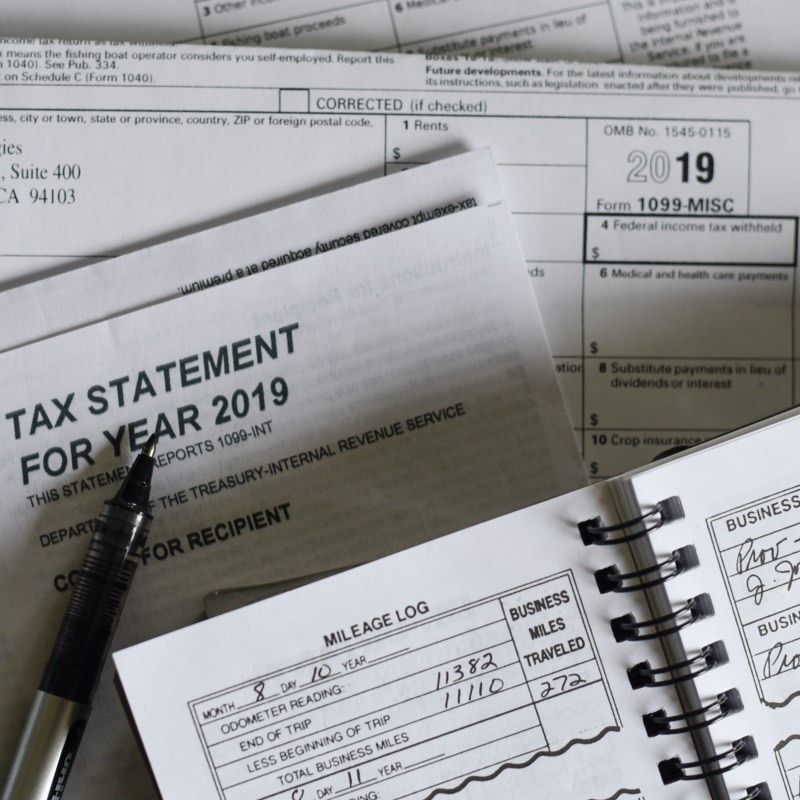

As a freelancer, the 1099 form is your proof of income. It's like your freelance financial report card, and it's crucial for tax purposes. Without it, the IRS might question where that extra cash in your account came from. And, as tax season approaches, the last thing you need is a sudden panic when you discover your 1099 Form is nowhere to be found.

In this article, we'll guide you through the process of obtaining your 1099 Form and what to do in case you misplace this crucial tax document.

When and Where to Expect Your 1099 Form

The waiting game – an inevitable part of the freelance hustle during tax season. Here's when you should keep an eye on your mailbox and inbox for this crucial tax form.

Deadline for employers to issue 1099 Forms

Employers have until January 31st to deliver your 1099 form. However, don't hit the panic button if it's fashionably late; these forms can sometimes take a detour before reaching your mailbox or inbox.

Common platforms and methods for receiving 1099 Forms

Your 1099 form can arrive via various avenues. Some prefer the traditional mail route, while others may send it electronically. Keep a keen eye on your mailbox and email inbox, and make sure to check spam folders. If you use online platforms like Upwork or Fiverr, you'll likely find your 1099 waiting for you there. These platforms provide a convenient space for you to access and download your tax documents. Take a deep breath, log in, and follow the virtual breadcrumbs to your financial paperwork.

Ensuring Accuracy in Your 1099 Form

When dealing with taxes, it's always important to thoroughly review the details of every document to prevent any issues or complications come tax season.

Here's a breakdown of what you should carefully look over:

Double-check your information: Accuracy matters

Once that 1099 is in your hands, resist the urge to file it away without a second glance. Take a moment to ensure that all the details are accurate. From your name to your social security number, any discrepancies could lead to headaches down the tax-filing road.

Review your:

- Name: Ensure that your full legal name is spelled correctly on the 1099 form. Any deviation may lead to confusion or potential issues with the IRS.

- Social Security Number (SSN) or Tax Identification Number (TIN): Confirm that your SSN or TIN is accurately recorded. A single digit error can result in complications when the IRS processes your tax return.

- Address: Check that your current address is listed correctly. Any discrepancies may delay the delivery of important tax-related documents.

- Income Amount: Verify that the income reported on the 1099 form aligns with your records. This includes both the gross and net income figures.

- Tax Year: Confirm that the tax year mentioned on the form corresponds to the correct tax year for which the income was earned.

- Employer Information: Double-check the employer's name, address, and identification number to ensure they match your records. This is crucial for accurate tracking and documentation.

- Correct Form Type: Confirm that you have the correct type of 1099 form. Different types exist, such as 1099-NEC for non-employee compensation or 1099-MISC for miscellaneous income.

What to do if there are errors in your 1099 Form

Oops! You spot a typo, a wrong digit in your SSN, or maybe your client misjudged the decimal point. It happens more often than you think. Don't panic! Reach out to your client or employer to rectify the mistake promptly. The IRS will appreciate your attention to detail, and so will your peace of mind.

What Should You Do If You Lose Your 1099 Form?

Losing important documents is a common mishap, and misplacing your 1099 form can be a source of anxiety. However, don't worry – there are steps you can take to remedy the situation and ensure a smooth tax-filing process.

1. Double-check your spaces

Before assuming the worst, retracing your steps and thoroughly checking common spaces where you store important documents can often yield positive results. Look through your filing cabinet, desk drawers, or any other designated areas where you keep tax-related paperwork.

2. Contact your employer or client

In the event that your search proves fruitless, the next logical step is to reach out to your employer or client. Request a duplicate copy of your 1099 form, explaining the circumstances surrounding the loss. Most employers are aware that these documents are critical, and they should be able to provide you with a replacement.

3. Use online platforms

If your work is facilitated through an online platform, such as Upwork or Fiverr, log in to your account. Many platforms store tax documents electronically, allowing you to download a duplicate copy of your 1099 form.

4. Check with the IRS

If all else fails, and you are unable to obtain a duplicate from your employer or online platform, don't panic. The IRS keeps a record of income reported on 1099 forms. You can contact the IRS to request a transcript of your income, which can be used for tax-filing purposes.

5. File on time

Regardless of the circumstances surrounding the loss, it's crucial to file your taxes on time. Missing the deadline can result in penalties and interest. If you're unable to retrieve your 1099 form before the filing deadline, estimate your income and file an extension if necessary. You can then fix or modify your return once you secure a copy of your 1099.

Navigating Tax Season with Your 1099 Form

Once you have retrieved your 1099 document, it's time to kick off the filing process.

Understanding tax deductions and credits for freelancers

As a freelancer, it's not just about reporting income; it's also about maximizing deductions. Dive into the world of allowable expenses – from home office costs to business-related travel. Keep meticulous records and explore the tax benefits available to freelancers. Every eligible deduction is a dollar saved when it comes time to settle up with Uncle Sam. By reducing your taxable income, you can keep more of your hard-earned money in your pocket.

How to report 1099 income on your tax return

Now that you have your 1099 form in hand and a slew of deductions available, let's tackle the tax return itself. Whether you're using tax software or consulting a professional, inputting your 1099 income correctly is crucial. Take it step by step, double-check your entries, and if in doubt, seek professional advice. Accuracy in reporting ensures a smooth journey through tax season.

Are There Unemployment Benefits for Freelancers?

For freelancers, fluctuations in income are not uncommon. During lean periods or unexpected gaps between projects, freelancers might wonder about their eligibility for unemployment benefits.

Exploring a safety net

Unfortunately, the traditional unemployment system is designed for traditional employees, leaving freelancers in a bit of a gray area.

Freelancers and traditional unemployment benefits

Traditional unemployment benefits are typically not available to freelancers since they are considered self-employed. However, it's crucial to stay informed about any changes in legislation or relief programs that may impact freelancers' eligibility for unemployment assistance.

Pandemic emergency unemployment compensation for freelancers

In response to the challenges posed by the COVID-19 pandemic, some governments have introduced special relief programs that extend pandemic unemployment assistance to self-employed individuals, including freelancers. Keep a close eye on announcements and updates from relevant authorities to understand the available support during exceptional circumstances.

Reporting unemployment income on your tax return

If you received unemployment benefits during the tax year, it's important to report this income accurately on your tax return. Unemployment benefits are considered taxable income and should be included in your overall financial picture for the year.

Remember, staying informed about the nuances of unemployment benefits for freelancers is an essential part of financial planning. While the traditional safety nets may not always align with the freelance lifestyle, exploring available options during challenging times can provide much-needed support.

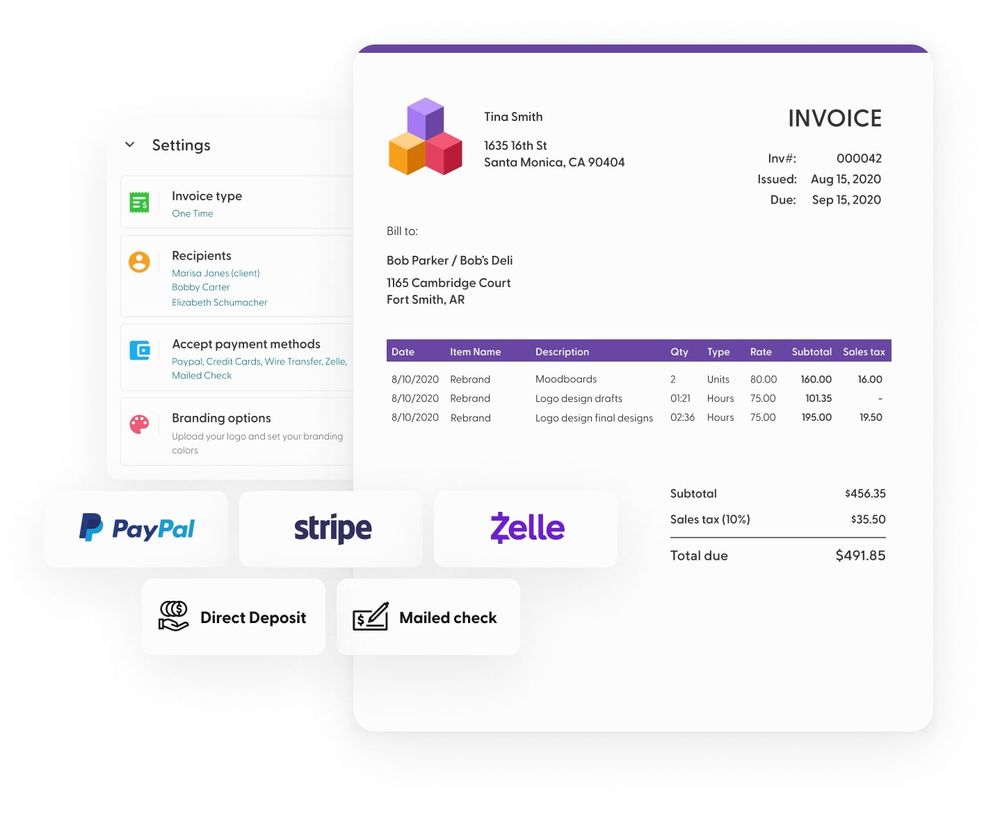

How Can Indy Help?

Managing your freelance business amidst the tax season can be demanding. However, Indy not only streamlines business operations but also contributes to reducing your tax expenses.

Here's how Indy can fast-track your success:

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your designs and grow your business.

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share designs and any other documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself! Let Indy handle the administrative side, so you can focus on what you do best, creating outstanding projects for clients. Get started today for free

A Quick Recap

Your 1099 Form is more than a mere document. It's your proof of the hard work, creativity, and dedication you poured into your freelance endeavors throughout the year. Embrace it, understand it, and wield it confidently as you journey through the intricacies of tax season. If in doubt, don't hesitate to consult with a tax professional who can guide you through the finer steps of navigating a federal tax return.

Looking to fast-track your freelance business and maximize savings come tax season? Get started with Indy for free and manage your entire business under one roof, from contracts to invoicing and everything in between.