If you’ve received an Internal Revenue Service tax audit and you're missing the financial records, things can feel a little stressful, to say the least. We're here to help you know how to handle the situation and how to develop a strategy to prove your financial integrity. Let’s take a look at what you can do to develop a strategy if that audit notice comes along and your receipts are nowhere to be seen.

Why does the IRS audit taxpayers?

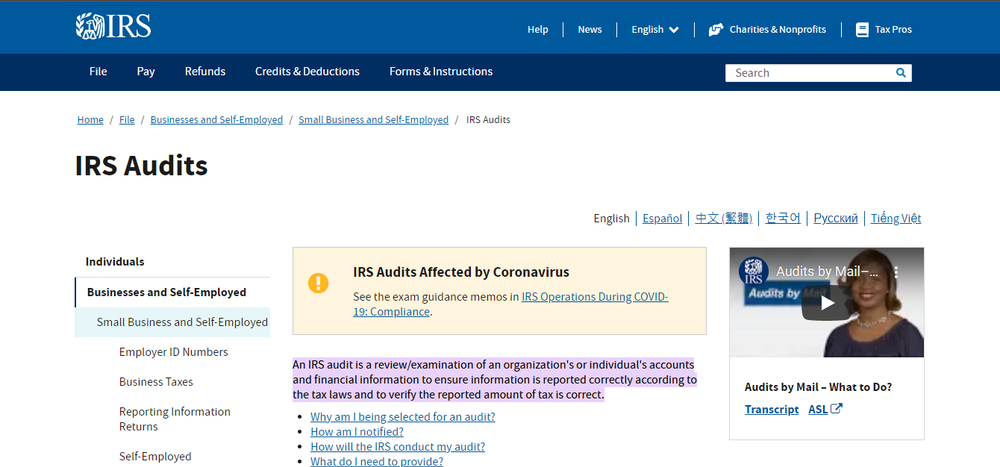

Firstly, let's define what an Internal Revenue Service (IRS) tax audit is. In short, it is a review of your accounts and financial information to ensure it has been reported correctly. Sometimes, IRS audits can be random; however, self-employed taxpayers are often audited based on suspicious activity. If you've received one of these, it may be because it is suspected your income is higher than you've reported.

How do I tackle a tax audit without receipts?

It's important to remember: a tax audit isn't there to catch you out - it is simply a review of your numbers. As a freelancer, having your documents in check is paramount, but what if you don’t? If you don't have receipts for your business expenses, things can be a little trickier. If you find yourself with incomplete records, you will need to take some extra measures to handle the audit successfully. In this instance, IRS auditors will allow you to prove your expenses through 'other credible evidence'.

Let’s walk through the steps you can take if you find yourself in this tricky situation:

Receiving a letter from the IRS

The first, most obvious step in the process is to ensure that the letter you have received from the IRS is genuine. It's not uncommon for scammers to produce fake IRS audit letters to take advantage of worried business owners. Remember, notification of IRS audit will always arrive by mail (not email or text). If you're concerned about the authenticity of your letter, you can always call the IRS phone number to verify your audit.

Get together all available evidence

An important first step to take is to gather the information you hold currently. You may have stored some receipts in a forgotten place, so don't forget to check! Spending some time to collate everything you do have will give you a clearer understanding of what's missing.

Find alternative proof for your expenses

If those receipts are nowhere to be seen, don't worry. There are some alternative methods you can take. The Cohan Rule is a court system in place to help in these circumstances – but we’ll discuss this later. For now, it’s important to gather some alternative proof of your business expenses. In place of receipts, you could provide the following documents as evidence: credit card statements and debit card statements, mileage records, emails, calendar records of meetings, or photographs of items.

Provide your proof to the IRS

In dealing with the IRS, organization is everything. Getting organized ahead of time is going to save you a lot of hassle when sending documentation over to the IRS. Once you've gathered as much information as possible, organize it in a clear format, with explanations alongside it.

Respond to questions swiftly

Remember, a tax audit doesn't mean you're on trial. If the IRS requires additional information about certain business expenses or wants you to explain something, be sure to communicate back promptly to help things along.

Receive your new tax audit from the IRS

Within 30 days, the IRS will notify you of the audit decision. The final calculations provided by the IRS will take into consideration the information you have supplied alongside the minimum amounts and the amount you can deduct.

Pay the extra amount or appeal

After reviewing the findings, you will have 30 days to either accept the decision and pay the amount or decide to look into it further and appeal the audit findings.

How to prove your expenses without receipts

What is the Cohan Rule?

The Cohan Rule is there to help if you’re missing receipts but wish to claim business expenses. It says, as long as you can prove it, you can claim reasonable expenses using alternative supporting evidence. It also says you can deduct the minimum standard amount for something purchased without receipts.

This rule is perceived as a saving grace for taxpayers who find themselves in a tough spot without receipts. They named it after the famous Broadway entertainer, George M. Cohan, who was the first to take the IRS to court after having no proof of expenses. The Court decided that the IRS should accept his estimated expenses.

How do I use the Cohan Rule?

Don’t forget, the Cohan Rule is there to help self-employed workers without receipts to prove their expenses, with estimates based on alternative evidence. We listed some of these examples above, but in the complete absence of a paper trail, you could take photographic evidence of an item purchased alongside thorough descriptions of the nature of the business purchase. In this instance, the IRS is likely to apply a minimum standard calculation for the cost of the items in question.

What happens if my reductions are rejected?

It might be the case that the IRS decides that your deduction for expenses is too high – and be prepared for this. If this is the case, you will likely be faced with a new tax bill. Don’t forget that this may shift you into a higher tax bracket. In this instance, you can either settle the additional tax bill, ask for a delay, or appeal the IRS audit ruling.

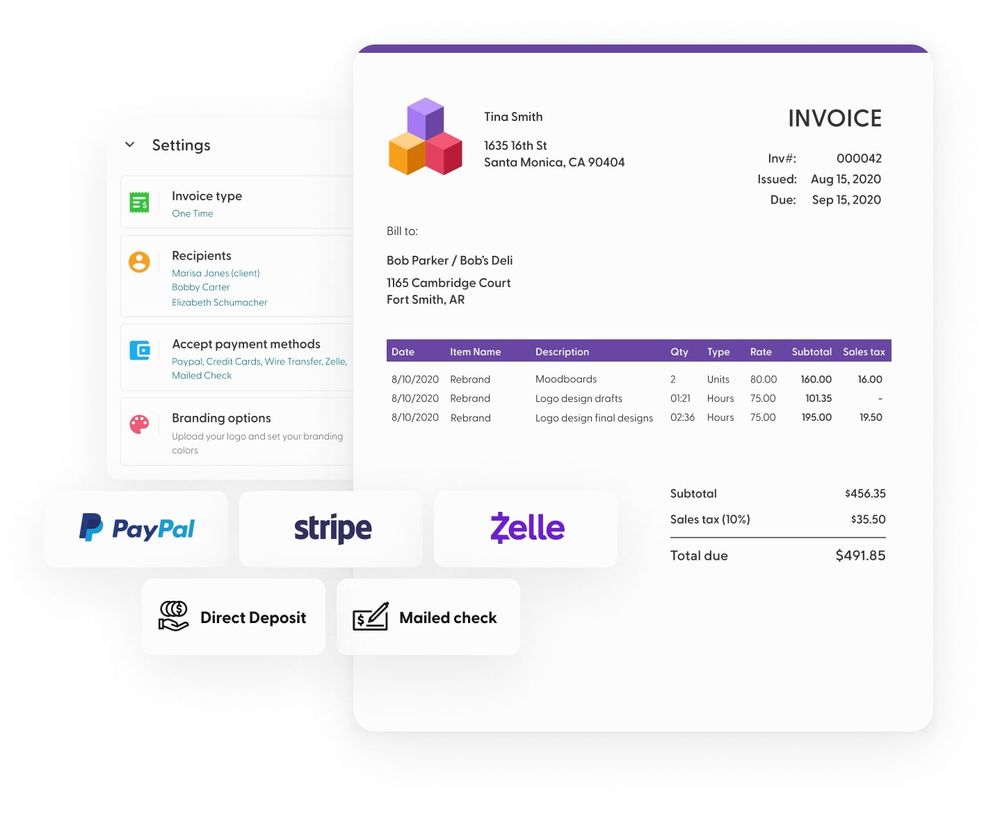

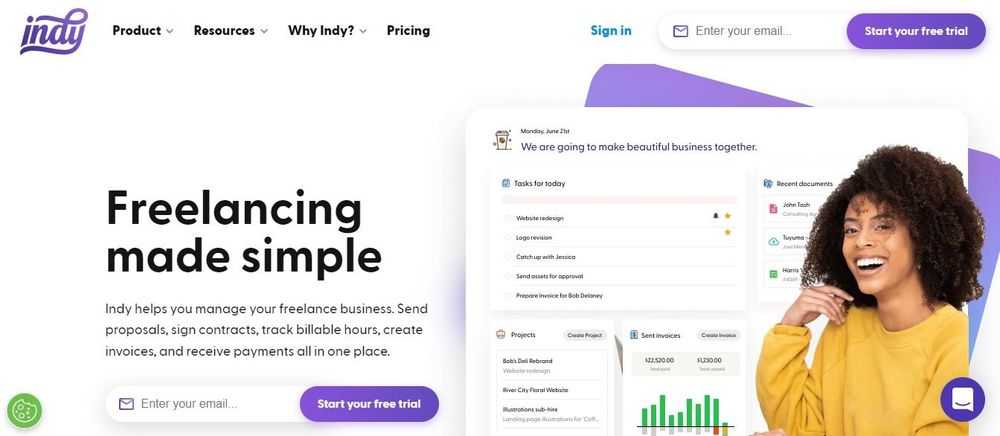

How can Indy help?

Managing your financial records as a freelancer can feel daunting, but Indy is here to help. Our specialized services for freelancers can help you manage your invoices, payments, and files in one simple place – making that dreaded tax return feel like a walk in the park. Why not try Indy for free today to see for yourself?