Managing a small business can be rewarding, but it's certainly not without its challenges. Whether you realize it or not, freelancers are small business owners, and they face the same issues in managing their businesses as big corporations do.

Luckily, you're not alone. This guide is designed for helping you go from overwhelmed to in control in just a few simple steps. Read on and learn all about how you can manage a small business and make day-to-day life far easier with these basic tips.

Separate personal and business finances

When you're a small business owner, it's important you keep personal expenses separate from business expenses. There are several easy ways of doing this.

First, open a small business bank account so you can keep business finances completely separate from personal ones.

Second, ensure that all of your business utilities — such as the business phone line and Internet access — are set up in the company's name, not yours. These utilities should all be paid using business finances.

Finally, take out a credit card for business expenses. This will allow you to not only keep track of your business expenses but also build credit for your business, which can be financially beneficial for you in the long run. While it may be tricky staying on top of your finances, as a small business owner, separating your personal and business finances is crucial for your long-term business management.

Write a business plan

It may seem challenging to write a business plan when you think of yourself as a freelancer, not a small business owner. But having a strong, detailed business plan is a good idea for a variety of reasons.

First, writing a business plan can help you narrow the focus of the work you want to do. By writing down what product or service you may offer, detailing your prices for each product or service, and explaining what makes your work unique, you can clarify what you want to prioritize and what running a business looks like to you.

Second, by writing a business plan that includes steps you can take to grow your business, you can take some time to think about what actions you might want to perform to enhance your small business. For example, if you think your business would benefit from a new marketing strategy involving social media or advertising on a mobile app, coming up with a plan early on will give you a clear goal for which to aim. If you have lofty plans for new products that might require an increase in your cash flow, you can start preparing to ask for a business loan. Although writing a business plan may seem overwhelming, the benefits it can offer you and your business far outweigh the cons.

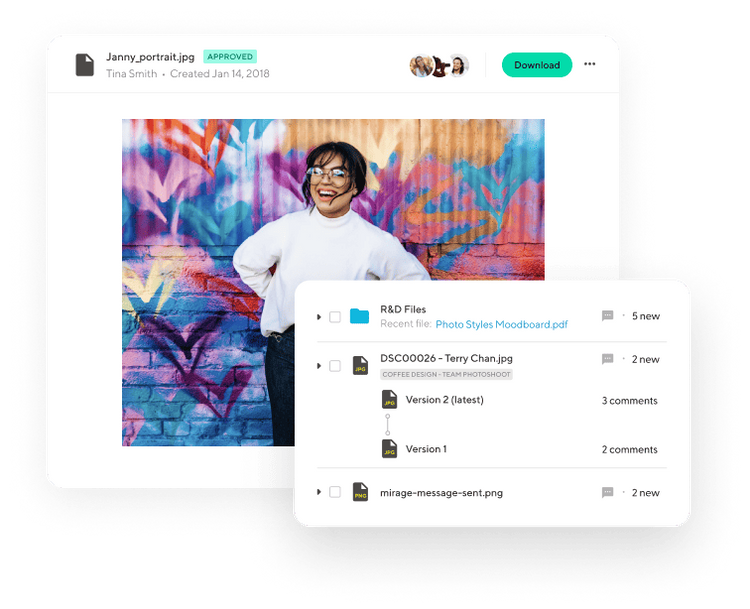

Use tools for keeping track of everything

When you're running a business, you simply don't have time to oversee every single detail. An important tool that can improve your time management and assist with day-to-day operations is a freelance platform, such as Indy. By providing standardized templates for contracts that have already been vetted by lawyers, invoices, and more, freelance platforms are invaluable tools for small business owners. Simply put, they're great for helping you spend more time doing the work you love and less time obsessing over the legal jargon in your latest client's contract.

Additionally, it's a good idea to use some form of accounting software to keep track of your business expenses. Not only will using accounting software help you keep your finances in order, but it can make tax paperwork a breeze at the beginning of every year, as many products automatically track sales tax (if applicable) and more. If you have employees or use contractors, an employee expense management software will also allow you to track their payments and certain tax forms. Overall, whether you need it to help with managing employees or simply to tracking long-term finances, accounting software can be enormously helpful for any small business owner.

Ask for help

Just because you're an incredible freelancer with great time management skills and a killer work ethic doesn't mean that you can — or should — try to do it all on your own. There's a wide variety of different people who can help you achieve your small business dreams. First, consider seeking broad-scale advice from people who have been in your shoes before. Whether they're current or former freelancers or small business owners, talking to people who have started their own small businesses is a great way to get advice on how to handle both general and specific concerns.

That being said, there are certain areas in which it's unwise to try and do it all yourself. If you've never balanced your personal checkbook before, you might want to speak to a business accountant before you take on your new business's bank account. An accountant can also provide valuable advice on how to track expenses and pay taxes, so you don't need to worry about landing in hot water with the IRS. Finally, speaking to a lawyer can be an invaluable way to get started with registering your small business and helping with everything from protecting your intellectual property to reviewing complicated contracts with big clients. No matter what kind of work you do, having contacts with experience in the realms of finance and law can be invaluable assets to any small business owner.

Conclusion

As a freelancer, you're used to working hard. Fortunately, there are many ways to make the transition from freelancer to small business owner an easy one. Separating one’s personal and business finances, writing a business plan, using freelance platforms and accounting software, and asking for help from peers and experts can all help you establish your own business and keep it running as smoothly as possible. Regardless of what field you're in, these tips can help you bring your small business to the next level.