You’re self-employed. And if you haven’t yet chosen a formal business entity (LLC, S Corp, etc.), you’re automatically a sole proprietor. Sounds cool, right?

But wait. What does this mean?

What is a sole proprietorship?

A sole proprietorship is the simplest form under which people can operate a business. Legally, the business has no separation from its owner, meaning that income and losses are marked on the business owner’s personal tax return (rather than as a separate entity).

Because freelancers aren’t typically raking in millions (hey, not saying you won’t!) and the work is low-risk, a sole proprietorship is a business entity that generally works well for most self-employed entrepreneurs.

Paying yourself as a sole proprietor

If you’re new to freelancing, you might wonder what the best way to pay yourself is when self-employed. And as the business is still getting on its feet, you might be tempted to not pay yourself anything and live off savings (or another job) until it takes off. However, there are two reasons you should always pay yourself something:

- To prove to the IRS that your business is legitimate

- To make accurate financial projections for the future

But let’s get into the fun part: the money. Paying yourself in a sole proprietorship is actually quite simple. It comes down to two key tasks:

- Setting up a business bank account

- Keeping track of your finances

Setting up a business bank account

Though being a sole proprietor means that you and your business are legally the same entity, you’ll make your life easier by separating your personal expenses and your business expenses with different bank accounts/cards. You can open a business account in your name (you’ll need to file a DBA if you want to use a different name) and use it for any business-related purchases and to receive your business income.

And now, you simply make transfers from your business account to your personal account. You have two options for paying yourself:

- An “Owner’s Draw”. With a draw, you are withdrawing profit from your business and putting it into your personal bank account. Because it’s not a salary, no income taxes, Social Security, or Medicare will come out of your check (or transfer, deposit, etc.). But do keep in mind that you will have to pay those taxes when you file your personal tax return, so put some money aside accordingly.

- A salary. If you have a steady and profitable business income and an idea of how much you can pay yourself on a monthly basis, you can instead opt to pay yourself by salary. This is a bit more complicated than a draw, and would require you to pay quarterly business taxes, including a self-employment tax, which does cover Social Security and Medicare. Check out the IRS’ description here for further information.

Keeping track of your finances

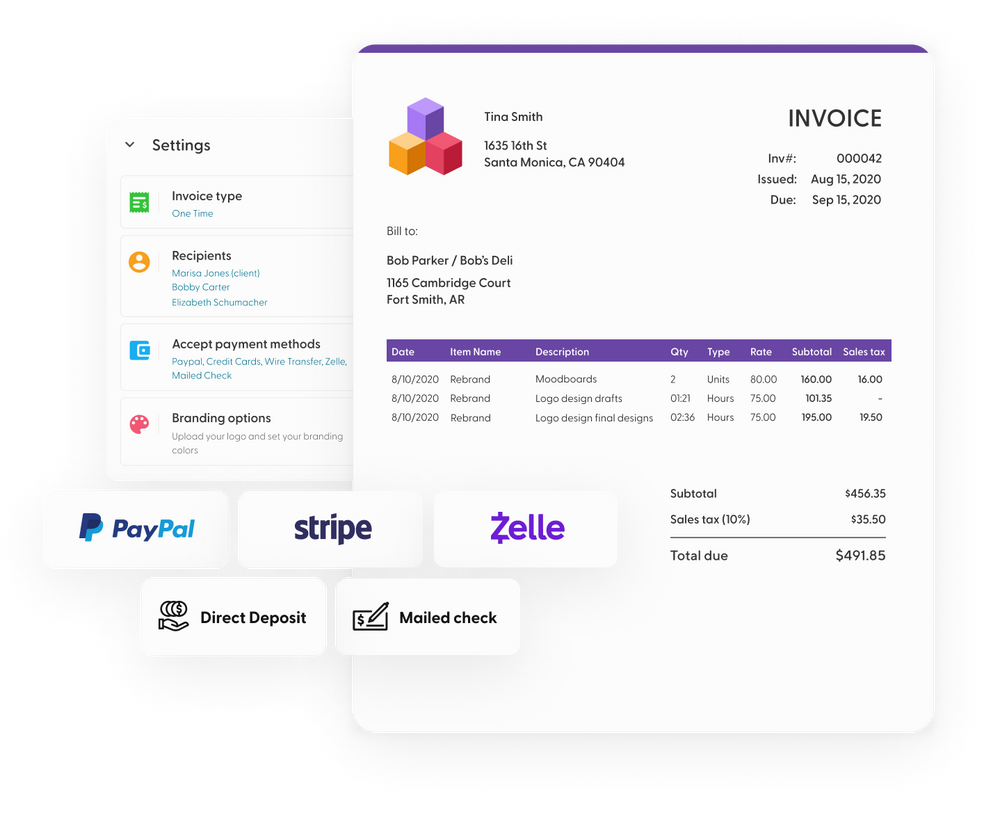

A sole proprietor can pay themselves through either of the two above options that work best for them. What’s key is to adopt a tracking software that makes your life easier and more organized. There are plenty of sophisticated online accounting tools for self-employed workers, and I highly recommend utilizing these over something like an Excel spreadsheet to save you time and headaches. A few online tools that work great are: QuickBooks Self-Employed, FreshBooks, Xero, Wave, and Expensify.

Indy: A one-stop guide on your journey as a sole proprietor

“How do I pay myself?” likely isn’t the only question that’s come up since being self-employed. At Indy, we’ve built a blog dedicated to answering your freelancing-related questions. Head here next to read about one of our blogger’s insights into how he manages his money as a one-person business.