Freelancing on Upwork gives you flexibility, but tax season can be tricky. The Upwork 1099 tax form is a critical element in this process, serving as a comprehensive summary of your earnings throughout the year.

In this article, we'll break down everything you need to know about the Upwork 1099, including its purpose, key components, and the different types it comes in.

What is the Upwork 1099 Tax Form?

The Upwork 1099 tax form is essentially a summary of your earnings from Upwork during the tax year. It's Upwork's way of reporting to the IRS how much they've paid you for your hard work. So, when tax season rolls around, you're not left scratching your head wondering where to start.

Purpose of the Upwork 1099 Form

- Income Documentation: The primary purpose of the Upwork 1099 tax form is to document the income you've earned as a freelancer on the platform. It serves as an official record of the payments made to you by Upwork for your freelance services.

- IRS Reporting: Upwork is required by the Internal Revenue Service (IRS) to report the payments made to freelancers, and a 1099 form is the vehicle through which this information is conveyed. The IRS relies on this documentation to ensure accurate reporting of income by freelancers.

Key Components of the Upwork 1099 Form

- Personal Information:

- The form includes your personal information, such as your name, address, and taxpayer identification number (usually your Social Security Number or Employer Identification Number). This ensures that the income is correctly attributed to you.

- Total Earnings:

- A crucial element of the 1099 form is the total earnings section, summarizing the gross income you received from Upwork during the tax year. This figure forms the basis for your income reporting on your tax return.

- Fees and Deductions:

- The form also outlines any fees or commissions that Upwork may have deducted from your earnings. Understanding these deductions is essential for calculating your net income accurately.

Who Receives the Upwork 1099 Tax Form?

Not everyone gets a golden ticket in the form of a 1099 from Upwork. You'll typically receive one if you've earned $600 or more during the tax year. Now, this doesn't mean you're off the hook if you've earned less – you're still responsible for reporting your income, but Upwork won't be sending you an official document.

Different Types of Upwork 1099 Forms

Now, let's talk variety. Upwork offers different flavors of 1099s – the most common ones being the 1099-NEC and the 1099-K.

1. 1099-NEC (Non-employee compensation):

The 1099-NEC is your go-to if you're an independent contractor, and you'll get this bad boy if you've earned $600 or more. It details your total earnings and any fees Upwork might have deducted.

Purpose:

- The 1099-NEC form is used to report non-employee compensation. If you are an independent contractor, freelancer, or self-employed individual and have earned $600 or more from Upwork during the tax year, you will receive this form.

Contents:

- Total Earnings: The 1099-NEC details your total earnings from Upwork.

- Fees Deducted by Upwork: Any fees or commissions deducted by Upwork will be reflected on this form, providing a clear picture of your net income.

Significance:

- This form is essential for independent contractors to report their income and associated expenses when filing their tax returns.

2. 1099-K:

On the flip side, Form 1099-K is for those of you who have hit the big leagues, earning $20,000 or more and having 200 or more transactions in a calendar year. However, for tax year 2024, this threshold will change from $20,000 to $5,000. This form is a bit more detailed, as it breaks down your income based on client payments.

Purpose:

- The 1099-K form is issued to freelancers who have reached a higher threshold of earnings and transactions. You will receive a 1099-K if you have earned $20,000 ($5,000 beginning in tax year 2024) or more and had 200 or more transactions in a calendar year.

Contents:

- Detailed Income Breakdown: Unlike the 1099-NEC, the 1099-K provides a more detailed breakdown of your income. It includes the total amount of payments you received from clients on Upwork, giving insight into your revenue based on client payments.

Significance:

- The 1099-K is typically issued to freelancers who have achieved a higher level of income and transaction volume on Upwork. It is important for those who have reached this threshold to report their income accurately.

Navigating the Tax Landscape: Upwork 1099 Implications and Freelancer Deductions

Having to pay taxes on your Upwork income is tough, but it's a part of the freelancing deal. The good news is, tax write-offs help soften the hit, letting you keep more of your earnings.

Taxation of Upwork earnings

Alright, let's get real about taxes. Upwork income is considered self-employment income, and that means you're responsible for both the employer and employee sides of Social Security and Medicare taxes.

When you receive your 1099, it's not just a memo; it's a call to action. You'll report your income on your Schedule C as part of your overall tax return. But don't worry – there are perks to being your own boss, like deducting business expenses to reduce your taxable income.

Deductions and expenses for Upwork freelancers

Now, about those deductions. As a freelancer, you're eligible to deduct business-related expenses to ease the tax burden. This could include anything from home office expenses to software subscriptions that keep your freelance ship sailing smoothly.

Some of the most common tax deductions for Upwork freelancers include:

- Home office expenses

- Software subscriptions

- Equipment purchases

- Professional development courses

- Portion of internet and phone bills

Keep detailed records of your expenses throughout the year, and come tax time, you'll be thanking yourself for those savvy deductions.

Receiving and Reviewing Your Upwork 1099 Form

As tax season nears and your 1099 Form arrives, there are a few crucial steps to take before diving into the filing process.

When and how Upwork sends 1099 Forms

Curious about when Upwork sends out your 1099 form? Hold tight – Upwork typically sends these forms by January 31st. So, keep an eye on your inbox or your physical mailbox around that time.

And in this digital age, Upwork usually provides an electronic copy of your 1099 in addition to the snail mail version. Double the chances of not missing it!

Verifying the accuracy of your Upwork 1099 Form

Once that 1099 arrives, give it a good look over. Make sure all the information is accurate, from your name and address to the amounts earned. If something looks fishy, don't hesitate to reach out to Upwork support to get things straightened out.

Remember, this form isn't just for show; it's the foundation of your tax reporting. Accuracy is key!

4 areas to verify Upwork 1099 accuracy:

- Personal Information: Check your personal details, including your name, address, and taxpayer identification number (usually your Social Security Number or Employer Identification Number). Any discrepancies in this information can lead to issues when reporting your income to the IRS.

- Earnings Summary: Scrutinize the earnings summary section of the 1099 form. Ensure that the total amount reported aligns with your records of income from Upwork during the tax year. If you notice any discrepancies, it's crucial to address them promptly to avoid miscalculations on your tax return.

- Correct Tax Year: Confirm that the tax year on the form is accurate. The 1099 should correspond to the income earned in the specific tax year, and using the wrong form for the wrong year could result in inaccuracies in your tax filings.

- Verification of Fees and Deductions: If Upwork has deducted any fees or commissions from your earnings, double-check these deductions. Ensure that they match Upwork's fee structure, and verify that you have accounted for these deductions in your own records. This step is crucial for accurately reporting your net income.

Filing Taxes with Upwork 1099 Forms

After confirming that your form is error-free, it's time to begin filing.

Including Upwork income in your tax return

When you're ready to tackle your tax return, you'll report your Upwork income on Schedule C (Profit or Loss from Business). This is where you detail your earnings and subtract your business expenses.

Here's 3 action steps to take during tax season:

- Receipt and Review: Upon receipt of the 1099 form, freelancers should carefully review all the information. Ensure that personal details, total earnings, and deductions are accurate. If discrepancies are identified, contacting Upwork support promptly is advisable.

- Tax Return Preparation: Freelancers should use the information provided on the 1099 form when preparing their tax returns. The total earnings reported on the form should be accurately reflected in the appropriate sections of the tax return.

- Documentation for Audits: The Upwork 1099 form serves as crucial documentation in case of an IRS audit. Keeping a copy of the form with your tax records ensures you have the necessary evidence to support the income reported on your tax return.

If the thought of DIY tax filing sends shivers down your spine, consider enlisting the help of tax software or a tax professional.

Common mistakes to avoid when filing Upwork taxes

Ah, the pitfalls of tax season. Let's address some common mistakes freelancers make when filing their Upwork taxes. First off, don't forget to report all your income, even if it's below the $600 threshold for receiving a 1099.

Secondly, keep those records in check. Detailed records of income and expenses are your best friends when the IRS comes knocking. And lastly, don't skip out on deductions you're entitled to. Every penny counts!

Here's 3 more common mistakes to avoid:

- Ignoring Quarterly Taxes: Freelancers often forget about quarterly estimated tax payments. Since Upwork doesn't withhold taxes from your payments, it's crucial to estimate your tax liability and make quarterly payments to avoid a hefty bill come tax season. Keep a calendar reminder to stay on top of these payments.

- Forgetting to Keep Personal and Business Finances Separate: Mixing personal and business finances is a recipe for confusion and potential tax headaches. Establish separate bank accounts for your freelance income and expenses. This not only simplifies record-keeping but also helps demonstrate the legitimacy of your business to the IRS.

- Ignoring Self-Employment Tax: Self-employment tax covers Social Security and Medicare taxes for freelancers. Some freelancers mistakenly overlook this aspect, leading to a surprise tax hit. Be sure to factor in self-employment tax when planning your finances and setting aside money for taxes.

Additional Tips and Resources for Self-Employment Taxes

Feeling a bit overwhelmed with the tax jargon and forms? It's totally okay to seek professional tax advice.

Seeking professional advice for Upwork taxes

A tax professional can provide personalized guidance based on your unique freelancing situation, ensuring you maximize your deductions and minimize your tax stress.

Here's some tips to help you choose the right tax advisor:

- Specialization in Freelancer Taxes: Look for a tax advisor with expertise in handling freelancer taxes. Freelancing comes with its own set of intricacies, and a professional who understands the unique challenges and opportunities in this field can provide more accurate and beneficial advice.

- Clear Fee Structure: Ensure transparency in the tax advisor's fee structure. Understand how they charge for their services – whether it's a flat fee, hourly rate, or a percentage of your refund. A clear fee structure helps you avoid surprises and allows you to budget for professional tax assistance effectively.

- Professional Certifications and Qualifications: Verify the tax advisor's certifications and qualifications. Enrolled Agents (EAs), Certified Public Accountants (CPAs), or tax attorneys bring different skill sets to the table. Ensure your chosen professional has the appropriate credentials and stays updated with the latest tax regulations.

Upwork resources for tax information

Don't forget to tap into Upwork's official resources. They've got FAQs, guides, and even customer support to assist with any tax-related queries. It's always good to go straight to the source for accurate and up-to-date information.

How Can Indy Help?

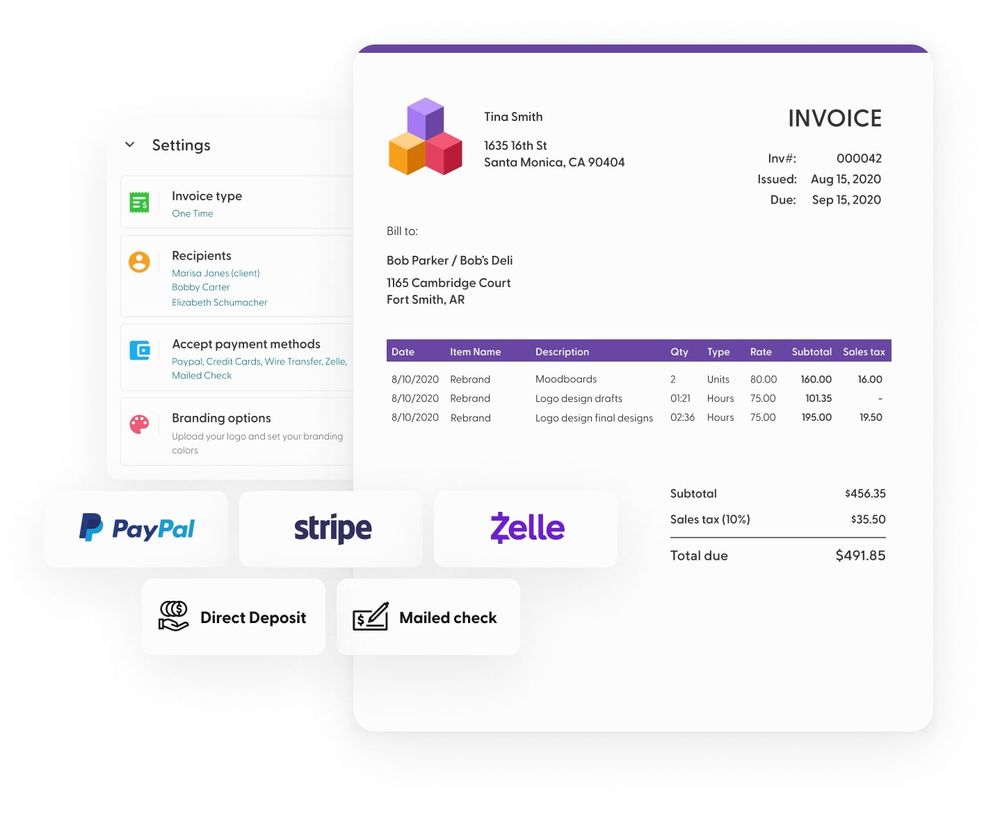

Balancing your freelance business alongside tax season can be tricky. However, tools like Indy not only make running your business easier but also contribute to saving money on your tax bill.

Let's explore how Indy can fast-track your success:

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your designs and grow your business.

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share designs and any other documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself! Let Indy handle the administrative side, freeing you up to focus on what you do best, crafting outstanding projects for clients.

Get started today for free and take your business to the next level!

A Quick Recap

For freelancers, handling taxes on platforms like Upwork is crucial for a successful business. The Upwork 1099 tax form plays a central role in documenting income and reporting to the IRS. Knowing details like personal information, total earnings, and deductions is essential for freelancers to report income accurately and stay on top of their financial game. Understanding income tax requires familiarity with the relevant tax laws. If you find it challenging to pay your income taxes, consider seeking professional legal or tax advice for assistance.

Looking to fast-track your freelance business and maximize savings come tax season, get started with Indy for free. Manage your entire business in one place, from contracts to invoicing and everything in between.