At least 33% of Americans will procrastinate filing their tax return and wait until the last minute. Although different taxpayers have varying reasons for procrastination, at least 40% of them do it because they find filing taxes too time-consuming.

Filling tax forms is perhaps even more hectic for freelancers that often do not keep good track of their earnings and expenditure.

The good news is that there is a simple solution that will take the hassle and fuss out of tax return filing, which is having tax professionals do the task for you.

With professional online tax software, freelancers do not have to keep procrastinating their tax return filing and risk not doing it in time.

What is a tax return preparation service?

Tax return preparation services will focus on helping taxpayers prepare their tax returns. They mostly do this by helping you fill up your tax return forms and they can help with both federal and state taxes.

A tax preparer will offer the services either through online tax software or in-person at a local office. However, the former is the most popular way of filing tax forms using tax software.

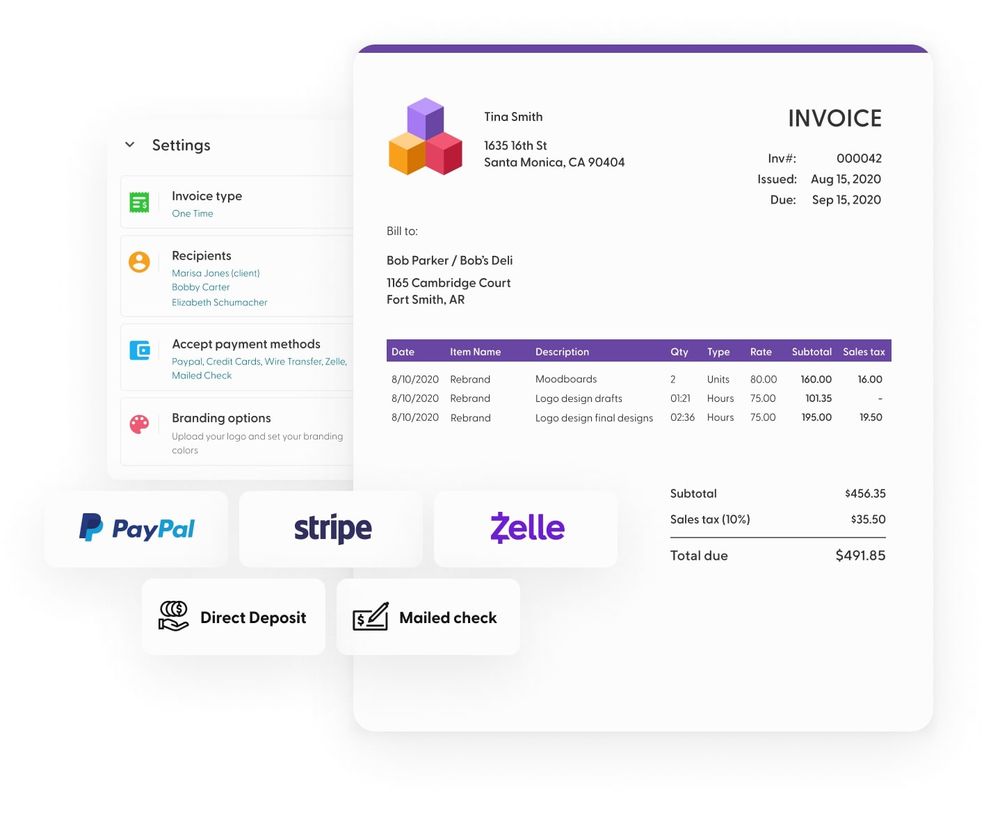

For online tax software providers, the taxpayers can get the services either through filing tax forms or through an interview.

Form-based tax software will give the taxpayers electronic versions of tax forms for them to fill up. All you need to do is fill in the data from your corresponding physical tax forms to file your tax returns.

With the interview-based online tax software, the tax filing process will involve a question and answer session.

The interview-based method is the easiest as you do not have to struggle to fill several forms that can be confusing. All you have to do is answer the questions and teh tax software will up the tax documents for you.

Why should freelancers use a tax return service?

A tax return preparation service is the best bet for any freelance that does not want to file their taxes manually for any reason.

Whether you just don't have the time to work on your taxes or find it to be a huge hassle, a tax preparer can be a lifesaver.

Also, tax software can save you the cost of having to hire a tax professional. On average it costs at least $176 to hire a CPA (certified public accountant) to file and submit your form 1040 and local state taxes.

This fee does not include any itemized deductions and including them makes it even more expensive as a certified public accountant will have a different rate for this.

Tax software will cost much less hence making tax filing cheaper for freelancers. Moreover, there are also many free tax software providers, meaning you can file federal tax returns without spending anything.

How to choose the best tax preparation services

There are many tax return services out there but not all will give you the experience you are looking for so you have to choose wisely.

Factors like ease of use, cost, professional tax assistance, and customer support should be at the top of your mind when deciding what tax software to use.

1. Consider the ease of use

Tax software should give you an easy time and not complicate things further for you when already dealing with complex tax situations.

The best tax software will have an easy-to-navigate menu and have lots of useful resources on the website such as FAQs to help you figure out how to resolve your tax situation.

2. Check the package prices

A tax preparation service will come at a cost, so you should never overlook what the company charges before settling for it as some can be quite expensive.

Look at the tax forms the tax preparation service offers and compare what they charge for them with the industry average to determine if it is affordable.

Also, it is a good idea to check whether there are any extra fees in the tax filing process such as for state tax filing.

3. Free filing option for simple taxes

A tax preparation software that offers free filing for simple taxes is always the best. You do not want to have to pay for something as simple as W2 or make a few tax deductions.

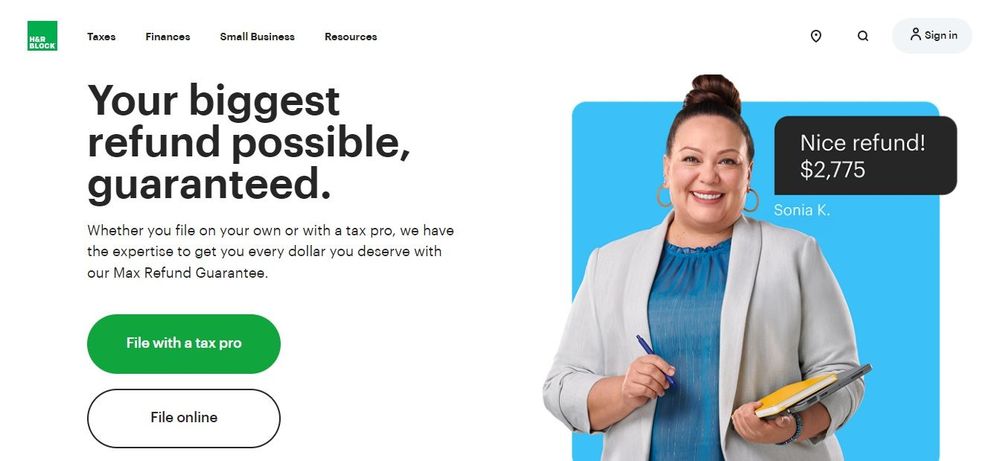

Most top tax filers like H&R Block will provide a free package for simple tax filing. Also, the IRS has a free file program. The IRS free file program can be very useful for those that qualify.

4. Tax professional assistance

Sometimes you might need advice from a tax professional even when using tax software. As you choose a tax filing service, it is important to make sure that you can get this assistance if you need it.

A tax program that provides professional audit support and has a live chat option that allows you to talk to a qualified tax specialist to resolve confusing tax situations will make filling tax returns less of a hassle for you.

5. Frequent updates

The best tax software is one that gets frequent updates to keep up with any changes in tax laws and IRS regulations to ensure your tax filing process is always up to date.

Tax software that gets frequent updates eliminates the need to have to keep up with changes in the tax laws yourself.

5 best tax software for freelancers

Here is an overview of the best tax return filers that will make filing taxes hassle-free for you.

1. H&R Block

H&R Block has been providing tax [preparation services since 1955, which makes it one of the oldest players in the industry. Also, it is one of the largest in the USA ad in 2019 alone the company did at least 1 out of every 7 tax returns.

The company supports both physical and online tax filling. You can visit one of their many offices spread across the USA for in-person tax pre or even to drop your tax documents and come back later to sign once the process is complete.

For their online services, taxpayers only need to upload all their forms and enjoy a fully virtual tax filing experience.

H&R Block does not charge for simple tax returns and offers several other packages plans to cater to all kinds of taxpayers. The plans include the $69.99 Deluxe Plan, $109.99 Premium plan, and $144.99 Self-Employed Plan. Additionally, they also have a state tax plan that costs $0 to $36.99.

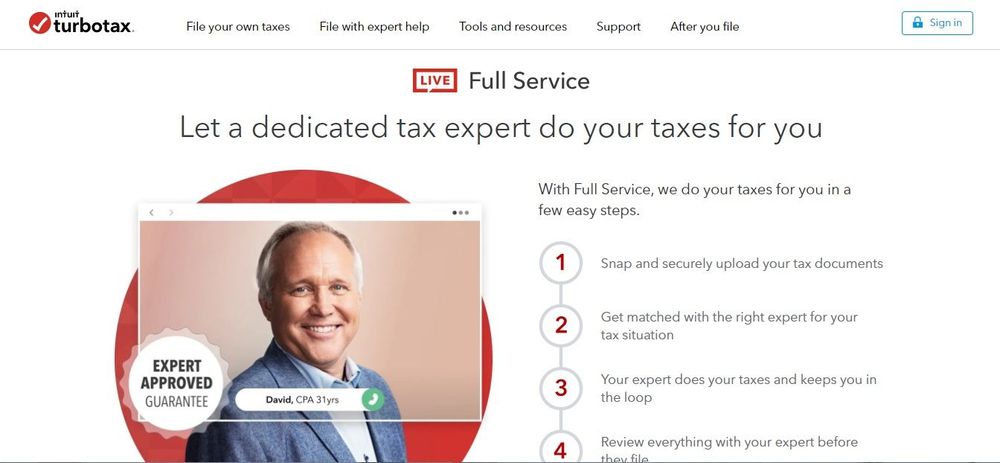

2. TurboTax

TurboTax is one of the best online tax software for those with more complicated tax situations. The company has been providing online tax services for many years and it is one of the most recognizable tax software.

The tax software supports 5 different plans starting with the free plan for simple returns. Others include a $39 Deluxe Edition that is very useful for those that want to maximize their tax credits and deductions.

Also, TurboTax has a $69 Premier Edition for those with rental properties and other similar investments and a $89 plan for self-employed individuals like freelancers. The tax software can also help you file state taxes with prices for this plan ranging from $0 to $49.

3. KPMG Spark

As an upcoming freelancer with a small business looking for the best tax software, KPMG Spark is a good option as they provide excellent online tax support with a team of qualified tax professionals.

KPMG Spark handles taxes for Fortune 500 companies so you can be sure your taxes are in good hands. What's more, the company provides more comprehensive accounting and bookkeeping services to ensure you never have to struggle with any aspect of accounting for your business income.

KPMG Sparks charges a monthly fee with a flat rate that starts at $395/month, and so it can be a little on the expensive side for some freelancers. However, they will give you better value for money than most tax software.

4. Jackson Hewitt

Jackson Hewitt is another old tax service that has been helping American residents file taxes for many decades. The company gives taxpayers three main options for filing taxes: in-person filling at their offices, Walmart stores, and using their online tax software.

The tax service has over 6,000 office locations and at least 3,000 Walmart locations. Most of these locations have flexible working hours including evenings and weekends to allow taxpayers to file taxes at their convenience.

Both the in-person and online tax filing processes are straightforward and they will often start by uploading your tax forms on the website, which you can even o by taking photos with your phone.

Jackson Hewitt rates start at $25 for simple federal tax filing and $49 for those that want to file both federal and unlimited state taxes.

5. TaxSlayer

TaxSlayer is one of the best tax software for anyone looking for something easy to use. Their tax services are super easy to access thanks to a highly intuitive interface.

Also, they have a free version that taxpayers can use to handle a simple federal and state tax situation. Prices for their paid plans start at $22.95 for the Classic plan that adds credits like child tax credits and deductions.

Other plans are the Premium plan ($42.95) which will also include phone, email for live chat with a tax expert for advice on issues like a tax refund query, and the $52.95 Self-employed plan that suits most freelancers.

FAQs

Why should freelancers use a tax professional?

A tax professional will take the fuss and hassle out of tax filing. As a self-employed person, you will hardly ever get enough time to spare for taxes but with the help of a professional or the best online tax software you can get things down within a short time. A professional also helps ensure you do not miss anything and understand what tax refund to claim.

Which is the best tax software for freelancers?

The best tax software for you depends on what you want. Do you want something that allows for free federal filing or something that can take care of your entire accounting and bookkeeping needs. KPMG Spark is hard to beat when you want comprehensive accounting solutions while H&R Block works well for those looking for free tax software.

How much will a tax return service cost a freelancer?

The actual charges vary from one company to the other and they will also depend on the specific service you are looking for. Many companies will have a free version for simple state and federal taxes and military personnel. For all other services, you can expect to pay at least $20.

Conclusion

Filing your taxes can be a hectic endeavor for a freelancer with a busy schedule and little time to spare. However, you can not avoid them regardless of your situation.

The best you can do is to make it less of a hassle by using a tax return service. There are different tax software that makes it easy to file taxes online. By comparing them using factors like ease of use cost and technical support you should get something that will work best for you.