Are you a makeup artist or thinking about taking off to freelance waters and starting your own business in the glamorous world of beauty? If so, you may be wondering what tax deductions are available for your line of work. The good news is, there are numerous tax write-offs specifically tailored to the unique needs and expenses of the beauty industry. From professional development courses to makeup products and even your home office setup – we've got you covered.

In this post, we'll explore some top tax deductions that are sure to save you money and help you run a profitable business. We will mention the tax deductions from your business expenses as a makeup artist --- everything from the supplies cost to the self-employed tax. Additionally, you'll get to see how Indy can help you stay organized and plan all your payments!

Introduction to Makeup Artist Tax Deductions

Along with other more common freelancer tax deductions, makeup artists are eligible for tax deductions for equipment that are specific to their line of work. The deductions you keep track of may not seem important on their own, but over time they build up to provide you a benefit at the end of the tax season.

Your makeup artist tax deductions will result in fewer taxes owed and more money in your pocket, which will make you pleased since you've reduced your taxable income.

How Do You Determine Whether or Not a Makeup Artist Expense Is Deductible?

The Internal Revenue Service (IRS), sets the guidelines for what costs can be written off. According to the rules, a cost must be both regular and necessary:

Regular refers to anything typical and accepted in your industry, like makeup brushes.

Necessary means that something is useful and acceptable for your line of work but is not essential. An excellent illustration of a necessary investment would be ongoing training.

But let's dive into a more detailed explanation of your tax-deductible business expenses as freelance makeup artist:

Equipment and supplies cost

As a makeup artist, you incur many makeup costs to do your job. If you want to be considered a serious freelance makeup artist, you need to have a professional kit.

The good news is that many of these costs can be written off as business expenses on your taxes, meaning you can write off makeup as a tax deduction since no one expects you to use the same makeup kit over and over again. Plus, since you don't use office supplies, here is the list of the equipment and makeup kit supplies costs that you can deduct:

- Makeup brushes

- Makeup products

- Skincare products

- Hair care products

- Nail care products

- Disposables (cotton balls, tissues, makeup wipes, etc.)

- Public transportation costs (if you travel to clients)

Health insurance

As a freelance makeup artist, you can deduct 100% of your monthly premiums as long as you don't have health insurance via a spouse or work. Remember that you may only deduct the amount of your monthly health insurance premiums (not the full cost of your plan) if you obtain a government subsidy. Your health insurance premiums are NOT deductible as a business expense on Form 1040, but rather as a personal deduction.

Vehicle costs and transportation fees

You can use the simplified option and calculate the deduction for car expenses using the standard mileage rate. Simply multiply the IRS-required mileage rate, which is 65.5 cents for 2023, by the total yearly miles that you used for business purposes (and not personal use).

As an alternative, you can keep track of your actual expenses and base your deductions on them. Deductions are permitted for additional costs including petrol, maintenance and repairs, parking fees, car insurance, and road tolls. It is important to remember that you cannot deduct these specific costs if you use a standard mileage rate. You can find more details about transportation write-offs in this article.

Cost of office and studio space

Whether you choose to work from home or rent office space, you can deduct all or part of directly related expenses for keeping it. Keep in mind that how much you use the home office will directly impact the expenses you may be able to deduct.

If you choose to rent an office space for business use, that is tax deductible. However, if you work from home, you can write off a percentage of your expenses for utilities, home insurance, and mortgage interest. Additionally, you may allocate and deduct the monthly phone and internet costs.

Professional development

To stay at the top of your game as a freelance makeup artist, you need to keep up the pace with the trends. So, if you attend online makeup classes or other training session, or buy makeup publications (like magazines and books), you can write it off as makeup artist tax deductions.

Self-Employment Tax as a Makeup Artist

Being your own boss and owning a makeup business means you are self-employed. This means that you are responsible for filing taxes on your own and paying for them. The good news is that there are several makeup artist tax deductions that you can take advantage of.

Self-employment tax is one of the taxes you are responsible for as a makeup artist. This tax is equal to 15.3% of your taxable income. This may seem like a lot, but it includes both Social Security and Medicare taxes. These taxes are used to fund programs that provide benefits for those who are retired or who have disabilities.

How Can Indy Help?

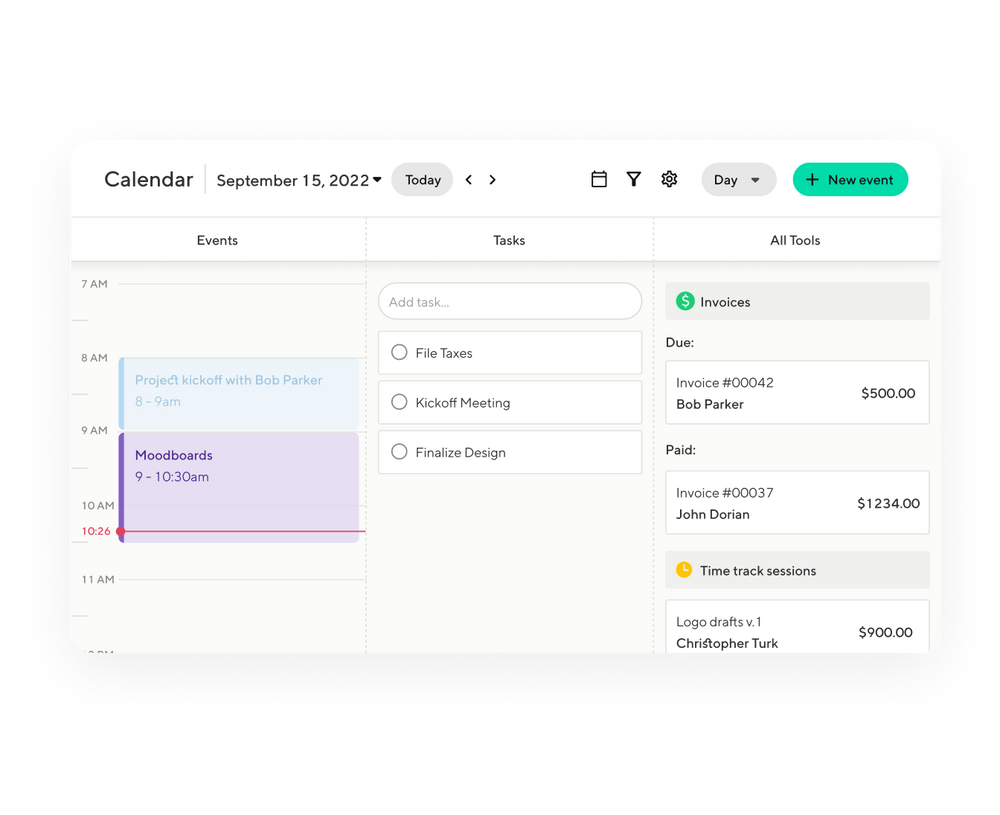

To be able to file taxes before you reach tax time, you need to have meticulous data on all your capital expenses. You can track the total cost of all your makeup expenses with Indy's Invoice app. This app lets you organize all of your current and future spendings while keeping you in check so as to not mix personal expenses into your makeup tax deductions.

Conclusion

As a makeup artist, tax deductions available to you can help you greatly by reducing your taxable income. Knowing what deductions are applicable for professionals in the beauty industry will help keep more of your money where it belongs - in your pocket! When you learn which of these tax write-offs you can get, you’ll be able to have more financial security, a bigger tax return, as well as peace of mind.