There’s no denying that freelancing is the best way to have more control over your hours, earnings, and work. But before you can even think of seeking clients, you’ll have to familiarize yourself with some of the important documentation you will encounter as a freelance business.

Some of these forms are there to provide you with financial protection, while others assist with the process of filing taxes. Some are even part of the legal requirements you, as a freelancer, will need to meet!

Let’s look at seven of the most important forms for any freelancer.

Work proposals

In order to start landing clients, the first form you’ll need is a proposal. This form is your opportunity to establish precisely what kind of work your client needs, how long it will take, how much money the job will need, and the final goods and services that fall in line with the project’s scope.

A typical proposal may include any upgrades you offer your clients, such as rush delivery and a project timeline. Other important details include the payment methods you will accept and which parties keep any copyright.

Work proposals are one of the documents that are there to provide you with financial protection. They set clear conditions and expectations for the work done between your client and you as the freelancer. So, if your client wants you to perform more work later down the line - work that does not fit within your project’s scope - or they change their mind on the agreed-upon terms, you can refer them to the work agreement. This can also help you avoid potentially losing any money.

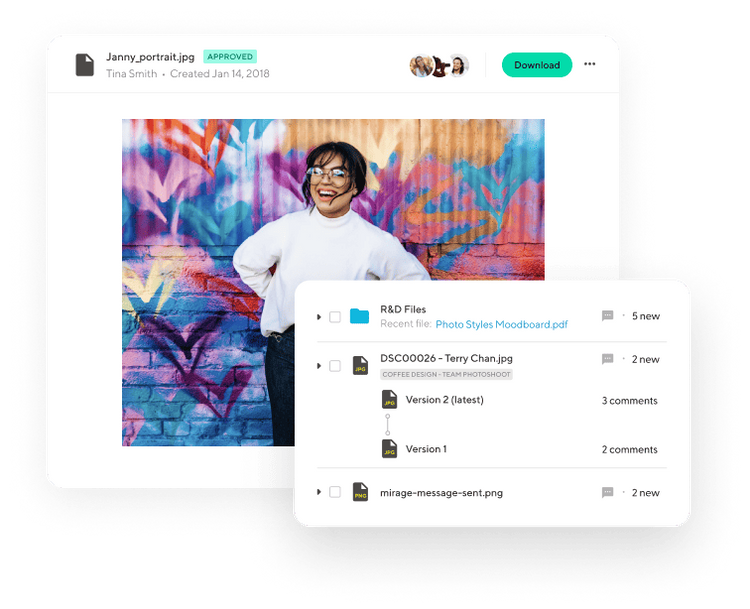

Freelance work proposals also make for helpful references for the requirements of your project as you resume your work. We have an intuitive proposal-building tool that makes it easy to draft professional proposals in minutes.

Work contracts

When you first start your journey as a freelancer, it’s tempting to jump right into contract work, completing jobs for people so that you can start bringing in income as soon as possible. However, avoid doing this at all costs until you have signed a contractor project agreement with your client.

This is perhaps the most important form in your arsenal as a freelancer. It provides you with legal protection for both of you during the work arrangement and will state all of the terms of the freelancing working agreement. This includes, but is not limited to:

- How your services will be performed

- The period for which you and your client will do business

- How you will be compensated

- How any disputes will be resolved

- Materials and who supplies them

- Whether you possess specific credentials, insurance, and licenses

- When the agreement ends, and how

- Relevant taxes to be paid, and who pays them

Without a proper work agreement, you could face some serious financial losses if your client does not pay you as promised – there would be no written evidence to back up your claims. You could also experience problems where your client tries to end the working relationship for no valid reason or tries to alter the terms of your agreement.

During tax time, the IRS (Internal Revenue Service) will value these contracts for clients to ensure that worker misclassification does not occur. At Indy, we make it easy for you to create your own contracts, which you can customize for each different client you work with.

IRS Form W-9

On the topic of the IRS, certain clients will request that you complete the IRS Form W-9. This form is a Request for Taxpayer Identification Number and Certification, and clients could ask for this no matter how much you are planning to earn by working with them.

With that being said, the IRS does require that freelancers fill this form out whenever they expect to make a minimum of $600 from your client throughout the taxation year. Clients usually need this document because it contains your tax ID number, which can be your Social Security Number or your Employer Identification Number (EIN).

It becomes invaluable when your clients send you tax forms that report compensations for your services. The W-9 Form also collects other essential information, including your name, business classification, address, and backup withholding status.

IRS Form 1099-NEC

Another essential tax-filing form you will come across as a freelancer is the 1099-NEC IRS Form (Nonemployee Compensation). For the previous tax year, any client who paid you at least $600 should provide this form to you in January or February.

Some clients send this form regardless of how much work was completed. A 1099-NEC Form contains basic information pertaining to you and your client, as well as the compensation amount and taxes that were withheld.

You will also have to provide your tax preparer with this form, or you’ll have to fill in the data yourself if you file your own taxes. Not getting a 1099-NEC form from a client does not mean that you are not obligated to pay taxes or report the income you earned.

Rather, you will have to gather data about your earnings from alternative sources, such as client invoices or bank statements. Form 1099-MISC was used for freelancing in the past, but it has since changed to Form 1099-NEC.

Client invoice templates

When you work as a full-time employee, you don’t have to concern yourself with asking your employer to pay you. You receive regular paychecks that your employer fully handles.

However, as a self-employed freelancer, you are going to need to invoice your clients for the work that you perform. You’ll need to do this to receive payment through the agreed-upon method in your work contract.

While you can choose from electronic and manual invoicing systems compatible with your bookkeeping system, at some point, you will probably need invoice templates that you can customize and send to your clients.

Business expense documents

Suppose you want to be able to determine your freelancing profits accurately, as well as report all necessary information for your tax return. In that case, you are going to need documentation that confirms business purchases and expenses that you have incurred.

These items will include professional services forms, supplies invoices, insurance, and other documents such as receipts, credit card statements, and canceled checks.

These are all useful documents for creating financial statements for your business, as you can deduct applicable expenses from your income and better understand your business’ stability and profitability. Your tax return will require you to report expenses on IRS Schedule C (Profit or Loss From Business).

This documentation can be useful if you are ever audited and must provide proof to the IRS that you actually spent the money you claim to have.

IRS Form 1040-ES

One of the most important differences between working full-time and working as a freelancer involves the way that you choose to pay your taxes. When you freelance, you are wholly responsible for calculating how much you will owe every year depending on your expenses, earnings, and potential deductions and credits.

After completing these calculations, you must send your estimated taxes to the IRS each quarter. Furthermore, you’ll have to pay a self-employment tax of 15.3%, which includes Social Security and Medicare taxes and your federal income tax.

You would only owe half of this amount as an employee since your employer would also have to pay a share. The IRS can provide you with Form 1040-ES (Estimated Tax for Individuals) and some worksheets that will help you garner the taxes you owe. These sheets also divide the total into quarters, making things easier for you finance-wise.

The estimate you provide to the IRS must be accurate. You don’t want to end up paying more than necessary or dealing with underpayment penalties down the line when you complete your tax returns.

Why freelance?

Freelancing is one of the most freeing forms of employment, as you become responsible for your work hours, salary, and more. As a freelancer, you can work for corporations or individuals and will be able to work on many contracts simultaneously.

While it is possible to work for a single company for an extended period as a freelancer, freelance jobs are usually short-term, and the job often involves working for several companies at once. You might work independently and offer your services to clients directly, or you can work for an agency that resells your services.

Freelancers usually have basic, predetermined fees agreed upon by all parties before work begins. You can choose to make freelancing your long-term, full-time profession or take it up part-time to supplement your income.

The benefits

Every field of employment offers its own advantages and disadvantages. Here are some reasons why freelancing may be an attractive option for earning an income:

Flexibility - Freelancers have the advantage of total flexibility in the workplace, choosing when to work and what kind of work they perform. Most freelancers choose to work remotely from the comfort of their homes, which is one of the greatest advantages of the profession.

Variety - As an independent contractor, you will constantly take on new projects and work for new and exciting clients. Your job will be far more interesting and varied than if you were to work a regular, full-time position.

Mobility - Because most freelancers are performing online work, the field offers a lot of freedom of mobility. While you’ll certainly be able to get up and walk around your house whenever you want, you’ll also be able to work and live wherever you want – that includes traveling while you work, a benefit that not many other jobs offer.

Opportunities - More and more companies are moving toward contracting more freelancers each year since it costs them less than it would to hire permanent employees. With this trajectory, there will be no shortage of jobs for freelancers to take on in the future.

Are there drawbacks?

The short answer: yes. As with any profession, a few unavoidable drawbacks come with working as a freelancer. Let’s discuss them now.

Low stability - Being self-employed might not offer the same stability as a permanent position would, especially since you would be responsible for every aspect of your working life. Depending on how experienced you are, you could easily compete with many other freelancers for work, but you are (sadly) easily replaceable by employers if they are not satisfied with your work.

Potentially low pay - In certain industries, freelancers can receive salary rates below average. This is especially common in highly competitive markets, so be prepared to lower your earning expectations for certain industries.

No paid benefits - As someone who is self-employed, you might not receive included benefits like pension provision, health insurance, and paid sick leave or holidays. Consider planning your monthly savings carefully and even putting them toward retirement and health insurance to help you when you freelance.

The dreaded self-employment tax - You are responsible for managing and paying your own taxes as a freelancer. This also means that you have to pay the self-employment tax, which can be debilitating if you are not earning well throughout the year.

Becoming a freelancer: How it’s done

If you are interested in becoming a freelancer, there are a few things that you need to know. Let’s go over them now.

Find your desired field

To be successful as a freelancer, you’ll first need to settle on what kind of services you want to offer to clients. Building in a fundamental field of expertise can help you get started and narrow your focus.

For example, if you want to do freelance art or graphic design, you should first work on deciding what kind of content you want to specialize in. You could explore creating fantasy artwork commissions or designing things like online brochures, advertisements, and organizational logos.

It helps to get a good grasp of exactly what you want to offer your potential clients, how much you want to charge for your services, and the methods of payment that you are willing to accept. Do market research to see what other freelancers in the same field are charging – that way, you’ll be able to establish a competitive base rate. It also helps to think about your objectives and goals when becoming a freelancer.

Develop a work portfolio

Potential clients will look at your work before they hire you to gauge whether you are a good fit for them or not. Look through the work you have completed in past projects, then gather all of your best work that demonstrates your talent.

When you are building your portfolio, provide a concise explanation of each item and the techniques and mediums used to produce them. Visually appealing portfolios also increase your likelihood of exposure and bringing in more clients.

Find your ideal customer

Being a freelancer, you can choose who to work with. With that in mind, it can be highly beneficial to identify potential clients who would gain the most from your services and products.

We suggest considering working with businesses or individuals, as well as the fields that you are interested in. When starting your career, you can make it easier to find clients by first identifying your target consumer.

You can expand your client base after you are more familiar with freelancing and have gained some expertise. To set yourself apart from your competition, look for a sector or customer that places a premium on quality.

Pick topics that you find interesting, and try to become the best in that field. After honing your skills, you will be ready to confidently charge your new clients more for your services.

Get a website up and running

These days, you’d be doing yourself and your business a massive disservice if you did not build a website. Websites are powerful tools for you to display your contact information, portfolio, pricing structures, and any other important information pertaining to the services that you offer.

It’s also a great place to provide your prospective clients with examples of the work you have done in the past. You can also set up your website in such a way that customers can purchase your services and products directly.

Establish a loyal customer base

While freelancing often involves short-term, temporary contracts, many will work with the same set of clients for extended periods. Building and maintaining loyal customers can help add some more stability to the otherwise unstable profession of freelancing.

Conclusion

Having these templates ready as a freelancer will make your journey simpler and more streamlined. Additionally, clients will be impressed that you have everything you need to work efficiently. Ensure you have these documents and forms saved in a Google Doc folder online so you can access them anytime, anywhere.