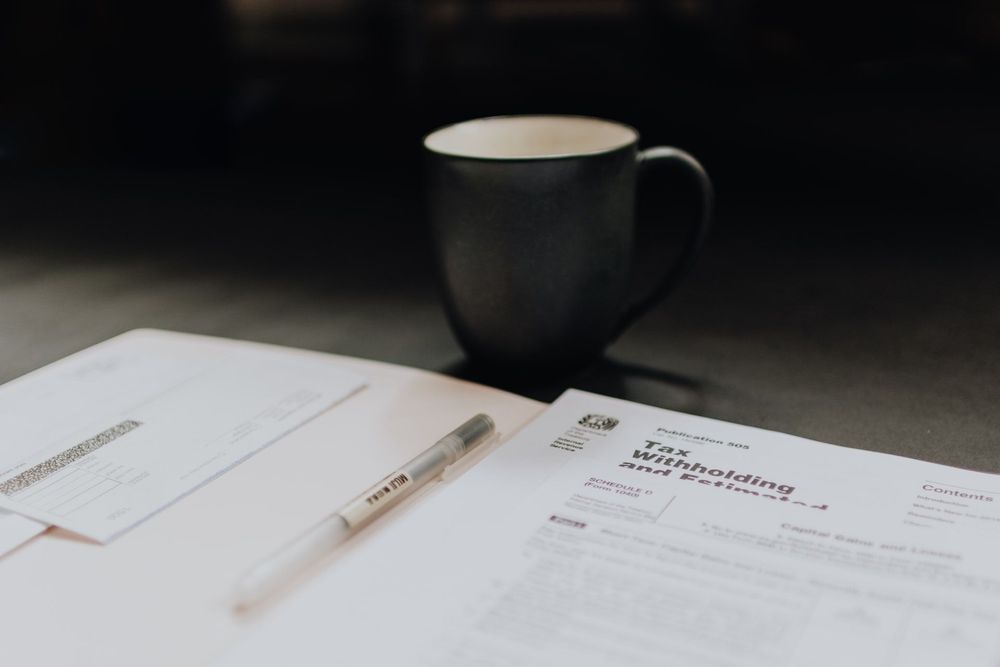

As a freelancer or independent contractor, you should already know that your clients are not obligated to send you a 1099 form for any earnings under $600. It is easy to assume that since clients do not have to send the 1099s, you do not need to report income below $600.

Also, some freelancers assume they do not need to file federal income tax for earnings if they do not receive the form 1099 from clients. However, all these are misconceptions as the Internal Revenue Service requires you to report income regardless of the amount or whether you get a 1099 or not.

This guide explains key things you need to know on reporting income below $600 and others, like keeping track of your income and expenses for the tax year.

Why is it necessary to report all income?

While the Internal Revenue Service will require clients and businesses to issue the 1099 form when the payments they make for the tax year are over $600, there is no such requirement for reporting income.

As an independent contractor, you have to report all income regardless of the amount when you file taxes. The IRS will require you to report all income using the form 1040, and failing to do it can lead to hefty monetary penalties or criminal penalties in some cases as it is illegal to evade or underpay taxes. The reported income should also include cash payments.

Besides getting in trouble with the IRS for tax fraud, failing to report any income when tax filing can have other adverse consequences for taxpayers.

Key among them is that it can deny you certain tax deductions and credits that depend on your taxable income, such as dependent and childcare credits. Without these credits, you end up with a higher self-employment tax obligation.

Additionally, failing to report any non-employee compensation for the tax year can affect your other financial transactions, such as credit and mortgage applications. Leaving out your small miscellaneous income can contribute to getting a lower credit score, as it will be hard to explain to any financial institution you earn more money than what you report in your tax return.

Finally, you can also look at it from the morality angle. Reporting all your income is the right thing to do, even if the IRS might not find out about some small earnings that do not qualify for inclusion in a Form 1099-NEC.

Do you have to pay self-employment taxes for income under $600?

The IRS does not peg payment of self-employment tax on the 1099 $600 minimum earnings. Therefore, even if you do not make the $600 minimum required to get a 1099 form, you may still need to pay self-employment taxes.

The IRS requires you to file taxes for your self-employment business if your income for the tax year is at least $400. The rule is that if your self-employment income is at least $400 after deducting all qualified business expenses, you have to pay self-employment taxes.

However, it is important to note that although the filing threshold for self-employment tax is $400, you still have to report all the income the business makes in the year. Also, you still owe taxes for other tax obligations, such as personal income taxes.

Are there penalties for not reporting income under $600?

Tax filing is mandatory regardless of your income, and the Internal Revenue Service will penalize you if you do not fill out your tax form to report income for the year regardless of the amount.

Failing to report any income under $600 means you will owe both the tax for that income and the penalty for failing to report and pay the tax. The interest on the penalty will start accumulating from the tax deadline day and will keep accruing until you pay the taxes plus fines.

Therefore, even if the IRS does not flag the tax underpayment now and picks it up many months or even years down the line, you will have to pay the taxes plus all the penalties. You can end up with a massive tax bill just for failing to report a few dollars.

The Internal Revenue Service publishes interest rates for tax underpayments every quarter. Also, it uses other factors like the amount of underpayment amount and the period the tax was due to calculate penalties for failing to report income.

That said, whether you get 1099s or not, your taxes owed will not disappear, and so you still need to report all your self-employment income to file taxes accurately.

How to report income under $600

Reporting your income under $600 for the tax year does not require any special IRS form or process as it is similar to how you would report any other income. The most important thing is to make sure you include it when calculating your taxable income.

Independent contractors and freelancers should use the Schedule C form that is part of form 1040 to report earnings for the year regardless of the amount they make.

Know the taxes to pay

As an independent contractor in the USA, you will need to pay 4 types of taxes, whether you earn $600 or not.

- Federal income tax

- State taxes

- Local/county taxes

- Self-employment taxes

What you need to pay for most of these taxes depends on factors like your taxable income and tax bracket. Also, your tax obligations are dependent on other things like the write-offs or tax deductions and credits you are entitled to for business expenses as a self-employed individual.

Self-employment taxes are the only type that does not change depending on your location or tax bracket. The taxes cover Medicare and Social Security taxes, and the current IRS rate is 15.3%.

Reporting using schedule C-EZ

The Schedule C-EZ form provides an easier way to file tax returns when you make income for your freelancer business that does not qualify for a form 1099. Schedule C-EZ is a simplified version of the Schedule C form as it requires less information than the latter and will hence be quicker and easier to fill out for earnings under $600.

However, the IRS has since discontinued the Schedule C-EZ form from the tax year 2019 going forward. Therefore, self-employed workers still have to use the Schedule C form to file any income even if it does not qualify for a 1099 tax form.

However, you will not need to file quarterly taxes if the income earned is less than $600. You will only need to fill up Schedule C and submit it with your federal tax return before the April 15 tax day deadline.

Keeping track of self-employment income throughout the year

Freelancers and independent contractors need to keep good records of all their business income and expenses throughout the year regardless of the amounts.

A detailed record ensures you get the largest tax breaks and avoid IRS penalties for underpaying taxes. Here are some simple methods you can use to track your self-employed income:

Tracking business income

It is important to keep track of every cent that your business earns. How you do it will vary from one business to the other.

Sole proprietors can use spreadsheets or software to keep track of business income, but the latter is a better solution as it automates the business income tracking process. Also, using software makes it easy to share your income with a tax professional when filing taxes.

Tracking personal income

Personal income is perhaps the most challenging when it comes to tracking your earnings for tax purposes. The income comes from multiple sources, including gifts from friends and relatives, and it is sometimes not business-related.

However, you should have an easy time by making it a habit to record every money you receive in a notebook or even a spreadsheet. Many people do not pay a lot of attention to keeping track of personal income, but the IRS requires you to report this income whether it is taxable or not.

Tracking business-related expenses

Keeping track of all business-related expenses is the best way to reduce your tax obligations, as most of these expenses are tax-deductible. Deductible business expenses include everything necessary to run your business, from simple things like office supplies to others such as home office, business travel expenses and payments from health insurance and retirement savings.

Business-related expenses will reduce your net earnings significantly if you track them throughout the year. Keeping all the receipts you get when you buy or pay for something is the easiest way to track expenses. Additionally, you can also use spreadsheets or software to monitor business expenditure.

When to seek professional assistance

As a non-employee, you are responsible for keeping track of your income and expenses. Also, it is your responsibility to save money for taxes, file returns and make the actual payment to the IRS before the due date.

However, there are some situations when you might not know how to deal with things, such as when you have several payments under $600 with no 1099s to help you out.

You need to talk to a tax professional or contact the IRS for help in such cases. For example, if you are sure you should receive 1099s for work done, the IRS can follow up with the employer on your behalf. A tax professional can provide tax advice or help you fill out the tax forms.

Bottom line

It is mandatory to report all your income even if you do not receive a 1099 form. Therefore, you must keep track of all your income, no matter how small, or you may miss something and end up underreporting your earnings when filing taxes.

Keeping track of all your business earnings and any other income you make in the year and keeping all receipts and any other proof of business-related expenses will ensure you always have an easy time filing taxes.

Indy makes this process simple with a strong invoicing system that keeps all of your invoices in one place, so you can quickly find the invoices you need to report come tax time. What's more, you can create and send invoices, and accept payments right through the platform. Check out Indy's Invoices tool today!