Who doesn’t love that feeling of sending out a delicious invoice for work well done? Those dollar signs are your best friends!

But is there something on that invoice doing you more harm than good? If you're using net 30 payment terms, there might be.

Most freelancers create their first contracts and invoices without much idea of what they’re doing (myself included). As a result, many choose net 30 payments because they know net 30 is common in the business world, so they shrug and say, “This’ll work” (again, guilty). But did you know that this isn't a viable option for small businesses?

Well, when you learn better, you do better, and this is where you learn why net 30 isn’t a freelancer’s friend. If you can avoid it altogether, do so.

What do Net 30 Payment Terms mean?

Net 30 terms are pretty simple to understand. Giving your customers net 30 payment terms, or trade credit, means the balance is due 30 calendar days after the invoice date. Essentially, you are giving interest-free credit to your clients for a month.

These are pretty generous payment terms, but they may cause cash flow problems for small businesses and freelancers.

Why Freelancers Should Avoid Net 30 Agreements

Simply put, 30 days is a long time before the client needs to pay the invoice. Net terms might work for more structured and established companies but offering longer payment terms presents several problems for freelancers.

Here's why you should avoid these credit terms like the plague the next time you offer freelance services to customers:

Cash Flow Issues

Net 30 terms are common in B2B sales because traditional companies are structured to have reserves available. They typically operate on more fluid income or payout schedules after delivering their goods or services. This is fine because they can afford to wait a long time before the customer pays.

As a freelance business, though, you’re running a household. Freelancers have tighter schedules of bills to pay with fewer reserves and, in some cases, low-profit margins. Even an early payout that arrives three weeks after you dedicate your valuable time to a project can be too late, depending on your bills’ due dates and business needs.

This can create cash flow problems for your business and mean delinquencies on your part and a ton of stress until the client pays.

Time for Problems to Arise

A lot can happen in the 30 days after the invoice date. Your client’s business can take a downturn, so they can no longer pay what they owe you on the due date. The client could also simply decide they no longer like the price they agreed to and choose to play hardball. Sure, you should win out in the end if there’s a signed contract, but no one wants the added headache regardless of how it ends up. Plus, your customer could have cash flow problems of their own.

The shorter the time span between making the agreement and requiring payment, the less can go wrong between that time. This includes the time between your invoice and the payment’s due date.

Long Delay for Repercussions

I like to expect the best from people, but we all know some clients enter agreements with no intention of paying off invoices. We all hope to spot red flags and weed out those scammers instead of working for them, but there’s always a possibility you won't receive full payment.

If your contract has net terms, you can’t even begin taking action to get the money until the end of the month. That includes sending debts to collections and charging interest on overdue amounts for the service provided. Sometimes you could sue them in small claims court before those 30 days, but only if they’ve explicitly stated they won’t pay you.

Smaller businesses and freelancers can't afford to wait until this works itself out and can end up with more problems in the long run.

May require accounting software

Payment processing of net terms is more complex since it requires more admin work on your end. It rests on your shoulders to not only establish net terms and the net amount for each customer but to also keep track of the invoices you've sent out, along with any discounts, delinquencies, collections, and if you decide on extending credit.

You may end up having to use an accounting software, or even get an accountant to handle this aspect of your business. If you're just starting out or have very few clients, this will mean less cash in your pocket at the end of the day.

What Other Payment Terms Could You Use?

What are your options if you don’t want to use net terms?

There are many different options, and they have advantages and disadvantages for business owners. Let's have a look at a few common invoice payment terms for small businesses:

Payments Due with the Invoice

You could choose to make your payments due when you send the invoice or cash on delivery of service. If you are delivering something specific, then this is an easy option. Here are some examples:

- You run a photography business. Instead of offering net terms, send watermarked images and videos to customers for approval. If the client approves, require full payment before sending the full-resolution files. This is how most businesses and shops operate. They get compensated before you leave the store with the goods, and everybody leaves happy.

- You are a web developer creating websites for customers. Instead of net 30 terms, build the website on a staging site and require invoice payoff before transfer to the customer's web hosting. You can guarantee transfer within a specific number of days if the customer makes this request.

You do not have to feel stuck offering net 30 terms when you deliver a specific piece of work. You may also utilize certain freelance platforms to create invoices for your business and manage all aspects of client contracts. These platforms have credit card-required policies in place to prevent losses and make it fair for both parties.

Payment is Due Within a Number of Days After the Invoice Date

Instead of net 30 terms, offer net 7, net 10, or net 15 as a credit term. This is basically the same as net 30 terms, but with fewer days. Instead of being due in 30 days, they can be made within 7 calendar days or 10 days. You did quality work, and you may expect the client to pay the bill promptly.

As a small business, the shorter payment term will help your cash flow and means you are not offering generous credit terms to businesses larger than yours. And this still allows your business to remain competitive when net terms are commonplace in your niche.

Offer a Discount for Early Payment

If you want to continue with net 30 terms, consider offering discounts to customers who pay before the due date. You can generate more sales and attract more clients to your business this way.

This strategy helps you get paid sooner and avoid late payments from customers. Many customers, especially savvy small business owners, will want to save as much cash as they can, so your early payment discount will entice them to pay the invoice as soon as possible.

This offer will also give you a competitive advantage, and new customers may want to take advantage of this offer. Ensure the percent discount is enough to cover your service and remain competitive.

Include Charges for Late Payments

Next on our list is the option to charge customers who pay late after the credit terms have been abused. It's only fair that your small business is compensated if you extend trade credit for non-payment.

If the customer has 30 days to pay, and the invoice isn't paid within this time, then charge your customer a late fee. There may be laws governing how much your late fees can be, so it's wise to check your local rules before approaching customers.

Combination terms/agreements

You can combine all the previously mentioned terms. For example, offer net 10 credit terms with an early payment discount and late charges that apply after the due date has passed. Of course, your customer might not like your credit terms and could go elsewhere. So it's better to find nicer ways of getting paid promptly for your service.

Perhaps the unwillingness from new clients to accept these terms is a sign of what to expect, and you can be saving yourself the trouble.

Remember: Payment Terms are Variable

This is something few people talk about, so it’s worth stating. You don’t have to give the same payment agreement to all of your customers, and you certainly don't have to extend net terms or any form of credit. There's no rule or law dictating this, so act according to your experience with a client.

We all have clients who consistently pay right away and others we don’t trust so much. It’s well within your rights to offer net 14 or net 20 invoicing terms to trustworthy clients with shorter timeframes to the sketchier few. You can also place new clients on temporary payment terms while you build trust and customer loyalty.

After all, net terms offer short-term credit, so there’s no need to give that credit to someone who doesn’t pay on time. You'll be doing your business a huge favor.

Standing Up for Your Business

In all honesty, for many freelancers, the toughest part when they start out is learning how to advocate for themselves and their business. It’s not an easy skill, even after years of solopreneurship. Many freelancers still struggle and feel intimidated by the potential to lose customers.

It becomes easier with practice but remember this: you’d expect to be paid on time by an employer, so don’t accept any less from clients. Choosing your payment terms well is an important part of protecting your budding business’s financial stability and will help your business grow.

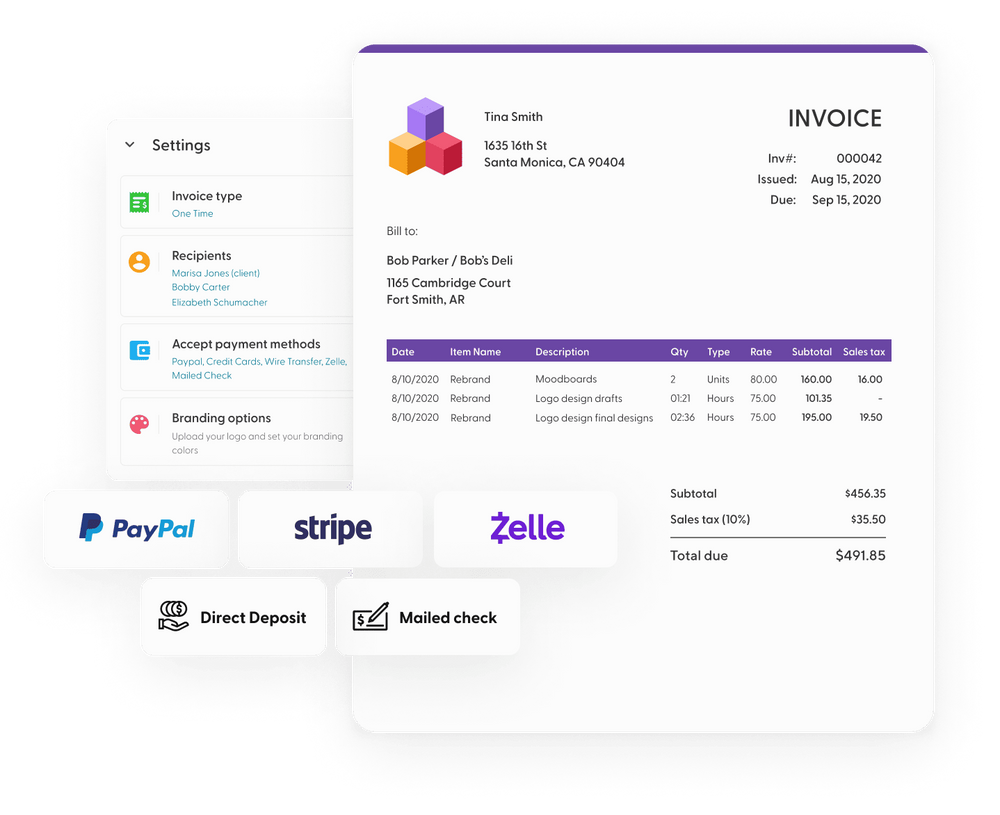

Whatever timeline you and your client agree on, Indy’s got you covered when it comes to getting paid. Not only does Indy utilize methods like PayPal, Zelle, and Stripe, but offers free Stripe and PayPal fee calculators that will show you the expected fee for an invoice and what you should charge to make sure you’re not paying for it.

FAQs

How Does Net 30 Terms Work?

Net 30 terms are a trade credit. This means your customer's bill is due in 30 days instead of immediately. Net 30 is a credit agreement, although usually without interest. The net 30 days means you get paid within 30 days of sending the invoice, which can mean next week or even the end of the month.

Why Do Companies Pay Net 30?

Net 30 has been the standard for many years and is one of the most common payment terms to offer credit to customers. 30 years ago, many businesses settled their bill by mail, and invoices were sent the same way. So, offering net 30 was a way for one business to offer its customers time to pay invoices without calculating interest or late fees. It was also a way to secure customer loyalty to a business.

Today, businesses have many more options, but net 30 is still used in business because it is standard practice and also generous. But remember, it isn't mandatory to offer net terms.

Does net 30 include weekends?

Using net 30 usually means weekends are included. When payments are required in 30 days, the custom simply requires payment on or before the same day next month. Trying to exclude weekends would complicate due dates and may confuse your customers and your business. Of course, some businesses can choose to exclude weekends and only count business days, but this will be clear on the invoice.

How do I know if Net terms are right for my business?

The decision to offer net terms to customers is entirely up to you. But, before you go ahead with net terms, you must understand that this is a form of credit, so you have to wait until your customers pay what is owed.

If you are in a position where you have consistent cash flow and you can afford to wait until day 30 to receive payment, net terms can be a viable option for your business. But, if you often find yourself stressed and unable to cover expenses until you receive payment, consider using other terms that are both fair to you and your customer.

What happens if a customer does not adhere to net terms?

If you choose to offer net terms, there's always a possibility that some customers may abuse the credit. This can have a devastating impact on a business, especially if it is a large and time-consuming project.

Since this is considered a contract in the eyes of the law, you will have to take legal action if you want to recoup your losses. Unfortunately, this can be a lengthy process, and it will be some time before your business sees a dollar of what was owed.

We strongly advise against offering credit to new customers or customers who have been dodgy on payments in the past to avoid these situations.