If you’re like many freelancers, you keep your receipts and invoices in a beleaguered file folder and look at the calendar with trepidation as tax deadlines approach. It’s not just that you get anxious that you might owe money while you are still waiting for four clients to pay up on their invoices, but also the fact that the process is confusing and if you do it wrong there could be costly penalties.

Taxes are simpler for workers with a full-time gig since their employers withhold taxes from their paychecks and they don’t need to do the accounting themselves every three months.

For freelancers, quarterly tax deadlines aren’t just stressful – they’re also often confusing. But don’t worry. We’ve got you covered with this quick explainer that will help you tackle your quarterly taxes like a pro.

What You Need to Know About Quarterly Taxes

Since your taxes aren’t being withheld at every paycheck, you’re required to pay taxes four times a year on your self-employed income if you expect to owe at least $1,000 in taxes in any tax year. If you expect to owe less than that, you can pay your taxes via your annual tax return.

Not sure if you will be making enough to pay taxes? Tracking your income and expenses in an Excel spreadsheet or with tax software will help you stay on top of how much you will owe. You can also pay quarterly taxes just in case you end up owing over $1,000 by the end of the year.

Which Taxes Do You Need to Pay?

Freelancers need to pay two taxes -- their income tax and a self-employed tax that bundles their share of the Social Security and Medicare taxes into one. While your income tax bracket will vary depending on how much you’re bringing in, the self-employment tax is 15.3% -- an amount that includes both the portion of these taxes you would pay if you were employed and the portion that your employer would have paid.

That’s right, you actually need to pay more tax as a freelancer. And depending on what state you live in, you might also need to pay quarterly state taxes. Make sure to look into what the rules are in your state.

When are Quarterly Taxes Due?

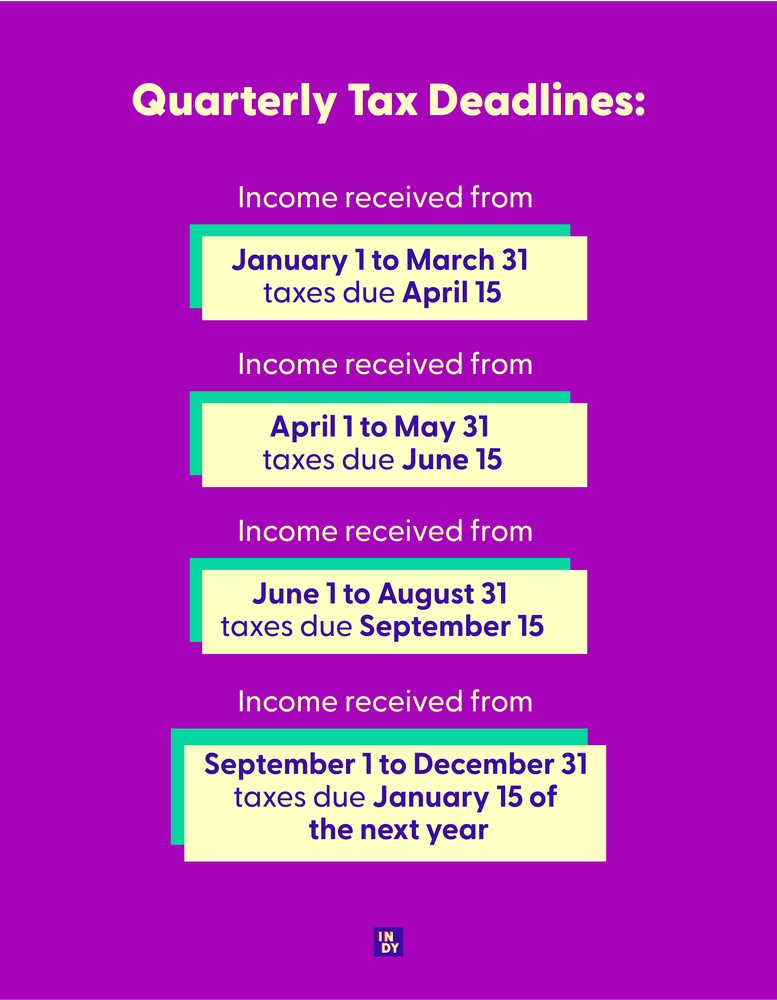

Quarterly taxes are connected to the calendar year and are due every three months. Make sure to put these dates into your agenda, set reminders for yourself, and cover your desk with sticky notes if you have to.

- For income you receive from January 1 to March 31 – your taxes are due April 15.

- For income you receive from April 1 to May 31 – your taxes are due June 15.

- For income you receive from June 1 to August 31 – your taxes are due September 15.

- For income you receive from September 1 to December 31 – your taxes are due January 15 of the next year.

What are the Penalties for Filing Late?

This is where paying taxes gets stressful. If you do it wrong, you could be hit with big penalties from the IRS. Unfortunately, if you forget to pay your taxes, are late on a payment, or screw up in your calculations, you could be on the hook for penalties that go up to 25% on the unpaid taxes you owe.

The first penalty you’ll get hit with is for filing late – you will need to pay at least $485 in a late penalty or 100% of the tax you owe if you owe less than that. However, if you owe more, you could be charged as much as 5% of the taxes you owe every month up to 25% of your unpaid taxes.

The second penalty you could get hit with is a penalty for late payments and is 0.5% each month up to 25% of your total unpaid taxes.

The good news is that combined the penalty can’t exceed 5% each month.

What does all this mean? It means that even if you can’t afford to pay your taxes because your income had to be spent on a project for another client, hasn’t yet been received, or was needed for groceries – you should still file your taxes if you can’t pay to keep your interest and penalties as low as possible.

Depending on your state, you might also be charged penalties if your quarterly state taxes are late.

How Do You Estimate How Much You Owe?

If you’re like me when I first started freelancing, estimating your quarterly taxes feels like something you need an oracle and a Magic Eight ball to do. But don’t turn to divination – a bit of arithmetic will do the trick!

To figure out how much you will need to pay, you’ll need to estimate how much you expect to make in a year and subtract your expenses and deductions for your estimated gross self-employed income. After that, you can check what income tax rate you will be charged, tack on the 15.3% in self-employment taxes, and any state taxes you need to pay. Then divide that by 4 to get your quarterly tax payment amount.

If you estimate your annual taxes too high or too low, you can fill out a 1040-ES form to refigure your estimated tax for the next quarter.

How Do You Actually Stay on Top of All This?

Are you stressed out just reading the quarterly tax explanations above? It’s okay – taxes are a stressful thing. But being on top of your quarterly taxes is easier than you think. It just requires that you keep track of your income and expenses as they are flowing in and out. While you can do that in an Excel spreadsheet you’ve expressly created for it, there are also computer programs, and apps developed to track just this. Make it as easy as possible for yourself!

Here are some more great tips:

- Get a second credit card and business bank account for all your business expenses if you don’t have one already. That will make your accounting and bookkeeping simple.

- Set aside an hour or two every month to update and check your finances to see if your annual income estimate is on track or if you need to tweak it the next time you file your quarterly taxes.

- Hate doing your finances? Hire someone. It could free up time to bring in more freelancing work instead. Stick to what you’re good at.

- Put at least 25% to 30% of your income aside to cover your taxes. Keep it in a separate account so that you don’t accidentally spend it.

- Even if you can’t afford to pay your quarterly taxes because you’re having cash flow issues – make sure to file them. Late fees for payments are significantly less than late fees for filing.

You’ve Got This!

I know this article is starting to sound a bit like a pep talk – but who doesn’t need a pep talk to tackle the hard things in life? Taxes are definitely one of those things where a little encouragement helps. While quarterly taxes may sound complicated, they’re actually simpler than they seem. All you have to do is send the government money every three months based on an estimate of your income. Calculate your expected income at the beginning of the year, set your quarterly payment reminders in your phone, check that you’re on track to make the income you expected and adjust when needed, then file and make your payments on time.

That’s it. You can totally do this. I believe in you.