Tax season has its share of challenges, which is why we’ve put together the ultimate guide on how to file self-employment taxes in 2024. So, whether you’re a web designer, writer, developer, business coach, virtual assistant, eBay store owner, or specializing in any self-employed venture, this guide is for you!

In this comprehensive article, we’ll cover it all—from understanding your status, filling out the essential tax forms, choosing the right business entity, calculating and paying taxes, exploring tax deductions, and how to seek professional help when necessary. But, first and foremost, you should know who an independent contractor is.

What is an Independent Contractor?

According to the IRS, an independent contractor is an individual who independently oversees and determines the outcomes of their work, focusing on achieving specific results without detailed instructions on how to perform the tasks.

The concept works well for both contractors and the individuals or businesses looking to get tasks done.

How do independent contractors get paid?

Independent contractors are typically compensated similarly to regular employees, receiving payments based on the nature of their projects. Payment structures may vary, with some contractors being paid per project or task, while others receive hourly compensation.

The method of payment often depends on the agreement between the contractor and the client. Additionally, independent contractors may be required to submit a Form W-9, providing their taxpayer identification number for accurate record-keeping and reporting by the client.

Tax Liability as an Independent Contractor

Scrolling through the extensive and ever-changing federal income tax code, which spans thousands of pages, can be complicated because of its constant revisions and lack of specific guidance.

That being said, independent contractors need to know their tax obligations, including what taxes they need to pay and to whom, so we’ll make it easy for you!

The taxes you have to pay

Every self-employed person must pay self-employment tax (around 15.3% of your net earnings), along with the traditional state and federal income tax.

Self-employment tax

FICA includes federal Social Security taxes and Medicare tax, 12.4% and 2.9%, respectively, totaling 15.3% of your net earnings. Whereas, an employer typically covers a portion of this cost for their employees, independent contractors and freelancers are responsible for footing the entire bill. The self-employment tax is filed using Schedule SE, Form 1040.

Income tax

Independent contractors, like other taxpayers, are required to pay income tax and self-employment taxes. Your taxable income is determined by subtracting all deductions from your total income. As tax rates tend to change often, you’ll need to check out the tax table for the particular year to find your income tax rate.

Which Tax Forms Do Independent Contractors Need?

Moving on to tax forms. As you can imagine, there’s many tax forms available to cover the wide range of income one can make being self-employed.

Schedule C takes the lead as the most frequently encountered document for self-employed individuals. Following closely are the 1099 forms, which come into play based on specific criteria. Whether you receive a 1099 or not hinges on meeting the designated requirements outlined by the IRS.

Let’s break down these forms in more detail:

1. Schedule C: The MVP of tax forms

As mentioned earlier, Schedule C is your go-to form for reporting income and deducting business expenses. It's the heart of your tax filing process. Keep track of every dollar earned and spent, and when tax season rolls around, Schedule C will be your trusty companion.

Tip: Familiarize yourself with the various expense categories on Schedule C to ensure you're maximizing your deductions.

2. 1099s: The sidekick forms

Now, let's dig into the 1099s – those crucial sidekick forms that showcase your financial superhero skills.

1099-NEC: In 2020, the 1099-NEC replacemed the traditional 1099-MISC when it comes to reporting non-employee compensation. If you provided services as an independent contractor and earned $600 or more from a client, expect to see this form. Fortunately, filling out the 1099-NEC is simple!

1099-MISC: While the 1099-NEC took over reporting non-employee compensation, the 1099-MISC still exists for reporting other types of income, such as rents, royalties, and healthcare payments. If you receive payments in various categories, you might still encounter this form.

1099-K: If you're hustling on platforms like Uber, Airbnb, Etsy, or third-party payment processors (like PayPal) and your earnings exceed $20,000 and have over 200 transactions, you'll likely receive a 1099-K. (Beginning with tax year 2024, the IRS plans to change the threshold from $20,000 to $5,000.) 1099-Ks summarize the total payments your clients made to you through these platforms. To learn more about the 1099-K, here’s everything you need to know about it.

1099-INT (Interest Income): Reports interest income earned, typically from bank accounts or other interest-bearing investments.

1099-DIV (Dividends and Distributions): Reports dividends and other distributions from investments in stocks or mutual funds.

1099-R (Distributions From Pensions, Annuities, Retirement, etc.): Reports distributions from retirement accounts, pensions, or annuities.

1099-G (Certain Government Payments): Reports certain government payments, such as unemployment compensation or state tax refunds.

1099-S (Proceeds from Real Estate Transactions): Reports proceeds from real estate transactions.

1099-C (Cancellation of Debt): Reports canceled debts, which may be taxable income.

1099-B (Proceeds from Broker and Barter Exchange Transactions): Reports proceeds from the sale of stocks, bonds, or other securities.

1099-A (Acquisition or Abandonment of Secured Property): Reports the acquisition or abandonment of secured property, which may have tax implications.

1099-CAP (Changes in Corporate Control and Capital Structure): Reports information about changes in corporate control and capital structure.

The deadline for businesses to send 1099 forms to independent contractors is January 31st, so if you haven’t received your 1099 form by then, there’s a few steps you can take to get a new copy. You’ll receive 1099 forms whenever you earn $600 or more from a contract. However, you’ll still need to report all income even if it’s below $600.

Tip: Businesses must send you the 1099 form by January 31st, so keep an eye on your mailbox for these forms, and make sure they match your records.

3. Upwork forms: Special mention

For our freelancers in the Upwork world, there are specific forms tailored just for you. Upwork provides a comprehensive guide on the various forms you might encounter, including the 1099-K and 1099-NEC equivalents. Check out the full Upwork tax requirements to ensure you're on top of your game.

4. Other potential forms for freelancers

Form W-9: This form is not one you'll receive but one you'll likely have to provide. Clients may ask for a completed W-9, which includes your taxpayer identification number, to ensure they have the correct information for reporting payments.

Form 1040-ES: If you're required to pay quarterly estimated taxes, this form is your roadmap. It helps you calculate how much you should be paying each quarter to avoid a hefty tax bill come April.

Form 8829 (Expenses for Business Use of Your Home): If you claim a home office deduction, this form is your ticket. It allows you to detail expenses associated with the business use of your home.

Choosing the Right Business Entity

Selecting the appropriate business entity is a pivotal decision that shapes the foundation of your independent contracting journey. Here's a breakdown of common business structures, each with its own set of characteristics:

Sole Proprietorship:

- Advantages:

- Simplicity: Easy to set up and manage.

- Full Control: You have complete control over decision-making.

- Tax Simplicity: Income and expenses are reported on your personal tax return (Form 1040).

- Disadvantages:

- Unlimited Liability: You are personally responsible for business debts and liabilities.

- Limited Growth Potential: May face challenges in raising capital.

Limited Liability Company (LLC):

- Advantages:

- Limited Liability: Personal assets are protected from business debts.

- Flexibility: Less formalities than a corporation but offers liability protection.

- Pass-Through Taxation: Income is reported on your personal tax return.

- Disadvantages:

- Costs: May have associated filing fees and administrative costs.

- Limited Life: Depending on the state, an LLC might have a limited lifespan.

S Corporation:

- Advantages:

- Limited Liability: Personal assets are protected.

- Tax Advantages: Potential tax savings through pass-through taxation.

- Business Credibility: Perceived as more formal and established.

- Disadvantages:

- Stricter Requirements: Must adhere to specific rules and regulations.

- Limited Eligibility: Restrictions on the number and type of shareholders.

C Corporation:

- Advantages:

- Limited Liability: Shareholders are protected from business debts.

- Attractive to Investors: Easier to attract investment capital.

- Disadvantages:

- Double Taxation: Profits are taxed at both the corporate and individual levels.

- Complexity: More administrative requirements and formalities.

Partnership:

- Advantages:

- Shared Responsibility: Partners share the burden of decision-making and financial responsibilities.

- Pass-Through Taxation: Income is passed through to individual partners.

- Disadvantages:

- Unlimited Liability: General partners are personally liable for business debts.

- Conflict Potential: Differences in decision-making can lead to disputes.

Choosing the right business entity requires careful consideration of your business goals, risk tolerance, and long-term vision. And each structure comes with its own set of tax rules. Consulting with a tax professional or legal advisor is highly recommended to ensure alignment with your specific needs and circumstances.

Tax Deductions for Independent Contractors

Before proceeding with this, you should know what a tax deduction is. A tax deduction lowers your taxable income and helps you keep more money with you. Taxable deductions are a major part of your taxable income calculations, and they should be considered when calculating taxes.

Employees cannot deduct business expenditures. However, an independent contractor can! Here is a list of qualified business income deductions you may qualify for as an independent contractor.

- Promotional expenses

- Fees and commissions

- Interest

- Meals

- Depreciation

- Marketing-related expenses

- Car and truck expenditure

- Health insurance without premiums

- Repairs and maintenance

- Phone and internet usage

- Educational courses

- Home office tax deductions

There is a specific set of instructions for how they should be calculated and, sometimes, restrictions on what can be subtracted for every expense. For instance, car and truck usage is subjected to miles traveled. If you travel often, you should calculate your miles and see if it is a deductible business expense or not. In other cases, tuition and fees can even be eligible for tax credits.

Some deductions, such as depreciation, have specific rules. Depreciation is a yearly income tax deductible that helps you recover your asset cost over time. The IRS marks expenditures deductible only when they are important and ordinary.

Deadlines for Contractor Tax

Taxes are paid quarterly and can be calculated using estimated tax worksheets found in Form 1040-ES. The easiest way to file quarterly taxes is through virtual means, either via the IRS website or EFTPS. Tax software is also available to assist in calculating quarterly estimated payments.

If you earn solely as an independent contractor, you can expect a tax refund. Quarterly estimated taxes ensure that you pay in accordance with the tax system, preventing unexpected tax bills when filing your annual tax return.

It's essential to remember that state and local tax deadlines may vary, as they are set differently from IRS deadlines.

Quarterly estimated tax filing deadlines for the 2023 tax year:

After you commence making quarterly tax payments for the 2023 tax year, the deadlines are:

- April 18, 2023

- June 15, 2023

- September 15, 2023

- January 16, 2024

Personal income tax deadline (Form 1040)

Tax filing for 2024 opens on January 18th. Your income tax for the 2023 tax year can be filed by April 15, 2024. If you need some time to file your taxes, you can ask for an extension. Once you get an extension, you can file by October 2024.

Make sure you pay on time, or you may be charged with a tax penalty. Although the self-employment tax is critical for contractors, don’t forget about your federal and state obligations. As every state and local tax is different, you should check with the US state's tax authority to find yours.

How to File Taxes as a Contractor

Now that we’ve covered everything you need to know about the essential forms, business structures, and deadlines, it’s time to start filing.

Here’s a step-by-step guide to make this process smooth and efficient.

Step 1: Gather the necessary documents

Collect all income-related documents, including W-2s, 1099s, and any additional income records. Keep receipts for deductible expenses such as medical bills, educational expenses, and business-related costs.

Step 2: Understand your filing status

Your filing status (Single, Married Filing Jointly, Head of Household, etc.) determines your tax rates and available deductions. Choose the status that best fits your situation.

Step 3: Choose the right tax forms

Select the appropriate tax forms based on your financial activities. The complexity of your financial situation will determine whether you use the basic 1040 form or other supplementary forms.

Step 4: Consider tax credits

Explore tax credits that may apply to your situation. Examples include the Child Tax Credit for parents and the Earned Income Tax Credit for low to moderate-income earners.

Step 5: Calculate your taxable income

Subtract eligible deductions from your total income to calculate your taxable income. Common deductions include student loan interest, medical expenses, and contributions to retirement accounts.

Step 6: Explore deductions

Look into deductions that can lower your taxable income. Examples include mortgage interest, property taxes, educational expenses, and charitable contributions.

Step 7: Review and verify

Thoroughly review your completed forms and calculations. Ensure all information is accurate to avoid errors that could trigger audits or delays in processing.

Step 8: Choose your filing method

Self-employed individuals can file taxes on their own, especially if there have been no significant changes to their business in the past two years.

DIY filing options:

Mail Filing: Order tax forms online, fill them out, and submit them to the IRS. Payments are made via check or money order.

Online Filing: Create a profile on the IRS website and pay directly. Online filing is faster, paper-saving, and convenient, allowing you to complete the process from the comfort of your home.

Decide whether to file online (e-filing) or by mail. E-filing is faster, saves paper, and you don't have to leave the comfort of your home.

Step 9: Pay attention to state taxes

Be aware of state tax requirements if you live in a state with income tax. Some states have different deadlines and rules, and you may need to file a separate state tax return.

Step 10: File your tax return

File your federal and state tax returns by the applicable deadline. The usual deadline for federal taxes is April 15th. Late filing may result in penalties and interest.

Step 11: Consider estimated tax payments

If you're self-employed or have income not subject to withholding, consider making estimated tax payments throughout the year to avoid a large tax bill at filing time.

Step 12: Track your refund

If you're due a refund, use the IRS's "Where's My Refund?" tool to monitor its status. This tool provides updates on when you can expect to receive your refund.

Step 13: Keep records

Keep a copy of your filed tax return and all supporting documents for at least three years. This documentation is essential in case of an audit or if you need to reference past filings.

Step 14: Address any issues

If the IRS identifies issues with your return, respond promptly. Address any errors or discrepancies to avoid penalties or delays in processing.

Step 15: Plan for the next year

Reflect on your current financial situation and make adjustments for the upcoming tax year. Consider any changes in income, expenses, and potential deductions. Stay informed about tax law changes that may impact your situation.

How to Amend a 1099 Form?

Discovering an error on a filed 1099, such as incorrect payee information, errors in reported amounts, changes in filing status, or omissions of income and deductions, can be anxiety-inducing.

But don’t worry – there's a process to set things right. Here's a more detailed guide on amending a 1099:

- Identify the Error: Before diving into the amendment process, carefully review your filed 1099 to pinpoint the error. It could be a mistake in the reported amount, an incorrect payee name, or any other detail that needs correction.

- Use Form 1099-X: The official document for amending a 1099 is Form 1099-X. Obtain this form from the IRS website or your tax software provider.

- Complete the Form: Provide the corrected information in the appropriate sections of Form 1099-X. Be meticulous and ensure that all necessary details are accurately updated.

- Explain the Changes: Alongside the corrected information, include a brief but clear explanation of the changes made. This helps the IRS understand the nature of the error and the steps taken to rectify it.

- Timely Submission: Time is of the essence when it comes to amendments. Submit the amended form as soon as you discover the error. Delayed corrections may lead to complications, including penalties and discrepancies in tax records.

- Consider Professional Guidance: If the amendment process seems complex or if you're unsure about any aspect, seeking guidance from a tax professional is a wise move. They can provide clarity, ensure proper completion of the form, and navigate any potential complexities.

Discovering errors in a filed 1099 is not uncommon, and while amending is a typical approach, there are situations where voiding the 1099 might be necessary.

Common Tax Mistakes to Avoid

Tax season gets complicated fast, and unfortunately, mistakes happen all the time. Let's delve into some of these tax pitfalls and how to steer clear of them:

- Miscalculating Income: Double-check all income sources, ensuring accurate calculations. Use accounting software to track income and expenses.

- Overlooking Deductible Expenses: Keep meticulous records of business-related expenses. Regularly review the IRS guidelines to identify eligible deductions.

- Failing to Keep Thorough Records: Establish a robust record-keeping system. Save receipts, invoices, and relevant documents for easy reference during tax season.

- Missing Filing Deadlines: Mark tax deadlines on your calendar. Consider setting reminders to ensure timely submissions. If needed, file for an extension well in advance.

- Not Staying Informed: Regularly update yourself on tax laws and regulations. Consult with a tax professional for advice tailored to your specific situation.

- Relying Solely on Software: While tax software is helpful, it's not foolproof. Review entries manually and, if possible, seek professional assistance for complex situations.

When to Seek Professional Help

While many independent contractors can handle their taxes independently, certain situations warrant professional assistance.

Professional assistance

Consider enlisting the help of a tax professional if:

- You're uncertain about your tax obligations.

- Your financial transactions involve complexities that may benefit from professional insight.

- Your business undergoes significant structural changes.

A tax professional brings a wealth of knowledge, providing valuable insights to optimize deductions and ensure compliance with tax laws. Finding an advisor who knows the ins and outs of being self-employed ensures you get advice that fits your specific situation.

Tax software for freelancers

Alternatively, using tax software is an attractive option for freelancers seeking a streamlined and cost-effective approach to tax preparation. Several platforms cater specifically to freelancers, offering user-friendly interfaces and features tailored to self-employment scenarios. These tools can guide you through income and expense tracking, help you uncover eligible deductions, and ensure accurate filings. Exploring the best tax software for freelancers allows you to leverage technology for efficient and personalized tax management.

Legal assistance

In certain situations, hiring an attorney can be advantageous for freelancers. The added benefit is that some legal fees are tax-deductible, making this choice not just smart but also financially beneficial. An attorney can offer advice on legal aspects related to your freelance business, such as contracts, intellectual property, or business structure. This dual advantage of legal counsel and potential tax deductions makes legal assistance an attractive choice for freelancers navigating the complexities of self-employment.

Which States Have the Lowest Income Tax?

The beauty of freelancing is that you can work from anywhere. Embracing this lifestyle has even given rise to a distinctive community known as digital nomads, who thrive on the adventure of constantly being on the move.

But it’s important to know that income tax rates vary by state, and understanding the tax landscape can impact your overall tax liability. States such as Florida, Texas, and Nevada have no state income tax, offering potential savings for independent contractors. However, it's crucial to consider other factors, such as cost of living and business regulations, when deciding where to establish your business.

Florida: A Tax-Friendly Oasis

Florida's appeal extends beyond its warm climate; it's a haven for those seeking to minimize their tax burden. The Sunshine State boasts no state income tax, allowing independent contractors to retain more of their hard-earned income. This tax-friendly environment, coupled with a relatively low cost of living, positions Florida as an attractive destination for establishing a freelance business.

Texas: Lone Star State, Low Tax Rates

Texas follows suit, embracing a business-friendly approach by not levying state income tax. Independent contractors in Texas enjoy the advantage of a tax-friendly environment, contributing to the state's reputation as a hub for entrepreneurship. The absence of state income tax, combined with a diverse and vibrant business landscape, makes Texas a compelling choice for freelancers looking to maximize their income.

Nevada: No State Income Tax, Big Opportunities

Nevada completes the trio of tax-friendly states for independent contractors. The Silver State's allure lies in its lack of state income tax, creating a favorable atmosphere for those seeking financial advantages. With its bustling business environment and unique opportunities, Nevada stands out as a state where freelancers can thrive without the additional burden of state income tax.

Considerations Beyond Income Tax:

Though not having state income tax is appealing, smart freelancers look at the bigger picture when picking a location for their business. Factors such as the cost of living, business regulations, and overall economic climate play pivotal roles. Considering the overall financial situation ensures that the benefits of no state income tax align with a business-friendly environment that promotes growth and success.

Many states in the U.S. provide excellent tax relief for freelancers, offering diverse opportunities for financial optimization. Do keep in mind, though, that if you plan to hit the road and begin state-hopping as a digital nomad, there are certain tax implications you’ll need to know about.

Self-Employment Income Tax Preparation Checklist

Phew! We’ve covered a lot of information here, so to wrap things up, here’s a quick tax checklist to get you through the filing process:

- Gather all documents of the income received.

- Tally up all business expenses and deductions.

- Draft estimated quarterly taxes.

- File your annual tax return.

- Celebrate fulfilling your tax responsibilities.

Always remember that every taxpayer should honestly pay his/her taxes. You should never withhold taxes. Paying taxes is your duty towards your country. If you need any advice for tax payment, don’t hesitate to contact a tax professional.

How Can Indy Help?

Navigating taxes as a freelancer can be challenging when you're the boss, but Indy simplifies the process!

Here's how Indy can fast-track your success:

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your projects and grow your business.

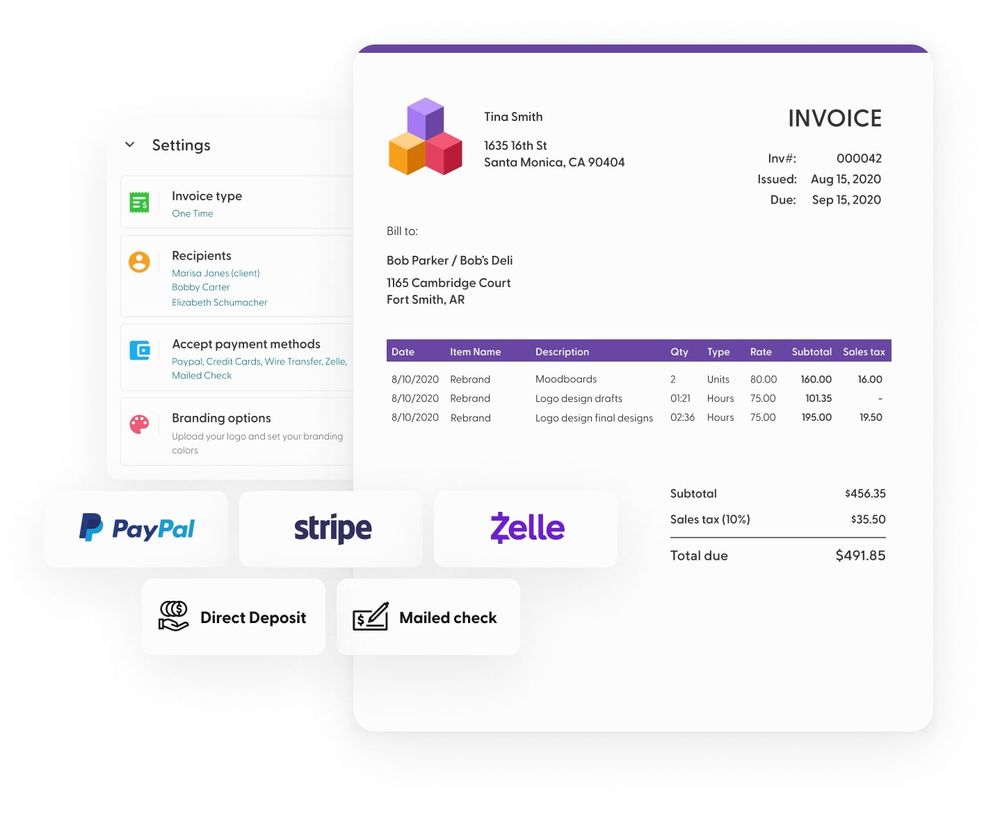

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself. Get started today for free!

A Quick Recap

There’s many benefits to being an independent contractor, like flexible work hours and greater control over your taxes. However, filing taxes as an independent contractor can get complicated fast. So, as you jumpstart your self-employment tax adventure, remember the key milestones: understanding your status, filling out the essential tax forms, choosing the right business entity, calculating and paying taxes, exploring tax deductions, and seeking professional help when necessary.

With the right approach, you can confidently navigate tax season and celebrate the successful fulfillment of your tax responsibilities. Ready to take your business to the next level? From proposals to project management to invoicing, Indy lets you do it all. Plus, it makes the perfect tax write-off. Get started today for free!

FAQ

What expenses can I deduct as an independent contractor?

Deductible expenses for independent contractors may include business-related travel, supplies, equipment, professional fees, and other costs directly related to your work. However, the exact expenses you can deduct will depend on your profession.

Here are some of the most common deductions for business coaches, beauty industry, writers, virtual assistants, photographers, influencers, software developers, content creators, videographers, graphic designers, and marketing.

Do I need to pay estimated taxes quarterly?

Yes, independent contractors often need to pay estimated taxes quarterly to cover their income and self-employment tax liabilities.

Can I deduct home office expenses if I work from home?

If you use part of your home exclusively for business, you may be eligible for a home office deduction.

Do freelancers ever have to issue Form 1099?

Freelancers may need to issue Form 1099 if they pay an individual or unincorporated business $600 or more for services during the tax year. It's a requirement for reporting income to the IRS.

How long should I keep tax records?

It's advisable to keep tax records for at least three years, and in some cases, longer. Records may be needed for audits or to support amended tax returns.

What is the difference between a 1099-MISC and a 1099-K?

A 1099-MISC reports miscellaneous income, while a 1099-K reports payments made by card and third-party network transactions. For 10 additional must-know questions and answers about 1099s, check out this resource along with our 10-step guide to form 1099 for independent contractors.