Freelancing is great for freedom and flexibility, letting you pursue your passions. But it comes with responsibilities, and one big one is handling self-employment taxes.

In this article, we'll break down self-employment tax details and share a treasure trove of tax deductions that can lighten the financial load for freelancers.

Understanding Self-Employment Tax Basics

Freelancing is a liberating journey where you get to be your own boss, set your schedule, and work on projects you're passionate about. However, it also comes with a unique set of responsibilities, including understanding and managing your taxes. One key aspect that every freelancer should grasp is the self-employment tax.

What is the self-employment tax?

Self-employment tax is the entrepreneur's version of Social Security and Medicare taxes. While traditional employees have these taxes withheld from their paychecks, freelancers are responsible for paying both the employer and employee portions. In other words, you're on the hook for the full 15.3% of your net earnings. It might sound daunting, but don't worry – there are strategies and deductions that can help ease the burden.

Navigating the Tax Filing Process for Freelancers

Navigating the tax filing process for freelancers is a crucial aspect of managing your financial responsibilities and ensuring compliance with tax regulations.

Key deadlines and requirements

Marking important dates on your calendar is crucial for managing your freelance taxes effectively. While the federal tax filing deadline is typically April 15th, it's wise to double-check for any changes. To avoid a hefty bill come tax season, stay on top of quarterly estimated tax payments.

Here are the key dates to remember:

- January 15. Quarterly estimated taxes due.

- April 15. Tax filing deadline.

- June 15. Quarterly estimated taxes due.

- September 15. Quarterly estimated taxes due.

Choosing the right tax form

Freelancers typically use Schedule C to report income and expenses from their freelance work. However, depending on the freelancer's specific circumstances, they may need additional forms. Here are some examples:

- Schedule C (Form 1040): This form is the primary document for reporting income and business expenses for freelancers. It allows freelancers to detail their profit or loss from business activities.

- Schedule SE (Form 1040): This form is used to calculate self-employment tax, which covers Social Security and Medicare taxes for freelancers.

- Form 1099-NEC: If a freelancer receives $600 or more in a tax year from a single client or entity, that client is required to provide the freelancer with a Form 1099-NEC, which reports non-employee compensation. Freelancers should use the information on this form when completing their tax returns.

- Form 1040-ES: Freelancers who expect to owe $1,000 or more in taxes when they file their annual return may need to make quarterly estimated tax payments using Form 1040-ES.

- Other Schedules and Forms: Depending on the complexity of a freelancer's financial situation, they might need additional schedules or forms to report various types of income, deductions, or credits. It's advisable to consult with a tax professional for personalized advice.

Top 10 Self-Employed Tax Deductions

Exploring the top 10 tax deductions for freelancers can make navigating freelance taxes more rewarding. These deductions bring valuable benefits, helping you optimize your financial strategies and boost your success.

1. Home office deductions

Working from the comfort of your home? The IRS allows you to deduct a portion of your housing-related expenses if you use part of your home exclusively for your business. This includes rent or mortgage interest, utilities, property taxes, and even homeowner's insurance. To qualify, you must have a dedicated space used regularly and exclusively for your freelance work. Measure the square footage of your office space compared to the total square footage of your home to determine the percentage of your home-related expenses you can deduct.

Common Deductible Home Office Expenses:

- Rent or Mortgage Interest: If you're a renter, a portion of your rent is deductible. If you own your home, you can deduct the interest on your mortgage.

- Utilities: Deduct the cost of utilities such as electricity, water, heating, and cooling that are directly related to your home office.

- Property Taxes: Homeowners can deduct a percentage of their property taxes that corresponds to the space used for their home office.

- Homeowner's Insurance: A portion of your homeowner's insurance, covering the space used for your business, is deductible.

- Internet and Phone Bills: If your freelance work relies on a dedicated internet connection or phone line, the associated costs are deductible.

- Home Maintenance and Repairs: Expenses related to maintaining and repairing your home office, such as painting or fixing the roof, can be deducted.

- Home Security System: If you've invested in a security system to protect your home office, a portion of that cost is deductible.

- Depreciation: Homeowners can take a depreciation deduction for the portion of their home used for business. This is based on the value of the space dedicated to your freelance work.

To calculate your home office deduction, determine the percentage of your home used for business by dividing the square footage of your office space by the total square footage of your home. This percentage is applied to the qualifying home-related expenses. Keep in mind that the IRS has simplified the process with a standard deduction of $5 per square foot of your home used for business, up to 300 square feet.

2. Equipment and supplies

Freelancers heavily rely on tools of the trade. Whether you're a graphic designer, writer, photographer, or consultant, investing in the right equipment and supplies is crucial for the success of your freelance business. The good news? The cost of these items is deductible, providing a valuable opportunity to recoup some of your business expenses.

Common Deductible Equipment:

- Laptops and Computers: The backbone of many freelance businesses, the cost of a new laptop or computer is fully deductible. Consider the processing power, storage, and features that align with your business needs.

- Cameras and Photography Equipment: Photographers and content creators can deduct the cost of cameras, lenses, tripods, lighting equipment, and other gear necessary for their craft.

- Printers and Scanners: If your business involves a significant amount of paperwork, the cost of printers, scanners, and other document management tools can be deducted.

- Software Subscriptions: Whether it's Adobe Creative Cloud, Microsoft Office, or project management software, the subscription costs for essential software are deductible.

- Office Furniture: Desks, chairs, and other office furniture items used exclusively for your freelance work can be deducted.

- Smartphones and Tablets: If you use your smartphone or tablet for business purposes, a portion of the cost can be deducted. Keep a record of your business-related usage.

- External Hard Drives and Storage Solutions: Safeguarding your work is crucial. The cost of external hard drives, cloud storage subscriptions, and other backup solutions is deductible.

Common Deductible Supplies:

- Stationery and Office Supplies: Deduct the cost of pens, notebooks, printer paper, and other office supplies that keep your workspace functioning.

- Ink and Toner: For those with printers, the expense of ink and toner cartridges is deductible.

- Postage and Shipping Supplies: If you regularly send physical documents or products to clients, deduct the cost of postage, envelopes, and packaging materials.

- Art Supplies: Graphic designers, illustrators, and artists can deduct the cost of art supplies such as sketchbooks, drawing tools, and painting materials.

- Reference Materials: Books, magazines, or any reference materials directly related to your freelance work can be deducted.

- Business Cards: The cost of designing and printing business cards to market your freelance services is a deductible expense.

Keep detailed records of your purchases, including receipts, to support these deductions.

3. Travel and transportation expenses

If your freelance business requires you to hit the road, the IRS allows you to deduct related travel expenses. This includes mileage for business-related travel, airfare, accommodation, transportation costs, and even meals. Keep a mileage log to track your business-related miles, and save receipts for travel-related expenses to ensure you can support your deductions.

Business-Related Travel Reasons That Qualify for Tax Write-Offs:

- Client Meetings: Traveling to meet clients, discuss projects, or negotiate contracts is a valid reason for a tax write-off.

- Conferences and Workshops: Attending industry conferences, workshops, or trade shows to enhance your skills and stay updated on industry trends is a deductible expense.

- Networking Events: If you travel to networking events or business gatherings to build professional connections and promote your freelance services, these expenses are tax-deductible.

- Site Visits: If your freelance work involves site visits, inspections, or assessments, the travel expenses associated with these visits are deductible.

- Collaboration and Partnerships: Traveling to meet potential collaborators, partners, or other professionals to explore business opportunities is a valid reason for a tax write-off.

4. Health insurance premiums and medical expenses

Freelancers often have to handle health insurance on their own, and the good news is that you can deduct health insurance premiums as a business expense. Additionally, certain medical expenses that exceed 7.5% of your adjusted gross income may be deductible. This includes costs like doctor visits, prescription medications, and other qualifying medical expenses.

Types of Deductible Health-Related Expenses:

- Health Insurance Premiums: Deduct the premiums paid for health insurance coverage, including plans for yourself, your spouse, and dependents.

- Medical Expenses: Deduct qualifying medical expenses, such as doctor visits, hospital stays, prescription medications, and other necessary health-related costs.

- Dental and Vision Insurance: Premiums for dental and vision insurance coverage are deductible as part of your overall health-related expenses.

- Long-Term Care Insurance: If you have long-term care insurance, the premiums paid for this coverage are also deductible.

5. Education and training expenses

Investing in your professional development directly benefits your freelance business, and the IRS acknowledges this by allowing deductions for education and training expenses. Whether you're taking a course to enhance your skills or attending a workshop to stay updated on industry trends, the associated costs are deductible.

Common Deductible Education and Training Expenses:

- Course Fees: Deduct the costs associated with courses directly related to your freelance business. This includes fees for online courses, workshops, seminars, and in-person classes.

- Books and Learning Materials: The cost of books, manuals, and other learning materials required for your education and training can be deducted.

- Tuition: If you're pursuing formal education, such as a degree or certification that enhances your skills as a freelancer, the tuition expenses are deductible.

- Professional Memberships: Membership fees for professional organizations or associations that contribute to your ongoing education and professional development are deductible.

- Webinars and Online Subscriptions: Fees for webinars, online training programs, and subscriptions to educational platforms can be deducted as business expenses.

6. Professional memberships and subscriptions

If you're a member of professional organizations or subscribe to industry publications, those costs are deductible as business expenses. Staying connected with your professional community and staying informed about industry trends can directly benefit your freelance business.

Common Deductible Professional Memberships and Subscriptions:

- Professional Memberships: Deduct fees associated with memberships to industry-specific professional organizations that provide networking opportunities, resources, and support for freelancers.

- Industry Publications: Expenses for subscriptions to industry publications, magazines, journals, or online platforms that keep you informed about the latest trends and developments in your field are deductible.

- Online Platforms and Communities: Deduct costs associated with memberships to online professional platforms and communities that facilitate networking and collaboration with other freelancers and professionals.

- Certification and Accreditation Fees: If your freelance profession requires certifications or accreditations, deduct the fees associated with obtaining and maintaining these credentials.

- Subscription to Freelance Platforms: If you subscribe to freelance job platforms or other online marketplaces to find work and connect with clients, the associated costs are deductible.

7. Website and marketing expenses

Maintaining a professional online presence is crucial for freelancers, and the associated costs are deductible. This includes expenses like domain registration, website hosting fees, and online advertising. Deducting these costs ensures that your business is visible and accessible to potential clients.

Common Deductible Website and Marketing Expenses:

- Domain Registration Fees: The cost of registering a domain for your freelance business is considered a deductible expense.

- Website Hosting Fees: Deduct expenses related to hosting your website, ensuring that it's accessible to clients and visitors.

- Website Design and Development: If you hire a professional to design or develop your website, those costs are deductible.

- Content Creation: Expenses related to creating content for your website, including writing, graphic design, and photography, can be deducted.

- Search Engine Optimization (SEO) Services: If you invest in SEO services to improve your website's visibility on search engines, these costs are deductible.

- Online Advertising: Money spent on online advertising platforms to promote your freelance services is a deductible business expense.

- Email Marketing Services: Deduct the costs associated with email marketing services and tools used to communicate with clients and prospects.

8. Legal and professional fees

Whether you consult with an attorney, hire an accountant, or engage other professionals for your business, the fees incurred are deductible. Seeking professional advice ensures that your business operates within the bounds of the law and maximizes available deductions.

Types of Deductible Legal and Professional Fees:

- Attorney Fees: Deduct fees paid to attorneys for legal advice, contract review, or representation in legal matters related to your freelance business.

- Accounting Fees: Deduct the fees paid to accountants or tax professionals for services such as bookkeeping, tax preparation, and financial advisory.

- Consulting Fees: Fees paid to business consultants or industry experts for their professional advice and insights are deductible.

- Business Coaching Fees: Deduct fees paid for business coaching services that help you improve your freelance skills and business strategies.

- Licenses and Permits: Fees associated with obtaining and renewing business licenses or permits required for your freelance activities are deductible.

9. Bank fees and interest

Running a business often involves banking fees and interest on loans or credit cards. These costs are deductible as business expenses. Keep track of your business-related banking transactions to capture these deductions accurately.

Types of Deductible Bank Fees and Interest:

- Monthly Account Fees: Deduct the monthly fees associated with your business bank account, including charges for account maintenance and services.

- Transaction Fees: Deduct fees incurred for business transactions, such as wire transfers, electronic fund transfers, or fees related to deposit and withdrawal activity.

- Loan Interest: If your freelance business has taken out loans or carries a balance on a business credit card, deduct the interest paid on these loans or credit card balances.

- Overdraft Fees: Deduct fees associated with overdrafts on your business bank account, provided they are directly related to business activities.

- Credit Card Annual Fees: If your freelance business uses a credit card with an annual fee, deduct this fee as a business expense.

10. Software and technology expenses

Freelancers rely on various software and technology tools to streamline their work. Whether it's project management software, graphic design tools, or other business-specific applications, the costs are deductible as business expenses.

Common Deductible Software and Technology Expenses:

- Project Management Software: Project management tools like Indy help you manage tasks, sign contracts, send invoices, and collaborate with clients. Plus, the software is tax deductible!

- Graphic Design Software: If your freelance work involves graphic design, deduct the costs of software such as Adobe Creative Cloud or other design-specific tools.

- Office Productivity Software: Expenses for office productivity tools like Microsoft Office or other software that enhances your efficiency are deductible.

- Accounting Software: Deduct the costs of accounting software that simplifies bookkeeping and financial management for your freelance business.

- Communication Tools: Expenses related to communication tools such as video conferencing platforms, messaging apps, and virtual collaboration software are deductible.

- Website Development Software: If you use software for website development or content management systems, these costs are considered business expenses.

Exploring Additional Areas for Freelance Tax Write-Offs

Let's take a look at some often overlooked areas of potential tax deductions, giving you additional ways to maximize your tax savings.

Retirement contributions for the self-employed

Securing your financial future is crucial, and the IRS encourages freelancers to save for retirement by offering deductions for contributions to retirement plans such as a Solo 401(k), SEP IRA, SIMPLE IRA, and Traditional IRA. Not only do these contributions reduce your taxable income, but they also help you build a nest egg for the years ahead.

Depreciation of assets

For significant business assets like computers, cameras and photography equipment, office furniture, vehicles, printers, scanners, or other specialized equipment with a useful life beyond one year, you can deduct the depreciation over time. This allows you to recover the cost of these assets gradually.

Charitable contributions

If your freelance business involves charitable contributions, whether in the form of monetary donations, goods and services, sponsorships, donation of equipment, or volunteer expenses, those contributions are deductible. It's a way to give back to your community while also reducing your taxable income.

While you cannot deduct the value of your time, you can deduct certain out-of-pocket expenses incurred while volunteering for a charitable organization. This may include travel expenses, parking fees, or supplies purchased for volunteer activities.

The Qualified Business Income deduction (QBI)

The Qualified Business Income (QBI) deduction is a tax deduction introduced as part of the Tax Cuts and Jobs Act (TCJA) in 2017. This deduction allows eligible businesses to deduct up to 20% of their qualified business income on their federal income tax return.

Here are some key points about the Qualified Business Income deduction:

- Eligible Entities: The QBI deduction is generally available to individuals, trusts, and estates that own interests in pass-through entities. These entities include sole proprietorships, partnerships, S corporations, and certain real estate investment trusts (REITs).

- Qualified Business Income: This deduction applies to income derived from a qualified trade or business. It does not apply to income such as wages, dividends, or interest. The definition of a qualified trade or business and the calculation of QBI can be complex and may involve various factors.

- Thresholds and Limitations: In 2023, the income threshold for single filers is < $182,100 (with partial deductions available up to $232,100) and $364,200 for married filing jointly (with partial deductions available up to $464,200).

- Specified Service Businesses: For certain high-income taxpayers, the QBI deduction may be limited or phased out for income generated from specified service businesses, such as those in the fields of health, law, accounting, and consulting.

- Wage and Capital Limitations: In some cases, limitations based on wages paid and the unadjusted basis of qualified property may apply, especially for businesses in certain service industries.

How Can Indy Help?

Using tools like Indy for self-employment tax deductions not only helps manage your business efficiently but also saves you money by trimming your tax bill.

Here's how Indy fast-tracks your success:

- Proposals: Craft compelling project proposals effortlessly and win more clients.

- Contracts: Get ready-made contracts that protect your business and build trust with clients.

- Forms: Indy has questionnaires, intake forms, project briefs, and feedback forms to help you get the information you need from clients to nail your designs and grow your business.

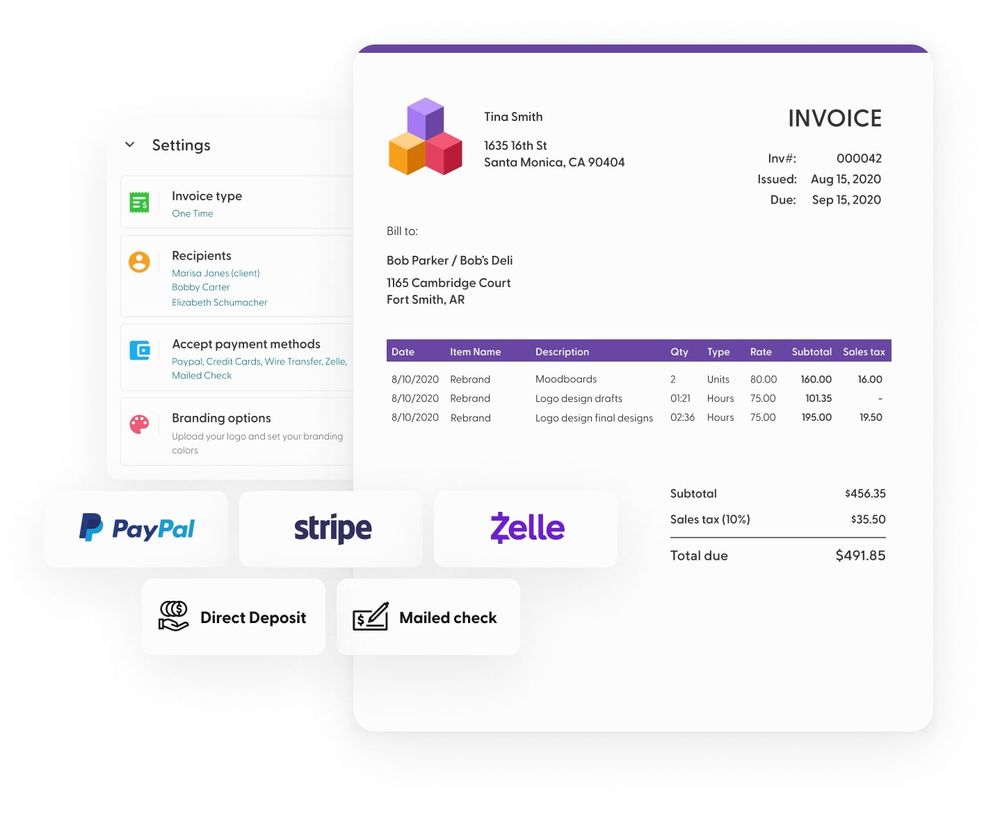

- Invoices: Generate polished invoices with ease and get paid right through Indy.

- Project Management: Break down projects into manageable tasks using both to-do lists and Kanban boards.

- Client Portals: Enhance client satisfaction with a centralized communication hub where you can chat with clients in real-time and share files.

- Time Tracker: Automatically track and log the time spent on each project to make billing easier.

- Files: Upload, store, and share designs and any other documents with clients and get feedback and approval.

- Calendar: Schedule meetings and get a daily, weekly, and monthly view of everything that's due or overdue.

And since Indy is tax deductible, it basically pays for itself! Let Indy handle the administrative side, freeing you up to focus on what you do best, crafting outstanding projects for your clients.

Get started today for free and take your business to the next level!

A Quick Recap

The Internal Revenue Service (IRS) offers valuable resources and guidelines tailored to assist small business owners in navigating tax obligations and ensuring compliance with tax regulations. Remember, while a self-employment tax deduction can significantly reduce your taxable income, it's essential to keep thorough records and, when in doubt, consult with a tax professional to ensure you're maximizing your deductions within the bounds of tax regulations.

Looking to streamline your freelance business and maximize savings come tax season? Get started with Indy for free and manage your entire business in one place, from contracts to invoicing and everything in between.