Being a freelancer is such a wonderful experience. You decide how much you want to earn and the frequency of how that money comes in. You choose when to work and when not to. You no longer exchange your time and freedom for the paycheck.

However, all these awesome things come with a terrifying reality. No one will offer you retirement schemes. You may also not qualify for emergency funds in case something comes up. That means you must do all the work to ensure you save and invest wisely for tomorrow and the day after.

But the good part is there are hundreds, if not thousands, of ways you can invest as a freelancer. Here's how to start and go full swing in growing your portfolio.

Benefits of investing as a freelancer

While investing is a good thing for everyone, freelancer or not, most people shy away from it because of the potential risks. For others, it's because they don't understand the juicy benefits of investing.

They end up not investing at all, which is quite risky considering the tumultuous economic times we have been experiencing in the last few years.

Investing as a freelancer is worth it, and the following reasons prove it.

It acts as a safety fund

Since you're not credited monthly with a specific amount, you have a higher chance of being financially deprived. Some months will be good, but others will make you miss your 9-5 employee benefits.

With freelancing, you're usually one terrible deal or month away from experiencing a big dent in your finances. And while that happens, your expenses will remain the same. You won't get any discounts when fueling your car or paying your rent simply because you didn't make as much this month as you expected.

During these kinds of financial constraints, your investment can step in for you to cushion the blow. Investments provide a great alternative source of income to fall back on whenever your freelance income is slowing down.

Your investment can be your passive income

An investment can be a great way to earn money while doing other things, including sleeping, traveling, or even just working on your freelancing job. Whether through property rent, dividends or stocks, investments can be the answer to earning that passive income everyone is talking about these days.

But you may ask, do you need passive income? After all, you have your freelancing income. Well, passive income always ensures you have some cash trickling in consistently. It acts as an assurance against uncertain situations. It's like that imaginary tree with money leaves in your backyard.

It helps with retirement planning

For many people, retirement comes later in life, and if you're employed, you'll most certainly get your pension. For freelancers, pension schemes are out of the question.

Unless you create investments outside your freelancing job, you may need to work even in old age for an income.

But the good thing is that many investments can help you plan your retirement wisely (and even get it early).

There are retirement savings accounts such as the Solo 401(k), the Simplified Employee Pension (SEP) Individual Retirement Account, and Health Savings Account (HSA), all of which you can use to plan and save for retirement.

It helps you achieve financial goals faster and easier

Since your investments bring in cash, you'll earn more, which is a good starting step to achieving your financial goals. You'll be able to pay off debts, improve your credit score, and even create an estate plan.

Paying for a vacation, buying a home, or setting emergency funds aside will become easier and stress-free. You'll be able to easily and quickly achieve financial freedom.

How to start investing as a freelancer

Freelancing may make you feel like you don't have time to sit down, research, and implement your goals due to your never-ending to-do list and looming deadlines.

What if all you need is a guide on what you need to do to start creating an investment portfolio for yourself? A guide for what you need to know before investing as a freelancer?

Consider this section the definitive guide to investing as a freelancer. Here's how to get started.

Learn the ins and outs of investments

There's no shortcut to investing. While anyone can invest and make a success out of it, it always starts by learning. You need to understand how things work around what you intend to invest in. Otherwise, you'll fail. Miserably.

However, the good thing is that we live in an age where technology is evolving, making it easier for us to tap into information wherever we are. You can learn just about anything, including different types of investments, strategies, how to scale, common terminologies, and much more.

You can find most of this information free online. You can also consider investing in courses or coaches. But be very careful about who you choose to learn from. Many wanna-be gurus will not only waste your time but will also run away with your money if you do not take caution.

Have an investment goal

What's your primary goal with the investment you want to participate in? Do you want it to be a secure, steady investment, or are you willing to jump to risky but potentially more rewarding investments? Are you planning to stick to one venture, or will you shift to others over time? And how much are you willing to spend on your investment?

As a caution, unless you're using your disposable income, avoid investing all your income. It's a daring move that is quite risky, especially for a beginner.

Aim to invest 10-20% of your income when starting.

Choose your broker or investment plan

A broker is a person or platform that helps you execute trades. You can choose to go with a broker or an investment plan, depending on your type of investment.

The one thing to be mindful of is how competent they are. Are they able to deliver what they promise? To ascertain this, check reviews online and dig deeper to know their reputation in the market.

Diversify your investment portfolio

Your portfolio is your collection of financial investments. If you only invest in one item, and things go south, you risk losing all your money. However, if your portfolio has several items, you will always have the stability the rest offer if one doesn't work out.

Avoid the get rich quick mentality

You're up for a big disappointment if you enter into an investment with the "get rich quick" mentality.

Yes, investing is exciting, and it can make you imagine all sorts of things — like how you'll soon get a new car, a new home, and pay for that trip you've been planning for ages.

But you have to be patient. If you rush and invest all your money because of the hype surrounding a venture, and don’t take the time to understand how it works, your wallet could suffer.

You need to practice being patient, investing just enough, and knowing when it's time to part ways with an investment.

Understand the market and stay on the course

Don't invest and disappear. You need to check in and see how your investments are performing regularly. You may not see much going on over a short period because of short-term difficulties, but if you analyze the progress over time, you may see a significant change that can help you make informed decisions.

Evaluating performance can help you know when it's time to reinvest, how much you should allocate, and at what frequency.

Be open to new opportunities

Once you become an investor, you must keep your eyes open for new opportunities. For example, consider those who invested in crypto when its concept was still widely unknown. They are probably worth millions if they haven't sold their investment.

A lot may happen worldwide, but sometimes, such chaos creates opportunities. And whoever boards the bus when they see those emerging opportunities will laugh all the way to the bank when things cool down.

You may need to study different markets, acquire new skills, and take many decisive steps before identifying any new opportunities, but it's all worth it in the end.

Best investments for freelancers (even if you don't have savings)

One of the best parts about being a freelancer is having control over your time and money. That means you have complete autonomy over how your money gets invested.

But what exactly are these investments? How do you start as a freelancer? And do you need savings to invest? Let's answer these questions by looking at the five best freelancers' investment ideas.

(Important note: If you are serious about investing, please speak with a financial advisor.)

Invest in stocks

Stocks have remained among many people's favorites for years because of the potential return once the market goes up. You can trade stocks for as little as $1. And it's not as intimidating as you would think.

Investing in stocks simply means buying shares of ownership in a public company. Nothing complicated.

You buy the stock and hold it as long as possible, hoping the company will grow over time; hence, your shares will gain value. When your shares become valuable, you can sell them at a profit.

With stock trading, the rule of thumb is to hold the shares for the long haul. Don't always be tempted to sell whenever you’re scared the price will drop in the short term.

Again, do your research on which shares to buy. Don't be misled by emotions. Evaluate. Check the company's growth rate. Understand the trend of the market it's serving, then decide if it's the best company to buy shares from.

Get into crowdfunded real estate

Real estate crowdfunding is a type of investment where many people contribute to buying property, becoming instant shareholders. This venture makes it possible for small investors (even those without savings) to get into real estate.

Crowdfunded real estate is a hot new way to tap into real estate. It eliminates the common concerns you would have if you were the only property owner. It also pays significant dividends compared to traditional real estate investment. Once the property brings in profits, shareholders each get their share accordingly.

However, something to note is that crowdfunded real estate investments are more expensive compared to stocks.

Buy gold

Your income will be affected by inflation, and precious metals such as gold can offer some form of stability during those high inflation periods. The price of gold goes up with an increase in inflation. And that's why many people run to buy gold whenever they smell inflation on the horizon.

Buying gold is a well-known and stable investment strategy, mainly because of its limited supply. And because it is a tangible commodity.

To profit through gold, you'll have to hold it and sell it when its price goes up.

Try out mutual funds

Investing in mutual funds allows you to diversify your portfolio over many stocks, which is a great way to combat risks that come with buying shares from companies.

To get started with mutual funds, you'll need to create an account with an online brokerage or an investment company and deposit cash. The money you deposit is then used to buy stocks, bonds, and other securities.

Mutual funds are profitable, and they pay in three different ways:

- As dividends and interests.

- As a profit, if the value of the security increases, the profit made when it was sold is distributed to investors at the end of the year.

- As a security value, if the fund does not sell the security, but the security has gained value, you'll still be paid for that.

Explore crypto

Cryptocurrencies have proven their resilience, and maybe it's time you dip your toe into this investment. Many people are still watching what's happening at the fence. But those who are already in are enjoying the party.

Crypto, just like any other investment, has its ups and downs. The market for some crypto coins may fluctuate, but there's nothing to worry about. Time the market when things are down and buy yourself some crypto. And the best part? You can start with as little as $1.

One thing to love about crypto is its uniqueness. It's decentralized. No government can govern its usage, making it a safe bet, especially in unstable countries. Unless someone knows your wallet password, no one can steal your investment.

To get started with crypto:

- Choose a crypto exchange

- Create an account and verify it

- Deposit money into the account

- Use the money to buy cryptocurrency

- Select a storage wallet to store your crypto

- Hold till the prices go up, then sell to make a profit

Conclusion

Deciding to invest is one of the best decisions you'll ever make in your life. Investments put your money to work and generate wealth for you. It's a significant step into becoming a financially free individual.

As a freelancer, you shouldn't be left behind when the rest of the world is moving forward, creating and increasing their investment portfolios.

You, too, can invest and build wealth for yourself and the generation to come. And what better way to start your journey other than using productivity tools?

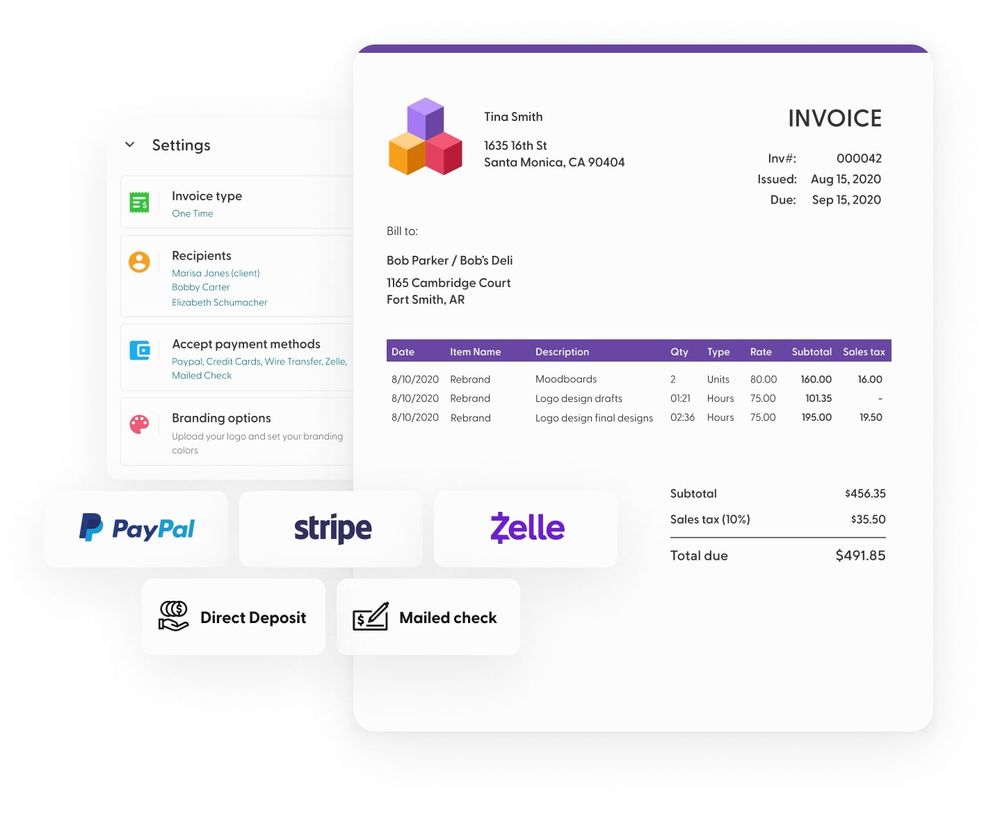

Indy has the proposals you need to win clients, contracts to seal that deal, and a time tracker to ensure you are on time with your tasks. Most importantly, Indy invoices will help you get paid quickly and easily.

We have all the tools you need to elevate your freelance working experience. Start your free trial today and start managing your business like a pro.