After long hours dancing around the pressure-valve of projects sitting in your to-do-list, you finally nailed the perfect solution for one of your recurring clients. You send out your well-executed piece of perfection and wipe the sweat off your brow. You're done! One down. But wait? Isn't there something you're forgetting? You still need to charge that client... again.

Freelancing is a balancing act. Between communicating with clients, executing projects, clerical duties, and the ever-dreaded tax season, trying to find time and energy to manage invoices and recurring payments isn't easy. Most successful freelancers have tracked invoices manually at some point in their careers, but in today's hyper-competitive landscape, time spent on invoices is time spent not making money.

If you have recurring clients on a set schedule, you need to be automatically billing and invoicing them. So, where do you start? Read on to learn why you need a recurring billing system and which one's freelancers love.

Why Do You Need A Recurring Billing System?

Recurring billing systems are automated billing solutions that send out invoices and bills to clients on a set schedule. Once you set up a client in your recurring billing system, it does the heavy lifting by sending out invoices, tracking payments, and sending email reminders.

Some freelancers choose to go down the tedious road of self-submitting invoices via a payment gateway like PayPal, sending out payment reminders, and spreadsheet-tracking client billing needs. But that process is time-consuming and expensive to maintain. Recurring billing systems nip those redundant tasks in the bud — giving you more time to focus on growth.

In the beginning, recurring billing systems can seem like a pain. You have to set up clients in the system, inform them of their new payment terms, and learn how to navigate various interfaces. But in the long run, you can expect benefits like:

- Improved cash flow: 60 percent of small online business owners struggle with cash flow. And a mind-boggling 19% of freelancers wait over 2 months to get paid. A few missed payments can be the difference between paid bills and angry letters from utility companies. Recurring billing systems completely automate payments, so you don't have to stress about missing or forgotten payments.

- Better client relationships: Is there anything more awkward than asking a client for money? Probably not. So why not have that cash automatically taken out of their accounts. It saves both of you from a stressful conversation.

- More free time: Every freelancer spends a decent chunk of their time on invoicing. What if you could nearly eliminate that time while cutting billing cycles significantly? Instead of writing invoices and chasing clients down for payments, you could spend your time creating amazing new projects and grabbing more precious leads.

Obviously, the recurring billing structure doesn't work for every client. Freelancers that spend most of their time on one-time projects (e.g., web design, programming, etc.) won't find much value in recurring billing. But any freelancer that deals with the same client month-to-month can save time, money, and plenty of headaches by incorporating an automated billing system into their daily workflow.

The 4 Best Recurring Billing Systems for Freelancers

Answering the question, "what is the best recurring billing system?" isn't easy. The bill management market is filled with wonderful software solutions all aimed at providing different layers of value. So, put away the spreadsheets, grab a cup of coffee, and get ready: here are the 3 best recurring billing systems that work best for freelancers.

Indy

Indy offers invoicing features that are freelancer-centric and built to handle your toughest and most critical clients. At Indy, we're always looking for ways to improve our solutions and generate tangible value for freelancers in today's competitive gig economy. We know that freelancers struggle to deal with the headaches of administrative responsibilities like invoices, so we packed a world-class billing and invoice system directly into our solution.

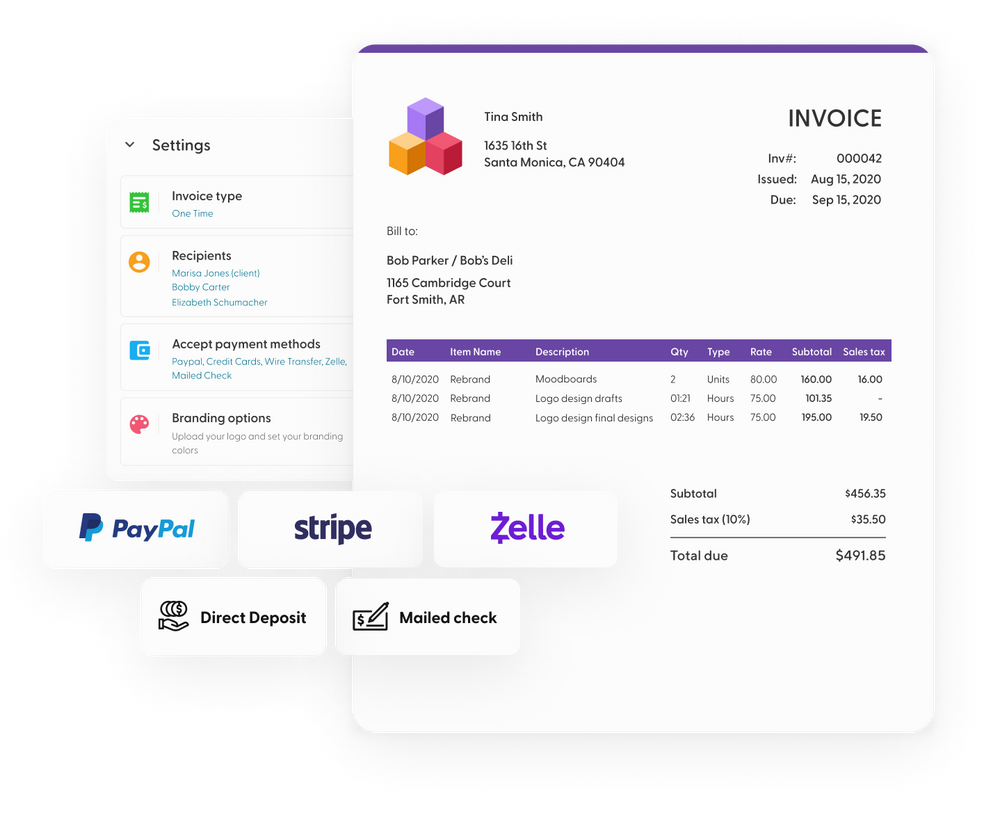

With Indy, you can automatically generate invoices, set up recurring payments, and keep tabs on all of your client payment terms. You can set Indy up with Stripe or PayPal for automated payment status marketing, or you can kick it old-school and use checks, wire transfer, or awesome services like Zelle. Here's the nitty-gritty truth: 54% of freelancers are getting paid late (or not at all). You need to take control of your invoicing.

Indy combines a swarm of freelancer tools into one cheap, $16 monthly solution. From tasks and time tracking to communication tools and contracts, we help you stay on top of your online business.

Pros:

- Recurring billing, invoices, time-tracking, communication tools, contracts, and more for $16 per month

- Built from the ground-up to cater to freelancers

- Simple, intuitive interface

- Easy to use

- Tons of payment options (e.g., PayPal, Stripe, Zelle, check, wire transfer, etc.)

Cons:

- Doesn't offer more advanced invoice features like coupons, metrics, KPIs, etc.

Zoho Subscriptions

Zoho Subscriptions markets its account software as a "customer subscription management software" targeted towards mid-market businesses and smaller agencies. But it also has recurring payment processing features that make it easy to track and automate your recurring client invoices.

For freelancers looking to get some extra bang from their recurring billing setup, Zoho also lets you dive into metrics, create add-ons for customers, and offer coupons for early payments. While setting Zoho up for the first time takes a while, it's jam-packed with billing features that help you collect payments and send out invoices with a touch of personalization.

The only con to Zoho is the price. Since it's geared more towards subscription-based services, it can be costly for freelancers looking to simply use the recurring billing features. The lowest tier of Zoho Subscriptions starts at $39, and it goes up to $199. That's only for the subscription component of Zoho — not any of the other Zoho product lines.

Pros:

- Feature-rich recurring billing solution

- Offers metrics and add-ons to help you measure success in the long-run

- Integrates with other Zoho apps

- Plenty of payment options (e.g., credit cards, PayPal, Stripe, 2Checkout, Authorize.net, etc.)

- Dunning management (i.e., dealing with decline payments) features

Cons:

- Costly (starts at $39 per month)

FreshBooks

Freshbooks provides accounting software geared towards small businesses and freelancers. This easy-to-use recurring billing software helps you track expenses and payments, as well as establish estimates and proposals. Less-advertised features like automated time-tracking, reminders, late payments, and tax calculations all make the Freshbooks feature list. Overall, Freshbooks is a great solution for freelancers and small business owners, though it may lack some of the non-payment oriented features freelancers may crave in today's tech marketplace.

Pros:

- Cost-effective solution (starts at $4.50 per month for 5 clients)

- Can invite your accountant for tax purposes

- Business health reports are a nifty feature

- Great and simple recurring billing capabilities

Cons:

- No communication tools or contracts

- Costs add up if you have many recurring clients

Clientjoy

Clientjoy CRM helps you streamline your entire invoicing process. The invoicing software is specifically designed for small and medium-sized businesses. We know that managing invoices is a key task for any business owner. While it may not be the most exciting part of running a business, it's essential to staying organized and on top of your finances.

With Clientjoy, you can easily compile beautiful invoices, set up automated reminders for your clients so you never have to manually follow up, set up one time, recurring & split payment systems.

Let Stripe, Paypal, or Payoneer charge your clients recurringly so you always get paid on time. Plus, Clientjoy’s real-time dashboard lets you see all the vital information at a glance, including sent invoices, monthly estimated revenue, and more.

Pros:

- Bill your clients in multiple currencies with compliant invoices in Clientjoy

- Manage your tax rates across items and categories as per your location

- Cost-effective option for small businesses and freelancers who want to avoid recurring expenses to manage simple invoicing. It has a 14 Day Pro Trial & has primarily put up its Lifetime Deal on Sale for just $129 Per User.

Cons:

- Invoices cannot be processed in multiple languages.

Recurring Billing Helps You Manage Your Clients

Juggling between client meetings, project execution, and administrative tasks like invoicing and billing isn't easy. Recurring billing helps you automate your recurring clients to ease some of that administrative burden. Luckily, many existing solutions go above-and-beyond by providing time-tracking features, communication tools, and contract-creation to help you swim through the murky waters of financials with ease.