Starting your own business is exciting, but it comes with its share of challenges. One big challenge is managing your money. The most important thing? Separating your business and personal taxes. That being said, many freelancers wonder if it’s possible to file your personal and business taxes separately.

In this article, we'll talk about why it’s important to separate your finances, whether or not you can file them separately, and how it can make your life as a freelancer easier.

Understanding the Importance of Separating Business and Personal Taxes

If you're diving into the exciting world of self-employment, you've probably realized that managing your finances is a bit more complex than it was when you were just a nine-to-fiver. One key aspect that can't be overlooked is the separation of business and personal taxes.

It's not just about following the rules; it can make your life a whole lot easier. Let's delve into the why and how of this crucial financial strategy.

Why separate business and personal taxes?

The separation of business and personal taxes isn't just a suggestion; it's often a legal requirement. Understanding the distinctions between your personal and business finances is not only good practice but can save you from potential legal headaches down the road.

In many jurisdictions, different tax rates, deductions, and regulations apply to personal and business income. By keeping these realms separate, you're not only playing by the rules, but you're also creating a clear and transparent financial picture.

Advantages of keeping business and personal finances separate

Now, why bother with all this separation? Well, there are some serious advantages to doing so. Picture this: clear financial visibility, reduced stress during tax season, and improved decision-making for your business. Intrigued? Let's explore these benefits in more detail.

For starters, maintaining a separation between personal and business expenses simplifies your accounting. You can easily track your business's financial health without sifting through personal transactions. Come tax time, you'll thank yourself for the organized records.

Moreover, keeping your business and personal finances distinct safeguards your personal assets. In the unfortunate event of legal troubles or business debt, your personal savings and property are less likely to be affected. It's like building a financial fortress around your personal life.

Can You File Business Taxes Separately from Personal Taxes?

Now, let's dive into the big question: Can you file business taxes separately from personal taxes? The answer depends on your chosen business structure, as this isn't just a label; it defines the legal and financial boundaries between your business and personal life.

Let's break down how each structure affects your personal liability and tax obligations:

1. Sole Proprietorship:

- Definition: In a sole proprietorship, there's no legal separation between you and your business. This means you're personally responsible for any business debts or legal issues. On the tax front, your business income is reported on your personal tax return.

- Tax Filing: Business income is reported on the owner's personal tax return using Schedule C. If self-employed with earnings exceeding $400, Schedule SE is also required.

- Separate Filing: No, business and personal taxes are filed together.

2. Partnership:

- Definition: A partnership involves two or more owners who share profits and responsibilities.

- Tax Filing: Partnerships file an information return using Form 1065. Each partner receives a K-1 to report their share of income on their personal tax return (Form 1040).

- Separate Filing: Business and personal taxes are filed separately, but individual partners integrate their share of business income on personal returns.

3. C Corporation:

- Definition: Now, let's talk corporations. C corporations are standalone entities with their own tax rates, and income is taxed at both the corporate and individual levels.

- Tax Filing: Business income is filed separately using Form 1120.

- Separate Filing: Yes, business and personal taxes are filed separately.

4. S Corporation:

- Definition: S corporations, on the other hand, pass income, deductions, and credits through to their shareholders for federal tax purposes. The key here is that both C and S corporations provide a level of personal liability protection.

- Tax Filing: S corporations file Form 1120-S. Shareholders receive a K-1 to report income on personal tax returns (Schedule E).

- Separate Filing: Business and personal taxes are filed separately, but shareholders report their share of business income on personal returns.

5. Limited Liability Company (LLC):

- Definition: Switching gears to an LLC, the clue is in the name: limited liability. Your personal assets generally aren't at risk in case of business troubles. As for taxes, an LLC can choose between pass-through taxation (where profits and losses pass through to the owners' personal tax returns) or corporate taxation.

- Tax Filing: Single-owner LLCs are often treated as sole proprietorships, filing with personal taxes. Multi-owner LLCs are treated as partnerships. LLCs can elect corporate status, requiring separate filing using business taxes.

- Separate Filing: Depends on the LLC's structure. Single-owner LLCs typically file with personal taxes, while multi-owner LLCs file business income with personal taxes. If the LLC elects corporate status, business and personal taxes are filed separately.

Choosing the right structure involves weighing the benefits of liability protection against the complexities of tax obligations. It's a balancing act that can have a significant impact on your freelancing journey.

However, even if filing separately isn't an option based on your chosen business structure, maintaining a clear separation between personal and business finances is a smart practice. Here's a guide on how to achieve that.

How to Separate Business and Personal Finances

Whether or not you can file taxes separately, maintaining a clear separation between your business and personal finances has plenty of benefits. It protects assets, ensures organized records, and simplifies accounting.

Now, let's dive into a step-by-step guide to get you started on the right foot.

Setting up separate bank accounts for business and personal use

The first and most fundamental step is setting up dedicated bank accounts for your business and personal transactions. This clear separation not only aids in record-keeping but also helps you resist the temptation to dip into your business funds for personal needs (and vice versa).

Choosing a business account that suits your freelancing needs is crucial. Look for an account with minimal fees, online banking options, and features tailored to small businesses. Remember, the goal is to make your financial life simpler, not more complicated.

Maintaining clear and accurate record-keeping

Now, let's talk about everyone's favorite topic: record-keeping. We get it; it's not the most thrilling part of freelancing, but trust us, it'll make things much easier. Keep detailed records of every business transaction, no matter how small.

Consider adopting a digital accounting system to streamline this process. Cloud-based tools not only make record-keeping more efficient but also allow you to access your financial data from anywhere. Quick, easy, and less paperwork—what's not to love?

Tracking business expenses: What you need to know

Business expenses are a lifesaver when it comes to minimizing your tax bill. But here's the catch: you can only benefit from them if you track them diligently. From office supplies to business travel, make it a habit to record every expense related to your freelancing gig.

Consider using apps designed for expense tracking. Many of them allow you to snap pictures of receipts, categorize expenses, and generate reports.

Here's some of the most common business deductions:

- Office supplies and equipment

- Professional development courses

- Marketing and advertising costs

- Software subscriptions

- Home office expenses

- Travel expenses for client meetings or conferences

Having a separate business bank account makes tracking business deductions easier, keeping your personal and business finances separate and your records crystal clear.

Hiring Professional Help: Accountants and Tax Advisors

Navigating the intricacies of business and personal taxes can be overwhelming, and that's where the pros come in. Let's explore the role of accountants and tax advisors in helping freelancers keep their financial house in order.

The role of an accountant in keeping business and personal taxes separate

An accountant is like your financial GPS, guiding you through the twists and turns of tax regulations. They can help you set up your accounting system, ensure compliance with tax laws, and provide valuable insights into maximizing your deductions.

One of the accountant's key roles is to assist in separating your business and personal finances. They can help you establish efficient record-keeping practices, ensuring that every transaction is properly categorized. This not only makes your life easier but also keeps the taxman at bay.

How to choose the right tax advisor for your freelance business

Choosing the right tax advisor is a bit like finding a business partner. You want someone who understands the intricacies of freelancing and is committed to helping your business thrive. Here are some tips for finding the perfect tax advisor for your needs:

- Look for experience: A tax advisor with experience working with freelancers understands the unique challenges and opportunities in this line of work.

- Check credentials: Ensure your tax advisor is qualified and up-to-date on the latest tax laws. Certifications like Certified Public Accountant (CPA) can be a good indicator of their expertise.

- Seek referrals: Ask fellow freelancers or small business owners for recommendations. Personal referrals often lead to trustworthy partnerships.

- Discuss fees upfront: Understand how your tax advisor charges for their services. Some may have hourly rates, while others work on a fixed-fee basis. Clarify expectations to avoid surprises.

Staying Informed: Updates and Changes in Tax Laws for Freelancers

Your tax strategy isn't a one-and-done deal. It's a living, breathing entity that needs regular check-ups. Schedule periodic reviews of your financial situation, business structure, and tax strategy. This ensures you're taking advantage of new deductions, credits, or changes in your business that may impact your tax liability.

Resources for staying updated on tax regulations

The internet is your best friend when it comes to staying informed. Bookmark reliable sources for tax news and updates, such as government websites, reputable financial publications, and professional associations. Following industry experts on social media can also provide real-time insights into changes that may affect freelancers.

Remember, knowledge is power when it comes to taxes. The more informed you are, the better equipped you'll be to navigate the ever-changing landscape of tax regulations.

How Can Indy Help?

Managing taxes as a freelancer can be tricky when you're running your own business, but Indy makes it easy!

Here's how Indy can fast-track your success:

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your projects and grow your business.

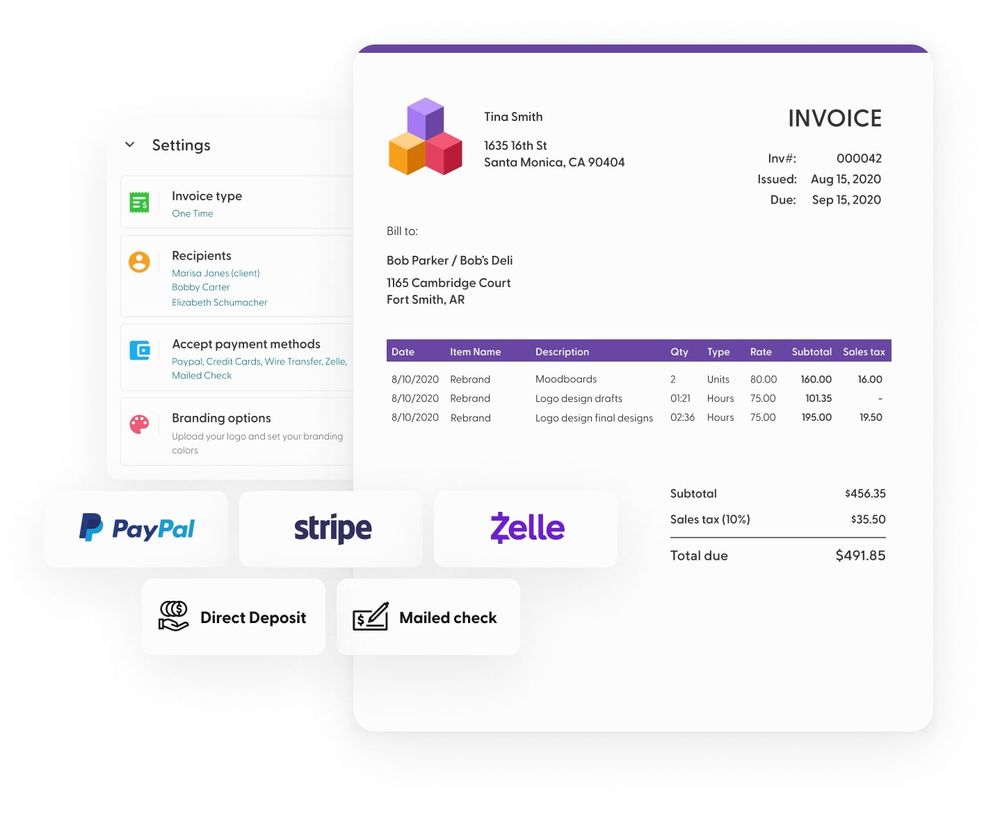

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself. Get started today for free!

A Quick Recap

The answer to whether you can file personal and business taxes separately depends on your chosen business structure. Nonetheless, separating your business and personal taxes is a smart move that can save you time, money, and headaches in the long run. Strategies like setting up separate bank accounts, maximizing deductions, and staying informed on tax laws are crucial for freelancers. If you make frequent purchases, consider getting a business credit card so you can avoid mixing business and personal expenses.

Ready to take your business to the next level? From proposals to project management to invoicing, Indy lets you do it all. Plus, it makes the perfect tax write-off. Get started today for free!