Whether you’re freelancing on the side or working as an independent contractor, self-employment is an amazing way to take control of your schedule, set your rates according to your skills, and gain independence outside of a traditional job.

However, as you total up your 2020 net income, don’t break out the bubbly to celebrate quite yet as Uncle Sam will need his cut. Being your own boss comes with many responsibilities, chief among them paying self-employment taxes and managing quarterly estimated taxes.

If the words “tax season” have you running for cover, we can’t blame you. With the help of the following resources, you can manage your taxes with ease this season and even get a jump start on next year’s taxes.

Independent Contractor Tax Forms

Since you don’t have an employer to withhold taxes from your income, you’ll need to use the following tax forms and schedules to complete your annual return:

- Form 1040: Form 1040, U.S. Individual Income Tax Return, is the main form self-employed individuals will need to file their taxes. Depending on your situation, you’ll use different schedules to report your income and deductions to determine how much you owe in taxes.

- Schedule C: Schedule C allows you to report profit or loss from a business or sole proprietorship that you operated.

- Schedule SE: Schedule SE enables you to calculate the taxes due on your net self-employment earnings. The Social Security Administration uses the information from Schedule SE to calculate your Social Security benefits.

In addition to state and federal taxes, you’ll use the above forms to pay self-employment taxes. Your self-employment tax, which consists of a federal Social Security tax (12.4%) and Medicare tax (2.9%), is 15.3% of your net business income and covers the portion of FICA that an employer typically covers.

Taxes for self-employed freelancers and independent contractors are a little more hands-on than they are for W2 employees. However, with the following resources, you can successfully and smoothly manage your taxes.

Business Credit Card

Do you have several business expenses throughout the year? Or just a few here and there? Regardless of your answer, a business credit card allows you to keep those expenditures separate from your personal accounting. A dedicated credit card for your business also makes it easier to categorize spending and track expenses that can be deducted from your taxable income. If you decide to use a professional accountant to handle your taxes, they won’t have to spend time sifting through both personal and business expenses—saving you money in the long run.

Separate Bank Accounts

It might seem simplest to use one bank account to manage all of your money. However, multiple bank accounts will provide a clearer sense of where you stand with your finances. At a minimum, it’s a good idea to set up a separate account dedicated to your taxes. A safe rule of thumb is to set aside 25-30% of your taxable income to pay quarterly estimated taxes and any other taxes you may owe come tax season.

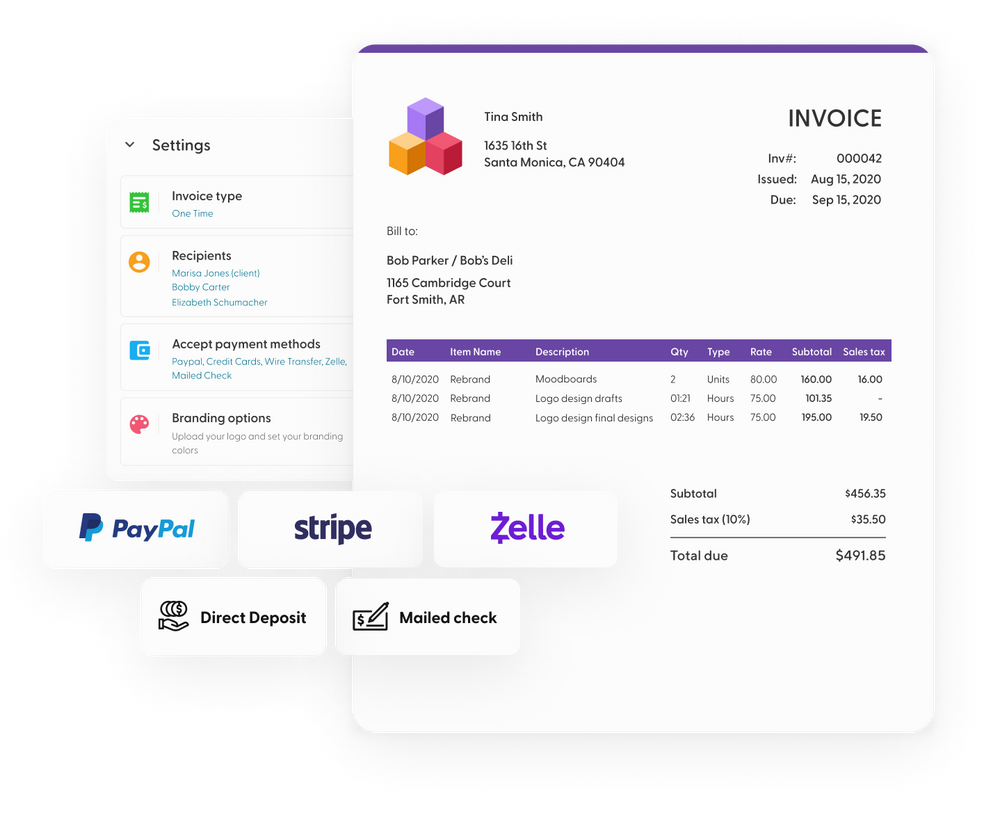

Digital Invoicing System

With Indy’s secure digital invoicing system, you can easily write and send invoices to clients and track payments. A streamlined invoicing system also allows you to integrate your preferred online payment method to simplify your accounting when tax season rolls around.

Although you’ll receive Form 1099s from your clients that paid more than $600 over the course of the year, it’s smart to double-check the amounts they’re reporting against your own invoice records. Reporting less total income than what’s reflected on your 1099s might get you a letter from the IRS.

Tax Preparation Service

If you’re debating whether you should file your own taxes or hire a professional, take a minute to think about your income and expenses. If your taxes are relatively straightforward and you have few deductions to take, you may be better off going the DIY route.

However, if your tax situation is complex (for example, if you have multiple deductions to take, hire subcontractors in your work, or have a high income), it may be worth it to consider investing in professional accounting help. A professional accountant can help you avoid making mistakes in your filing and can also ensure you’re maximizing your tax deductions.

Tax Deductions for the Self-Employed

To lessen the tax burden on self-employed individuals, the IRS offers a number of ways to reduce your taxable income. When you file your tax return, maximize your deductions with the following items commonly used by freelancers and independent contractors:

Home Office

As a freelancer or independent contractor, you’ve probably been working from home even before COVID forced many others to do the same. The home office deduction is more complex than other deductions (you need to calculate the cost of any workspace used exclusively for your business) but could go a long way in reducing your taxable income this year.

Internet and Phone Usage

Whether or not you claim the home office deduction, you can deduct the business usage of your phone and internet bills. However, you need to ensure you’re only deducting the expenses that directly relate to your business.

Health Insurance Premiums

If you’re self-employed and pay for your health insurance premium, you can deduct the cost of your premiums (including health, dental, and qualified long-term care) from your taxable income. You can even deduct premiums paid to cover your spouse and dependents!

Vehicle Use

When you drive your vehicle for business purposes, the mileage is tax-deductible. Keep accurate records of dates, miles driven, and the purpose of each trip. The 2020 standard mileage rate is 57.5 cents per mile and 56 cents per mile in 2021. You can even use mileage tracking apps to simplify these savings.

Professional Fees

If you pay for services that relate to your business, such as bookkeeping, accounting, or legal fees, you can deduct these expenses from your business income.

Marketing

Whatever you spend on advertising and marketing to get the word out about your business is fully deductible. These expenses could include print media, paid social media ads, services from a marketing professional, website design and administration costs, business cards, etc.

Fees and Subscriptions

Deductible fees and subscription costs could include business credit card fees, subscriptions for business software, trade publications related to your line of work, and membership dues for a professional organization.

Filing taxes as a self-employed individual may seem intimidating at first. However, with the help of the resources mentioned above, you can file your taxes with ease this year—and save money in the meantime if you maximize your applicable tax deductions. Even if you feel less than prepared to file your 2020 taxes, do your future self a favor by getting to work on next year’s taxes now.