure your paid preparer is experienced. How much experience is up to you to decide. But, given the gravity of the job, you want someone who has already dealt with the IRS previously.

Tax advisor red flags

We've looked at the good qualities of a tax advisor, so now let's explore the red flags you'll see in some tax professionals. So you'll know what to avoid.

- Someone who charges a percentage based on the tax refund you get: This can indicate under-the-table behavior with the IRS.

- Won't sign the tax return: All tax professionals should sign a tax return if they've helped prepare it.

- Promises you'll get an incredible tax return: A tax preparer can't make guarantees like this. If people are trying to entice you with promises of a bigger refund, it's a big red flag.

- No permanent business presence: Be wary of someone who doesn't have a proper office space or no web presence. This could indicate a fraudster who has set themselves up quickly.

Good tax advisors will charge a flat fee based on their services, not a percentage or a fee based on the tax refund you get. Always follow your gut too. If you don't have a good feeling about it, trust your intuition.

How to find a good tax advisor

Finding the right tax preparer takes research. Prepare to look into several different tax professionals and interview more than one. You want to compare them against each other to learn what the market rate is for their services. You'll need to weigh up cost vs. benefits. One might be more expensive because they specialize in a specific part of tax preparation, or they have more credentials.

Research and make contact

First, research tax professionals in your area, reach out to your network, and make recommendations. Once you have some names, look them up online. Do they have websites? Do they have an active social media presence? Do they come across professionally?

For small business owners, your time is money, and you don't want someone to waste your time. Remember, you will trust this person to handle all your business's finances to prepare you for electronically filing your taxes. Research their credentials and make sure everyone has a PTIN and relevant licenses.

Interview and confirm their credentials

Once you've found a few tax advisors you want to meet with, you should set up conversations and confirm their qualifications. It doesn't need to be an hour, but you can have a short phone call to ask all your questions that weren't answered on their website. You can also ask for references, which should be people they've worked with previously.

Tax preparers with more than ten tax returns must e-file (electronically file) taxes. So asking whether they e-file is an excellent indicator of how many clients they currently have. If they say they don't, they can't have more than ten clients.

During the interview, you want to question if your tax advisor is open all year round. Sometimes tax forms come back, and additional forms are requested. So you want to make sure you'll be able to contact your tax advisor after the tax return has been filed.

Some good questions to ask include:

- Do you do paper returns or e-file?

- What is your fee structure? Is it a flat fee, or do you charge hourly?

- Will any additional fees apply?

- Do you prepare tax returns yourself or have additional staff?

- How many returns do you file annually?

- What are your credentials?

- How do you keep your data safe?

Establish charges up front

Tax advisors usually charge clients on a sliding scale depending on how much work they need. In business, it's always good to establish fees upfront so you're aware of how much you'll need to pay. For someone who only requires a few tax forms filled out, and their taxes e-filed, it'll be a lower cost than for people with complicated tax situations.

Compare tax advisor fees to understand the market rate for the work you need. Remember that no genuine tax advisor should be basing their price on your refund.

Hire them

Once you've followed all the above steps, you'll be well on your way to hiring your tax advisor. If you're happy after having a chat with them, and you feel they've answered all your questions honestly, nothing is stopping you from taking the final step.

Now you've got a suitable tax advisor! They'll be able to answer any tax questions you have about file fees, when tax returns are due, and what information is necessary. They'll help with all forms of tax preparation.

When to file your taxes

Tax filing day in America is on April 15. The fifteenth day of the fourth month after the fiscal year ends. You can request an extension if you need to. But, as long as your taxes are e-filed before the end of April 15 or postmarked with a date before April 16, they'll be on time.

If April 15 falls on a Saturday or Sunday, your taxes are due on the next business day.

Conclusion

Choosing the right person to support you with taxes - whether a certified public accountant or a tax advisor - is crucial when you're self-employed. There are, unfortunately, fraudsters out there looking to take advantage. Luckily, you can check with the IRS whether the person you intend to use is licensed.

Using a tax advisor to support you with filing taxes can bring many benefits to you. First, it allows you to spend more time running and expanding your business. Second, tax advisors specialize in tax legislation and will be aware of loopholes and tax breaks, so chances are they'll save you money.

When looking for a tax advisor, you should consider their qualifications, experience, and public reputation. Don't forget to research and vet any potential tax advisors thoroughly. You can conduct a short interview before hiring too.

If you don't feel ready to commit to hiring tax professionals, various tax software providers can help you organize your tax prep.

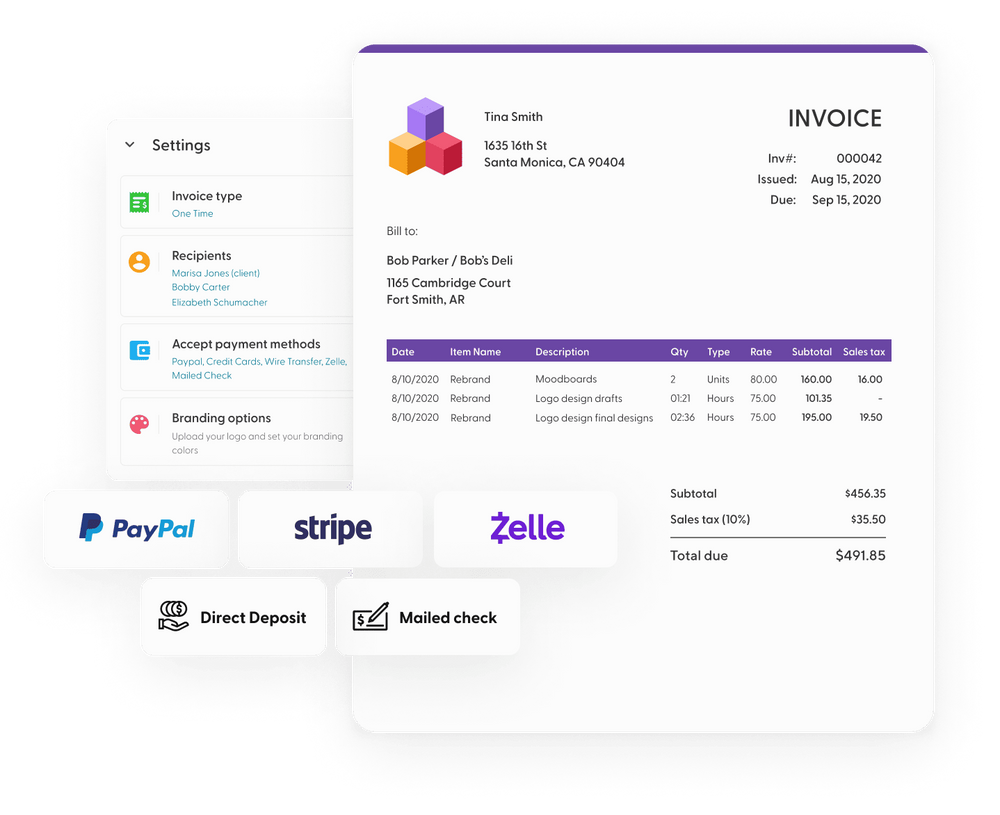

Tax season gets complicated in a hurry if you don’t have a strong way to keep your business organized. Indy’s project management software can give you the scheduling, file, and storage tools you need to simplify this busy time.