You certainly don't need to hire an accountant to file your income tax returns. While some freelancers do it on their own, others take the help of accounting software. However, some freelancers don't prefer doing their taxes and using accounting services.

While an employee has to deal with a W2 form, self-employed people have multiple 1099s, a lot of business expense receipts, and Schedule C forms to deal with. Owing to the additional complexities, it is suggested that a business should be assessed by an account, estimate the quarterly tax payments and it should enhance your freelance business finances.

Difference between a CPA and an Accountant

In simple words, a Certified Public Accountant is an accountant, but an accountant may not be a CPA. A CPA has to meet the special education and experience required to pass the examination and is licensed by one of the 50 states of the US.

There is no need for a CPA or accountant to file your IT. Anyone can do it, but choosing a certified professional to do it for you for the 'peace of mind' factor.

Questions to ask before choosing a business and personal expenses accountant

Before appointing an accountant, make sure you have spoken on the phone or met in person. Find out if they are suitable for your freelance business. Some of the questions to ask accounting professionals before hiring them are:

Have you got any experience of working with freelancers?

Freelancers are distinctive. They are not like salaried people and may have unusual business expenses. Hence, the accountant must properly categorize these things and legally include them as business expenses. Ensure the accountant has worked before with sole proprietors.

Do you work the traditional way or the digital way?

If you have hired an accountant remotely, then chances are they will be working digitally. It is suggested to go comfortable with electronic filing.

How do you choose to safeguard financial details?

Always ensure the accountant has a safe connection. A secure connection safeguards your login credentials.

Do you use any accounting software?

Using a software for accounting is helpful; it helps to make error-free calculations faster and better.

Will you prepare the tax returns?

Some accountants may outsource their tax preparation work to someone else. It is important to find out beforehand, who will prepare your taxes.

What are your charges for small business accounting?

An accountant should specify the charge for income tax preparation and other inclusive services needed. Just make sure you know how much they charge, before assigning them, the task.

What is the onboarding procedure for a new client?

If you have chosen a new accountant, it is important to find out the details and documents you will need to provide them with.

Other essential tips for freelancers looking for tax professionals

Don't wait till the last moment

Accountants are often decked with last-minute tax preparations during tax season, March and April. It is suggested to get your taxes done earlier. Waiting till the last minute may make it tough for you to get your income tax filed at the right time.

Accountants handle more than just usual tax returns.

If you need more services related to your business transactions, such as bookkeeping, managing balance sheet, and other accountancy services, you can look for that too. It may take you to follow the 'trial and error' method, but you will eventually find a compatible accountant for your business.

Reasons to hire an accountant for your freelance income

Hiring a CPA is a great investment. After all, your taxes are complex when you manage all the work on your own. While there are several reasons to hire a professional accountant for your income taxes, the major one is that they are professionals when it comes to handling tax regulations and changing rules. A qualified accountant has the knowledge, expertise, and resources to handle the workload for you, allowing yourself to focus on your core business.

Familiar with tax laws

Tax law is complex because of the federal, state, and local bodies; each has different rules. The rules are updated and changed regularly, and your accountant knows how to track the changes and make recommendations while making business reports.

For instance, the Affordable Care Act in 2015 was a major tax code change in the last 2 decades, and it affected small businesses and individual businesses. While commoners were unaware of it, accountants had complete knowledge about the change, and they navigated their clients to stay on the right path.

You're a freelancer

Being self-employed, you own an office, internet connection, mileage, new devices. These are all your concerns. You may enjoy several benefits of running a small business, and a professional accountant will help you navigate this tricky path. A perfect accountant can help a self-employed client save an extravagant amount of money. Don't you think paying an accountant fee is worth the short!

Math is not for everyone

Taxes are completely related to math. How much money do you have in your bank accounts? What interest are you receiving on it? What are the tax deductions?

A good accountant will know how to resolve this math completely and give you precise financial results.

Apart from that, accountants have a lot of experience managing tax forms. They are better at preparing financial records, understanding taxes, and filing returns.

You have several income sources

If you have been working for a long time and own properties or have started a separate business, you may generate more than one source of income. Though it is great for your bank account, it makes calculating taxes more complicated. You may be eligible for extra tax savings that you are not aware of.

You will save time

A major reason you should hire CPA's is that they save your time and offer great precision.

It may take you hours to prepare profit and loss statements, but an accountant can do it fairly quickly. They will be well aware of the tax laws and tax-saving opportunities. However, you can save their fee by collecting all fiscal data together. Share the cash flow statements, so your accountant needs less time to work on them.

You can stay in contact with an accountant all around the year to resolve all sorts of financial queries and complexities.

Your accountant is your financial advisor too

A good accountant helps you make efficient financial decisions based on their experience, skill, and professionalism. They will explain all pros and cons of business management and help you assess the financials of your business.

You may find your finances simple. You need to send invoices and collect the finances. But, accounting is much more than a professional accountant will help you resolve all issues.

Does accounting software prove beneficial?

You are in no shortage of cloud-based accounting services for small businesses and larger small businesses. You can either hire the best accountants or choose bookkeeping software and accounting software for it. Rather than hiring 10 people for different jobs, the accounting software can handle all tasks for you. They are majorly designed for independent contractors, freelancers, and sole proprietors. A few are available for free, while others have a subscription fee.

Some of the functions that accounting software performs are:

- Works more than the balance sheet Freelancers have more needs than tracking their income and expenditure. They may have to record payments, perform payroll services do tax, inventory tracking, and more. The software can handle all of it together!

- Helps you with journal entries, too: If you need double-entry accounting software, then you have accounting solutions designed to handle it for you.

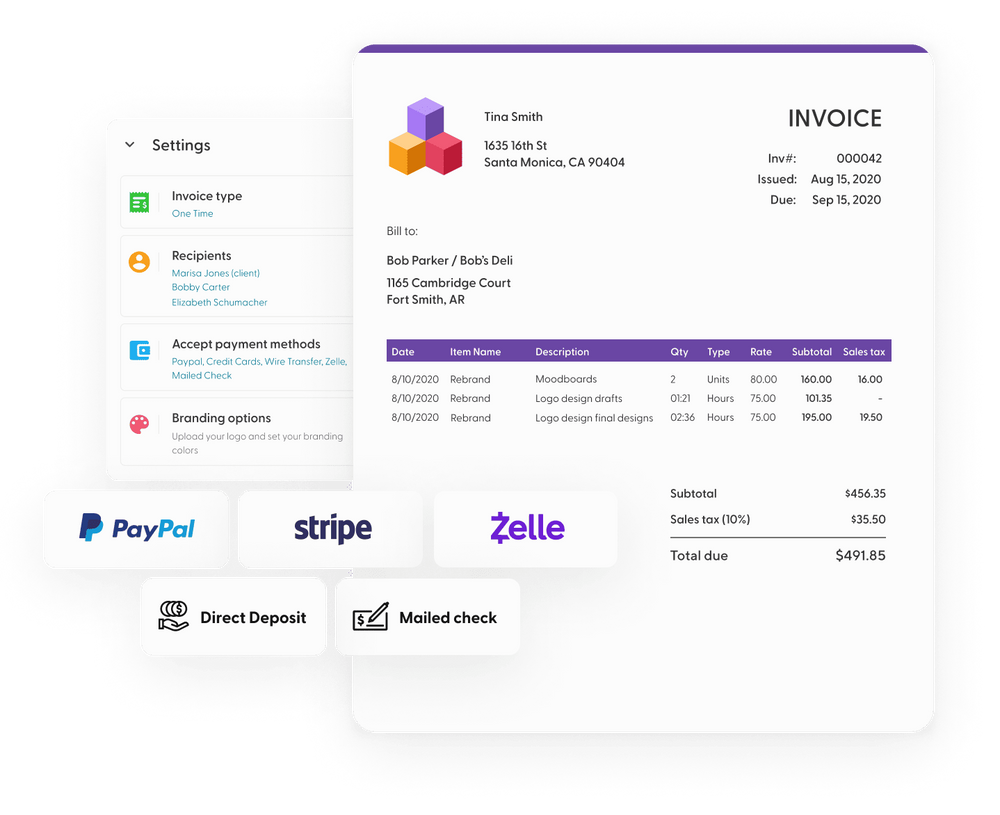

- The software allows you to create invoices, automatically send reminders and evaluate late fees.

- You can access the software from a distance and enjoy additional bonus features such as automatic mileage tracking. The software can be accessed on the desktop as well as on mobile.

- Quarterly estimated taxes: It is essential to keep track of estimated taxes to simplify your annual tax calculations. The software helps you do it with ease.

- Ecommerce integration: Your accountancy program can be integrated with your e-commerce platform to generate your financial reports automatically.

- Customizable: The accountancy program you choose can be customized as per your specific business use. Most freelancers use preformatted report templates and customizable data views.

- Even the smallest business today needs safety, and QuickBooks online offer these services. They offer two-factor authentication and don't let anyone steal your financial information.

Final Thoughts

Taxes are distressing for all, and hence as a freelancer, it is my advice to hire an accountant to handle all your financial transactions, bookkeeping, and future growth. Find someone compatible with your company to have a good and long-lasting relationship.