Welcome aboard the Tax Talk Express! We know, we know—taxes aren't the most thrilling topic, but for sole proprietors like us, it's a crucial part of the freelancing journey. You're not just the creative genius behind your business; you're also the financial wiz making sense of income, expenses, and all things tax-related.

In this article, we're breaking down the important sole proprietorship tax forms into bite-sized, easy-to-digest nuggets. No jargon, no confusion—just the lowdown on how to navigate the tax world like a pro.

What is a Sole Proprietorship?

If you're just starting your freelancing journey, you might have come across the term "sole proprietorship." Essentially, it means you're the boss – a one-person show running your own business. But what does this mean for your taxes?

In the tax realm, a sole proprietorship is what's known as a "pass-through" entity. It's not a separate legal entity from its owner, so all the business income and expenses flow through to your personal tax return. It's like having your business and personal finances intertwined, which can be both liberating and, at times, a bit confusing.

Essential Tax Forms for Sole Proprietorship Taxation

Now that we've dipped our toes into the waters of sole proprietorship taxes, let's take a deeper dive into the cornerstone of it all.

Schedule C – Profit or loss from business

One of the central players in the sole proprietorship tax game is Schedule C – Profit or Loss from Business. This form is where you lay bare the financial intricacies of your freelancing endeavors.

Documenting your revenue

On the revenue side of things, you'll detail your earnings. Whether you're a graphic designer, a writer, or a virtual assistant, every dollar you make needs its moment in the spotlight. Your clients, the dates of payment, and the services or products provided— it's all in there.

Deductible business expenses

Now, here's where the freelancing rubber meets the tax road. Deductible business expenses are your allies in reducing your taxable income. Did you invest in a new laptop? Deductible. Subscribe to a design software? Deductible. The coffee you buy for those late-night creative sessions? You get the picture.

Calculating your net profit

After tallying up your revenue and subtracting your deductible expenses, you arrive at your net profit. This is essentially your freelancing paycheck before taxes. It's the reward for your hard work, but remember, it's not the final number that Uncle Sam is interested in.

Form 1040 – Individual income tax return

With Schedule C in hand, you now move on to the grand stage of Form 1040 – Individual Income Tax Return.

Reporting your business income

Your net profit from Schedule C flows into your Form 1040. It becomes part of your total income, standing side by side with any other sources of personal revenue you might have—like interest income, investment gains, or that part-time job you took for some extra stability.

Self-employment tax: The not-so-welcome guest

As a sole proprietor, you wear many hats, and one of them is the tax collector. Enter self-employment tax. The self-employment tax rate is 15.3%. This covers your Social Security and Medicare taxes, and unlike traditional employees, you foot the entire bill. It's a significant chunk, but this contribution serves you well in the long run.

Schedule SE – Self-employment tax

Now, let's zoom in on the details of Schedule SE – Self-Employment Tax. This is the form where you crunch the numbers and determine just how much you owe in self-employment tax.

Calculating self-employment tax

Begin by determining your net profit from Schedule C, and then follow the steps outlined in Schedule SE for the self-employment tax calculation. The good news? You're not taxed on every penny. There's a threshold beyond which the IRS takes its share, but hey, those contributions do come with future benefits.

Embracing the dual role

Being both the employer and the employee might seem like a daunting task, but it's a role that comes with its perks. You have control over your retirement contributions, and the flexibility to shape your financial destiny. So, while Schedule SE might feel like a financial balancing act, it's a dance that sets you up for financial security down the road.

Form 1099-MISC – Reporting miscellaneous income

Now, let's talk about a little celebratory pat on the back—the Form 1099-MISC. This is a form you might receive from clients or businesses who have paid you $600 or more during the tax year.

The "Congrats, you're officially a taxpayer" moment

Receiving a 1099-MISC can feel like a milestone in your freelancing career. It's official recognition that your services are valued, and it also means the IRS is keeping tabs on your earnings. Don't panic—it's routine, and it's a crucial piece of the tax puzzle.

Cross-checking your records

As you receive 1099-MISC forms, cross-reference them with your own records to ensure accuracy. Mistakes happen, and you want to catch any discrepancies before tax season kicks into high gear. Plus, accurate reporting is a sign of a responsible freelancer.

Form 1099-K – Payment card and third-party network transactions

In the ever-evolving landscape of freelancing, online transactions play a significant role. If you're engaged in these transactions, you might encounter Form 1099-K.

Unveiling the world of digital transactions

With the rise of online platforms and digital transactions, Form 1099-K has become increasingly relevant. It reports income received through payment card transactions and third-party network transactions. Think of it as the taxman's way of acknowledging the digital shift in commerce.

Keeping tabs on digital income

If you're receiving income through online platforms like PayPal, Stripe, or others, the transactions might be reported to the IRS via Form 1099-K. Keep a watchful eye on these forms, and again, cross-reference with your records to ensure everything aligns.

Deductions and Credits for Sole Proprietors

Ah, deductions—a powerful tool for optimizing tax savings. Let's unravel the world of business deductions and explore some common expenses you can deduct from your taxable income.

Common business expenses to track

As a freelancer, your business expenses might be diverse, but here are some common ones to keep a keen eye on:

Home office expenses

For many freelancers, the home doubles as the office. Track expenses related to your workspace—whether it's rent, utilities, or that ergonomic chair that saved your back during those long nights of work.

Equipment and supplies

From laptops to software subscriptions, equipment and supplies are often necessary investments. Keep receipts and records of these purchases, as they can be deducted from your taxable income.

Travel and meals

If your freelancing adventures take you on the road for client meetings or industry events, those travel and meal expenses can add up. Log every receipt, jot down the purpose of the trip, and watch as these expenses work in your favor come tax time.

Marketing and advertising costs

Promoting your freelancing services is part of the game. Whether it's online ads, business cards, or a website domain, these costs are considered legitimate business expenses.

Health insurance premiums

Unlike traditional employees, freelancers often bear the burden of their health insurance costs. The good news? You can potentially deduct these premiums, reducing your taxable income and providing a bit of relief for your healthcare expenses.

Tax credits available to sole proprietors

Now, let's shift our focus to tax credits—another avenue for saving on your tax bill. While deductions reduce your taxable income, tax credits directly decrease the amount of tax you owe. Here are a couple of credits that may be particularly relevant to sole proprietors.

1. Earned Income Tax Credit (EITC)

The EITC is a credit designed to assist low to moderate-income individuals and families. While it's often associated with employees, self-employed individuals can also qualify. The amount of the credit depends on your income and the number of qualifying dependents.

2. Retirement Savings Contributions Credit (Saver's Credit)

As a sole proprietor, you're responsible for your retirement savings. The Saver's Credit rewards you for contributing to a retirement account, such as an IRA or 401(k). Depending on your income and contributions, this credit can be a valuable incentive to prioritize your financial future.

3. Health Coverage Tax Credit (HCTC)

If you're paying for health insurance through the Health Insurance Marketplace, the HCTC can provide a significant credit. It's designed to help eligible individuals afford their health insurance premiums.

Quarterly Estimated Taxes - What You Need to Know

As a sole proprietor, you're not just a freelancer; you're also your own tax-withholding department. Welcome to the world of quarterly estimated tax payments.

Understanding the basics

Unlike traditional employees who have taxes withheld from each paycheck, freelancers are responsible for estimating their tax liability and making quarterly payments to the IRS. These payments cover income tax and self-employment tax.

The quarterly tax dates each year fall on:

- January 15

- April 15

- June 15

- September 15

Calculating your quarterly payments

To determine your quarterly estimated tax payments, you'll need to estimate your annual income and calculate the corresponding taxes. The IRS provides Form 1040-ES to help you with this process. It's a proactive approach that prevents a hefty tax bill come April.

Avoiding underpayment penalties

Failure to make accurate and timely quarterly payments can lead to underpayment penalties. It's a fine balance—paying too much might mean you're parting with cash unnecessarily, while paying too little can result in penalties. Stay on top of your income and expenses to refine your quarterly estimates.

Annual tax filing deadlines for sole proprietors

While quarterly estimates keep you in the IRS's good graces throughout the year, there's still the grand finale—the annual tax filing.

Filing your annual return – Form 1040

When April 15th comes around, it's time to submit your Form 1040 – Individual Income Tax Return. This is the big reveal, where all your meticulous record-keeping, deductions, and credits come into play.

Additional considerations for sole proprietors

As a sole proprietor, you may encounter additional forms or schedules depending on your specific circumstances. For example, if you have employees, you'll need to handle payroll taxes and file additional forms like Schedule H. Stay informed about any changes in tax laws that might impact your annual filing requirements.

Ensuring timely submission

Procrastination and tax season are not the best of friends. Mark your calendar, set reminders, and aim to submit your tax return well before the deadline. Filing late can result in penalties and interest, so it's in your best interest to stay ahead of the game.

Seeking Professional Guidance

Sure, going solo and being your own boss feels pretty awesome, but there comes a moment when bringing in a tax pro isn't just a good idea—it's a game-changer.

When to consult a tax professional

You should consider hiring a tax advisor if your freelancing endeavors involve complex business structures or transactions, you want to maximize deductions and credits, or you'd like to have a professional in your back pocket ready to help in case of an IRS audit.

They also take the stress out of filing taxes, giving you a customized tax plan that's perfectly tailored to your business.

That being said, Not all tax professionals are created equal, and finding the right fit for your freelancing business is essential.

Here's some tips for choosing the right tax professional for you:

- Credentials and Experience: Look for professionals with the appropriate credentials, such as Certified Public Accountant (CPA) or Enrolled Agent (EA). Experience in working with sole proprietors or freelancers is a significant plus.

- Client References: Ask for client references or reviews.

- Transparent Pricing: Understand the pricing structure upfront.

- Communication Style: Choose a tax professional who explains complex concepts in a way you can understand and who is responsive to your inquiries.

How Can Indy Help?

Managing taxes as a freelancer poses challenges, especially while navigating the demands of running your own business. However, Indy makes this process easy!

Here's how Indy can fast-track your success:

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your projects and grow your business.

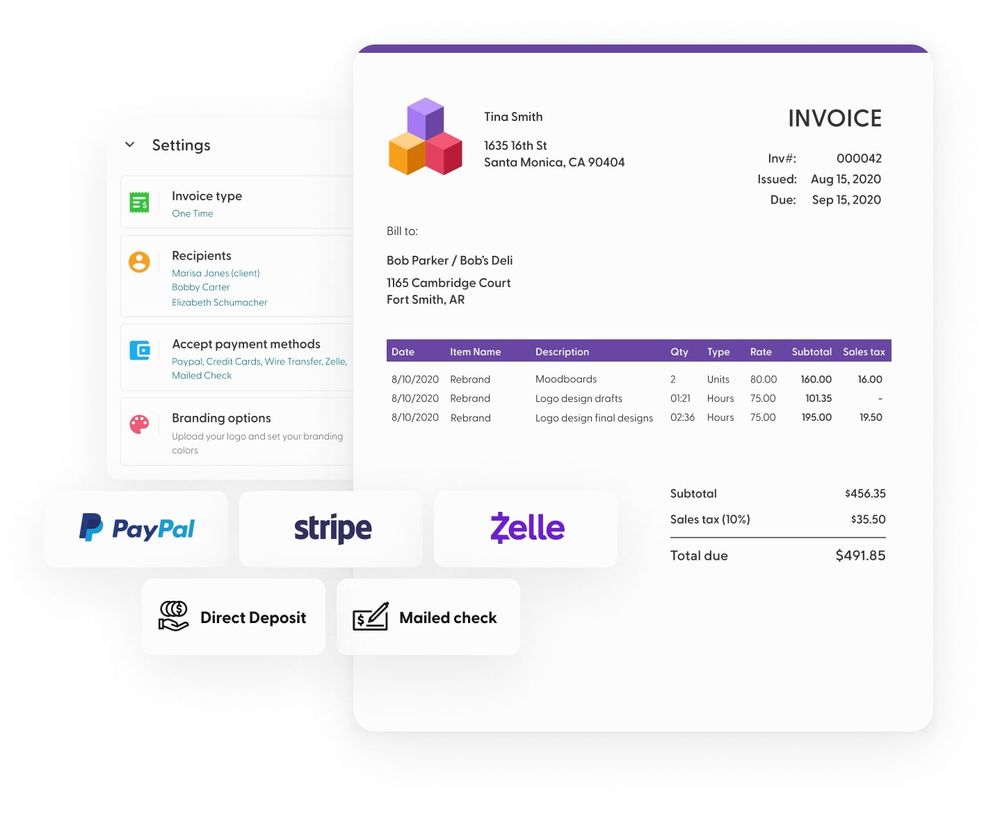

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself. Get started today for free!

A Quick Recap

Sole proprietorship taxation may seem daunting, but understanding the key components and taking proactive steps can make the process more manageable. From the foundational Schedule C to the nuances of quarterly estimated taxes, freelancers have the opportunity to optimize their financial standing.

Crucial elements like deductions, credits, and compliance with reporting forms such as 1099-MISC and 1099-K play pivotal roles in shaping a sole proprietor's tax landscape. These aspects not only impact the immediate tax liability but also contribute to long-term financial security. Along with paying your self-employment taxes, don't forget about your state and federal income tax obligations.

Ready to run your sole proprietorship business business efficiently and save on taxes? Manage everything in one place with Indy, from contracts to invoicing and everything in between. Get started with Indy for free!